2018年湖南ACCA12月考期成绩查询时间2019年1月16日

发布时间:2019-01-05

已经参加完2018年12月ACCA考试的同学不要着急,你的考试成绩将于2019年1月16日(星期三)左右公布,届时大家可根据以下三种方式查询到你的考试结果。

ACCA成绩查询方式:

一、邮寄

关于考试成绩的唯一官方的正式的通知。每次考试的两个半月后由ACCA总部发出,您收到邮件的时间决定于邮局的工作速度。

二、假如你并没有等待的耐心,你想更加快速地查看自己的成绩,那么你还可以通过电子邮件来接受你的考试成绩。具体方法为:登录myACCA,并选择通过email接收考试成绩。

另外,你还可以在线查看自己的考试成绩。

具体查询方法:

1.进入ACCA官网点击右上角My

ACCA进行登录:

2.输入账号、密码登录后进入主页面,点击Exam

status&Results:

3.跳转页面后选择View your status report:

4.进入之后,就可以查询自己所报科目的成绩详情了。

以上就是查询2018年12月ACCA考试成绩公布的具体时间及查分方法。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) The management of Division C has identified the need to achieve cost savings in order to become more

competitive. They have decided that an analysis and investigation of quality costs into four sub-categories will

provide a focus for performance measurement and improvement.

Required:

Identify the FOUR sub-categories into which quality costs can be analysed and provide examples (which

must relate to Division C) of each of the four sub-categories of quality cost that can be investigated in order

that overall cost savings might be achieved and hence the performance improved. (8 marks)

(b) Quality costs may be monitored by measuring costs of non-conformance and costs of conformance.

Costs of non-conformance occur when the product fails to reach the design quality standards. Such costs may be subdivided

into internal failure costs and external failure costs.

Internal failure costs occur when the failure is detected before the transfer of the product to the customer.

External failure costs occur when the failure to reach the required standards is not detected until after the product has been

transferred to the customer.

Costs of conformance are those incurred in reducing or eliminating the costs of non-conformance. Such costs may be

subdivided into appraisal costs and prevention costs.

Appraisal costs are those associated with the evaluation of items such as purchased material and services in order to ensure

that they conform. to the agreed specification.

Prevention costs are those associated with the implementation of a quality improvement programme. Such costs are planned

in advance and their implementation should lead to continuous improvement.

Examples of quality costs relevant to Division C may include:

Internal failure costs: cost of materials scrapped due to poor receipt and storage procedures or losses of CC output due to poor

processing routines.

External failure costs: cost of quality problems with batch of CC not detected until it has reached Division B. This may require

free replacement of the batch and compensation for loss of output by Division B.

Appraisal costs: evaluation of purchased material and services in relation to the manufacture of CC to ensure that it conforms

to the agreed specification; e.g. inspection and testing before use.

Prevention costs: the cost of implementation of staff training and the costs of equipment testing to ensure that it conforms to

the specification standards required for the production of CC.

(Alternative relevant examples would be accepted)

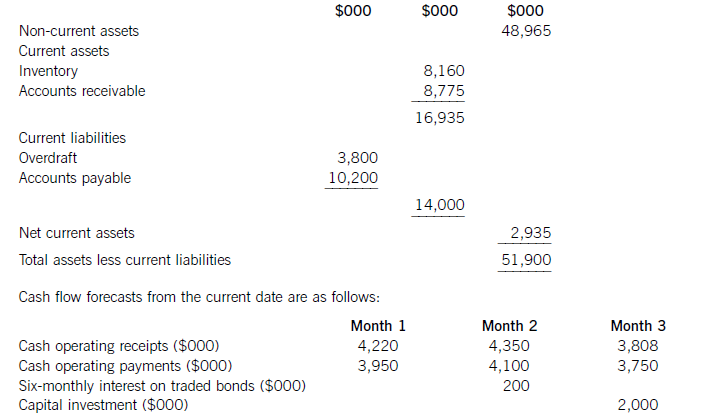

The following financial information relates to HGR Co:

Statement of financial position at the current date (extracts)

The finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements, which he believes will reduce accounts receivable days to the average sector value of 53 days. This reduction would take six months to achieve from the current date, with an equal reduction in each month. He has also proposed changes to inventory management methods, which he hopes will reduce inventory days by two days per month each month over a three-month period from the current date. He does not expect any change in the current level of accounts payable.

HGR Co has an overdraft limit of $4,000,000. Overdraft interest is payable at an annual rate of 6·17% per year, with payments being made each month based on the opening balance at the start of that month. Credit sales for the year to the current date were $49,275,000 and cost of sales was $37,230,000. These levels of credit sales and cost of sales are expected to be maintained in the coming year. Assume that there are 365 working days in each year.

Required:

(a) Discuss the working capital financing strategy of HGR Co. (7 marks)

(b) For HGR Co, calculate:

(i) the bank balance in three months’ time if no action is taken; and

(ii) the bank balance in three months’ time if the finance director’s proposals are implemented.

Comment on the forecast cash flow position of HGR Co and recommend a suitable course of action.

(10 marks)

(c) Discuss how risks arising from granting credit to foreign customers can be managed and reduced.

(8 marks)

(a)Whenconsideringthefinancingofworkingcapital,itisusefultodividecurrentassetsintofluctuatingcurrentassetsandpermanentcurrentassets.Fluctuatingcurrentassetsrepresentchangesinthelevelofcurrentassetsduetotheunpredictabilityofbusinessactivity.Permanentcurrentassetsrepresentthecorelevelofinvestmentincurrentassetsneededtosupportagivenlevelofturnoverorbusinessactivity.Asturnoverorlevelofbusinessactivityincreases,thelevelofpermanentcurrentassetswillalsoincrease.Thisrelationshipcanbemeasuredbytheratioofturnovertonetcurrentassets.Thefinancingchoiceasfarasworkingcapitalisconcernedisbetweenshort-termandlong-termfinance.Short-termfinanceismoreflexiblethanlong-termfinance:anoverdraft,forexample,isusedbyabusinessorganisationastheneedarisesandvariableinterestischargedontheoutstandingbalance.Short-termfinanceisalsomoreriskythanlong-termfinance:anoverdraftfacilitymaybewithdrawn,orashort-termloanmayberenewedonlessfavourableterms.Intermsofcost,thetermstructureofinterestratessuggeststhatshort-termdebtfinancehasalowercostthanlong-termdebtfinance.Thematchingprinciplesuggeststhatlong-termfinanceshouldbeusedforlong-terminvestment.Applyingthisprincipletoworkingcapitalfinancing,long-termfinanceshouldbematchedwithpermanentcurrentassetsandnon-currentassets.Afinancingpolicywiththisobjectiveiscalleda‘matchingpolicy’.HGRCoisnotusingthisfinancingpolicy,sinceofthe$16,935,000ofcurrentassets,$14,000,000or83%isfinancedfromshort-termsources(overdraftandtradepayables)andonly$2,935,000or17%isfinancedfromalong-termsource,inthiscaseequityfinance(shareholders’funds)ortradedbonds.ThefinancingpolicyorapproachtakenbyHGRCotowardsthefinancingofworkingcapital,whereshort-termfinanceispreferred,iscalledanaggressivepolicy.Relianceonshort-termfinancemakesthisriskierthanamatchingapproach,butalsomoreprofitableduetothelowercostofshort-termfinance.Followinganaggressiveapproachtofinancingcanleadtoovertrading(undercapitalisation)andthepossibilityofliquidityproblems.(b)Bankbalanceinthreemonths’timeifnoactionistaken:Workings:ReductioninaccountsreceivabledaysCurrentaccountsreceivabledays=(8,775/49,275)x365=65daysReductionindaysoversixmonths=65–53=12daysMonthlyreduction=12/6=2daysEachreceivablesdayisequivalentto8,775,000/65=$135,000(Alternatively,eachreceivablesdayisequivalentto49,275,000/365=$135,000)Monthlyreductioninaccountsreceivable=2x135,000=$270,000ReductionininventorydaysCurrentinventorydays=(8,160/37,230)x365=80daysEachinventorydayisequivalentto8,160,000/80=$102,000(Alternatively,eachinventoryday=37,230,000/365=$102,000)Monthlyreductionininventory=102,000x2=$204,000OverdraftinterestcalculationsMonthlyoverdraftinterestrate=1·06171/12=1·005or0·5%Ifnoactionistaken:Period1interest=3,800,000x0·005=$19,000Period2interest=3,549,000x0·005=$17,745or$18,000Period3interest=3,517,000x0·005=$17,585or$18,000Ifactionistaken:Period1interest=3,800,000x0.005=$19,000Period2interest=3,075,000x0.005=$15,375or$15,000Period3interest=2,566,000x0.005=$12,830or$13,000DiscussionIfnoactionistaken,thecashflowforecastshowsthatHGRCowillexceeditsoverdraftlimitof$4millionby$1·48millioninthreemonths’time.Ifthefinancedirector’sproposalsareimplemented,thereisapositiveeffectonthebankbalance,buttheoverdraftlimitisstillexceededinthreemonths’time,althoughonlyby$47,000ratherthanby$1·47million.Ineachofthethreemonthsfollowingthat,thecontinuingreductioninaccountsreceivabledayswillimprovethebankbalanceby$270,000permonth.Withoutfurtherinformationonoperatingreceiptsandpayments,itcannotbeforecastwhetherthebankbalancewillreturntolessthanthelimit,orevencontinuetoimprove.Themainreasonfortheproblemwiththebankbalanceisthe$2millioncapitalexpenditure.Purchaseofnon-currentassetsshouldnotbefinancedbyanoverdraft,butalong-termsourceoffinancesuchasequityorbonds.Ifthecapitalexpenditurewereremovedfromtheareaofworkingcapitalmanagement,theoverdraftbalanceattheendofthreemonthswouldbe$3·48millionifnoactionweretakenand$2·05millionifthefinancedirector’sproposalswereimplemented.GiventhatHGRCohasalmost$50millionofnon-currentassetsthatcouldpossiblybeusedassecurity,raisinglong-termdebtthrougheitherabankloanorabondissueappearstobesensible.Assumingabondinterestrateof10%peryear,currentlong-termdebtintheform.oftradedbondsisapproximately($200mx2)/0·1=$4m,whichismuchlessthantheamountofnoncurrentassets.AsuitablecourseofactionforHGRCotofollowwouldthereforebe,firstly,toimplementthefinancedirector’sproposalsand,secondly,tofinancethecapitalexpenditurefromalong-termsource.Considerationcouldalsobegiventousingsomelong-termdebtfinancetoreducetheoverdraftandtoreducethelevelofaccountspayable,currentlystandingat100days.(c)Whencreditisgrantedtoforeigncustomers,twoproblemsmaybecomeespeciallysignificant.First,thelongerdistancesoverwhichtradetakesplaceandthemorecomplexnatureoftradetransactionsandtheirelementsmeansforeignaccountsreceivableneedmoreinvestmentthantheirdomesticcounterparts.Longertransactiontimesincreaseaccountsreceivablebalancesandhencetheleveloffinancingandfinancingcosts.Second,theriskofbaddebtsishigherwithforeignaccountsreceivablethanwiththeirdomesticcounterparts.Inordertomanageandreducecreditrisks,therefore,exportersseektoreducetheriskofbaddebtandtoreducethelevelofinvestmentinforeignaccountsreceivable.Manyforeigntransactionsareon‘openaccount’,whichisanagreementtosettletheamountoutstandingonapredetermineddate.Openaccountreflectsagoodbusinessrelationshipbetweenimporterandexporter.Italsocarriesthehighestriskofnon-payment.Onewaytoreduceinvestmentinforeignaccountsreceivableistoagreeearlypaymentwithanimporter,forexamplebypaymentinadvance,paymentonshipment,orcashondelivery.Thesetermsoftradeareunlikelytobecompetitive,however,anditismorelikelythatanexporterwillseektoreceivecashinadvanceofpaymentbeingmadebythecustomer.Onewaytoacceleratecashreceiptsistousebillfinance.Billsofexchangewithasignedagreementtopaytheexporteronanagreedfuturedate,supportedbyadocumentaryletterofcredit,canbediscountedbyabanktogiveimmediatefunds.Thisdiscountingiswithoutrecourseifbillsofexchangehavebeencountersignedbytheimporter’sbank.Documentarylettersofcreditareapaymentguaranteebackedbyoneormorebanks.Theycarryalmostnorisk,providedtheexportercomplieswiththetermsandconditionscontainedintheletterofcredit.Theexportermustpresentthedocumentsstatedintheletter,suchasbillsoflading,shippingdocuments,billsofexchange,andsoon,whenseekingpayment.Aseachsupportingdocumentrelatestoakeyaspectoftheoveralltransaction,lettersofcreditgivesecuritytotheimporteraswellastheexporter.Companiescanalsomanageandreduceriskbygatheringappropriateinformationwithwhichtoassessthecreditworthinessofnewcustomers,suchasbankreferencesandcreditreports.Insurancecanalsobeusedtocoversomeoftherisksassociatedwithgivingcredittoforeigncustomers.Thiswouldavoidthecostofseekingtorecovercashduefromforeignaccountsreceivablethroughaforeignlegalsystem,wheretheexportercouldbeatadisadvantageduetoalackoflocalorspecialistknowledge.Exportfactoringcanalsobeconsidered,wheretheexporterpaysforthespecialistexpertiseofthefactorasawayofreducinginvestmentinforeignaccountsreceivableandreducingtheincidenceofbaddebts.

(b) Write a letter to Joanne setting out the value added tax (VAT) registration requirements and advising on

whether or not she should or could register for VAT and if registered if she could recover the VAT suffered on

the consultancy fees and computer purchased in October 2005. (7 marks)

(b) [Joanne’s address] [Firm’s address]

Dear Joanne 5 February 2006

I am writing to you in order to set out the value added tax (VAT) issues you face on registering your trade, together with some

other aspects of VAT that are relevant to you.

Registration

VAT registration is compulsory once taxable supplies exceed £58,000. This turnover figure is based on the value of your

cumulative taxable supplies in the previous 12 months. You have an obligation to inform. Customs within 30 days of the end

of the month in which the annual limit is exceeded. Registration will become effective on the first day of the following month.

VAT registration is also required if there are reasonable grounds for believing that the taxable supplies in the following 30 days

will exceed £58,000. In such cases, notification is required by the end of that 30 day period with registration being effective

from the start of that period.

Based on your estimates of taxable supplies, you will exceed the annual limit in October 2006 when your cumulative turnover

will be £62,000. You will therefore have to inform. Customs by the end of November. Your registration will be effective as of

1 December 2006.

You also have the option of voluntarily registering prior to then in which case you will normally become registered from the

date you applied. This is useful where your sales are to VAT registered customers for whom the extra VAT would not be a cost.

You would then be able to recover VAT on your attributable costs. However, you will have to comply with the VAT

administrative requirements.

Recovery of pre-registration VAT

It is possible to claim the recovery of VAT incurred prior to registering for VAT. There are some conditions, however. The costs

of the goods or services must have been incurred for the purpose of the business and there are time limits. You have three

years from the effective date of registration to recover the VAT on fixed assets (such as your computer) but only six months in

the case of purchased services (such as the consultancy fees).

As a result, I would recommend that you apply for voluntary registration as soon as possible, as registering after 1 April 2006

will mean that you will be unable to reclaim the VAT on your consultancy fees.

I hope the above information is useful to you.

Yours sincerely,

A. Consultant.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-08-12

- 2019-03-20

- 2020-04-26

- 2020-08-12

- 2020-09-05

- 2021-05-22

- 2020-08-12

- 2019-03-20

- 2020-08-12

- 2020-01-10

- 2020-09-05

- 2019-03-20

- 2021-01-07

- 2019-01-05

- 2020-01-10

- 2020-01-10

- 2021-01-07

- 2021-01-06

- 2021-04-04

- 2020-09-05

- 2019-03-20

- 2021-01-07

- 2020-09-05

- 2019-03-20

- 2021-01-08

- 2021-04-08

- 2020-09-05

- 2020-04-03

- 2020-10-18

- 2020-08-12