备考资料:2020年ACCA考试审计与认证业务知识点(1)

发布时间:2020-10-09

又到了每日分享小课堂,各位赶快集合。今天51题库考试学习网分享的内容是备考资料:2020年ACCA考试审计与认证业务知识点(1),这个考点都清楚了吗?还未了解的小伙伴一起来看看吧。

【知识点】The objective of external audit

engagements 外部审计业务的目标

The objective of external audit engagements

• The objective of an audit is to enable

the auditor to express an opinion whether the FS are prepared, in all material

respects, in accordance with an applicable financial reporting framework. (ISA

200 Objective and General Principles Governing an Audit of FS).

• In AA, the framework is International

Financial Reporting Standards. (IFRS).

• The main purpose of external audit is to

enhance the degree of confidence of users in the FS.

• External audits include statutory audit

and non-statutory audit.

【知识点】International auditing and assurance

standards board (IAASB) 国际审计与鉴证准则理事会

International auditing and assurance

standards board (IAASB)

※ IAASB, including 18 members, is a

technical standing committee of the IFAC.

Its members are nominated by IFAC Board and

are responsible for setting ISAs.

The objective of the IAASB, on behalf of

the IFAC Board, is to serve the public interest by:

√ setting high quality auditing and

assurance standards;

√facilitating the convergence of

international and national standards;

√ enhancing the quality and uniformity of

practice throughout the world;

√strengthening public confidence in the

global auditing and assurance profession.

The IAASB achieves its objective

specifically by:

√ Establishing high quality auditing

standards and guidance for financial statement audits that are generally

accepted and recognized by key stakeholders across the world.

√ Establishing high quality standards and

guidance for other types of assurance services on both financial and

non-financial matters.

√ Establishing high quality standards and

guidance for other related services.

√Establishing high quality standards for quality

control covering the scope of services addressed by the IAASB.

√ Publishing other pronouncements on

auditing and assurance matters.

√ Advancing public understanding of the

roles and responsibility of professional auditors and assurance service providers.

以上就是51题库考试学习网带给大家的全部内容,相信小伙伴们都了解清楚。预祝12月份ACCA考试取得满意的成绩,如果想要了解更多关于ACCA考试的资讯,敬请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

1 Stuart is a self-employed business consultant aged 58. He is married to Rebecca, aged 55. They have one child,

Sam, who is aged 24 and single.

In November 2005 Stuart sold a house in Plymouth for £422,100. Stuart had inherited the house on the death of

his mother on 1 May 1994 when it had a probate value of £185,000. The subsequent pattern of occupation was as

follows:

1 May 1994 to 28 February 1995 occupied by Stuart and Rebecca as main residence

1 March 1995 to 31 December 1998 unoccupied

1 January 1999 to 31 March 2001 let out (unfurnished)

1 April 2001 to 30 November 2001 occupied by Stuart and Rebecca

1 December 2001 to 30 November 2005 used occasionally as second home

Both Stuart and Rebecca had lived in London from March 1995 onwards. On 1 March 2001 Stuart and Rebecca

bought a house in London in their joint names. On 1 January 2002 they elected for their London house to be their

principal private residence with effect from that date, up until that point the Plymouth property had been their principal

private residence.

No other capital disposals were made by Stuart in the tax year 2005/06. He has £29,500 of capital losses brought

forward from previous years.

Stuart intends to invest the gross sale proceeds from the sale of the Plymouth house, and is considering two

investment options, both of which he believes will provide equal risk and returns. These are as follows:

(1) acquiring shares in Omikron plc; or

(2) acquiring further shares in Omega plc.

Notes:

1. Omikron plc is a listed UK trading company, with 50,250,000 shares in issue. Its shares currently trade at 42p

per share.

2. Stuart and Rebecca helped start up the company, which was then Omega Ltd. The company was formed on

1 June 1990, when they each bought 24,000 shares for £1 per share. The company became listed on 1 May

1997. On this date their holding was subdivided, with each of them receiving 100 shares in Omega plc for each

share held in Omega Ltd. The issued share capital of Omega plc is currently 10,000,000 shares. The share price

is quoted at 208p – 216p with marked bargains at 207p, 211p, and 215p.

Stuart and Rebecca’s assets (following the sale of the Plymouth house but before any investment of the proceeds) are

as follows:

Assets Stuart Rebecca

£ £

Family house in London 450,000 450,000

Cash from property sale 422,100 –

Cash deposits 165,000 165,000

Portfolio of quoted investments – 250,000

Shares in Omega plc see above see above

Life insurance policy note 1 note 1

Note:

1. The life insurance policy will pay out a sum of £200,000 on the death of the first spouse to die.

Stuart has recently been diagnosed with a serious illness. He is expected to live for another two or three years only.

He is concerned about the possible inheritance tax that will arise on his death. Both he and Rebecca have wills whose

terms transfer all assets to the surviving spouse. Rebecca is in good health.

Neither Stuart nor Rebecca has made any previous chargeable lifetime transfers for the purposes of inheritance tax.

Required:

(a) Calculate the taxable capital gain on the sale of the Plymouth house in November 2005 (9 marks)

Note that the last 36 months count as deemed occupation, as the house was Stuart’s principal private residence (PPR)

at some point during his period of ownership.

The first 36 months of the period from 1 March 1995 to 31 March 2001 qualifies as a deemed occupation period as

Stuart and Rebecca returned to occupy the property on 1 April 2001. The remainder of the period will be treated as a

period of absence, although letting relief is available for part of the period (see below).

The exempt element of the gain is the proportion during which the property was occupied, real or deemed. This is

£138,665 (90/139 x £214,160).

(2) The chargeable gain is restricted for the period that the property was let out. This is restricted to the lowest of the

following:

(i) the gain attributable to the letting period (27/139 x 214,160) = £41,599

(ii) £40,000

(iii) the total exempt PPR gain = £138,665

i.e. £40,000.

(3) The taper relief is effectively wasted, having restricted losses b/f to preserve the annual exemption.

(ii) Theory Y. (5 marks)

(ii) Theory Y is at the opposite end of the continuum and reflects a contemporary approach to motivation, reflecting growth in professional and service employment. It is based on the idea that the goals of the individual and the organsiation can– indeed should – be integrated and that personal fulfilment can be achieved through the workplace. It assumes that for most people, work is as natural as rest or play and employees will exercise self-discipline and self-direction in helping to achieve the organisation’s objectives. Physical and mental effort at work is perfectly natural and is actively sought as a source of personal satisfaction.

In addition, the average employee seeks and accepts responsibilty and creativity. Innovative thinking is widely distributed amongst the whole population and should therefore be encouraged in the work situation.

The intellectual ability of the average person is only partly used and should be encouraged and thus individuals are motivated by seeking self-achievement. Since control and punishment are not required, management therefore has to encourage and develop the individual. However, the operation of a Theory Y approach can be difficult and frustrating,time consuming and sometimes regarded with suspicion.

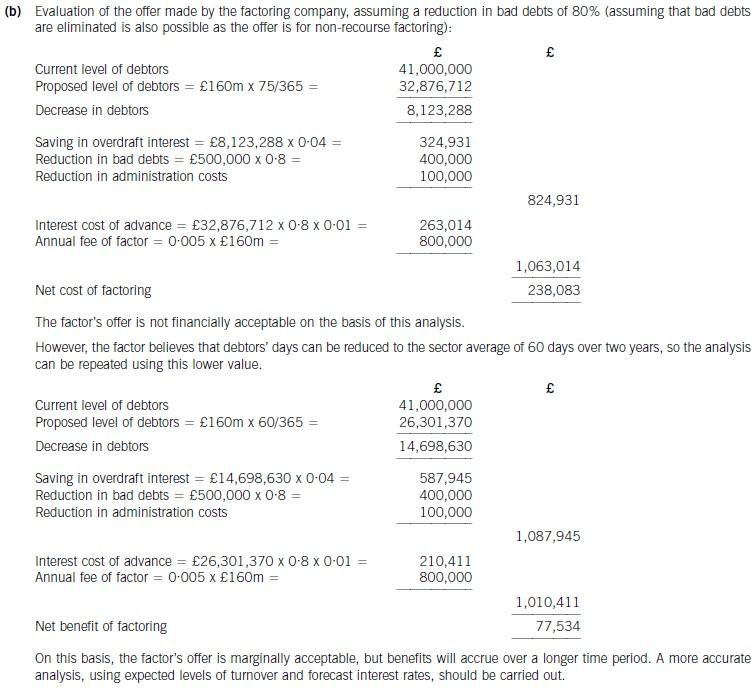

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-10-18

- 2020-10-18

- 2019-01-04

- 2020-10-09

- 2020-10-09

- 2020-10-18

- 2020-10-18

- 2020-10-09

- 2020-10-09

- 2020-10-18

- 2020-10-18

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-18

- 2020-10-18

- 2020-10-09

- 2020-10-18

- 2020-10-09

- 2020-10-09

- 2020-10-18

- 2020-10-18

- 2020-10-18

- 2020-10-09

- 2020-10-18

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09