重庆考ACCA有什么福利政策?

发布时间:2021-03-12

重庆考ACCA有什么福利政策?

最佳答案

优惠政策:

购房补贴

ACCA被列入临空创新人才目录,最高可获200万元项目资金,60万元人才补贴,25万元一次性购房补贴。临空创新人才及其配偶、子女户口可随调随迁。下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

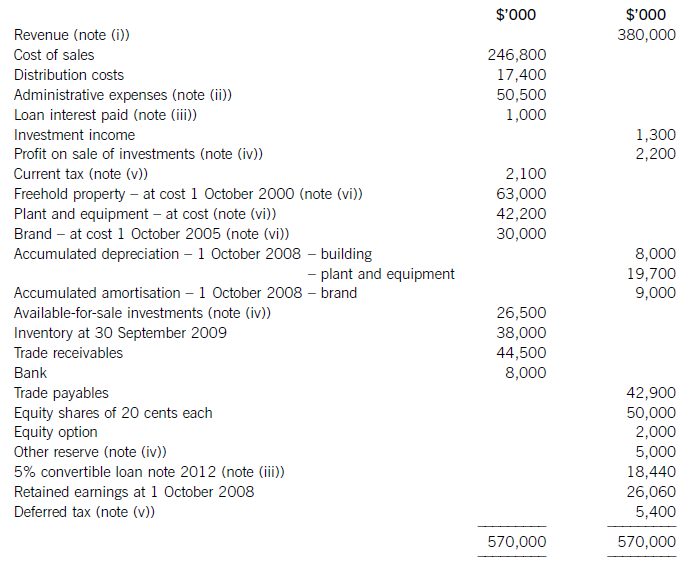

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities.

(b) Illustrate EACH of the six problems chosen in (a) using the data from the Bettamould division/TRG scenario;

and (6 marks)

(b) An illustration of each of the problems using the data from the Battamould division/TRG scenario is as follows:

Meeting only the lowest targets

– In the scenario, the budgeted variable cost of $200 per tonne has been agreed. There is no specific incentive for the

Bettamould division to try to achieve a better level of performance.

Using more resources than necessary

– In the scenario, the current budget allows for 5% machine idle time. There is evidence that a move to outsourcing

machine maintenance from a specialist company could help reduce idle time levels and permit annual output in excess

of 100,000 tonnes.

Making the bonus – whatever it takes

– At present, the only sanction/incentive is to achieve 100,000 tonnes of output. There is no mention of any sanction for

example, if processing losses (and hence costs) rise to 20% of material inputs.

Competing against other divisions, business units and departments

– At present, the Bettamould division sources its materials from chosen suppliers who have been used for some years.

There is evidence that materials of equal specification could be sourced for 40% of the annual requirement from another

TRG division which has spare capacity. Why has this not been investigated?

Ensuring that what is in the budget is spent

– In the Bettamould scenario, there is a fixed cost budget allowance of $50,000,000. We are told in the question that

salaries of all employees and management are paid on a fixed salary basis. Bettamould’s management will not want a

reduction in the fixed budget allowance, since this could lead to the need to reduce the number of employees, which

they may see as having a detrimental effect on the ability of the division to meet its annual budget output target of

100,000 tonnes.

Providing inaccurate forecasts

– In the scenario there may have been deliberate efforts to increase the agreed budget level of aspects of measures and

costs. For example, by putting forward the argument that the budget requirement of 15% processing losses is acceptable

because of the likelihood that ageing machinery will be less effective in the coming budget period.

Meeting the target but not beating it

– In the scenario the bonus of 5% of salary is payable as long as the 100,000 tonnes of output is achieved. This does

not require that actual results will show any other aspects of the budget being improved upon. For example there is no

need to consider a reduction in the current level of quality checks (25% of daily throughput) to the 10% level that current

evidence suggests is achieved by competitor companies. The current budget agreement allows the Bettamould division

to transfer its output to market based profit centres at $200 + $500 = $700 per tonne. There is no specified penalty

if costs exceed this target level.

Avoiding risks

– Bettamould has not yet incorporated the changes listed in note 4 in the question. For example why has the sourcing of

40% of required materials from another TRC division not been quantified and evaluated. It is possible that the division

with spare capacity could supply the material at cost (possibly based on marginal cost) which would be less than

currently paid to a supplier external to TRC. It may be that Bettamould have not pursued this possibility because of risk

factors relating to the quality of the material transferred or its continued availability where the supplying division had an

upturn in the level of more profitable external business.

(b) Ambush loaned $200,000 to Bromwich on 1 December 2003. The effective and stated interest rate for this

loan was 8 per cent. Interest is payable by Bromwich at the end of each year and the loan is repayable on

30 November 2007. At 30 November 2005, the directors of Ambush have heard that Bromwich is in financial

difficulties and is undergoing a financial reorganisation. The directors feel that it is likely that they will only

receive $100,000 on 30 November 2007 and no future interest payment. Interest for the year ended

30 November 2005 had been received. The financial year end of Ambush is 30 November 2005.

Required:

(i) Outline the requirements of IAS 39 as regards the impairment of financial assets. (6 marks)

(b) (i) IAS 39 requires an entity to assess at each balance sheet date whether there is any objective evidence that financial

assets are impaired and whether the impairment impacts on future cash flows. Objective evidence that financial assets

are impaired includes the significant financial difficulty of the issuer or obligor and whether it becomes probable that the

borrower will enter bankruptcy or other financial reorganisation.

For investments in equity instruments that are classified as available for sale, a significant and prolonged decline in the

fair value below its cost is also objective evidence of impairment.

If any objective evidence of impairment exists, the entity recognises any associated impairment loss in profit or loss.

Only losses that have been incurred from past events can be reported as impairment losses. Therefore, losses expected

from future events, no matter how likely, are not recognised. A loss is incurred only if both of the following two

conditions are met:

(i) there is objective evidence of impairment as a result of one or more events that occurred after the initial recognition

of the asset (a ‘loss event’), and

(ii) the loss event has an impact on the estimated future cash flows of the financial asset or group of financial assets

that can be reliably estimated

The impairment requirements apply to all types of financial assets. The only category of financial asset that is not subject

to testing for impairment is a financial asset held at fair value through profit or loss, since any decline in value for such

assets are recognised immediately in profit or loss.

For loans and receivables and held-to-maturity investments, impaired assets are measured at the present value of the

estimated future cash flows discounted using the original effective interest rate of the financial assets. Any difference

between the carrying amount and the new value of the impaired asset is an impairment loss.

For investments in unquoted equity instruments that cannot be reliably measured at fair value, impaired assets are

measured at the present value of the estimated future cash flows discounted using the current market rate of return for

a similar financial asset. Any difference between the previous carrying amount and the new measurement of theimpaired asset is recognised as an impairment loss in profit or loss.

In 2014 Mr Yuan inherited an estate of RMB2 million from his uncle who had died two months earlier.

What is the correct treatment of the estate income for individual income tax purposes?

A.The estate income is not taxable

B.The estate income will be taxed as occasional (ad hoc) income

C.The estate income will be taxed as other income

D.The estate income will be taxed as service income

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-12-31

- 2021-04-16

- 2021-03-10

- 2021-12-31

- 2021-06-05

- 2021-05-06

- 2021-05-11

- 2021-03-12

- 2021-03-12

- 2021-03-11

- 2021-06-02

- 2021-03-10

- 2021-03-11

- 2021-01-03

- 2021-05-09

- 2021-03-12

- 2021-03-12

- 2021-05-11

- 2021-12-31

- 2021-04-21

- 2021-05-09

- 2021-04-24

- 2021-03-12

- 2021-03-10

- 2021-03-11

- 2021-01-06

- 2021-06-05

- 2021-06-02

- 2021-03-11

- 2021-03-11