你必须注意:中国ACCA考试通过率能有多少?

发布时间:2020-04-02

大家很想知道ACCA考试在中国通过率有多少,今天51题库考试学习网就告诉大家中国学员通过率还是挺高的,大家对考试要有信心。

对于ACCA的难度,其实很大一部分是来自于英语和坚持,只要英语过关,一般平时认真看书,做题还是很容易通过的。ACCA全球单科通过率基本在30-40%左右,中国学员通过率为50-60%。

有人说,ACCA考试的难度是以英国大学学位考试的难度为标准的,具体而言,第一、第二部分的难度分别相当于学士学位高年级课程的考试难度,第三部分的考试相当于硕士学位最后阶段的考试。但与国内的CPA考试相比之下,在考试难度上,ACCA要远远低于CPA。

那么,ACCA究竟难在哪儿呢?其实,对于很大部分人来说全英文的考试环境和漫长的考试周期。

ACCA考试每个季度都会进行一次考试,每个考季考生最多可以报考4个科目,但是每年考生最多只能报考8个科目。因此,考生最快需要一年半的时间才能通过ACCA全部科目的考试,当然学习进度慢的考生很可能需要花上3-4年的时间。因此,对于我们来说,只要克服了英语,只要坚持不懈地学习,那么,ACCA真的并不是想象中的那么难。

课程设置

ACCA考试是按现代企业财务人员需要具备的技能和技术的要求而设计的,共有13门课程,两门选修课,课程分为3个阶段:

第一阶段(知识阶段)(AB MA FA)分涉及基本会计学原理、管理学原理、管理会计基础;

第二阶段(技能阶段)(LW PM TX FR AA FM)涵盖专业财会人员应具备的核心专业技能;

第三阶段(高级阶段)(SBL SBR APM AFM ATX AAA)培养学员以专业知识对信息进行评估,并提出合理的经营建议和忠告。

注册资格

a.具有教育部认可的大专以上学历,既可以报名成为ACCA的正式学员。

b.教育部认可的高等院校在校生,且顺利通过第一学年的所有课程考试,既可报名成为ACCA正式学员。

c.未符合以上报名资格的申请者,但年龄在18岁以上,可以先注册为FIA,并通过FAB,FMA,FFA三门考试(该三门考试与AB、MA、FA一致)便可以转为ACCA正式学员(需要在账户中选择转换路径),并获得前三门免试,直接进入ACCA技能课程阶段的考试。

以上就是51题库考试学习网为大家分享的内容了,考试的通过率最可以反映考试的难度,中国学员的通过率还不错,大家都要加油哦。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) When a director retires, amounts become payable to the director as a form. of retirement benefit as an annuity.

These amounts are not based on salaries paid to the director under an employment contract. Sirus has

contractual or constructive obligations to make payments to former directors as at 30 April 2008 as follows:

(i) certain former directors are paid a fixed annual amount for a fixed term beginning on the first anniversary of

the director’s retirement. If the director dies, an amount representing the present value of the future payment

is paid to the director’s estate.

(ii) in the case of other former directors, they are paid a fixed annual amount which ceases on death.

The rights to the annuities are determined by the length of service of the former directors and are set out in the

former directors’ service contracts. (6 marks)

Required:

Draft a report to the directors of Sirus which discusses the principles and nature of the accounting treatment of

the above elements under International Financial Reporting Standards in the financial statements for the year

ended 30 April 2008.

(b) Directors’ retirement benefits

The directors’ retirement benefits are unfunded plans which may fall under IAS19 ‘Employee Benefits’.

Sirus should review its contractual or constructive obligation to make retirement benefit payments to its former directors at the

time when they leave the firm. The payments may create a financial liability under IAS32, or may give rise to a liability of

uncertain timing and amount which may fall within the scope of IAS37 ‘Provisions, contingent liabilities and contingent

assets’. Certain former directors are paid a fixed annuity for a fixed term which is payable annually, and on death, the present

value of future payments are paid to the director’s estate. An annuity meets the definition of a financial liability under IAS32,

if there is a contractual obligation to deliver cash or a financial asset. The latter form. of annuity falls within the scope of

IAS32/39. The present value of the annuity payments should be determined. The liability is recognised because the directors

have a contractual right to the annuity and the firm has no discretion in terms of withholding the payment. As the rights to

the annuities are earned over the period of the service of the directors, then the costs should have been recognised also over

the service period.

Where an annuity has a life contingent element and, therefore, embodies a mortality risk, it falls outside the scope of IAS39

because the annuity will meet the definition of an insurance contract which is scoped out of IAS39, along with employers’

rights and obligations under IAS19. Such annuities will, therefore, fall within the scope of IAS37 if a constructive obligation

exists. Sirus should assess the probability of the future cash outflow of the present obligation. Because there are a number of

similar obligations, IAS37 requires that the class of obligations as a whole should be considered (similar to a warranty

provision). A provision should be made for the best estimate of the costs of the annuity and this would include any liability

for post retirement payments to directors earned to date. The liability should be built up over the service period rather than

just when the director leaves. In practice the liability will be calculated on an actuarial basis consistent with the principles in

IAS19. The liability should be recalculated on an annual basis, as for any provision, to take account of changes in directors

and other factors. The liability will be discounted where the effect is material.

22 Which of the following statements about limited liability companies’ accounting is/are correct?

1 A revaluation reserve arises when a non-current asset is sold at a profit.

2 The authorised share capital of a company is the maximum nominal value of shares and loan notes the company

may issue.

3 The notes to the financial statements must contain details of all adjusting events as defined in IAS10 Events after

the balance sheet date.

A All three statements

B 1 and 2 only

C 2 and 3 only

D None of the statements

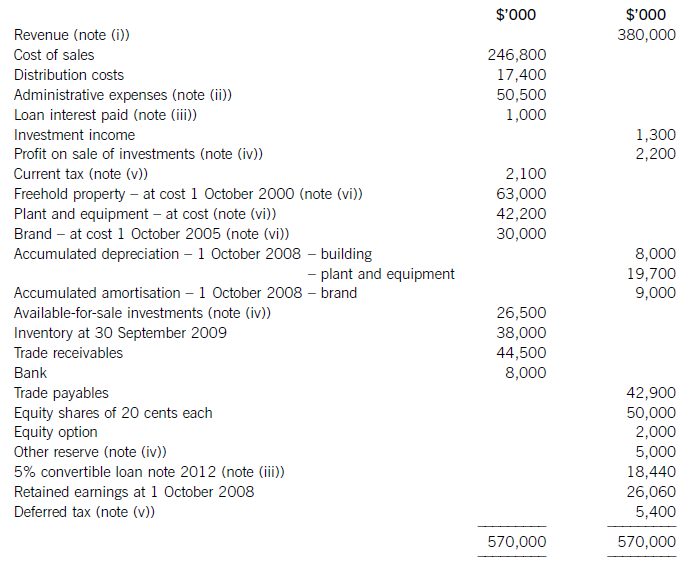

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-05-09

- 2020-05-20

- 2020-01-09

- 2020-03-29

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-02-20

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-03-04

- 2020-01-28

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2019-06-27

- 2021-06-26

- 2020-01-09

- 2020-01-09

- 2020-01-10

- 2020-04-30

- 2020-01-10

- 2020-01-10

- 2020-05-13

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10