ACCA是什么,学习ACCA有哪些好处,了解一下

发布时间:2020-04-16

初次接触ACCA考试的小伙伴对于ACCA可能不太了解,今天就给大家分享一下ACCA是什么?有哪些特征?学习ACCA有哪些好处?一起来看看吧。

ACCA是什么

ACCA(the Association of Chartered Certified Accountants)是全球规模的专业会计师组织,目前在全球拥有20万名会员和50万名学员,学员遍布180多个国家,全球超过7500家机构成为ACCA认证雇主。ACCA也是最早进入中国的国际专业会计师组织,截止到2020年,ACCA中国地区会员和学员总数也分别超过了2.4万及6.1万名,考点遍布了北京、西安、哈尔滨、沈阳、大连、天津、青岛、泰安、济南、武汉、保定、烟台、郑州、兰州、乌鲁木齐、呼和浩特、上海、南京、杭州、合肥、无锡、长沙、南昌、广州、深圳、海口、南宁、厦门、成都、重庆等城市,并在北京、上海、成都、广州、深圳、沈阳、青岛、武汉、长沙、香港以及澳门11个地区设有代表处。

ACCA有哪些特征

1.系统性强

ACCA是一个系统性的学习体系,对于ACCA学员们来说,从零开始学习ACCA,就相当于从零基础开始,阶梯性地培养学生成为一个具备高端财务技能和职业操守的综合性人才。对于中国考生来说,ACCA的学习是一次全面提升财务能力及商务英语水平的机会,历经13门课程的考核,可以将学生培养成为能够驾驭跨国集团财务工作的高级人才。

2.知名度和认可度高

ACCA以其专业的财务技能及严谨的职业操守,在全球财务领域享有极高的知名度,也在中国地区得到了广泛的认可。据统计,大多数ACCA会员都能在大型上市公司担任CFO、财务总监、投资总监、董事会秘书、审计经理、内审经理等重要职务,年薪高达30-100万,甚至250万。

3.完善的后续教育系统

此外,ACCA还为其会员建立了完善的后续教育系统,ACCA会员或已完成知识和技能课程的ACCA学员可以通过提交7500字论文获得牛津布鲁克斯大学理学学士学位。ACCA会员还可以免费获取到最新的国际会计及审计准则原文,为其的职业生涯奠定坚实的基础。

4.与多个会计师组织签署互认协议

ACCA在全球与很多会计师组织有密切合作,与加拿大CGA等十多个组织签署了互认协议。ACCA会员只需要学习并通过加拿大税务和法律科目,即可得到CGA资格,ACCA会员累积五年工作经验后即可通过绿色通道申请ACA会计师会员资格。

学习ACCA有哪些好处

在全球会计准则趋同的形式下,先人一步的掌握领先的财务知识,应对全英文案例式考试的能力,将成为中国地区ACCA会员商务及财务英文水平的最有力证明。

以上就是今天分享的全部内容了,相信各位对ACCA考试有了更详细的了解,如需了解更多ACCA考试的相关内容,请继续关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) ‘opinion shopping’; (5 marks)

(b) ‘Opinion shopping’

Explanation of term

‘Opinion shopping’ occurs when management approach auditing firms (other than their incumbent auditors) to ask their views

on the application of accounting standards or principles to specific circumstances or transactions.

Ethical risks

The reasons for ‘opinion shopping’ may be:

■ to find alternative auditors; or

■ to get advice on a matter of contention with the incumbent auditor.

The member who is not the entity’s auditor must be alert to the possibility that their opinion – if it differs from that of the

incumbent auditor – may create undue pressure on the incumbent auditor’s judgement and so threaten the objectivity of the

audit.

Furthermore, by aligning with the interests of management when negotiating taking on an engagement, an incoming auditor

may compromise their objectivity even before the audit work commences. There is a risk that the audit fee might be seen to

be contingent upon a ‘favourable’ opinion (that is, the audit judgement coinciding with management’s preferences).

Employed professional accountants (accountants in industry) who support their company’s management in seeking second

opinions may call into question their integrity and professional behaviour.

Sufficiency of current ethical guidance

Current ethical guidance requires that when asked to provide a ‘second opinion’ a member should seek to minimise the risk

of giving inappropriate guidance, by ensuring that they have access to all relevant information.

The member should therefore:

■ ascertain why their opinion is being sought;

■ contact the auditor to provide any relevant facts;

■ with the entity’s permission, provide the auditor with a copy of their opinion.

The member’s opinion is more likely to differ if it is based on information which is different (or incomplete) as compared with

that available to the incumbent auditor. The member should therefore decline to act if permission to communicate with the

auditor is not given.

‘Opinion shopping’ might be less prevalent if company directors had no say in the appointment and remuneration of auditors.

If audit appointments were made by an independent body ‘doubtful accounting practices’ would (arguably) be less of a

negotiating factor. However, to be able to appoint auditors to multi-national/global corporations, such measures would require

the backing of regulatory bodies worldwide.

Statutory requirements in this area could also be more stringent. For example, an auditor may be required to deposit a

‘statement of circumstances’ (or a statement of ‘no circumstances’) in the event that they are removed from office or resign.

However, disclosure could be made more public if, when a change in accounting policy coincides with a change of auditors,

the financial statements and auditor’s report highlight the change and the auditors state their concurrence (or otherwise) with

the change. This could be made a statutory requirement and International Standards on Auditing (ISAs) amended to give

guidance on how auditors should report on changes.

Further, if the incoming auditor were to have a statutory right of access to the files and working papers of the outgoing auditors

they would be able to make a better and informed assessment of the desirability of the client and also appreciate the validity

(or otherwise) of any ‘statement’ issued by the outgoing auditor.

(d) Describe the three stages of a formal grievance interview that Oliver might seek with the appropriate partner

at Hoopers and Henderson following the formal procedure. (9 marks)

Part (d):

Oliver should arrange a formal grievance interview with the appropriate partner. Both Oliver and the partner need to be aware that

the grievance interview follows three steps in a particular and logical order. The meeting between Oliver and the partner responsible

for human resources must be in a formal atmosphere.

The first stage is exploration. The manager or supervisor – in this case the partner responsible for human resources – must gather

as much information as possible. No solution must be offered at this stage. The need is to establish what is actually the problem;

the background to the problem (in this case the icy relationship between Oliver and David Morgan) and the facts and causes of

the problem – in this case the resentment felt by David Morgan over Oliver’s appointment.

The second stage is the consideration stage. This is undertaken by the appropriate manager or partner here, who must firstly check

the facts, analyse the causes of the complaint and evaluate possible solutions. The meeting may be adjourned if at this stage the

partner requires more time to fulfil this step.

The final stage is the reply. This will be carried out by the partner after he or she has reached and reviewed a conclusion. It is

important that the outcome is recorded in writing; the meeting and therefore the interview and procedure is only successful when

an agreement is reached.

If no agreement is reached then the procedure should be taken to a higher level of management.

17 Which of the following statements are correct?

(1) All non-current assets must be depreciated.

(2) If goodwill is revalued, the revaluation surplus appears in the statement of changes in equity.

(3) If a tangible non-current asset is revalued, all tangible assets of the same class should be revalued.

(4) In a company’s published balance sheet, tangible assets and intangible assets must be shown separately.

A 1 and 2

B 2 and 3

C 3 and 4

D 1 and 4

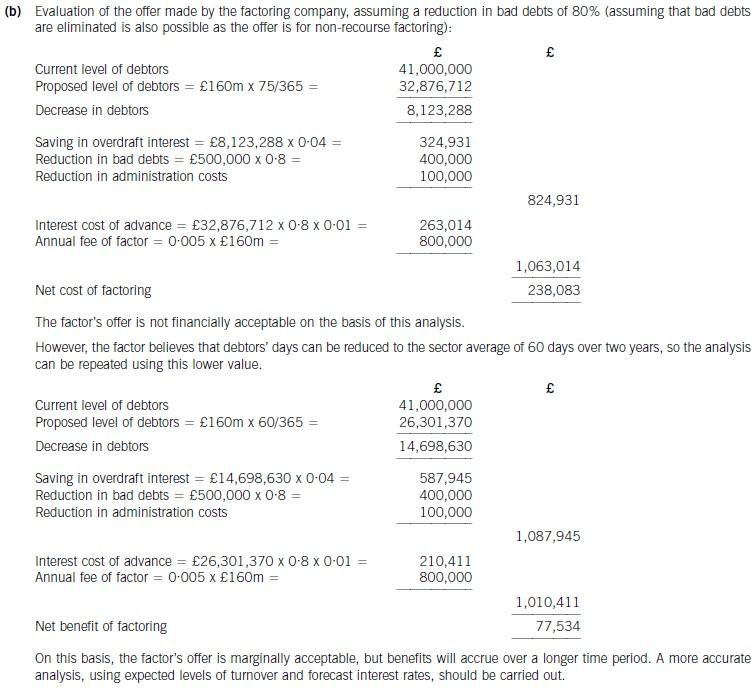

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-04-28

- 2020-01-10

- 2020-04-24

- 2020-01-10

- 2020-01-10

- 2020-02-27

- 2020-05-09

- 2020-01-10

- 2020-01-10

- 2020-04-22

- 2020-02-06

- 2020-02-20

- 2019-07-20

- 2020-01-10

- 2020-01-10

- 2020-02-20

- 2020-04-23

- 2020-01-10

- 2020-03-14

- 2020-01-10

- 2020-01-10

- 2020-05-19

- 2020-02-18

- 2020-01-09

- 2020-01-10

- 2020-04-15

- 2020-01-10

- 2020-01-31

- 2020-01-10

- 2019-12-27