ACCA考试想提高通过率?这六大“基本原则”一定要看!

发布时间:2019-01-09

距离2018年12月3日ACCA考试还有3天!相信大家在最后的这几天时间里,都想要提高自己的ACCA考试通过率,那么,今天就为大家分享一下那些努力成功的考生的六大“基本原则”吧!

基本原则

1、通过为王:相信大家都不是奔着100分去的。对于ACCA这门考试,它只是一个资格水平测试。50分与100分都是一样的,都不会影响拿证的。ACCA官方只关心我们过没有过50,不关心我们考多高。

2、因人而异:有很多考生会比较纠结报什么班,选择哪个老师等等。其实说实话,每个当讲课的老师,都肯定能帮你考过,其根本原因就看你愿不愿意选择这个听这个老师的课,学习本来就枯燥,如果是自己愿意听得老师上课那自然就学的津津乐道啦。

3、坚持下去:作为ACCA考试的一员,还是要有计划的,不是等一天过完一半才去想做什么?到底该复习哪些,哪怕不能全部落实,也总比什么都没有强。每个月回顾回顾,自己是不是要赶赶进度了。在这里建议大家平时每天至少要保证两小时的学习时间,冲刺阶段比较特殊,建议尽量多空出时间来做历年真题、听备考科目的冲刺课,对重难点进行梳理及考法总结,更有助大家通过ACCA。

4、有舍有弃:在ACCA考试的过程中,遇到自己不会的题就先放弃,先做自己会的,不要一直纠结那一道题,这样会影响自己的答题时间,可能还会影响到心态等等。

5、步步为营:废其十指不如断其一指,先复习完一门,再来下一门,绝对比每天看几页这个,再看几页那个强。最后冲刺阶段,几门课混着看就好了。

6、心无旁骛:在备考ACCA考试的时候,不要学5分钟休息两个小时,这样是很没有效率的,在学习的过程中,尽量让自己的注意力集中,不要被外界事物所打扰,这样不仅会打断自己的学习思路和学习状态,而且还是加剧人的懒惰性。建议在备考ACCA考试的时候忘掉一切会影响自己的东西。

ACCA考试的通过率完全掌握在自己的手里。还有3天就要考试了,相信准备ACCA考试的考生心里还是有些紧张,在这里,建议大家一定要调整好心态,但也不要忘了上面关于ACCA考试的“六大原则”,加油吧!!!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Explain the advantages from a tax point of view of operating the new business as a partnership rather than

as a company whilst it is making losses. You should calculate the tax adjusted trading loss for the year

ending 31 March 2008 for both situations and indicate the years in which the loss relief will be obtained.

You are not required to prepare any other supporting calculations. (10 marks)

(b) The new business

There are two tax advantages to operating the business as a partnership.

(i) Reduction in taxable income

If the new business is operated as a company, Cindy and Arthur would both be taxed at 40% on their salaries. In

addition, employer and employee national insurance contributions would be due on £105 (£5,000 – £4,895) in respect

of each of them.

If the new business is operated as a partnership, the partners would have no taxable trading income because the

partnership has made a loss; any salaries paid to the partners would be appropriations of the profit or loss of the

business and not employment income. They would, however, each have to pay Class 2 national insurance contributions

of £2·10 each per week.

(ii) Earlier relief for trading losses

If the new business is operated as a company, its tax adjusted trading loss in the year ending 31 March 2008 would

be as follows:

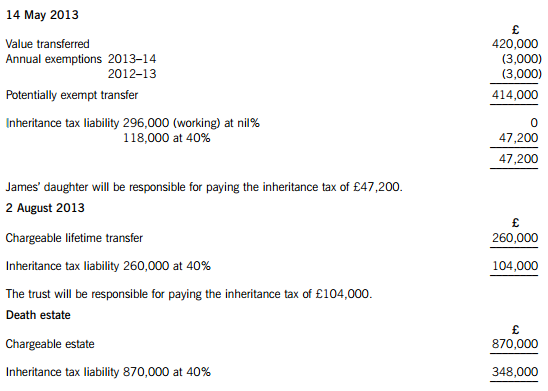

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.

(b) Examine how adopting a Six Sigma approach would help address the quality problems at UPC.

(10 marks)

(b) In many ways Six Sigma started out as a quality control methodology. It focused on measurement and the minimisation of

faults through pursuing Six Sigma as a statistical measure of some aspects of organisational performance. However, Six Sigma

has developed into something much more than a process control technique. It includes a problem-solving process called

DMAIC and a comprehensive toolkit ranging from brainstorming to balanced scorecards and process dashboards. It also has

defined team roles for managers and employees, often with martial arts names such as Black Belt, Green Belt and Master

Black Belt.

Six Sigma was first used in organisations in the early 1990s. However, it was its adoption and promotion by Jack Welch, the

CEO of GE that brought Six Sigma wider publicity. He announced that ‘Six Sigma is the most important initiative GE has ever

undertaken’. As Paul Harmon comments, ‘Welch’s popularity with the business press, and his dynamic style, guaranteed that

Six Sigma would become one of the hot management techniques of the late 1990s’.

Six Sigma uses an approach called DMAIC in its problem solving process. This stands for Define, Measure, Analyse, Improve

and Control. Three aspects of this are considered below in the context of how they would address the problems at UPC.

Defining the problem

Part of defining the problem is the identification of the customer. It is important to understand what customers really want

and value and one of the main themes of Six Sigma is its focus on the customer. Six Sigma explicitly recognises the ‘voice of

the customer’ (VOC) in its approach. In the UPC situation quality requirements are currently defined by the physical condition

of the goods and by the alignment of the image. However, this may be a limiting view of quality because there is no evidence

of any systematic investigation of the requirements of the customer. Solving these problems may not lead to any significant

long-term gain; they may be quickly replaced by other ‘quality issues’. Furthermore, the customer is also perceived in a limited

way. These quality requirements are in the eye of the gift shop owner who is interested in saleable products. The end customer

– the consumer – who buys and uses the product may have other requirements which can also be addressed at this time.

By considering the VOC the problem and scope of the project becomes re-defined and the solution of the problems potentially

more valuable.

Measurement

Measurement is fundamental to Six Sigma. This includes the gathering of data to validate and quantify the problem. The

creation of the inspection team was based on initial evidence about an increase in breakages. This needs to be quantified.

The inaccurate printing of the image had been quantified as 500 units per month, out of the 250,000 shipped out of the

company. This equates to a failure rate of 0·2%, so that 99·8% of items are shipped with a correctly aligned image. This

sounds quite reasonable but it still raises issues and complaints that have to be dealt with, as well as creating wastage costs

of $10,000 per month. The problem is that even a relatively low percentage of defects can lead to a lot of unhappy customers.

Aiming for Six Sigma would reduce defects down to about one faulty item per month, reducing the wastage cost to $20.

Analysis

Analysis is concerned with understanding the process to find the root cause. Six Sigma focuses on processes and their

analysis. Analysis concerns methods, machines, materials, measures, Mother Nature and people. The alignment problem

needs investigation to find out what causes the imaging machine to irregularly produce misaligned images. Management

currently appear to blame the machine but it may be due to the way that certain people load the machine. The analysis of

the breakages is particularly important. It is unclear at present where these breakages occur (for example, are some of the

items broken before they leave UPC’s despatch facility) or are they all broken in transit? Neither is it understood why the

breakages occur. Management appear to blame the packers for packing incorrectly and not following the correct method.

However, it may be that the material is just not strong enough to withstand heavy handling by couriers who are outside the

control of UPC. Additionally, the breakages may be due to some manufacturing problem or raw material imperfection in the

items that break. Six Sigma stresses understanding the problem before solving it.

Although DMAIC has been selected as the framework for the sample answer, focusing on other aspects of Six Sigma would

be acceptable – as long as they are presented in the context of the UPC scenario.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-02-02

- 2020-01-10

- 2020-04-17

- 2020-01-14

- 2020-02-15

- 2020-01-10

- 2020-05-05

- 2020-01-09

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-01-09

- 2020-02-14

- 2020-04-09

- 2020-01-10

- 2020-01-10

- 2020-02-21

- 2020-04-28

- 2020-01-03

- 2020-02-20

- 2020-01-10

- 2020-05-21

- 2020-01-10

- 2020-05-14

- 2019-12-29

- 2020-01-10

- 2020-01-14

- 2020-01-10

- 2020-01-10

- 2020-01-10