ACCA 考试常见英语词汇(2)

发布时间:2021-02-14

想知道ACCA考试常见英语词汇有哪些?那还不赶紧和51题库考试学习网一起去了解下!

Acquisition收购:

一家公司收购另一家公司的多数股权

AcquisitionPremium收购溢价:

收购一家公司的实际成本与该公司收购前估值之间的差额

AffiliatedCompanies联营公司:

一家公司拥有另一家公司少数权益(低于50%)的情况,或指两家公司之间存在某些关联

AffiliatedPerson关联人士:

能影响一家企业活动的人士,包括董事、行政人员及股东等

AfterHoursTrading收盘后交易:

主要大型交易所正常交易时间以外进行的买卖交易

AfterTaxOperatingIncome-ATOI税后营运收入:

一家公司除税后的总营运收入。计算方法为将总营运收入减税项

AfterTaxProfitMargin税后利润率:

一种财务比率,计算方法为税后净利润除以净销售额

AfterTheBell收盘铃后:

股票市场收盘后

Agent代理人:

a.为客户进行证券买卖的人士或机构

b.持有销售保险许可证的人士

c.代表证券经纪行或发行人向公众出售或尝试出售证券的证券销售人员

AgencyBonds机构债券:

由政府机构发行的债券

AgencyCross交叉代理人:

一项由一名代理人同时代表买方与卖方的交易,也称为撍卮砣藬“DualAgency”。

AgencyProblem代理问题:

债券人、股东及管理人员因目标不同而产生的利益冲突

AgencySecurities机构证券:

由美国政府支持的企业发行的低风险债务

AggressiveAccounting激进会计法:

不当地编制损益表以取悦投资者及提高股价

AggressiveInvestmentStrategy进取投资策略:

投资组合经理尝试争取最高的回报。进取的投资者把较高比重的资产投入股票,比重较其他风险较低的债务证券要高

以上就是51题库考试学习网给大家分享的全部信息,希望能够帮到大家!后续请持续关注51题库考试学习网,51题库考试学习网将会为大家持续更新最新、最热的考试资讯!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Ratio analysis in general can be useful in comparing the performance of two companies, but it has its limitations.

Required:

State and briefly explain three factors which can cause accounting ratios to be misleading when used for

such comparison. (6 marks)

(b) (i) One company may have revalued its assets while the other has not.

(ii) Accounting policies and estimation techniques may differ. For example, one company may use higher depreciation rates

than the other.

(iii) The use of historical cost accounting may distort the capital and profit of the two companies in different ways.

Other answers considered on their merits.

(ii) Discuss TWO problems that may be faced in implementing quality control procedures in a small firm of

Chartered Certified Accountants, and recommend how these problems may be overcome. (4 marks)

(ii) Consultation – it may not be possible to hold extensive consultations on specialist issues within a small firm, due to a

lack of specialist professionals. There may be a lack of suitably experienced peers to discuss issues arising on client

engagements. Arrangements with other practices for consultation may be necessary.

Training/Continuing Professional Development (CPD) – resources may not be available, and it is expensive to establish

an in-house training function. External training consortia can be used to provide training/CPD for qualified staff, and

training on non-exam related issues for non-qualified staff.

Review procedures – it may not be possible to hold an independent review of an engagement within the firm due to the

small number of senior and experienced auditors. In this case an external review service may be purchased.

Lack of specialist experience – where special skills are needed within an engagement; the skills may be bought in, for

example, by seconding staff from another practice. Alternatively if work is too specialised for the firm, the work could be

sub-contracted to another practice.

Working papers – the firm may lack resources to establish an in-house set of audit manuals or standard working papers.

In this case documentation can be provided by external firms or professional bodies.

(ii) the recent financial performance of Merton plc from a shareholder perspective. Clearly identify any

issues that you consider should be brought to the attention of the ordinary shareholders. (15 marks)

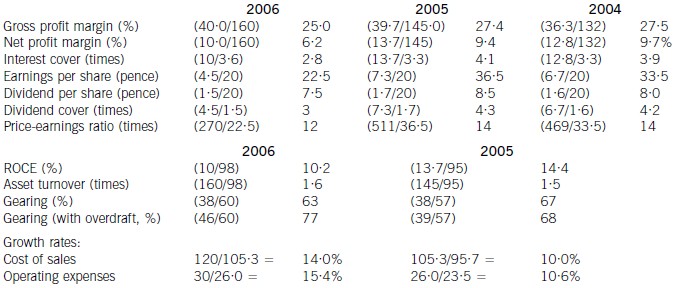

(ii) Discussion of financial performance

It is clear that 2006 has been a difficult year for Merton plc. There are very few areas of interest to shareholders where

anything positive can be found to say.

Profitability

Return on capital employed has declined from 14·4% in 2005, which compared favourably with the sector average of

12%, to 10·2% in 2006. Since asset turnover has improved from 1·5 to 1·6 in the same period, the cause of the decline

is falling profitability. Gross profit margin has fallen each year from 27·5% in 2004 to 25% in 2006, equal to the sector

average, despite an overall increase in turnover during the period of 10% per year. Merton plc has been unable to keep

cost of sales increases (14% in 2006 and 10% in 2005) below the increases in turnover. Net profit margin has declined

over the same period from 9·7% to 6·2%, compared to the sector average of 8%, because of substantial increases in

operating expenses (15·4% in 2006 and 10·6% in 2005). There is a pressing need here for Merton plc to bring cost

of sales and operating costs under control in order to improve profitability.

Gearing and financial risk

Gearing as measured by debt/equity has fallen from 67% (2005) to 63% (2006) because of an increase in

shareholders’ funds through retained profits. Over the same period the overdraft has increased from £1m to £8m and

cash balances have fallen from £16m to £1m. This is a net movement of £22m. If the overdraft is included, gearing

has increased to 77% rather than falling to 63%.

None of these gearing levels compare favourably with the average gearing for the sector of 50%. If we consider the large

increase in the overdraft, financial risk has clearly increased during the period. This is also evidenced by the decline in

interest cover from 4·1 (2005) to 2·8 (2006) as operating profit has fallen and interest paid has increased. In each year

interest cover has been below the sector average of eight and the current level of 2·8 is dangerously low.

Share price

As the return required by equity investors increases with increasing financial risk, continued increases in the overdraft

will exert downward pressure on the company’s share price and further reductions may be expected.

Investor ratios

Earnings per share, dividend per share and dividend cover have all declined from 2005 to 2006. The cut in the dividend

per share from 8·5 pence per share to 7·5 pence per share is especially worrying. Although in its announcement the

company claimed that dividend growth and share price growth was expected, it could have chosen to maintain the

dividend, if it felt that the current poor performance was only temporary. By cutting the dividend it could be signalling

that it expects the poor performance to continue. Shareholders have no guarantee as to the level of future dividends.

This view could be shared by the market, which might explain why the price-earnings ratio has fallen from 14 times to

12 times.

Financing strategy

Merton plc has experienced an increase in fixed assets over the last period of £10m and an increase in stocks and

debtors of £21m. These increases have been financed by a decline in cash (£15m), an increase in the overdraft (£7m)

and an increase in trade credit (£6m). The company is following an aggressive strategy of financing long-term

investment from short-term sources. This is very risky, since if the overdraft needed to be repaid, the company would

have great difficulty in raising the funds required.

A further financing issue relates to redemption of the existing debentures. The 10% debentures are due to be redeemed

in two years’ time and Merton plc will need to find £13m in order to do this. It does not appear that this sum can be

raised internally. While it is possible that refinancing with debt paying a lower rate of interest may be possible, the low

level of interest cover may cause concern to potential providers of debt finance, resulting in a higher rate of interest. The

Finance Director of Merton plc needs to consider the redemption problem now, as thought is currently being given to

raising a substantial amount of new equity finance. This financing choice may not be available again in the near future,

forcing the company to look to debt finance as a way of effecting redemption.

Overtrading

The evidence produced by the financial analysis above is that Merton plc is showing some symptoms of overtrading

(undercapitalisation). The board are suggesting a rights issue as a way of financing an expansion of business, but it is

possible that a rights issue will be needed to deal with the overtrading problem. This is a further financing issue requiring

consideration in addition to the redemption of debentures mentioned earlier.

Conclusion

Ordinary shareholders need to be aware of the following issues.

1. Profitability has fallen over the last year due to poor cost control

2. A substantial increase in the overdraft over the last year has caused gearing to increase

3. It is possible that the share price will continue to fall

4. The dividend cut may warn of continuing poor performance in the future

5. A total of £13m of debentures need redeeming in two year’s time

6. A large amount of new finance is needed for working capital and debenture redemption

Appendix: Analysis of key ratios and financial information

The town of Brighttown in Euraria has a mayor (elected every five years by the people in the town) who is responsible for, amongst other things, the transport policy of the town.

A year ago, the mayor (acting as project sponsor) instigated a ‘traffic lite’ project to reduce traffic congestion at traffic lights in the town. Rather than relying on fixed timings, he suggested that a system should be implemented which made the traffic lights sensitive to traffic flow. So, if a queue built up, then the lights would automatically change to green (go). The mayor suggested that this would have a number of benefits. Firstly, it would reduce harmful emissions at the areas near traffic lights and, secondly, it would improve the journey times for all vehicles, leading to drivers ‘being less stressed’. He also cited evidence from cities overseas where predictable journey times had been attractive to flexible companies who could set themselves up anywhere in the country. He felt that the new system would attract such companies to the town.

The Eurarian government has a transport regulation agency called OfRoad. Part of OfRoad’s responsibilities is to monitor transport investments and it was originally critical of the Brighttown ‘traffic lite’ project because the project’s benefits were intangible and lacked credibility. The business case did not include a quantitative cost/benefit analysis. OfRoad has itself published a benefits management process which classifies benefits in the following way.

Financial: A financial benefit can be confidently allocated in advance of the project. Thus if the investment will save $90,000 per year in staff costs then this is a financial benefit.

Quantifiable: A quantifiable benefit is a benefit where there is sufficient credible evidence to suggest, in advance, how much benefit will result from the project. This benefit may be financial or non-financial. For example, energy savings from a new building might be credibly predicted in advance. However, the exact amount of savings cannot be accurately forecast.

Measurable benefit: A measurable benefit is a benefit which can only be confidently assessed post-implementation, and so cannot be reliably predicted in advance. Increase in sales from a particular initiative is an example of a measurable benefit. Measurable benefits may either be financial or non-financial.

Observable benefit: An observable benefit is a benefit which a specific individual or group will decide, using agreed criteria, has been realised or not. Such benefits are usually non-financial. Improved staff morale might be an example of an observable benefit.

One month ago, the mayoral elections saw the election of a new mayor with a completely distinct transport policy with different objectives. She wishes to address traffic congestion by attracting commuters away from their cars and onto public transport. Part of her policy is a traffic light system which gives priority to buses. The town council owns the buses which operate in the town and they have invested heavily in buses which are comfortable and have significantly lower emissions than the conventional cars used by most people in the town. The new mayor wishes to improve the frequency, punctuality and convenience of these buses, so that they tempt people away from using their cars. This will require more buses and more bus crews, a requirement which the mayor presents as ‘being good for the unemployment rate in this town’. It will also help the bus service meet the punctuality service level which it published three years ago, but has never yet met. ‘A reduction in cars and an increase in buses will help us meet our target’, the mayor claims.

The mayor has also suggested a number of initiatives to discourage people from taking their cars into the town. She intends to sell two car parks for housing land (raising $325,000) and this will reduce car park capacity from 1,000 to 800 car spaces per day. She also intends to raise the daily parking fee from $3 to $4. Car park occupancy currently stands at 95% (it is difficult to achieve 100% for technical reasons) and the same occupancy rate is expected when the car park capacity is reduced.

The new mayor believes that her policy signals the fact that Brighttown is serious about its green credentials. ‘This’, she says, ‘will attract green consumers to come and live in our town and green companies to set up here. These companies and consumers will bring great benefit to our community.’ To emphasise this, she has set up a Go Green team to encourage green initiatives in the town.

The ‘traffic lite’ project to tackle congestion proposed by the former mayor is still in the development stage. The new mayor believes that this project can be modified to deliver her vision and still be ready on the date promised by her predecessor.

Required:

(a) A ‘terms of reference’ (project initiation document, project charter) was developed for the ‘traffic lite’ project to reduce traffic congestion.

Discuss what changes will have to be made to this ‘terms of reference’ (project initiation document, project charter) to reflect the new mayor’s vision of the project. (5 marks)

(b) The new mayor wishes to re-define the business case for the project, using the benefits categorisation suggested by OfRoad. Identify costs and benefits for the revised project, classifying each benefit using the guidance provided by OfRoad. (14 marks)

(c) Stakeholder management is the prime responsibility of the project manager.

Discuss the appropriate management of each of the following three stakeholders identified in the revised (modified) project.

(i) The new mayor;

(ii) OfRoad;

(iii) A private motorist in Brighttown who uses his vehicle to commute to his job in the town. (6 marks)

(a) Objectives and scope

From the perspective of the ‘traffic lite’ project, the change in mayor has led to an immediate change in the objectives driving the project. This illustrates how public sector projects are susceptible to sudden external environmental changes outside their control. The project initially proposed to reduce traffic congestion by making traffic lights sensitive to traffic flow. It was suggested that this would improve journey times for all vehicles using the roads of Brighttown. However, the incoming mayor now wishes to reduce traffic congestion by attracting car users onto public transport. Consequently she wants to develop a traffic light system which will give priority to buses. This should ensure that buses run on time. The project is no longer concerned with reducing journey times for all users. Indeed, congestion for private cars may get worse and this could further encourage car users to switch to public transport.

An important first step would be to confirm that the new mayor wishes to be the project sponsor for the project, because the project has lost its sponsor, the former mayor. The project scope also needs to be reviewed. The initial project was essentially a self-contained technical project aimed at producing a system which reduced queuing traffic. The revised proposal has much wider political scope and is concerned with discouraging car use and improving public bus services. Thus there are also proposals to increase car parking charges, to reduce the number of car park spaces (by selling off certain car parks for housing development) and to increase the frequency, quality and punctuality of buses. The project scope appears to have been widened considerably, although this will have to be confirmed with the new project sponsor.

Only once the scope of the revised project been agreed can revised project objectives be agreed and a new project plan developed, allocating the resources available to the project to the tasks required to complete the project. It is at this stage that the project manager will be able to work out if the proposed delivery date (a project constraint) is still manageable. If it is not, then some kind of agreement will have to be forged with the project sponsor. This may be to reduce the scope of the project, add more resources, or some combination of the two.

(b) Cost benefit

The re-defined project will have much more tangible effects than its predecessor and these could be classified using the standard approach suggested in the scenario. Benefits would include:

– One-off financial benefit from selling certain car parks

– this appears to be a predictable financial benefit of $325,000 which can be confidently included in a cost/benefit analysis.

– Increased income from public bus use – this appears to be a measurable benefit, in that it is an aspect of performance which can be measured (for example, bus fares collected per day), but it is not possible to estimate how much income will actually increase until the project is completed. – Increased income from car parks

– this appears to be a quantifiable benefit if the assumption is made that usage of the car parks will stay at 95%. There may indeed be sufficient confidence to define it as a financial benefit. Car park places will be reduced from 1,000 to 800, but the increase in fees will compensate for this reduction in capacity. Current expected daily income is 1,000 x $3 x 0·95 = $2,850. Future expected income will be 800 x $4 x 0·95 = $3,040.

– Improved punctuality of buses – this will again be a measurable benefit. It will be defined in terms of a Service Level promised to the residents of Brighttown. Improved punctuality might also help tempt a number of vehicle users to use public transport instead.

– Reduced emissions – buses are more energy efficient and emit less carbon dioxide than the conventional vehicles used by most of the inhabitants of Brighttown. This benefit should again be measurable (but non-financial) and should benefit the whole of the town, not just areas around traffic lights.

– Improved perception of the town – the incoming mayor believes that her policy will help attract green consumers and green companies to the town. Difficulties in classifying what is meant by these terms makes this likely to be an observable benefit, where a group, such as the Go Green team, established by the council itself can decide (based on their judgement) whether the benefit has been realised or not.

The costs of implementing the project will also have to be re-assessed. These costs will now include:

– The cost of purchasing more buses to meet the increased demand and frequency of service.

– The operational costs of running more buses, including salary costs of more bus drivers.

– Costs associated with the disposal of car parks.

– Costs associated with slowing down drivers (both economic and emotional).

The technical implementation requirements of the project will also change and this is almost certain to have cost implications because a solution will have to be developed which allows buses to be prioritised. A feasibility study will have to be commissioned to examine whether such a solution is technically feasible and, if it is, the costs of the solution will have to be estimated and entered into the cost-benefit analysis.

(c) A stakeholder grid (Mendelow) provides a framework for understanding how project team members should communicate with each stakeholder or stakeholder group. The grid itself has two axes. One axis is concerned with the power or influence of the stakeholder in this particular project. The other axis is concerned with the stakeholder’s interest in the project.

The incoming mayor: High power and high interest. The mayor is a key player in the project and should be carefully and actively managed throughout. The mayor is currently enthusiastic about the project and this enthusiasm has to be sustained. As the likely project sponsor, it will be the mayor’s responsibility to promote the project internally and to make resources available to it. It will also be up to her to ensure that the promised business benefits are actually delivered. However, she is also the person who can cancel the project at any time.

OfRoad – a government agency: OfRoad were critical of the previous mayor’s justification for the project. They felt that the business case was solely based on intangible benefits and lacked credibility. It is likely that they will be more supportive of the revised proposals for two reasons. Firstly, the proposal uses the classification of benefits which it has suggested. Secondly, the proposal includes tangible benefits which can confidently be included in a cost-benefit analysis. OfRoad is likely to have high power (because it can intervene in local transport decisions) but relatively low interest in this particular project as the town appears to be following its guidelines. An appropriate management strategy would be to keep watch and monitor the situation, making sure that nothing happens on the project which would cause the agency to take a sudden interest in it.

The private motorist of Brighttown: Most of these motorists will have a high interest in the project, because it impacts them directly; but, individually, they have very little power. Their chance to influence policy has just passed, and mayoral elections are not due for another five years. The suggested stakeholder management approach here is to keep them informed. However, their response will have to be monitored. If they organise themselves and band together as a group, they might be able to stage disruptive actions which might raise their power and have an impact on the project. This makes the point that stakeholder management is a continual process, as stakeholders may take up different positions in the grid as they organise themselves or as the project progresses.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-10-18

- 2020-10-15

- 2020-09-05

- 2020-10-11

- 2020-10-15

- 2021-02-14

- 2019-03-17

- 2021-02-14

- 2021-04-04

- 2020-10-15

- 2020-10-11

- 2021-02-14

- 2020-10-11

- 2021-02-14

- 2021-04-08

- 2020-09-05

- 2020-10-15

- 2020-10-15

- 2020-10-18

- 2020-10-11

- 2021-02-14

- 2020-10-18

- 2020-09-05

- 2021-02-14

- 2020-10-15

- 2020-10-11

- 2021-02-14

- 2021-04-08

- 2021-02-14

- 2020-10-11