2018年河南ACCA12月考期成绩查询时间2019年1月16日

发布时间:2019-01-05

已经参加完2018年12月ACCA考试的同学不要着急,你的考试成绩将于2019年1月16日(星期三)左右公布,届时大家可根据以下三种方式查询到你的考试结果。

ACCA成绩查询方式:

一、邮寄

关于考试成绩的唯一官方的正式的通知。每次考试的两个半月后由ACCA总部发出,您收到邮件的时间决定于邮局的工作速度。

二、假如你并没有等待的耐心,你想更加快速地查看自己的成绩,那么你还可以通过电子邮件来接受你的考试成绩。具体方法为:登录myACCA,并选择通过email接收考试成绩。

另外,你还可以在线查看自己的考试成绩。

具体查询方法:

1.进入ACCA官网点击右上角My

ACCA进行登录:

2.输入账号、密码登录后进入主页面,点击Exam

status&Results:

3.跳转页面后选择View your status report:

4.进入之后,就可以查询自己所报科目的成绩详情了。

以上就是查询2018年12月ACCA考试成绩公布的具体时间及查分方法。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(c) Explain the benefits of performance-related pay in rewarding directors and critically evaluate the implications

of the package offered to Choo Wang. (8 marks)

(c) Choo Wang’s remuneration package

Benefits of PRP

In general terms, performance-related pay serves to align directors’ and shareholders’ interests in that the performancerelated

element can be made to reflect those things held to be important to shareholders (such as financial targets). This, in

turn, serves to motivate directors, especially if they are directly responsible for a cost or revenue/profit budget or centre. The

possibility of additional income serves to motivate directors towards higher performance and this, in turn, can assist in

recruitment and retention. Finally, performance-related pay can increase the board’s control over strategic planning and

implementation by aligning rewards against strategic objectives.

Critical evaluation of Choo Wang’s package

Choo Wang’s package appears to have a number of advantages and shortcomings. It was strategically correct to include some

element of pay linked specifically to Southland success. This will increase Choo’s motivation to make it successful and indeed,

he has said as much – he appears to be highly motivated and aware that additional income rests upon its success. Against

these advantages, it appears that the performance-related component does not take account of, or discount in any way for,

the risk of the Southland investment. The bonus does not become payable on a sliding scale but only on a single payout basis

when the factory reaches an ‘ambitious’ level of output. Accordingly, Choo has more incentive to be accepting of risk with

decisions on the Southland investment than risk averse. This may be what was planned, but such a bias should be pointed

out. Clearly, the company should accept some risk but recklessness should be discouraged. In conclusion, Choo’s PRP

package could have been better designed, especially if the Southland investment is seen as strategically risky.

(c) Discuss the factors that might influence whether the initial bid is likely to be accepted by the shareholders of Wragger plc.

(c) The type of payment might influence the success of the bid. Paxis is proposing a share for share exchange which offers a continuation in ownership of the entity, albeit as part of the successful bidder. However, relative share prices will change during the period of the bid, and the owner of shares in the potential victim company will not know the precise postacquisition value of the bid. An alternative might be cash payments which provides a known, precise sum, and might be favoured for this reason. However, in some countries payment in cash might lead to an immediate capital gains tax liability for the investor.

The effective price offered would of course be a major influence. Paxis would need to offer a premium over the existing share price, but the size of the premium that would be acceptable is unknown. Informal discussions with major shareholders of Wragger might assist in determining this (subject to such discussions being permitted by the regulatory authorities).

(ii) Can we entertain our clients as a gesture of goodwill or is corporate hospitality ruled out? (3 marks)

Required:

For EACH of the three FAQs, explain the threats to objectivity that may arise and the safeguards that should

be available to manage them to an acceptable level.

NOTE: The mark allocation is shown against each of the three questions.

(ii) Corporate hospitality

A partner in an audit firm is obviously in a position to influence the conduct and outcome of an audit. Therefore a

partner being on ‘too friendly’ terms with an audit client creates a familiarity threat. Other members of the audit team

may not exert as much influence on the audit.

A self-interest threat may also be perceived (e.g. if corporate hospitality is provided to keep a prestigious client).

There is no absolute prohibition against corporate hospitality provided:

■ the value attached to such hospitality is ‘insignificant’; and

■ the ‘frequency, nature and cost’ of the hospitality is reasonable.

Thus, flying the directors of an audit client for weekends away could be seen as significant. Similarly, entertaining an

audit client on a regular basis could be seen as unacceptable.

Partners and staff of Boleyn will need to be objective in their assessments of the significance or reasonableness of the

hospitality offered. (Would ‘a reasonable and informed third party’ conclude that the hospitality will or is likely to be

seen to impair your objectivity?)

If they have any doubts they should discuss the matter in the first instance with the audit engagement partner, who

should refer the matter to the ethics partner if in doubt.

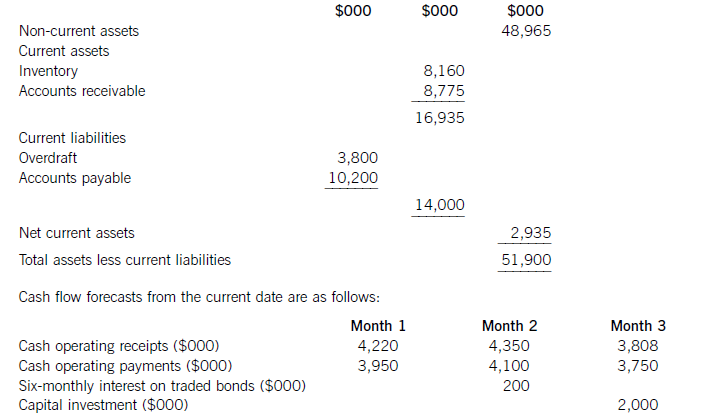

The following financial information relates to HGR Co:

Statement of financial position at the current date (extracts)

The finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements, which he believes will reduce accounts receivable days to the average sector value of 53 days. This reduction would take six months to achieve from the current date, with an equal reduction in each month. He has also proposed changes to inventory management methods, which he hopes will reduce inventory days by two days per month each month over a three-month period from the current date. He does not expect any change in the current level of accounts payable.

HGR Co has an overdraft limit of $4,000,000. Overdraft interest is payable at an annual rate of 6·17% per year, with payments being made each month based on the opening balance at the start of that month. Credit sales for the year to the current date were $49,275,000 and cost of sales was $37,230,000. These levels of credit sales and cost of sales are expected to be maintained in the coming year. Assume that there are 365 working days in each year.

Required:

(a) Discuss the working capital financing strategy of HGR Co. (7 marks)

(b) For HGR Co, calculate:

(i) the bank balance in three months’ time if no action is taken; and

(ii) the bank balance in three months’ time if the finance director’s proposals are implemented.

Comment on the forecast cash flow position of HGR Co and recommend a suitable course of action.

(10 marks)

(c) Discuss how risks arising from granting credit to foreign customers can be managed and reduced.

(8 marks)

(a)Whenconsideringthefinancingofworkingcapital,itisusefultodividecurrentassetsintofluctuatingcurrentassetsandpermanentcurrentassets.Fluctuatingcurrentassetsrepresentchangesinthelevelofcurrentassetsduetotheunpredictabilityofbusinessactivity.Permanentcurrentassetsrepresentthecorelevelofinvestmentincurrentassetsneededtosupportagivenlevelofturnoverorbusinessactivity.Asturnoverorlevelofbusinessactivityincreases,thelevelofpermanentcurrentassetswillalsoincrease.Thisrelationshipcanbemeasuredbytheratioofturnovertonetcurrentassets.Thefinancingchoiceasfarasworkingcapitalisconcernedisbetweenshort-termandlong-termfinance.Short-termfinanceismoreflexiblethanlong-termfinance:anoverdraft,forexample,isusedbyabusinessorganisationastheneedarisesandvariableinterestischargedontheoutstandingbalance.Short-termfinanceisalsomoreriskythanlong-termfinance:anoverdraftfacilitymaybewithdrawn,orashort-termloanmayberenewedonlessfavourableterms.Intermsofcost,thetermstructureofinterestratessuggeststhatshort-termdebtfinancehasalowercostthanlong-termdebtfinance.Thematchingprinciplesuggeststhatlong-termfinanceshouldbeusedforlong-terminvestment.Applyingthisprincipletoworkingcapitalfinancing,long-termfinanceshouldbematchedwithpermanentcurrentassetsandnon-currentassets.Afinancingpolicywiththisobjectiveiscalleda‘matchingpolicy’.HGRCoisnotusingthisfinancingpolicy,sinceofthe$16,935,000ofcurrentassets,$14,000,000or83%isfinancedfromshort-termsources(overdraftandtradepayables)andonly$2,935,000or17%isfinancedfromalong-termsource,inthiscaseequityfinance(shareholders’funds)ortradedbonds.ThefinancingpolicyorapproachtakenbyHGRCotowardsthefinancingofworkingcapital,whereshort-termfinanceispreferred,iscalledanaggressivepolicy.Relianceonshort-termfinancemakesthisriskierthanamatchingapproach,butalsomoreprofitableduetothelowercostofshort-termfinance.Followinganaggressiveapproachtofinancingcanleadtoovertrading(undercapitalisation)andthepossibilityofliquidityproblems.(b)Bankbalanceinthreemonths’timeifnoactionistaken:Workings:ReductioninaccountsreceivabledaysCurrentaccountsreceivabledays=(8,775/49,275)x365=65daysReductionindaysoversixmonths=65–53=12daysMonthlyreduction=12/6=2daysEachreceivablesdayisequivalentto8,775,000/65=$135,000(Alternatively,eachreceivablesdayisequivalentto49,275,000/365=$135,000)Monthlyreductioninaccountsreceivable=2x135,000=$270,000ReductionininventorydaysCurrentinventorydays=(8,160/37,230)x365=80daysEachinventorydayisequivalentto8,160,000/80=$102,000(Alternatively,eachinventoryday=37,230,000/365=$102,000)Monthlyreductionininventory=102,000x2=$204,000OverdraftinterestcalculationsMonthlyoverdraftinterestrate=1·06171/12=1·005or0·5%Ifnoactionistaken:Period1interest=3,800,000x0·005=$19,000Period2interest=3,549,000x0·005=$17,745or$18,000Period3interest=3,517,000x0·005=$17,585or$18,000Ifactionistaken:Period1interest=3,800,000x0.005=$19,000Period2interest=3,075,000x0.005=$15,375or$15,000Period3interest=2,566,000x0.005=$12,830or$13,000DiscussionIfnoactionistaken,thecashflowforecastshowsthatHGRCowillexceeditsoverdraftlimitof$4millionby$1·48millioninthreemonths’time.Ifthefinancedirector’sproposalsareimplemented,thereisapositiveeffectonthebankbalance,buttheoverdraftlimitisstillexceededinthreemonths’time,althoughonlyby$47,000ratherthanby$1·47million.Ineachofthethreemonthsfollowingthat,thecontinuingreductioninaccountsreceivabledayswillimprovethebankbalanceby$270,000permonth.Withoutfurtherinformationonoperatingreceiptsandpayments,itcannotbeforecastwhetherthebankbalancewillreturntolessthanthelimit,orevencontinuetoimprove.Themainreasonfortheproblemwiththebankbalanceisthe$2millioncapitalexpenditure.Purchaseofnon-currentassetsshouldnotbefinancedbyanoverdraft,butalong-termsourceoffinancesuchasequityorbonds.Ifthecapitalexpenditurewereremovedfromtheareaofworkingcapitalmanagement,theoverdraftbalanceattheendofthreemonthswouldbe$3·48millionifnoactionweretakenand$2·05millionifthefinancedirector’sproposalswereimplemented.GiventhatHGRCohasalmost$50millionofnon-currentassetsthatcouldpossiblybeusedassecurity,raisinglong-termdebtthrougheitherabankloanorabondissueappearstobesensible.Assumingabondinterestrateof10%peryear,currentlong-termdebtintheform.oftradedbondsisapproximately($200mx2)/0·1=$4m,whichismuchlessthantheamountofnoncurrentassets.AsuitablecourseofactionforHGRCotofollowwouldthereforebe,firstly,toimplementthefinancedirector’sproposalsand,secondly,tofinancethecapitalexpenditurefromalong-termsource.Considerationcouldalsobegiventousingsomelong-termdebtfinancetoreducetheoverdraftandtoreducethelevelofaccountspayable,currentlystandingat100days.(c)Whencreditisgrantedtoforeigncustomers,twoproblemsmaybecomeespeciallysignificant.First,thelongerdistancesoverwhichtradetakesplaceandthemorecomplexnatureoftradetransactionsandtheirelementsmeansforeignaccountsreceivableneedmoreinvestmentthantheirdomesticcounterparts.Longertransactiontimesincreaseaccountsreceivablebalancesandhencetheleveloffinancingandfinancingcosts.Second,theriskofbaddebtsishigherwithforeignaccountsreceivablethanwiththeirdomesticcounterparts.Inordertomanageandreducecreditrisks,therefore,exportersseektoreducetheriskofbaddebtandtoreducethelevelofinvestmentinforeignaccountsreceivable.Manyforeigntransactionsareon‘openaccount’,whichisanagreementtosettletheamountoutstandingonapredetermineddate.Openaccountreflectsagoodbusinessrelationshipbetweenimporterandexporter.Italsocarriesthehighestriskofnon-payment.Onewaytoreduceinvestmentinforeignaccountsreceivableistoagreeearlypaymentwithanimporter,forexamplebypaymentinadvance,paymentonshipment,orcashondelivery.Thesetermsoftradeareunlikelytobecompetitive,however,anditismorelikelythatanexporterwillseektoreceivecashinadvanceofpaymentbeingmadebythecustomer.Onewaytoacceleratecashreceiptsistousebillfinance.Billsofexchangewithasignedagreementtopaytheexporteronanagreedfuturedate,supportedbyadocumentaryletterofcredit,canbediscountedbyabanktogiveimmediatefunds.Thisdiscountingiswithoutrecourseifbillsofexchangehavebeencountersignedbytheimporter’sbank.Documentarylettersofcreditareapaymentguaranteebackedbyoneormorebanks.Theycarryalmostnorisk,providedtheexportercomplieswiththetermsandconditionscontainedintheletterofcredit.Theexportermustpresentthedocumentsstatedintheletter,suchasbillsoflading,shippingdocuments,billsofexchange,andsoon,whenseekingpayment.Aseachsupportingdocumentrelatestoakeyaspectoftheoveralltransaction,lettersofcreditgivesecuritytotheimporteraswellastheexporter.Companiescanalsomanageandreduceriskbygatheringappropriateinformationwithwhichtoassessthecreditworthinessofnewcustomers,suchasbankreferencesandcreditreports.Insurancecanalsobeusedtocoversomeoftherisksassociatedwithgivingcredittoforeigncustomers.Thiswouldavoidthecostofseekingtorecovercashduefromforeignaccountsreceivablethroughaforeignlegalsystem,wheretheexportercouldbeatadisadvantageduetoalackoflocalorspecialistknowledge.Exportfactoringcanalsobeconsidered,wheretheexporterpaysforthespecialistexpertiseofthefactorasawayofreducinginvestmentinforeignaccountsreceivableandreducingtheincidenceofbaddebts.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-10-19

- 2021-04-07

- 2020-10-18

- 2020-08-19

- 2019-03-20

- 2019-01-05

- 2020-09-08

- 2020-09-04

- 2019-01-05

- 2021-01-06

- 2020-08-12

- 2019-01-05

- 2020-08-12

- 2020-09-05

- 2020-09-05

- 2021-01-07

- 2020-10-19

- 2020-04-16

- 2020-09-05

- 2020-10-18

- 2020-04-01

- 2020-01-10

- 2021-04-04

- 2020-09-05

- 2020-01-10

- 2020-12-24

- 2020-01-10

- 2020-01-10

- 2019-01-05

- 2021-04-07