备考资料:2020年ACCA考试FR财务报告知识点(6)

发布时间:2020-10-09

今日51题库考试学习网为大家带来“备考资料:2020年ACCA考试FR财务报告知识点(6)”的相关知识点,各位辛勤备考的小伙伴一起来看看吧。

【知识点】Other Government assistance其他政府援助

Other Government assistance

Some forms of government assistance are

excluded from the definition of government grants.

(a) Some forms of government assistance

cannot reasonably have a value placed on them, e.g. free technical or marketing

advice, provision of guarantees.

(b) There are transactions with government

which cannot be distinguished from the entity\'s normal trading transactions,

e.g. government procurement policy resulting in a portion of the entity\'s

sales. Any segregation would be arbitrary.

Disclosure of such assistance may be

necessary because of its significance;Its nature, extent and duration should be

disclosed.

【知识点】Development costs开发成本

Development costs

Development costs may qualify for

recognition as intangible assets provided that the following strict criteria

can be demonstrated.

a) The technical feasibility of completing

the intangible asset so that it will be available for use or sale.

b) Its intention to complete the intangible

asset and use or sell it.

c) Its ability to use or sell the

intangible asset.

d) How the intangible asset will generate

probable future economic benefits. The entity should demonstrate the existence

of a market for the output of the intangible asset or the intangible asset

itself.

e) Its ability to measure the expenditure

attributable to the intangible asset during its development reliably.

f) Resources adequate and available to

complete.

【知识点】Indicators of impairment 减值指标

Indicators of impairment

External sources of information

A fall in the asset\'s market value that is

more significant than would normally be expected from passage of time over

normal use.

A significant change in the technological,

market, legal or economic environment of the business in which the assets are

employed.

An increase in market interest rates or

market rates of return on investments likely to affect the discount rate used

in calculating value in use.

The carrying amount of the entity\'s net

assets being more than its market capitalization.

Internal sources of information

evidence of obsolescence or physical

damage, adverse changes in the use to which the asset is put, or the asset\'s

economic performance.

No indications of impairment

Even if there are no indications of

impairment, the following assets must always be tested for impairment annually.

An intangible asset with an indefinite

useful life.

Goodwill acquired in a business combination.

以上就是51题库考试学习网带给大家的全部内容,相信小伙伴们都了解清楚。预祝12月份ACCA考试取得满意的成绩,如果想要了解更多关于ACCA考试的资讯,敬请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(d) Explain whether or not Dovedale Ltd, Hira Ltd and Atapo Inc can register as a group for the purposes of value

added tax. (3 marks)

(d) Dovedale Ltd and Hira Ltd can register as a group for the purposes of value added tax (VAT) because Dovedale Ltd controls

Hira Ltd and both companies are established in the UK in that their head offices are in the UK.

Dovedale Ltd will also control Atapo Inc. However, Atapo Inc cannot be part of a group registration unless it is established

in the UK or has a fixed establishment in the UK. It will be regarded as established in the UK if it is centrally managed and

controlled in the UK or if its head office is in the UK. A fixed establishment is a place where the company has staff and

equipment and where its business is carried on.

(c) (i) Explain the inheritance tax (IHT) implications and benefits of Alvaro Pelorus varying the terms of his

father’s will such that part of Ray Pelorus’s estate is left to Vito and Sophie. State the date by which a

deed of variation would need to be made in order for it to be valid; (3 marks)

(c) (i) Variation of Ray’s will

The variation by Alvaro of Ray’s will, such that assets are left to Vito and Sophie, will not be regarded as a gift by Alvaro.

Instead, provided the deed states that it is intended to be effective for IHT purposes, it will be as if Ray had left the assets

to the children in his will.

This strategy, known as skipping a generation, will have no effect on the IHT due on Ray’s death but will reduce the

assets owned by Alvaro and thus his potential UK IHT liability. A deed of variation is more tax efficient than Alvaro

making gifts to the children as such gifts would be PETs and IHT may be due if Alvaro were to die within seven years.

The deed of variation must be entered into by 31 January 2009, i.e. within two years of the date of Ray’s death.

(ii) Explain the organisational factors that determine the need for internal audit in public listed companies.

(5 marks)

(ii) Factors affecting the need for internal audit and controls

(Based partly on Turnbull guidance)

The nature of operations within the organisation arising from its sector, strategic positioning and main activities.

The scale and size of operations including factors such as the number of employees. It is generally assumed that larger

and more complex organisations have a greater need for internal controls and audit than smaller ones owing to the

number of activities occurring that give rise to potential problems.

Cost/benefit considerations. Management must weigh the benefits of instituting internal control and audit systems

against the costs of doing so. This is likely to be an issue for medium-sized companies or companies experiencing

growth.

Internal or external changes affecting activities, structures or risks. Changes arising from new products or internal

activities can change the need for internal audit and so can external changes such as PESTEL factors.

Problems with existing systems, products and/or procedures including any increase in unexplained events. Repeated or

persistent problems can signify the need for internal control and audit.

The need to comply with external requirements from relevant stock market regulations or laws. This appears to be a

relevant factor at Gluck & Goodman.

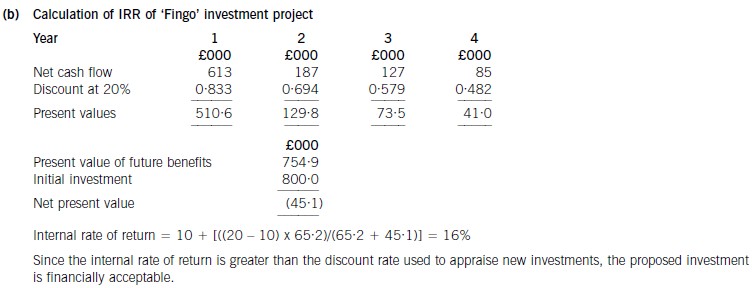

(b) Calculate the internal rate of return of the proposed investment and comment on your findings. (5 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-10-09

- 2020-10-09

- 2019-01-04

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2019-01-04

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2019-01-04