2020年ACCA考试报名流程

发布时间:2020-02-26

伴随着新年的到来,2020年ACCA考试报名也在如火如荼的进行中。目前,已经有小伙伴在网上查询相关的报名信息,比如报名流程。鉴于此,51题库考试学习网在下面为大家带来有关2020年ACCA考试报名方法的相关情况,以供参考。

报考ACCA考试首先需要注册成为学员,注册要求以及流程还请各位考生咨询最近的ACCA代表处。在完成注册之后,考生可通过以下步骤完成报名:

第一步:登陆ACCA官网,然后进入MY ACCA

第二步:在登录界面输入ACCA 注册号以及密码

第三步:登陆到MY ACCA之后点击进入左边的 EXAM ENTRY

第四步:点击“EXAM ENTRY”后出现的是考试费情况,点击Enter for Exams(注意,越早报名,考试费用越低)

第五步:选择考试季, 点击下拉框选择考试季,显示如下点击“Apply for Exam session”(ACCA报名费用较高,小伙伴们要根据自己的实际学习情况,选择合适的考试时间)

第六步:选择ACCA考试科目,在select exam下面的方框打钩,exam type选择“computer based“or”paper based“,没有选项的默认为paper based, 选择考试国家和地点,然后点击next(小伙伴们在报名时,应多次确认,在确保无误后再点击)

第七步:再次确认考试信息和支付金额,如果有欠费,或是年费,在myACCA account balance due后面会显示金额(中国地区2020年3月份的ACCA考试已经取消,考试费用也将返还到考生的myACCA账户,请之前报考的考生注意)

第八步:在方框处打钩,点击“proceed topayment”

第九步:选择支付方式,支付宝or信用卡(1)选择信用卡,填写Card Number(卡号)、Card Holder Name(持卡人姓名)、Card expiry Date(有效期)、CVC(安全码)、点击“next“。支付完考试费后,考试报名就完成了。

以上就是关于ACCA考试报名流程的相关情况。51题库考试学习网提醒:ACCA注册后每年都需要缴纳年费,参加考试也需要缴纳考试费,如果未及时缴纳,账户会被冻结,影响考试报名,因此小伙伴们要注意缴费时间。最后,51题库考试学习网预祝准备参加2020年ACCA考试的小伙伴都能顺利通过。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Calculate the corporation tax (CT) liabilities for Alantech Ltd, Boron Ltd and Bubble Ltd for the year ending

31 December 2004 on the assumption that loss reliefs are taken as early as possible. (9 marks)

(b) Schedule D Case I calculation

The three companies form. a group for both group relief and capital gains purposes as all shareholdings pass the 75%

ownership test. The calculation of the corporation tax liabilities is as follows:

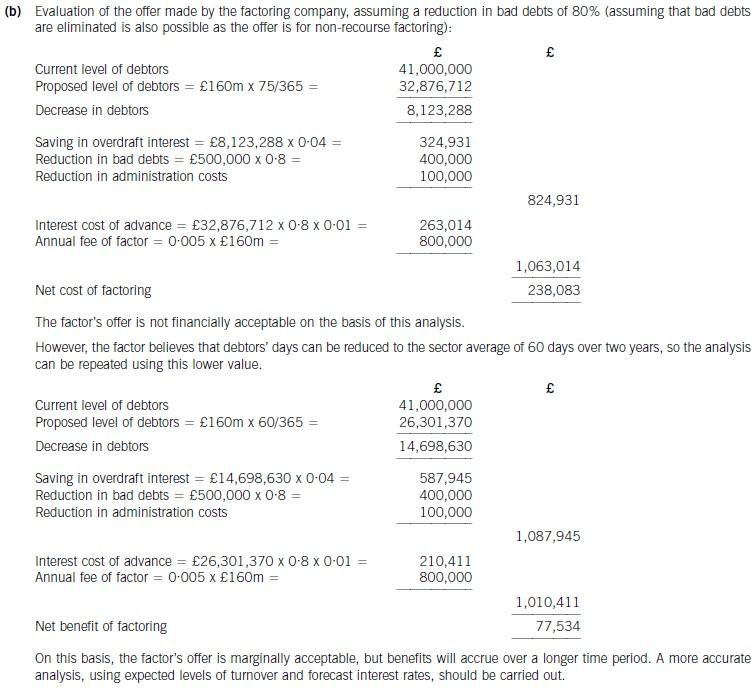

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

(b) Describe five main barriers to an effective appraisal interview. (10 marks)

(b) The appraisal system should be well constructed and fair to both the individual and the organisation. However, there are a number of barriers, often because employees see the appraisal as one or more of the following:

Confrontation due to lack of agreement on performance, badly explained or subjective feedback, performance based on recent events or disagreement on longer term activities.

Judgement, the appraisal is seen as a one sided process based entirely on the manager’s perspective.

Chat is the worst of all worlds. The appraisal interview is seen as an informal, loosely constructed and badly managed conversation without purpose.

Unfinished business is when the appraisal is not seen as part of a continuing process of performance management.

An annual event when the appraisal is seen as largely irrelevant and simply an event to set annual targets that quickly become out of date.

A system of bureaucracy based on forms devised solely to satisfy the organisation’s human resources department so that its main purpose, that of identifying individual and organisation performance and improvement, is forgotten.

(c) Explanatory notes, together with relevant supporting calculations, in connection with the loan. (8 marks)

Additional marks will be awarded for the appropriateness of the format and presentation of the schedules, the

effectiveness with which the information is communicated and the extent to which the schedules are structured in

a logical manner. (3 marks)

Notes: – you should assume that the tax rates and allowances for the tax year 2006/07 and for the financial year

to 31 March 2007 apply throughout the question.

– you should ignore value added tax (VAT).

(c) Tax implications of there being a loan from Flores Ltd to Banda

Flores Ltd should have paid tax to HMRC equal to 25% of the loan, i.e. £5,250. The tax should have been paid on the

company’s normal due date for corporation tax in respect of the accounting period in which the loan was made, i.e. 1 April

following the end of the accounting period.

The tax is due because Flores Ltd is a close company that has made a loan to a participator and that loan is not in the ordinary

course of the company’s business.

HMRC will repay the tax when the loan is either repaid or written off.

Flores Ltd should have included the loan on Banda’s Form. P11D in order to report it to HMRC.

Banda should have paid income tax on an annual benefit equal to 5% of the amount of loan outstanding during each tax

year. Accordingly, for each full year for which the loan was outstanding, Banda should have paid income tax of £231

(£21,000 x 5% x 22%).

Interest and penalties may be charged in respect of the tax underpaid by both Flores Ltd and Banda and in respect of the

incorrect returns made to HMRC

Willingness to act for Banda

We would not wish to be associated with a client who has engaged in deliberate tax evasion as this poses a threat to the

fundamental principles of integrity and professional behaviour. Accordingly, we should refuse to act for Banda unless she is

willing to disclose the details regarding the loan to HMRC and pay the ensuing tax liabilities. Even if full disclosure is made,

we should consider whether the loan was deliberately hidden from HMRC or Banda’s previous tax adviser.

In addition, companies are prohibited from making loans to directors under the Companies Act. We should advise Banda to

seek legal advice on her own position and that of Flores Ltd.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-01-22

- 2021-04-10

- 2020-01-10

- 2020-01-10

- 2020-01-30

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2021-01-13

- 2020-01-09

- 2020-05-02

- 2020-01-10

- 2020-01-09

- 2020-01-13

- 2020-01-09

- 2021-01-08

- 2020-01-09

- 2020-09-03

- 2021-02-13

- 2020-01-09

- 2020-01-08

- 2020-02-05

- 2020-01-08

- 2020-01-10

- 2020-01-10

- 2020-01-09

- 2020-09-04

- 2021-01-29

- 2020-01-09

- 2020-02-27