不知道如何追加ACCA免试资格?看这里!

发布时间:2021-01-22

由于会计行业的高速发展,ACCA考试也越来越受到关注,那么,大家知道ACCA学员如何追加免试资格吗?今天51题库考试学习网为大家带来了相关内容,让我们一起来看看吧!

已注册成功的学员,在获得相关可申请免试的证书(例如会计学位、CPA证书)后可向ACCA申请追加免试,具体的步骤为:

1、将证书的原件和翻译件以电子版形式发送至 students@accaglobal.com

2、请注意查收邮件或登录MYACCA学员账户查看免试信息。

3、免试申请成功后,结果会显示接下来的一个考季,例如学员在4月份免试申请成功获得前三科,那么该免试结果显示的时间是6月份。

关于ACCA免考政策相关注意事项,详情如下:

1、申请牛津布鲁克斯大学的学士学位,不再需要英文证明

2、学员只有顺利通过整学年的课程才能够申请免试。

3、针对在校生的部分课程免试政策只适用于大学本科的在读学生,而不适用于硕士学位或大专学历的在读学生。

4、获得硕士学位和大专文凭的学生的免试课程只能按所学课程的相关性由ACCA免试评估部门进行逐门评估而定。

5、在中国,会计学学士学位是指会计学士、会计学学士、会计与金融学士或经济学学士(专业方向为会计学,会计与金融,国际会计,注册会计师)。

6、取得与会计学相关领域专业的学位都按“其他专业”对待,例如财务会计、工业会计、外贸会计、会计电算化、铁路会计等。

7、在大学第一学年所学过的课程不能作为申请免试的依据。

8、特许学位(即海外大学与中国本地大学合作而授予海外大学学位的项目),部分完成时不能申请免试。

9、本政策适用于在中国教育部认可的高等院校全部完成或部分完成本科课程的学生,而不考虑目前居住地点。

ACCA有效期:

ACCA学员有七年的时间通过专业阶段的考试。如果学员不能在七年内通过所有专业阶段考试,那么超过七年的已通过专业阶段科目的成绩将作废,须重新考试。七年时限从学员通过第一门专业阶段考试之日算起。

以上就是今天分享的全部内容了,希望能够帮到大家!51题库考试学习网在此预祝各位取得满意的成绩,如需了解更多相关内容,请持续关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

3 Organisations need to recruit new employees. An important step in the process is the selection interview.

Required:

(a) Explain the purpose of the selection interview. (4 marks)

3 The interview is extensively used for the selection of new employees and in many cases is the only method of selection. However,interviews have been criticised for failing to identify appropriate candidates suitable for the organisation. It is essential therefore that professional accountants recognise both the problems and opportunities that the formal selection interview presents.

(a) The purpose of the selection interview is to find the best possible person for the position who will fit into the organisation. Those conducting the interview must also ensure that the candidate clearly understands the job on offer, career prospects and that all candidates feel that fair treatment has been provided through the selection process.In addition, the interview also gives the opportunity to convey a good impression of the organisation, whether the candidate has been successful or not.

(d) Discuss the professional accountant’s liability for reporting on prospective financial information and the

measures that the professional accountant might take to reduce that liability. (6 marks)

(d) Professional accountant’s liability

Liability for reporting on PFI

Independent accountants may be required to report on PFI for many reasons (e.g. to help secure a bank loan). Such forecasts

and projections are inherently unreliable. If the forecast or projection does not materialise, and the client or lenders (or

investors) consequently sustain financial loss, the accountant may face lawsuits claiming financial loss.

Courts in different jurisdictions use various criteria to define the group of persons to whom independent accountants may be

held liable for providing a report on an inaccurate forecast or projection. The most common of these are that an accountant

is liable to persons with whom there is proximity:

(i) only (i.e. the client who engaged the independent accountant);

(ii) or whose relationship with the accountant sufficiently approaches privity;

(iii) and to persons or members of a limited group of persons for whose benefit and guidance the accountant supplied the

information or knew that the recipient of the information intended to supply it;

(iv) and to persons who reasonably can be foreseen to rely on the information.

Measures to reduce liability

As significant assumptions will be essential to a reader’s understanding of a financial forecast, the independent accountant

should ensure that they are adequately disclosed and clearly stated to be the management’s responsibility. Hypothetical

assumptions should be clearly distinguished from best estimates.

The introduction to any forecast (and/or report thereon) should include a caveat that the prospective results may not be

attained. Specific and extensive warnings (‘the actual results … will vary’) and disclaimers (‘we do not express an opinion’)

may be effective in protecting an independent accountant sued for inaccuracies in forecasts or projections that they have

reported on.

Any report to a third party should state:

■ for whom it is prepared, who is entitled to rely on it (if anyone) and for what purpose;

■ that the engagement was undertaken in accordance with the engagement terms;

■ the work performed and the findings.

An independent accountant’s report should avoid inappropriate and open-ended wording, for example, ‘we certify …’ and ‘we

obtained all the explanations we considered necessary’.

Engagement terms to report on PFI should include an appropriate liability cap that is reasonable given the specific

circumstances of the engagement.

The independent accountant may be able to obtain indemnity from a client in respect of claims from third parties. Such ‘hold

harmless’ clauses obligate the client to indemnify the independent accountant from third party claims.

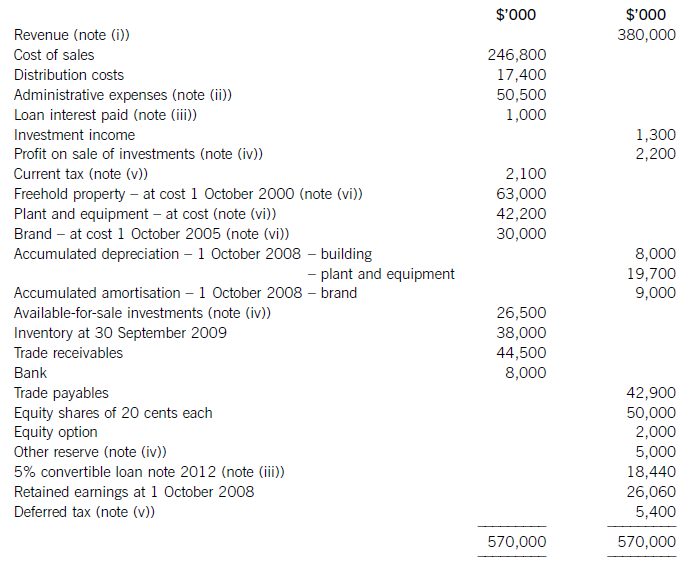

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-01-08

- 2020-01-29

- 2020-01-08

- 2021-01-13

- 2020-05-01

- 2020-08-16

- 2020-09-03

- 2020-04-08

- 2020-01-09

- 2020-02-27

- 2021-05-22

- 2020-01-02

- 2021-04-17

- 2021-01-13

- 2018-12-04

- 2020-08-15

- 2021-04-04

- 2020-07-04

- 2020-02-28

- 2020-03-15

- 2020-08-13

- 2020-01-10

- 2021-06-19

- 2020-01-08

- 2020-02-27

- 2020-01-09

- 2020-02-27

- 2020-03-11

- 2020-02-22