51题库考试学习网为你解答:ACCA年费需要一直缴纳吗?

发布时间:2020-03-28

大家一定很想知道ACCA年费需要一直缴纳吗?如果不交对自己有什么影响呢,今天51题库考试学习网就来告诉你这些问题的答案。

ACCA官方规定,所有报考ACCA的学员以及通过考试的ACCA准会员、会员,每年都需要缴纳不同额度的年费来确保ACCA资格的有效性。那么,这就意味着ACCA年费必须要从注册之日起要终身缴纳吗?首先,ACCA政策上是没有强制缴纳,不过只要我们还需要ACCA会员的头衔,那么我们就需要按照ACCA的规定每年缴纳会员年费。

不过,ACCA规定,在每年5月10日之前首次注册ACCA/FIA的学员,需要缴纳当年的年费,之后注册的学员免除当年年费。因此,对于我们的学员,如果不急于ACCA考试,可以选择在5月10日之后注册。

ACCA年费缴纳流程:

1:进入ACCA官网,在My ACCA里登陆个人账户,在左边找到Fees,Payment and Receipts.点击进入

2:在Transaction

Summary中找到open的annual

subscription fee(年费)。这里要注意的是,ACCAer也要注意一下自己有没有除了年费以外其他的未交的费用(注册费或者考试费),也会显示为open的状态。

3:页面跳转至支付的页面,核对一下项目和金额。

4:在选择支付方式的时候,可以选择支付宝或者银联卡。支付宝比较方便,如果真的交易不成功的话也会48小时内退回账户中。

5:交易成功后会跳转一个交易成功的页面。

6:同时也有英国的邮件会通知你支付成功。

注册后如果不交年费,会有什么影响?

如果不交年费,ACCA学员/准会员/会员的头衔就会被取消,同时也失去了获得ACCA资深会员,即FCCA的资格。

原则上来说,ACCA考完以后还是要交年费的,而且考完以后成为准会员和以后申请成为会员所要交的年费比ACCA学员交的要更多。

在这里提醒大家还是继续交纳年费比较好。

首先,如果不交年费,ACCA学员/准会员/会员的头衔就会被取消,可能有些同学会觉得,反正我ACCA学完了,本事都学到了,ACCA头衔对我来说可有可无,但因为ACCA头衔带给大家的并不仅仅只是表面上的一张证书,ACCA官方会定期组织各种活动,能够获得与财会界许多同行一起交流的机会,这也是财会人拓宽自己视野和交际比较好的机会。在成为ACCA会员5年以后还可以申请成为ACCA资深会员,即FCCA,为了年费失去这样的机会真的是得不偿失。

以上就是关于考试的全部内容了,大家看完之后是不是已经知道了ACCA年费的缴费规则了呢,大家想要了解更多关于ACCA考试的信息,就请持续关注51题库考试学习网吧。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

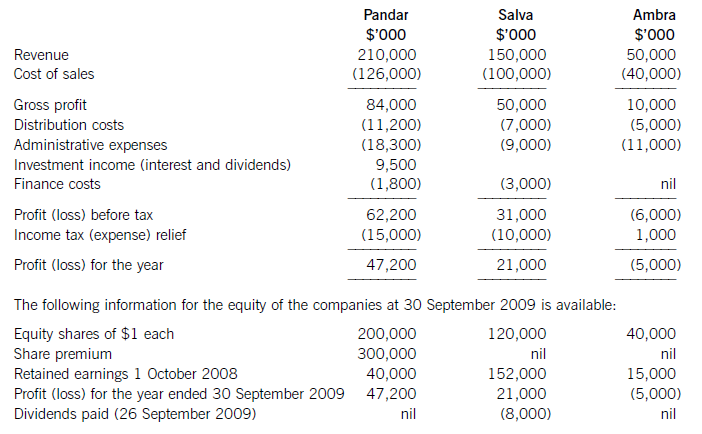

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

(b) Illustrate how you might use analytical procedures to provide audit evidence and reduce the level of detailed

substantive procedures. (7 marks)

(b) Illustration of use of analytical procedures as audit evidence

Tutorial note: Note that ‘as audit evidence’ requires consideration of substantive analytical procedures rather that the

identification of risks (relevant to part (a)).

Revenue

Analytical procedures may be used in testing revenue for completeness of recording (‘understatement’). The average selling

price of a vehicle in 2005 was $68,830 ($526·0 million ÷ 7,642 vehicles). Applying this to the number of vehicles sold

in 2006, might be projected to generate $698·8 million ($68,830 × 10,153) revenue from the sale of vehicles. The draft

financial statements therefore show a potential shortfall of $110·8 million ($(698·8 – 588·0) million) that is, 15·6%.

This should be investigated and substantiated through more detailed analytical procedures. For example, the number of

vehicles sold should be analysed into models and multiplied by the list price of each for a more accurate estimate of potential

revenue. The impact of discounts and other incentives (e.g. 0% finance) on the list prices should then be allowed for. If

recorded revenue for 2006 (as per draft income statement adjusted for cutoff and consignment inventories) is materially lower

than that calculated, detailed substantive procedures may be required in order to show that there is no material error.

‘Proof in total’/reasonableness tests

The material correctness, or otherwise, of income statement items (in particular) may be assessed through appropriate ‘proof

in total’ calculations (or ‘reasonableness’ tests). For example:

■ Employee benefits costs: the average number of employees by category (waged/salaried/apprenticed) × the average pay

rate for each might prove that in total $91·0 million (as adjusted to actual at 31 December 2006) is not materially

misstated. The average number of employees needs to be checked substantively (e.g. recalculated based on the number

of employees on each payroll) and the average pay rates (e.g. to rates agreed with employee representatives).

Tutorial note: An alternative reasonableness might be to take last year’s actual adjusted for 2006 numbers of

employees grossed-up for any pay increases during the year (pro-rated as necessary).

■ Depreciation: the cost (or net book value) of each category of asset × by the relevant straight-line (or reducing balance)

depreciation rate. If a ‘ballpark’ calculation for the year is materially different to the annual charge a more detailed

calculation can be made using monthly depreciation calculations. The cost (or net book value) on which depreciation

is calculated should be substantively tested, for example by agreeing brought forward balances to prior year working

papers and additions to purchase invoices (costings in respect of assets under construction).

Tutorial note: Alternatively, last year’s depreciation charge may be reconciled to this year’s by considering depreciation

rates applied to brought forward balances with adjustments for additions/disposals.

■ Interest income: an average interest rate for the year can be applied to the monthly balance invested (e.g. in deposit

accounts) and compared with the amount recognised for the year to 31 December 2006 (as adjusted for any accrued

interest per the bank letter for audit purposes). The monthly balances (or averages) on which the calculation is

performed should be substantiated to bank deposit statements.

■ Interest expense: if the cash balances do not go into overdraft then this may be similar expenses (e.g. prompt payment

discounts to customers). If this is to particular dealers then a proof in total might be to apply the discount rate to the

amounts invoiced to the dealer during the period.

Immaterial items

For immaterial items analytical procedures alone may provide sufficient audit evidence that amounts in the financial

statements are not materially misstated so that detailed substantive procedures are not required. For example, a comparison

of administration and distribution, maintenance and insurance costs for 2006 compared with 2005 may be sufficient to show

that material error is highly unlikely. If necessary, further reasonableness tests could be performed. For example, considering

insurance costs to value of assets insured or maintenance costs to costs of assets maintained.

Ratio analysis

Ratio analysis can provide substantive evidence that income statement and balance sheet items are not materially misstated

by considering their inter-relationships. For example:

■ Asset turnover: Based on the draft financial statements property, plant and equipment has turned over 5·2 times

($645·5/124·5) compared with 5·9 times in 2005. This again highlights that income may be overstated, or assets

overstated (e.g. if depreciation is understated).

■ Inventory turnover: Using cost of materials adjusted for changes in inventories this has remained stable at 10·9 times.

Tutorial note: This is to be expected as in (a) the cost in the income statement has increased by 9% and the value of

inventories by 8·5%.

Inventories represent the smallest asset value on the balance sheet at 31 December 2006 (7·8% of total assets).

Therefore substantive procedures may be limited to agreeing physical count of material items (vehicles) and agreeing

cutoff.

■ Average collection period: This has increased to 41 days (73·1/645·5 × 365) from 30 days. Further substantive analysis

is required, for example, separating out non-current amounts (for sales on 0% finance terms). Substantive procedures

may be limited to confirmation of amounts due from dealers (and/or receipt of after-date cash) and agreeing cutoff of

goods on consignment.

■ Payment periods: This has remained constant at 37 days (2005 – 38 days). Detailed substantive procedures may be

restricted to reconciling only major suppliers’ statements and agreeing the cutoff on parts purchased from them.

(ii) Determine whether your decision in (b)(i) would change if you were to use the Maximin and Minimax

regret decision criteria. Your answer should be supported by relevant workings. (6 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-04-23

- 2020-05-10

- 2020-01-09

- 2020-01-09

- 2020-01-09

- 2020-01-01

- 2020-04-12

- 2020-03-08

- 2020-05-10

- 2020-05-17

- 2020-02-15

- 2020-01-09

- 2020-02-13

- 2020-01-09

- 2020-05-17

- 2020-05-14

- 2020-04-04

- 2020-01-09

- 2020-03-19

- 2019-12-30

- 2020-05-17

- 2020-01-09

- 2020-03-28

- 2020-01-09

- 2020-02-05

- 2020-01-09

- 2020-04-10

- 2020-01-09

- 2020-04-14

- 2020-05-14