安徽省考生注意:怎么才能避免ACCA考试失分?

发布时间:2020-01-10

51题库考试学习网结合了历年高分学霸们的心得体会后,得出了避免ACCA考试丢分7个小技巧,希望对备考的你有多帮助,现在51题库考试学习网就来告诉你怎样避免失分:

01填写信息,稳定情绪

试卷发下来后,立即忙于答题是不科学的,应先填写信息,写清姓名和准考证号等,这样做不仅是考试的要求,更是一剂稳定情绪的“良药”。等待自己的心情有所平静的时候,在慢慢地开始做题,尽快找到考试状态。

02总揽全卷,区别难易

打开试卷,看看哪些是基础题,哪些是中档题,哪些是难题或压轴题,按先易后难的原则,确定解题顺序,逐题进行解答。将低难度的题拿全分、中等难度的题不丢分、高难度的题尽可能多拿分。

力争做到“巧做低档题,题题全做对;稳做中档题,一分不浪费;尽力冲击高档题,做错也无悔。

03认真审题,灵活答题

审题要做到一不漏掉题,二不看错题,三要审准题,四要看全题目的条件和结论。

审题中还要灵活运用知识,发现和寻找简捷的解题方法。其实,所有的问题都是回归本质的知识点的。抓准知识要点即可,难题迎刃而解。

04过程清晰,稳中求快

一要书写清晰,速度略快;

二要一次成功;

三要提高答题速度;

四要科学使用草稿纸;

五要力求准确,防止欲速不达。

(当然这也是根据考生的能力而定的,总而言之准确率第一)

05心理状态,注意调节

考试中,要克服满不在乎的自负心理,要抛弃“胜败在此一举”的负重心理,要克服畏首畏尾的胆怯心理。面对难、中、易的试卷,调节好心理,积极应对。

(面对简单的题不骄傲放纵,以免马虎失分。面对十分困难的题不慌张焦急,将自己能解答的先上去,然后慢慢回忆背诵和复习的知识要点)

06尽量多做,分分必争

ACCA考试评分,多按步骤、按知识点给分、按要点给分毕竟ACCA考试费用不低。

通常来说,考试时间是不够的,因此,考生在答题时,就要会多少,答多少,哪怕是一条辅助线,一个符号,一小段文字,都可写上,没有把握也要敢于写,千万不要将不能完全做出或答案算不出的题放弃不做

07抓住“题眼”,构建“桥梁”

一般难题都有个关键点(称之为“题眼”),抓住了“题眼”,问题就易于解决了。

此外,还要利用相关的知识、规律、信息进行多方联系,构建“桥梁”,找出问题的内在联系,从而构思解题方案,准确、快捷地解决问题。

试纸飘墨香,金笔待启程。忍心为功名,墨汁污纸张。51题库考试学习网预祝参加3月ACCA考季的小伙伴取得好成绩哦~

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Calculate the amount of input tax that will be recovered by Vostok Ltd in respect of the new premises in the

year ending 31 March 2009 and explain, using illustrative calculations, how any additional recoverable input

tax will be calculated in future years. (5 marks)

(b) Recoverable input tax in respect of new premises

Vostok Ltd will recover £47,880 (£446,500 x 7/47 x 72%) in the year ending 31 March 2009.

The capital goods scheme will apply to the purchase of the building because it is to cost more than £250,000. Under the

scheme, the total amount of input tax recovered reflects the use of the building over the period of ownership, up to a maximum

of ten years, rather than merely the year of purchase.

Further input tax will be recovered in future years as the percentage of exempt supplies falls. (If the percentage of exempt

supplies were to rise, Vostok Ltd would have to repay input tax to HMRC.)

The additional recoverable input tax will be computed by reference to the percentage of taxable supplies in each year including

the year of sale. For example, if the percentage of taxable supplies in a particular subsequent year were to be 80%, the

additional recoverable input tax would be computed as follows.

£446,500 x 7/47 x 1/10 x (80% – 72%) = £532.

Further input tax will be recovered in the year of sale as if Vostok Ltd’s supplies in the remaining years of the ten-year period

are fully vatable. For example, if the building is sold in year seven, the additional recoverable amount for the remaining three

years will be calculated as follows.

£446,500 x 7/47 x 1/10 x (100% – 72%) x 3 = £5,586.

(b) What are the advantages and disadvantages of using franchising to develop La Familia Amable budget hotel

chain? (8 marks)

(b) Franchising is typically seen as a quick and cost effective way of growing the business but Ramon should be aware of both

the advantages and disadvantages of using it as the preferred method of growth. Franchised chains are argued to benefit from

the sort of brand recognition and economies of scale not enjoyed by independent owner/managers. When combined with the

high levels of motivation normally associated with owner/managed businesses, franchises can be argued to get the best of

both worlds.

Franchising is defined as ‘a contractual agreement between two legally independent companies whereby the franchisor grants

the right to the franchisee to sell the franchisor’s product or do business under its trademarks in a given location for a specified

period of time. In return, the franchisee agrees to pay the franchisor a combination of fees, usually including an up-front

franchise fee, royalties calculated as a percentage of unit revenues, and an advertising conbribution that is also usually a

percentage of unit sales.’

Ramon is considering a type of franchising called ‘business-format franchising’, where the franchisor sells a way of doing

business to its franchisees. Business-format franchising is a model frequently found in the fast food and restaurant industry,

hotels and motels, construction and maintenance, and non-food retailing. Often these franchises are labour intensive and

relatively small-scale operations.

Franchising is seen as a safer alternative to growing the business organically, so while this may be true of well established

global franchises, failure rates among franchised small businesses were greater than those of independent businesses (in one

US study a 34·7% failure rate for franchises as opposed to 28·0% for independents over a six or seven year period). Often

it is the failure of the franchisor that brings down its franchisees. Failure stems from the franchisee not only having to rely on

their own skills and enthusiasm but also the capacity of the franchisor and other franchisees to make the overall operation

work.

The advantages to the franchisee are through gaining access to a well-regarded brand name that will generate a higher level

of demand and use of a tried and tested business model that should reduce the franchisee’s operating costs. Both of these

benefits stem from being a member of a well-established franchised system. Yet La Familia Amable along with many other

franchises will be new and small. These smaller franchises tend to be regional in scope, and fairly unknown outside their

regional market. This has a significant effect on what the franchisees can expect to gain from their franchisors and their

prospects of success. Both parties need to carefully assess the strengths and weaknesses of the system. Companies growing

via franchises need to take the time to understand their business model thoroughly and determine how franchising fits with

their long-term strategy. Care must be taken with the franchise agreement that creates a genuine partnership with the rightbalance between freedom and control over the franchisees.

Big Cheese Chairs (BCC) manufactures and sells executive leather chairs. They are considering a new design of massaging chair to launch into the competitive market in which they operate.

They have carried out an investigation in the market and using a target costing system have targeted a competitive selling price of $120 for the chair. BCC wants a margin on selling price of 20% (ignoring any overheads).

The frame. and massage mechanism will be bought in for $51 per chair and BCC will upholster it in leather and assemble it ready for despatch.

Leather costs $10 per metre and two metres are needed for a complete chair although 20% of all leather is wasted in the upholstery process.

The upholstery and assembly process will be subject to a learning effect as the workers get used to the new design.

BCC estimates that the first chair will take two hours to prepare but this will be subject to a learning rate (LR) of 95%.

The learning improvement will stop once 128 chairs have been made and the time for the 128th chair will be the time for all subsequent chairs. The cost of labour is $15 per hour.

The learning formula is shown on the formula sheet and at the 95% learning rate the value of b is -0·074000581.

Required:

(a) Calculate the average cost for the first 128 chairs made and identify any cost gap that may be present at

that stage. (8 marks)

(b) Assuming that a cost gap for the chair exists suggest four ways in which it could be closed. (6 marks)

The production manager denies any claims that a cost gap exists and has stated that the cost of the 128th chair will be low enough to yield the required margin.

(c) Calculate the cost of the 128th chair made and state whether the target cost is being achieved on the 128th chair. (6 marks)

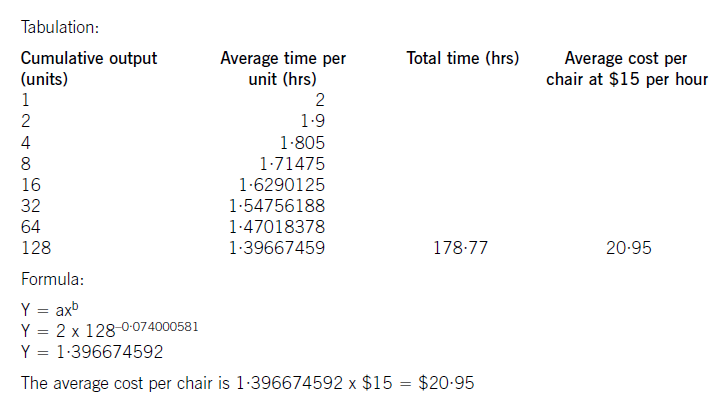

(W1)

The cost of the labour can be calculated using learning curve principles. The formula can be used or a tabular approach would

also give the average cost of 128 chairs. Both methods are acceptable and shown here.

(b) To reduce the cost gap various methods are possible (only four are needed for full marks)

– Re-design the chair to remove unnecessary features and hence cost

– Negotiate with the frame. supplier for a better cost. This may be easier as the volume of sales improve as suppliers often

are willing to give discounts for bulk buying. Alternatively a different frame. supplier could be found that offers a better

price. Care would be needed here to maintain the required quality

– Leather can be bought from different suppliers or at a better price also. Reducing the level of waste would save on cost.

Even a small reduction in waste rates would remove much of the cost gap that exists

– Improve the rate of learning by better training and supervision

– Employ cheaper labour by reducing the skill level expected. Care would also be needed here not to sacrifice quality or

push up waste rates.

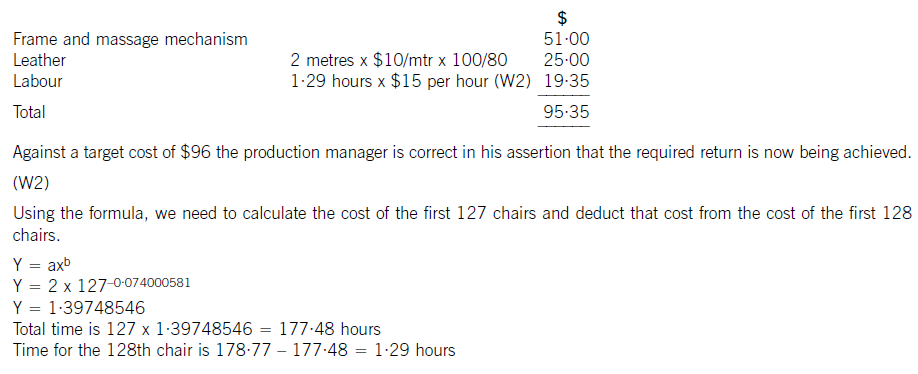

(c) The cost of the 128th chair will be:

(b) Explain how Perfect Shopper might re-structure its upstream supply chain to address the problems identified

in the scenario. (10 marks)

(b) Perfect Shopper currently has a relatively short upstream supply chain. They are bulk purchasers from established suppliers

of branded goods. Their main strength at the moment is to offer these branded goods at discounted prices to neighbourhood

shops that would normally have to pay premium prices for these goods.

In the upstream supply chain, the issue of branding is a significant one. At present, Perfect Shopper only provides branded

goods from established names to its customers. As far as the suppliers are concerned, Perfect Shopper is the customer and

the company’s regional warehouses are supplied as if they were the warehouses of conventional supermarkets. Perfect

Shopper might look at the following restructuring opportunities within this context:

– Examining the arrangements for the delivery of products from suppliers to the regional warehouses. At present this is in

the hands of the suppliers or contractors appointed by suppliers. It appears that when Perfect Shopper was established

it decided not to contract its own distribution. This must now be open to review. It is likely that competitors have

established contractual arrangements with logistics companies to collect products from suppliers. Perfect Shopper must

examine this, accompanied by an investigation into downstream distribution. A significant distribution contract would

probably include the branding of lorries and vans and this would provide an opportunity to increase brand visibility and

so tackle this issue at the same time.

– Contracting the supply and distribution of goods also offers other opportunities. Many integrated logistics contractors also

supply storage and warehousing solutions and it would be useful for Perfect Shopper to evaluate the costs of these.

Essentially, distribution, warehousing and packaging could be outsourced to an integrated logistics company and Perfect

Shopper could re-position itself as a primarily sales and marketing operation.

– Finally, Perfect Shopper must review how it communicates orders and ordering requirements with its suppliers. Their

reliance on supplier deliveries suggests that the relationship is a relatively straightforward one. There may be

opportunities for sharing information and allowing suppliers access to forecasted demand. There are many examples

where organisations have allowed suppliers access to their information to reduce costs and to improve the efficiency of

the supply chain as a whole.

The suggestions listed above assume that Perfect Shopper continues to only supply branded goods. Moving further upstream

in the supply chain potentially moves the company into the manufacture and supply of goods. This will raise a number of

significant issues about the franchise itself.

At present Perfect Shopper has, by necessity, concentrated on branded goods. It has not really had to understand how these

goods sell in specific locations because it has not been able to offer alternatives. The content of the standing order reflects

how the neighbourhood shop wishes to compete in its locality. However, if Perfect Shopper decides to commission its own

brand then the breadth of products is increased. Neighbourhood shops would be able to offer ‘own brand’ products to compete

with supermarkets who also focus on own brand products. It would also increase the visibility of the brand. However, Perfect

Shopper must be sure that this approach is appropriate as a whole. It could easily produce an own brand that reduces the

overall image of the company and hence devalues the franchise. Much more research is needed to assess the viability ofproducing ‘own brand’ goods.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-02-02

- 2021-08-29

- 2020-01-10

- 2019-01-04

- 2019-04-17

- 2020-01-10

- 2020-02-20

- 2020-01-10

- 2020-05-02

- 2019-04-10

- 2020-01-10

- 2020-04-18

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-02-27

- 2020-04-21

- 2020-05-17

- 2020-02-20

- 2020-01-09

- 2020-05-07

- 2020-05-14

- 2020-02-28

- 2020-01-10

- 2020-01-30

- 2020-01-01

- 2020-01-10

- 2020-03-11

- 2020-01-09