解答~考ACCA真的可以申请英国硕士学位吗,又应该如何申请呢

发布时间:2020-03-28

考ACCA真的可以申请英国硕士学位吗?答案是肯定的。但是如何才能申请英国硕士?今天51题库考试学习网就为大家分享一份详细的ACCA英国硕士申请攻略!

1、如果你是ACCA学员——ACCA专业阶段前2门核心课程(SBL&SBR)将获伦敦大学认可,学生在学习或通过这2门核心课程时就有资格申请伦敦大学该硕士学位;

2、如果你是ACCA会员/准会员——需要成功完成“财会专业人士的全球议题”和战略财务项目,方可获得这一学位。

该硕士学位由伦敦大学国际项目部颁发,由伦敦大学学院(UCL)管理科学与创新部门的世界级师资团队制定教学方案。

因此,参与伦敦大学国际专业会计硕士学位项目的ACCA会员/准会员如能顺利完成课程并通过考核,即可获得由伦敦大学(UOL)颁发的会计学硕士学位,但是具体的教学体系和实施由伦敦大学学院(UCL)制定。

申请英国硕士,要准备的材料具体如下:

1.申请时必须递交的材料:已有成绩单,在读证明,两封推荐信,个人陈述

2.申请时可以不递交但必须在入学前递交的材料:雅思成绩单(如适用),护照信息页(发CAS用)

3.其他材料:CV、GRE/GMAT证书(少数学校要求必须递交),获奖证书,实习证明,作品(部分专业要求递交作品,如记者、设计)等。

准备申请的流程:

1.把握最佳申请时间,可提高申请成功率

英国硕士课程每年9月底正式开学,提前一年开始接受申请。建议申请者在每年9月到次年3月递交申请。不过,学生要留意个别大学或专业特别提出的申请截止日期,英国留学讲的是先到先得,一旦人数招满,随时关闭申请,即使学生条件再优秀,也只得再等一年。

2.全方位考量,确定大学和专业方向

学生要准确客观评估自身情况,综合考虑排名、专业水平、留学费用、地理位置、交通等情况,结合自己的本科专业、喜爱程度、未来的职业发展等情况选择适合自己的学校。学校一般可以同时申请3-5所,应按照高中低的层次合理分配。

3.注重文书写作,用个人魅力打动招生官

英国大学除了看重学生本科学校背景(是否是211/985)、本科平均成绩、雅思成绩、本科专业与所申请专业是否相关这些硬性条件外,还非常看重申请者的自述信、推荐信、简历等软材料。他们更希望看到体现申请者个性、爱好、独特素质、实习工作经历的文书。这些申请文书,对于英国硕士申请,特别是名校申请,往往关系到申请的成败。

4.良好语言水平是硬道理,无雅思可先申请

关于英国硕士申请的雅思条件,商科、社会学、文史类专业要求雅思达到6.0-7.0,理工科专业要求雅思达到6.0-6.5.如果在申请时已有雅思成绩为最佳。如未考雅思,也可先申请大学的有条件录取。达不到语言要求的学生可以提前1-2个月到学校读语言课程,然后就可以直接入读硕士课程。部分学校语言课程的名额也相当紧张,所以也要尽早申请。

又到了与大家说再见的时候了,以上就是今天51题库考试学习网为大家分享的全部内容,希望本篇文章能够帮助到大家,如有其他疑问请继续关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

24 What figure should appear in the consolidated balance sheet of the J group as at 31 December 2004 for minority

interest?

A $32,000

B $16,000

C $10,000

D $24,000

20% x 120,000

4 (a) A company may choose to finance its activities mainly by equity capital, with low borrowings (low gearing) or by

relying on high borrowings with relatively low equity capital (high gearing).

Required:

Explain why a highly geared company is generally more risky from an investor’s point of view than a company

with low gearing. (3 marks)

(a) A highly-geared company has an obligation to pay interest on its loans regardless of its profit level. It will show high profits if

its overall rate of return on capital is greater than the rate of interest being paid on its borrowings, but a low profit or a loss if

there is a down-turn in its profit such that the rate of interest to be paid exceeds the return on its assets.

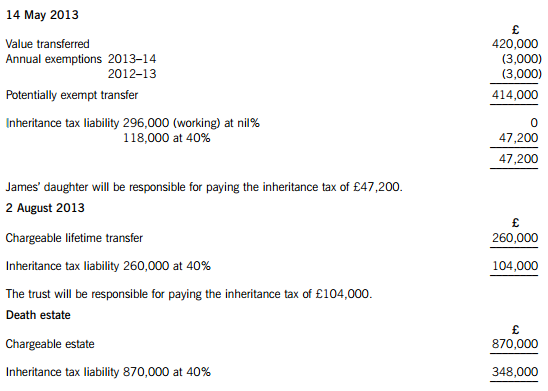

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.

(ii) Following on from your answer to (i), evaluate the two purchase proposals, and advise Bill and Ben

which course of action will result in the highest amount of after tax cash being received by the

shareholders if the disposal takes place on 31 March 2006. (4 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-11-13

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-04-21

- 2020-01-10

- 2020-02-05

- 2020-08-14

- 2020-02-01

- 2020-04-21

- 2020-04-08

- 2020-03-14

- 2020-01-09

- 2020-01-09

- 2020-02-20

- 2020-03-07

- 2020-01-10

- 2021-06-19

- 2020-03-19

- 2020-02-18

- 2020-01-01

- 2020-03-25

- 2020-01-10

- 2019-12-27

- 2020-01-10

- 2020-05-07

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-02-02