如何帮助广东省考生高效的学习ACCA考试?

发布时间:2020-01-10

2020年已经到来,第一次ACCAer们对考试已经了解了多少了呢?一点也不了解也不用担心,51题库考试学习网帮助大家收集到了一些关于考试的高效学习技巧,希望对备考的你有多帮助,现在且随51题库考试学习网,告诉你怎有哪些技巧吧:

复习的首要任务是巩固和加深对所学知识的理解和记忆。首先,要根据教材的知识体系确定好一个中心内容,把主要精力集中在教材的中心、重点和难点上,不真正搞懂,决不放松。其次,要及时巩固,防止遗忘。复习最好在遗忘之前,倘若在遗忘之后,效率就低了。复习还要经常,不能一曝十寒。

对于一个新人而言,刚刚学ACCA,肯定都在想:我是报班呢还是报班呢?报班的话该选择什么样的辅导班?其次,如果自学的话有没有希望?

首先,明确一点,无论是否报班学习,最终决定成败的还是自己。

其次ACCA学习是一个由浅入深、由简到难的过程。对于学习能力好的大神来说,选择自学也是没有问题的!但是这个过程会耗时耗力,难抓住重点,如果有高顿经验丰富的老师身经百战总结出来的重要知识点,将会如虎添翼!

最后自学备考ACCA的过程重在坚持,但是大多数人都会被周围的事情分散注意力而导致备考意志力不够坚定,最后的结果也很失败。而报高顿ACCA面授课,除了有专业讲师系统性的讲解,针对性的答疑,能遇到许多志同道合的小伙伴,互相鼓励,互相监督,更有负责的学管团队全程及时提醒沟通,帮你克服意志力薄弱的问题,早日全科通关。

学习acca是否有必要参加辅导班

根据每个人的基础来判别,有些基础比较好的考生,简单的科目完全自学,难点科目自己看看网课就可以顺利通过了;基础一般的同学大部分科目需要借助网课的帮助来通过考试;基础较差的同学可能就需要面授课老师来帮忙了。不管哪个级别的考生,基本上是不太可能不借助任何辅导通过的。

基础较差的考生参加ACCA辅导班跟着老师学习,会轻松很多,也会节省很多时间,自己自学不知道重点,遇到知识点要弄很久才弄明白,比较费劲。

所以考生们可以根据自己的情况来安排辅导的力度哦。

具体的备考步骤分为以下四步:

第一步是拿2-3套ACCA真题,自己扫一遍所有的题干,可以不看题目,然后用这几套真题总结一下出题的套路和重点的知识点。ACCA的考试中重要的知识点一定是每年都出的,用这几套完全可以总结出重要知识点。当然如果真的基础不错,可以拿一套真题先做一下,然后你就有动力去进行后续的复习了。

第二步是看书,不过是先根据课本的目录,给自己梳理出来一个框架图,然后结合第一步的总结,所有的重点都一目了然。

第三步就是看书了,ACCA的教材一般会分为16-18个章节,一个章节如果完全投入进去阅读,两个小时完全可以搞明白。更何况最开始还整理出来了重点,那么复习详略得当,这个时间是足够的。还要注意一下就是每个章节如果真题中有考到这个章节的知识点,BPP的教材是会给出提示的,务必保证每个章节在学习完做一道题,总结答题思路。

最后一步是真题,一具体就要做的真题数目决定。51题库考试学习网建议大家有时间就尽量多做题,虽然题海战术不算什么高端的战术,但它却是最有用的。用来检测知识点是否掌握,如果是重要知识点没掌握,务必要回去复习了。

总结必考题的答题套路,就想F7/P2的合并报表,一定有它必备的一些步骤一样,这些必考题一定有每年都要做的相同部分。

完全的考前模拟,看看考试的时候如何安排时间比较合理。

以上就是关于备考ACCA考试的相关经验分享,你Get到了吗?俗话说,好的开始是成功的一半,大家要积极地认真地备考ACCA考试哦,要相信你所付出的一定会得到结果的~

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

3 You are the manager responsible for the audit of Albreda Co, a limited liability company, and its subsidiaries. The

group mainly operates a chain of national restaurants and provides vending and other catering services to corporate

clients. All restaurants offer ‘eat-in’, ‘take-away’ and ‘home delivery’ services. The draft consolidated financial

statements for the year ended 30 September 2005 show revenue of $42·2 million (2004 – $41·8 million), profit

before taxation of $1·8 million (2004 – $2·2 million) and total assets of $30·7 million (2004 – $23·4 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) In September 2005 the management board announced plans to cease offering ‘home delivery’ services from the

end of the month. These sales amounted to $0·6 million for the year to 30 September 2005 (2004 – $0·8

million). A provision of $0·2 million has been made as at 30 September 2005 for the compensation of redundant

employees (mainly drivers). Delivery vehicles have been classified as non-current assets held for sale as at 30

September 2005 and measured at fair value less costs to sell, $0·8 million (carrying amount,

$0·5 million). (8 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Albreda Co for the year ended

30 September 2005.

NOTE: The mark allocation is shown against each of the three issues.

3 ALBREDA CO

(a) Cessation of ‘home delivery’ service

(i) Matters

■ $0·6 million represents 1·4% of reported revenue (prior year 1·9%) and is therefore material.

Tutorial note: However, it is clearly not of such significance that it should raise any doubts whatsoever regarding

the going concern assumption. (On the contrary, as revenue from this service has declined since last year.)

■ The home delivery service is not a component of Albreda and its cessation does not classify as a discontinued

operation (IFRS 5 ‘Non-current Assets Held for Sale and Discontinued Operations’).

? It is not a cash-generating unit because home delivery revenues are not independent of other revenues

generated by the restaurant kitchens.

? 1·4% of revenue is not a ‘major line of business’.

? Home delivery does not cover a separate geographical area (but many areas around the numerous

restaurants).

■ The redundancy provision of $0·2 million represents 11·1% of profit before tax (10% before allowing for the

provision) and is therefore material. However, it represents only 0·6% of total assets and is therefore immaterial

to the balance sheet.

■ As the provision is a liability it should have been tested primarily for understatement (completeness).

■ The delivery vehicles should be classified as held for sale if their carrying amount will be recovered principally

through a sale transaction rather than through continuing use. For this to be the case the following IFRS 5 criteria

must be met:

? the vehicles must be available for immediate sale in their present condition; and

? their sale must be highly probable.

Tutorial note: Highly probable = management commitment to a plan + initiation of plan to locate buyer(s) +

active marketing + completion expected in a year.

■ However, even if the classification as held for sale is appropriate the measurement basis is incorrect.

■ Non-current assets classified as held for sale should be carried at the lower of carrying amount and fair value less

costs to sell.

■ It is incorrect that the vehicles are being measured at fair value less costs to sell which is $0·3 million in excess

of the carrying amount. This amounts to a revaluation. Wherever the credit entry is (equity or income statement)

it should be reversed. $0·3 million represents just less than 1% of assets (16·7% of profit if the credit is to the

income statement).

■ Comparison of fair value less costs to sell against carrying amount should have been made on an item by item

basis (and not on their totals).

(ii) Audit evidence

■ Copy of board minute documenting management’s decision to cease home deliveries (and any press

releases/internal memoranda to staff).

■ An analysis of revenue (e.g. extracted from management accounts) showing the amount attributed to home delivery

sales.

■ Redundancy terms for drivers as set out in their contracts of employment.

■ A ‘proof in total’ for the reasonableness/completeness of the redundancy provision (e.g. number of drivers × sum

of years employed × payment per year of service).

■ A schedule of depreciated cost of delivery vehicles extracted from the non-current asset register.

■ Checking of fair values on a sample basis to second hand market prices (as published/advertised in used vehicle

guides).

■ After-date net sale proceeds from sale of vehicles and comparison of proceeds against estimated fair values.

■ Physical inspection of condition of unsold vehicles.

■ Separate disclosure of the held for sale assets on the face of the balance sheet or in the notes.

■ Assets classified as held for sale (and other disposals) shown in the reconciliation of carrying amount at the

beginning and end of the period.

■ Additional descriptions in the notes of:

? the non-current assets; and

? the facts and circumstances leading to the sale/disposal (i.e. cessation of home delivery service).

3 On 1 January 2007 Dovedale Ltd, a company with no subsidiaries, intends to purchase 65% of the ordinary share

capital of Hira Ltd from Belgrove Ltd. Belgrove Ltd currently owns 100% of the share capital of Hira Ltd and has no

other subsidiaries. All three companies have their head offices in the UK and are UK resident.

Hira Ltd had trading losses brought forward, as at 1 April 2006, of £18,600 and no income or gains against which

to offset losses in the year ended 31 March 2006. In the year ending 31 March 2007 the company expects to make

further tax adjusted trading losses of £55,000 before deduction of capital allowances, and to have no other income

or gains. The tax written down value of Hira Ltd’s plant and machinery as at 31 March 2006 was £96,000 and

there will be no fixed asset additions or disposals in the year ending 31 March 2007. In the year ending 31 March

2008 a small tax adjusted trading loss is anticipated. Hira Ltd will surrender the maximum possible trading losses

to Belgrove Ltd and Dovedale Ltd.

The tax adjusted trading profit of Dovedale Ltd for the year ending 31 March 2007 is expected to be £875,000 and

to continue at this level in the future. The profits chargeable to corporation tax of Belgrove Ltd are expected to be

£38,000 for the year ending 31 March 2007 and to increase in the future.

On 1 February 2007 Dovedale Ltd will sell a small office building to Hira Ltd for its market value of £234,000.

Dovedale Ltd purchased the building in March 2005 for £210,000. In October 2004 Dovedale Ltd sold a factory

for £277,450 making a capital gain of £84,217. A claim was made to roll over the gain on the sale of the factory

against the acquisition cost of the office building.

On 1 April 2007 Dovedale Ltd intends to acquire the whole of the ordinary share capital of Atapo Inc, an unquoted

company resident in the country of Morovia. Atapo Inc sells components to Dovedale Ltd as well as to other

companies in Morovia and around the world.

It is estimated that Atapo Inc will make a profit before tax of £160,000 in the year ending 31 March 2008 and will

pay a dividend to Dovedale Ltd of £105,000. It can be assumed that Atapo Inc’s taxable profits are equal to its profit

before tax. The rate of corporation tax in Morovia is 9%. There is a withholding tax of 3% on dividends paid to

non-Morovian resident shareholders. There is no double tax agreement between the UK and Morovia.

Required:

(a) Advise Belgrove Ltd of any capital gains that may arise as a result of the sale of the shares in Hira Ltd. You

are not required to calculate any capital gains in this part of the question. (4 marks)

(a) Capital gains that may arise on the sale by Belgrove Ltd of shares in Hira Ltd

Belgrove Ltd will realise a capital gain on the sale of the shares unless the substantial shareholding exemption applies. The

exemption will be given automatically provided all of the following conditions are satisfied.

– Belgrove Ltd has owned at least 10% of Hira Ltd for a minimum of 12 months during the two years prior to the sale.

– Belgrove Ltd is a trading company or a member of a trading group during that 12-month period and immediately after

the sale.

– Hira Ltd is a trading company or the holding company of a trading group during that 12-month period and immediately

after the sale.

Hira Ltd will no longer be in a capital gains group with Belgrove Ltd after the sale. Accordingly, a capital gain, known as a

degrouping charge, may arise in Hira Ltd. A degrouping charge will arise if, at the time it leaves the Belgrove Ltd group, Hira

Ltd owns any capital assets which were transferred to it at no gain, no loss within the previous six years by a member of the

Belgrove Ltd capital gains group.

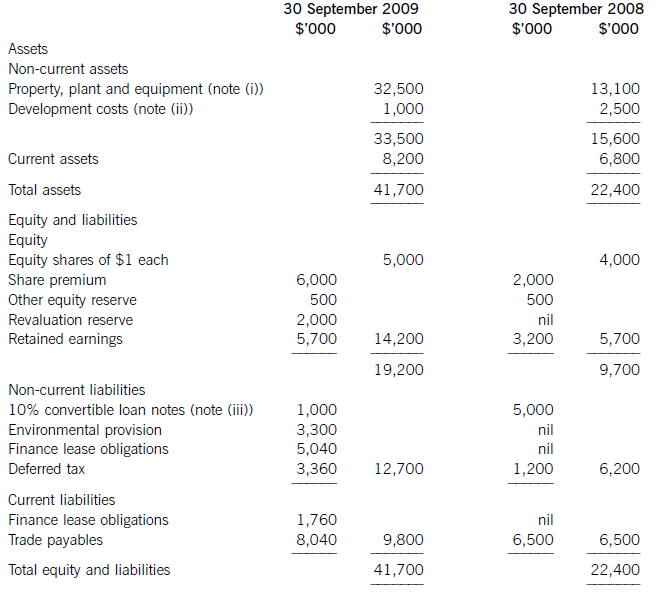

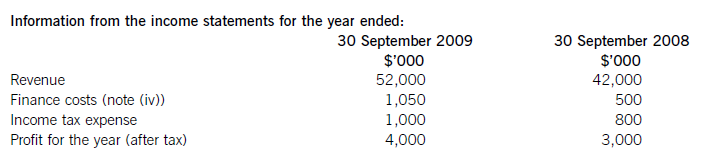

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

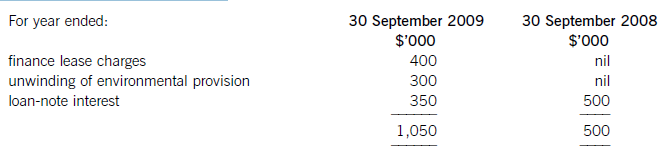

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced.

(b) What are the advantages and disadvantages of using a balanced scorecard to better assess the overall

performance of Lawson Engineering? (8 marks)

(b) In many ways Lawson Engineering and its performance explains why Kaplan and Norton developed the balanced scorecard

to overcome the reliance on traditional, and they would argue flawed, financial measures of performance such as return on

capital employed (ROCE). Lawson Engineering as a privately owned company does not have the same pressure to maximise

shareholder wealth, which is the overarching long-term goal of publicly quoted companies. The intangible resources discussed

above – both internal and external – reflect the success of the company in meeting the expectations of the other key

stakeholders in the business, namely customers, employees and suppliers. In terms of the other measures of performance

used in the balanced scorecard the customer perspective seems to be very much a positive area of performance. Lawson

Engineering has developed a clear niche strategy based on the excellence of its products. Market share as a measure of

customer satisfaction is not too relevant as the company has chosen to develop its own markets and is not looking for large

volumes and a dominant market share. The growth of the company suggests that it is both retaining its existing customer

base and acquiring new ones. Clearly there need to be measures in place to show where its growth is coming from. Customer

acquisition is usually an expensive but necessary activity and cutomer retention a more positive route to profitability. Today

there is increasing emphasis on customer relationship management (CRM) and measures to show the share of a particular

customer’s business the company has, rather than the overall market share the company has achieved. Michael Porter has

drawn attention to the fact that having the biggest market share is not necessarily associated with being the most profitable

company in that market. Customer acquisition and retention are both useful indicators of customer satisfaction which many

companies have problems in measuring. Finally, knowing which customers are profitable ones is a key requirement.

Surprisingly there is a lot of evidence to suggest that many companies are unsure which of their products and which

customers actually contribute to their profits.

The third measure in the balanced scorecard is an internal one – the effectiveness or otherwise of the firm’s internal processes.

In turn there are three areas where performance should be measured – innovation, operational processes and after sales

service (where appropriate). Innovation itself is a result of effective internal processes and Lawson Engineering through its

patents and awards has tangible evidence of its success. Many firms are measuring the contribution of products introduced

in the last three or four years – 3M, a global manufacturer of consumer and industrial products looks to achieve 30% of its

sales from products that are less than four years old. Equally important in a company such as Lawson Engineering is the time

taken to develop and get new products to their customers. The strategy of being ‘first to market’ can be a very effective

competitive strategy.

Equally important for the customers are the operational processes that produce and deliver the inputs from their suppliers.

The introduction of JIT and the use of technology to shorten and simplify the links between supplier and customer are ways

of shortening lead times and increasing customer satisfaction. Lawson Engineering has looked to innovate its processes as

well as its products and can look to develop measures of key areas of operational performance. Finally it is worth stressing

that financial performance, customer satisfaction and effective internal processes are all dependent on the people who make

things happen in the firm. Employees and the way they learn and grow in their jobs will determine whether or not the firm

succeeds. Again there is evidence to suggest that Lawson Engineering’s employees are being trained and developed and as

a consequence are well motivated.

The balanced scorecard has been criticised on a number of accounts. Firstly, such a comprehensive set of performance

measures will take considerable time and commitment on the part of senior management to develop. There is a need to avoid

over-complexity and assess the costs and benefits of the process. Secondly, there is the question of whether all the key

stakeholders have shared goals and expectations and whether the measures are focused on short-, medium- or long-term

performance. Thirdly, its focus on internal and external processes may not come easily to firms that have organised themselves

on traditional lines. Most organisations have retained departments within which functional specialists are located, e.g.

production, marketing etc. Changing the way performance is measured may need a radical change in culture and meetsignificant resistance.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-03-28

- 2020-01-04

- 2020-05-02

- 2020-01-10

- 2020-01-09

- 2020-03-11

- 2019-08-02

- 2020-01-10

- 2020-04-15

- 2020-04-11

- 2020-01-30

- 2020-02-14

- 2020-01-01

- 2020-01-10

- 2020-09-03

- 2020-01-10

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2021-07-28

- 2020-04-30

- 2020-01-10

- 2020-05-08

- 2020-03-21