考生必看:考不过ACCA的原因,你知道有哪些吗?

发布时间:2021-05-29

各位小伙伴请注意了!ACCA作为“国际财会界的通行证”,每年报考的人数都十分多,有的考生报一科过一科,而有的考生一科报考了好几次,总是通不过,这是为什么呢?51题库考试学习网为大家带来了相关内容,让我们一起来看看吧!

一、死记硬背

ACCA考试为全英文考试,考试难度比较大,需要有较强的逻辑思维能力,但很多考生在备考的过程中,却没有找到正确的学习方法,觉得反正都是英文,我把这些内容背下来不就可以了,结果等到考试的时候,题型一变就完全不知道怎么回答了。所以在备考的过程中,我们一定要做到熟练掌握书中的内容,注重基础知识,抓住考试重点,理解记忆,千万不要死记硬背。对于那些英语基础不好的同学来说,先打好英语基础是非常有必要的,ACCA考试对于英语的要求不高,但是由于是全英文的考试,所以让很多考生望而却步,大家在备考的时候要尤其注意对考试专业词汇的掌握,这样大家在做题时就会轻松很多。

二、投机取巧

学习并不是一蹴而就、一朝一夕就可以完成的,而是要一点点积累的。但有的考生在备考的过程中,喜欢投机取巧,过度依赖学习技巧,不重视基础知识,想通过学习技巧从而达到快速学习的目的,但这样做往往会事倍功半,学习技巧我们可以加以利用,但要正确适当地利用这些学习技巧,不要过于极端,要将这些学习技巧多加研究,结合自身的情况,形成自己的学习方法。在复习的时候要踏踏实实复习,不要抱有侥幸心理。

三、学习意志不坚定

因ACCA考试难度大,很多小伙伴在备考的过程中,难免会产生想要放弃的想法,总觉得自己无法坚持,要不然就是学习懒散拖拉,无法端正学习的态度,不能正视自己的问题,总是为自己找借口,找原因,逃避学习,等到考试的时候,自然是考不好的。所以备考ACCA,我们一定要积极乐观地面对,既然报考了,我们就要抱着必胜的决心考下来。拥有坚定的意志力对于通过考试有着非常大的帮助,所以大家一定要学会坚持。

以上就是今天分享的全部内容了,各位小伙伴根据自己的情况进行查阅,希望本文对各位有所帮助,预祝各位取得满意的成绩,如需了解更多相关内容,请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(d) Corporate annual reports contain both mandatory and voluntary disclosures.

Required:

(i) Distinguish, using examples, between mandatory and voluntary disclosures in the annual reports of

public listed companies. (6 marks)

(d) (i) Mandatory and voluntary disclosures

Mandatory disclosures

These are components of the annual report mandated by law, regulation or accounting standard.

Examples include (in most jurisdictions) statement of comprehensive income (income or profit and loss statement),

statement of financial position (balance sheet), cash flow statement, statement of changes in equity, operating segmental

information, auditors’ report, corporate governance disclosure such as remuneration report and some items in the

directors’ report (e.g. summary of operating position). In the UK, the business review is compulsory.

Voluntary disclosures

These are components of the annual report not mandated in law or regulation but disclosed nevertheless. They are

typically mainly narrative rather than numerical in nature.

Examples include (in most jurisdictions) risk information, operating review, social and environmental information, and

the chief executive’s review.

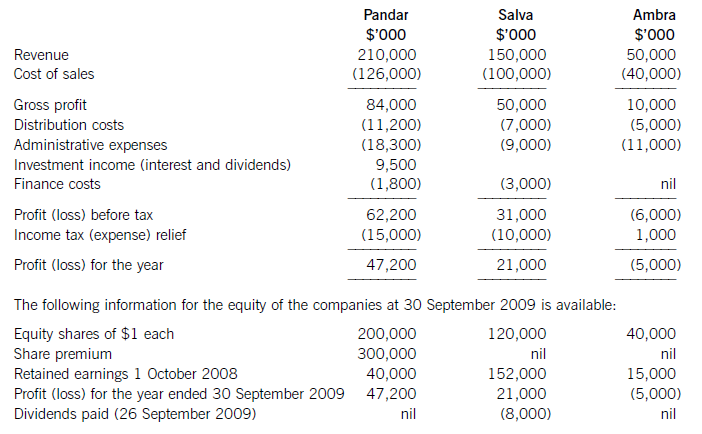

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

(d) There is considerable evidence to suggest that as a result of implementation problems less than 50% of all

acquisitions achieve their objectives and actually end up reducing shareholder value.

Required:

Provide Ken with a brief report on the most likely sources of integration problems and describe the key

performance indicators he should use to measure progress towards acquisition objectives. (15 marks)

(d) Many academic studies, together with actual managerial experience, point to the post-acquisition integration phase as being

the key to an acquirer achieving their acquisition objectives. In particular, the creation (or destruction) of shareholder value

rests most heavily on the success of the integration phase, which in turn helps determine whether the acquirer has chosen

the ‘right’ target company and paid the right price for it. One source strongly argues that the capability to manage the

integration of the two organisational sturctures, in particular the conversion of information systems and retention and

motivation of key employees, determines how much value can be extracted from the combined entities. The ability to manage

the integration process will therefore affect the success of the prior phases of the acquisition process – the search for and

screening of potential candidates, the effective carrying out of due diligence, financial evaluation and successful negotiation

of the deal.

Unfortunately, the failure to develop the necessary integration skills dooms many firms to continued failure with their

acquisitions, though some firms are conspicuously successful in developing such a capability and they gain significant

competitive advantage over their less successful competitors and create value for the stakeholders. One explanation for this

conspicuous inability to learn from past acquisition experience, compared with other activities in the value chain, lies with

their infrequency and variety. ‘No acquisition is like another.’ Much of the difficulty however lies in the complex

interrelationship and interdependency between the activities being integrated and a consequent difficulty of knowing what is

causing performance problems. Thus, it is no good communicating all the positives to the customer if there is a failure to

retain and motivate the sales force. To this complexity of integrating different processes is added the problem of developing

appropriate measures of and accurate monitoring of the integration processes. In one study of US bank acquirers, only 40%

had developed specific performance measures for the systems conversion process, despite the critical importance of systems

integration to efficient operation of the combined banks. Key performance indicators need to be set in the areas previously

identified as offering major opportunities for synergies. These synergies will affect both the cost and revenue side of the

business. Real cost reductions are clearly a major reason for the proposed acquisition in view of the competitive environment

faced. Equally relevant are appropriate measures of customer service. Each area will need appropriate key performance

indicators showing priorities and relevant timescales for achievement.

Therefore, there is a critical need to learn from previous experience and the relationship between decisions made, actions

taken and performance outcomes. This knowledge and experience needs to be effectively recorded and shared. It can then

influence the earlier phases of the acquisition referred to above, thus leading to a virtuous circle of better integration and

acquisitions that actually enhance value. In so doing, acquisitions can lead to faster growth and better performance.

Which of the following statements relating to internal and external auditors is correct?

A.Internal auditors are required to be members of a professional body

B.Internal auditors’ scope of work should be determined by those charged with governance

C.External auditors report to those charged with governance

D.Internal auditors can never be independent of the company

A is incorrect as internal auditors are not required to be members of any professional body. C is incorrect as external auditors report to shareholders rather than those charged with governance. D is incorrect as internal auditors can be independent of the company, if, for example, the internal audit function has been outsourced.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2019-12-29

- 2021-05-29

- 2019-03-09

- 2020-09-05

- 2021-05-29

- 2020-08-15

- 2020-10-10

- 2020-10-10

- 2020-10-10

- 2020-10-18

- 2020-10-10

- 2020-09-04

- 2019-03-17

- 2020-10-21

- 2020-09-05

- 2020-10-18

- 2021-02-13

- 2021-05-29

- 2021-02-13

- 2021-05-29

- 2020-10-21

- 2020-10-10

- 2020-10-21

- 2020-10-10

- 2020-01-02

- 2020-10-21

- 2021-05-29

- 2019-03-24

- 2020-10-18

- 2020-10-10