速看:财务会计概念框架的含义及内容

发布时间:2020-09-05

各位小伙伴注意啦,在备考ACCA考试的时候大家是否有不太能理解的知识点呢?对于不理解的知识点大家要及时地查阅资料把它理解透彻,这样学习效率才会更高。51题库考试学习网给大家带来了“财务会计概念框架”的相关内容,让我们一起来看看吧!

一、财务会计概念框架的含义及内容

财务会计的概念框架是会计理论架构,是在更高层面上描述财务会计的范围和目标,从而构成财务报告的内容、财务信息的质量特征以及会计报告的基本要素。

通常认为财务会计概念体系由财务报告的目标、财务会计信息质量特征、财务报表的要素及其确认和计量构成。

二、财务报告的目标和财务会计信息的使用者

(一)财务报告的目标

财务报告的目标是要求会计人员向报告使用者提供有用信息,并且财务报告的信息将有助于信息使用者的决策。财务会计报告的目的是有助于各方利益相关人使用会计信息,以使其及时进行科学决策。

(二)财务会计信息的使用者

现代公司是通过一系列契约关系,将不同生产要素和利益集团组织在一起,进行生产经营活动的一种企业组织形式,是一个“契约关系”(或合同关系)的集合。在这个契约关系集合中,企业的所有者(股东)、债权人、经理、企业职工、供应商、客户以及政府、社会等不同利益集团都是利益相关者,也是财务会计信息的使用者。每一利益集团均在企业中有不同的利益诉求,他们也从财务会计信息中取得其所需要的决策依据。

三、会计要素及其确认和计量

(一)会计要素

会计要素是根据交易或事项的经济特征对会计对象所做的基本分类,是会计核算对象的具体化。会计要素按照其性质分为资产、负债、所有者权益、收入、费用和利润。其中,资产、负债和所有者权益要素侧重于反映企业的财务状况。收入、费用和利润要素侧重于反映企业的经营成果。

(二)会计要素的确认和计量的原则

1.权责发生制原则

2.实际成本原则

3.配比原则

4.划分收益性支出与资本性支出

(三)会计计量属性

计量属性是指被计量对象的特性或外在表现形式,即被计量对象予以数量化的特征。会计计量属性主要包括:

1.历史成本

2.重置成本

3.可变现净值

4.现值

5.公允价值

四、财务会计信息质量要求

会计信息的质量要求是对企业财务会计报告中所提供会计信息质量的基本要求,是使财务报告中所提供的会计信息对投资者等使用者决策有用而应具备的基本特征。它包括可靠性、相关性、可理解性、可比性、实质重于形式、重要性、谨慎性和及时性等八个方面。

以上就是今天分享的全部内容了,各位小伙伴根据自己的情况进行查阅,希望本文对各位有所帮助,预祝各位取得满意的成绩,如需了解更多相关内容,请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

2 Assume that today’s date is 1 July 2005.

Jan is aged 45 and single. He is of Danish domicile but has been working in the United Kingdom since 1 May 2004

and intends to remain in the UK for the medium to long term. Although Jan worked briefly in the UK in 1986, he

has forgotten how UK taxation works and needs some assistance before preparing his UK income tax return.

Jan’s salary from 1 May 2004 was £74,760 per annum. Jan also has a company car – a Jaguar XJ8 with a list price

of £42,550 including extras, and CO2 emissions of 242g/km. The car was available to him from 1 July 2004. Free

petrol is provided by the company. Jan has other taxable benefits amounting to £3,965.

Jan’s other 2004/05 income comprises:

£

Dividend income from UK companies (cash received) 3,240

Interest received on an ISA account 230

Interest received on a UK bank account 740

Interest remitted from an offshore account (net of 15% withholding tax) 5,100

Income remitted from a villa in Portugal (net of 45% withholding tax) 4,598

The total interest arising on the offshore account was £9,000 (gross). In addition, Jan has not remitted other

Portuguese rental income arising in the year, totalling a further £1,500 (gross).

Jan informs you that his employer is thinking of providing him with rented accommodation while he looks for a house

to buy. The accommodation would be a two bedroom flat, valued at £155,000 with an annual value of £6,000. It

would be made available from 6 August 2005. The company will pay the rent of £600 per month for the first six

months. All other bills will be paid by Jan.

Jan also informs you that he has 25,000 ordinary shares in Gilet Ltd (‘Gilet’), an unquoted UK trading company. He

has held these shares since August 1986 when he bought 2,500 shares at £4.07 per share. In January 1994, a

bonus issue gave each shareholder nine shares for each ordinary share held. In the last week all Gilet’s shareholders

have received an offer from Jumper plc (‘Jumper’) who wishes to acquire the shares. Jumper has offered the following:

– 3 shares in Jumper (currently trading at £3.55 per share) for every 5 shares in Gilet, and

– 25p cash per share

Required:

(a) Calculate Jan’s 2004/05 income tax (IT) payable. (11 marks)

(ii) analytical procedures, (6 marks)

might appropriately be used in the due diligence review of MCM.

(ii) Analytical procedures

Tutorial note: The range of valid answer points is very broad for this part.

■ Review the trend of MCM’s profit (gross and net) for the last five years (say). Similarly earnings per share and

gearing.

■ For both the National and International businesses compare:

– gross profit, net profit, and return on assets for the last five years (say);

– actual monthly revenue against budget for the last 18 months (say). Similarly, for major items of expenditure

such as:

– full-time salaries;

– freelance consultancy fees;

– premises costs (e.g. depreciation, lease rentals, maintenance, etc);

– monthly revenue (also costs and profit) by centre.

■ Review projections of future profitability of MCM against net profit percentage at 31 December 2004 for:

– the National business (10·4%);

– the International business (38·1%); and

– overall (19·9%).

■ Review of disposal value of owned premises against book values.

■ Compare actual cash balances with budget on a monthly basis and compare borrowings against loan and overdraft

facilities.

■ Compare the average collection period for International’s trade receivables month on month since 31 December

2004 (when it was nearly seven months, i.e.

$3·7

–––– × 365 days) and compare with the National business.

$6·3

■ Compare financial ratios for each of the national centres against the National business overall (and similarly for the

International Business). For example:

– gross and net profit margins;

– return on centre assets;

– average collection period;

– average payment period;

– liquidity ratio.

■ Compare key performance indicators across the centres for the year to 31 December 2004 and 2005 to date. For

example:

– number of corporate clients;

– number of delegates;

– number of training days;

– average revenue per delegate per day;

– average cost per consultancy day.

(b) Misson has purchased goods from a foreign supplier for 8 million euros on 31 July 2006. At 31 October 2006,

the trade payable was still outstanding and the goods were still held by Misson. Similarly Misson has sold goods

to a foreign customer for 4 million euros on 31 July 2006 and it received payment for the goods in euros on

31 October 2006. Additionally Misson had purchased an investment property on 1 November 2005 for

28 million euros. At 31 October 2006, the investment property had a fair value of 24 million euros. The company

uses the fair value model in accounting for investment properties.

Misson would like advice on how to treat these transactions in the financial statements for the year ended 31

October 2006. (7 marks)

Required:

Discuss the accounting treatment of the above transactions in accordance with the advice required by the

directors.

(Candidates should show detailed workings as well as a discussion of the accounting treatment used.)

(b) Inventory, Goods sold and Investment property

The inventory and trade payable initially would be recorded at 8 million euros ÷ 1·6, i.e. $5 million. At the year end, the

amount payable is still outstanding and is retranslated at 1 dollar = 1·3 euros, i.e. $6·2 million. An exchange loss of

$(6·2 – 5) million, i.e. $1·2 million would be reported in profit or loss. The inventory would be recorded at $5 million at the

year end unless it is impaired in value.

The sale of goods would be recorded at 4 million euros ÷ 1·6, i.e. $2·5 million as a sale and as a trade receivable. Payment

is received on 31 October 2006 in euros and the actual value of euros received will be 4 million euros ÷ 1·3,

i.e. $3·1 million.

Thus a gain on exchange of $0·6 million will be reported in profit or loss.

The investment property should be recognised on 1 November 2005 at 28 million euros ÷ 1·4, i.e. $20 million. At

31 October 2006, the property should be recognised at 24 million euros ÷ 1·3, i.e. $18·5 million. The decrease in fair value

should be recognised in profit and loss as a loss on investment property. The property is a non-monetary asset and any foreign

currency element is not recognised separately. When a gain or loss on a non-monetary item is recognised in profit or loss,

any exchange component of that gain or loss is also recognised in profit or loss. If any gain or loss is recognised in equity ona non-monetary asset, any exchange gain is also recognised in equity.

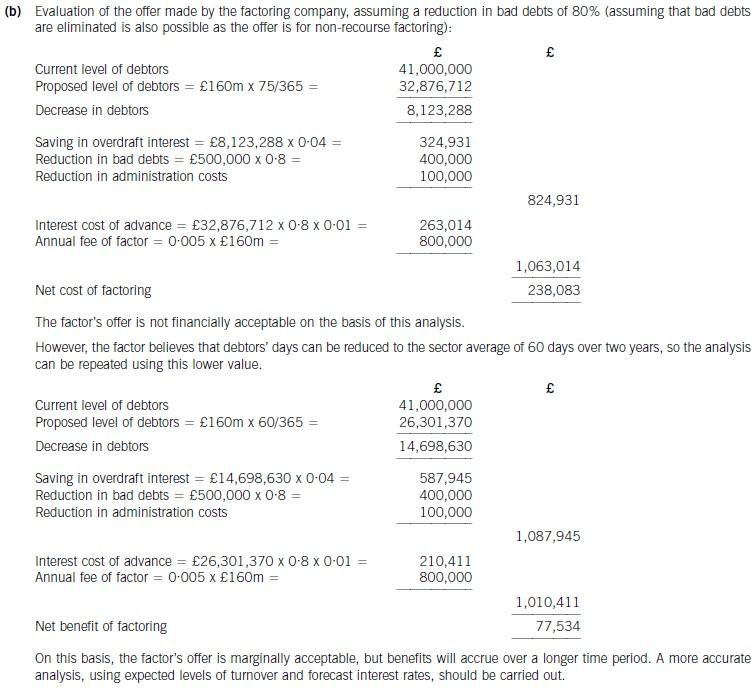

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-02-14

- 2020-10-11

- 2021-02-14

- 2021-04-08

- 2021-04-04

- 2020-10-15

- 2020-10-18

- 2020-09-05

- 2020-10-11

- 2021-04-02

- 2020-10-18

- 2021-02-14

- 2020-10-15

- 2020-09-05

- 2021-02-14

- 2020-10-11

- 2020-10-15

- 2019-06-29

- 2020-10-15

- 2020-10-11

- 2020-10-11

- 2020-10-15

- 2020-10-11

- 2021-02-14

- 2020-10-15

- 2020-10-11

- 2021-02-14

- 2019-03-17

- 2021-02-14

- 2021-02-14