ACCA2019-2020MA(F2)考试大纲,速看!

发布时间:2019-07-19

2019-2020年的考试大纲已经上线了,小编特地整理了MA(F2)科目的考纲变动细节情况给大家,具体内容如下。

一、科目关联(Relation Diagram)

Management Accounting(MA)《管理会计》课程中的相关知识首先与Performance Management(PM)《业绩管理》和Advanced

Performance Management(APM)《高级业绩管理》这两门科目中的知识有所关联。此外,还会涉及到一定的Strategic Business Leader(SBL)《战略商业报告》。

而在MA课程中学到的知识,将会运用到学员后续高阶课程的PM以APM科目的学习中。MA课程中的Part B最后一章节Alternative costing methods会出现在PM的Part A,Part E有关Performance management的部分会出现在PM以及APM课程里。

MA课程中为之后的PM课程以及高阶必修的SBR课程打下基础。而MA课程直接承接的是PM,二者紧密关联,MA培养学员基础的管理会计技巧和认知,PM以及APM则培养学员更高级、真实的业绩管理能力。所以对于后期选修对APM有兴趣的学员来说,MA更是极为重要的一门科目!

二、新课程框架和新考纲(New Framework and Syllabus)

整体变化是增加了一个版块,这个版块整合了关于Date analysis and

statistical techniques的内容,同时又新增了一些这个内容的其他知识点。

第一个变化

新增版块Data analysis and statistical techniques成为了Part B部分。但是其他版块内容不变,以此往后顺延。由原来的Part A-Part E

5个Part的内容;变成了现在Part A-Part F 6个Part的内容。

第二个变化

将原来考纲Part C Budgeting中的Statistical

techniques这个知识点放在了新考纲Part B Data analysis and

statistical techniques的Forecasting techniques中。

第三个变化

新增了一部分的知识点。一个是Big data and analysis,放在了Part A The nature,source and purpose ofmanagement information的Sources of data中;一个是Summarising

and analysing data,放在了Part B Date analysis and

statistical technique。

对于此次考纲的调整,可以看出对Date analysis and statistical

techniques进行了一个整合。内容基本不变,我们主要看的就是新增的知识点。

三、新增知识点1:Big data and analysis

考纲要求的是Describe the main uses of big data

andanalytics for organisations。那也就是需要大家知道和分析大数据在企业中的用途。考试依然最多是以选择题形式进行考察。

四、新增知识点2:Summarising and analysing data

考纲要求:

a)Calculate the mean,mode and median

forungrouped data and the mean for groupeddata.

b)Calculate measures of dispersion

including thevariance,standard deviation and coefficient ofvariation both

grouped and ungrouped data.

c)Calculate expected values for use in

decisionmaking.

d)Explain the properties of a

normaldistribution.

e)Interpret normal distribution graphs and

tables

那么要求大家掌握的就是对均值、中位数、离散度、标准差、变异系数、均值及期望值等的计算。对正太分布图,要了解它的性质并能够解读其中的含义。考试通常会以计算分析等形式进行考察。

关于考试:

五、MA课程考试形式和分值分布:

Section A是35道2分的填空选择,一共70分;Section

B是3道大题,每题10分,各来自Part C、D、E,也是填空选择的形式。

综合以上就是关于MA的考纲变化详情,希望能对各位小伙伴有用。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

Background information

B-Star is a theme park based on a popular series of children’s books. Customers pay a fixed fee to enter the park,where they can participate in a variety of activities such as riding roller-coasters, playing on slides and purchasing themed souvenirs from gift shops.

The park is open all year and has been in operation for the last seven years. It is located in a country which has very little rainfall – the park is open-air so poor weather such as rain results in a significant fall in the number of customers for that day (normally by 50%). During the last seven years there have been on average 30 days each year with rain.

B-Star is now very successful; customer numbers are increasing at approximately 15% each year.

Ticket sales

Customers purchase tickets to enter the theme park from ticket offices located outside the park. Tickets are only valid on the day of purchase. Adults and children are charged the same price for admission to the park. Tickets are preprinted and stored in each ticket office.

Tickets are purchased using either cash or credit cards.

Each ticket has a number comprising of two elements – two digits relating to the ticket office followed by six digits to identify the ticket. The last six digits are in ascending sequential order.

Cash sales

1. All ticket sales are recorded on a computer showing the amount of each sale and the number of tickets issued.

This information is transferred electronically to the accounts office.

2. Cash is collected regularly from each ticket office by two security guards. The cash is then counted by two

accounts clerks and banked on a daily basis.

3. The total cash from each ticket office is agreed to the sales information that has been transferred from each office.

4. Total cash received is then recorded in the cash book, and then the general ledger.

Credit card sales

1. Payments by credit cards are authorised online as the customers purchase their tickets.

2. Computers in each ticket office record the sales information which is transferred electronically to the accounts office.

3. Credit card sales are recorded for each credit card company in a receivables ledger.

4. When payment is received from the credit card companies, the accounts clerks agree the total sales values to the amounts received from the credit card companies, less the commission payable to those companies. The receivables ledger is updated with the payments received.

You are now commencing the planning of the annual audit of B-Star. The date is 3 June 2009 and B-Star’s year end is 30 June 2009.

Required:

(a) List and explain the purpose of the main sections of an audit strategy document and for each section, provide an example relevant to B-Star. (8 marks)

(b) (i) For the cash sales system of B-Star, identify the risks that could affect the assertion of completeness of sales and cash receipts; (4 marks)

(ii) Discuss the extent to which tests of controls and substantive procedures could be used to confirm the

assertion of completeness of income in B-Star. (6 marks)

(c) (i) List the substantive analytical procedures that may be used to give assurance on the total income from

ticket sales for one day in B-Star;

(ii) List the substantive analytical procedures that may be used to give assurance on the total income from

ticket sales in B-Star for the year. (8 marks)

(d) List the audit procedures you should perform. on the credit card receivables balance. (4 marks)

(b)(i)Riskaffectingcompleteness–Thecomputersystemdoesnotrecordsalesaccuratelyand/orinformationislostortransferredincorrectlyfromtheticketofficecomputertotheaccountsdepartmentcomputer.–Cashsalesarenotrecordedinthecashbook;cashisstolenbytheaccountsclerks.–Ticketsareissuedbutnopaymentisreceived–thatisthesaleisnotrecorded.–Cashisremovedbytheticketofficepersonnel,bythesecurityguardsorbytheaccountclerks.–Theaccountclerksmiscounttheamountofcashreceivedfromaticketoffice.(ii)UseoftestsofcontrolsandsubstantiveproceduresTestsofcontrolsTestsofcontrolaredesignedtoensurethatdocumentedcontrolsareoperatingeffectively.Ifcontrolsoverthecompletenessofincomewereexpectedtooperatecorrectly,thentheauditorwouldtestthosecontrols.InB-Star,whilecontrolscouldbeinoperation,e.g.theaccountclerksagreeingphysicalcashtocomputersummaries,thereisnoindicationthatthecontrolisdocumented;thatisthecomputersummaryisnotsignedtoshowthecomparisonhastakenplace.Theauditorcouldusethetestofinquiry–askingtheclerkswhetherthecontrolhasbeenused,andobservation–actuallywatchingtheclerkscarryoutthecontrols.Asnotedabovethough,lackofdocumentationofthecontroldoesmeanrelyingontestsofcontrolfortheassertioncompletenessofincomehaslimitedvalue.SubstantiveproceduresSubstantiveproceduresincludeanalyticalproceduresandotherprocedures.Analyticalproceduresincludetheanalysisofsignificantratiosandtrendsandsubsequentinvestigationofanytrendsorrelationshipsthatappeartobeabnormal.TheseprocedurescanbeusedeffectivelyinB-Starasanapproximationofincomethatcanbeobtainedfromsourcesotherthanthecashreceiptrecords.Otherprocedures,ortestsofdetail,arenormallyusedtoverifystatementoffinancialpositionassertionsandincludeobtainingauditevidencerelevanttospecificassertions.However,theycouldbeusedinB-Startotraceindividualtransactionsthroughthesales/cashsystemstoensureallticketsaleshavebeenrecorded(completenessassertion).Theuseofotherprocedureswillbetimeconsuming.(c)(i)Substantiveanalyticalprocedures–completenessofincomeforoneday–Obtainproofintotal.Ticketssoldtimespriceshouldequalday’sincome.–Comparedailysalestobudgeteddailysales(forexampleweekendsandbankholidayswouldexpectmoreincome).–Comparesaleswithpreviousdaysandaccountforchangessuchasvariationsforweather.–Comparesalestosouvenirssales(morepeopleinparkmeansmoresouvenirsales).–Compareticketofficesday-by-dayandstaffrotationtoseeifsaleslowersomeday/somestaff(attempttoidentifyfraudalso).–Comparetheexpectedsalesfromticketnumberstothetotalsalesamountfromcashandcreditsalesforeachticketoffice.(ii)Substantiveanalyticalprocedures–completenessofincomefortheyear–Obtainthesalesincomefromthepreviousyear.Multiplythisby115%toprovidearoughestimateoftheincomeforthisyear.–Obtaininformationonthenumberofdayswithrainduringthelastyear.Wherethisismoreorlessthan30,adjusttheincomeestimateby1/730downforeachdayofrainabove30or1/730upforeachdayofrainlessthan30.(Note:B-Staronlyattracts50%ofthenormalnumberofcustomersonarainyday;henceonedayofraindecreasestotalcustomersby1/730intheyear.)–Compareactualincometobudgetedincomefortheyear.Askthedirectorstoexplainanysignificantdeviations.–Obtainindustryinformationonthepopularityofthemeparks,andchangeincustomernumbers.ComparethesetrendstotheresultsobtainedbyB-Star.WhereB-Starperformedsignificantlybetterorworsethanaverage,obtainexplanationsfromthedirectors.(d)Auditofyearendcreditcardreceivable–Agreethebalancesoneachcreditcardcompany’sledgeraccounttothelistofreceivables.–Castthelistofreceivablesandagreethetotaltothetotalonthereceivablesledgercontrolaccount.–Forthelastdayofthefinancialyearandthefirstdayofthenewfinancialyear,agreetotalsalesincomefromticketofficerecordstothecashbookandreceivablesledgerensuringtheyarerecordedinthecorrectperiod.Forasampleofmaterialbalancesandarandomsampleofimmaterialitems,–ObtaindirectconfirmationfromthecreditcardcompanyoftheamountduetoB-Starusingareceivablesconfirmationletter.–Wheredirectconfirmationisnotpossible,obtainevidenceofcashreceiptaftertheendofthefinancialyear.AgreetheamountonthebankstatementspostyearendofB-Startotheamountdueinthereceivablesledger(lessanycommissiondue).–Reviewafterdatesalesdaybookfordebitnotesindicatingthatsalesmayhavebeenoverstatedintheprioryear.–ObtainthefinancialstatementsofB-Starandensurethatthereceivablesamountisdisclosedasacurrentassetnetofcommissionduetothecreditcardcompanies.

4 You are an audit manager in Nate & Co, a firm of Chartered Certified Accountants. You are reviewing three situations,

which were recently discussed at the monthly audit managers’ meeting:

(1) Nate & Co has recently been approached by a potential new audit client, Fisher Co. Your firm is keen to take the

appointment and is currently carrying out client acceptance procedures. Fisher Co was recently incorporated by

Marcellus Fisher, with its main trade being the retailing of wooden storage boxes.

(2) Nate & Co provides the audit service to CF Co, a national financial services organisation. Due to a number of

errors in the recording of cash deposits from new customers that have been discovered by CF Co’s internal audit

team, the directors of CF Co have requested that your firm carry out a review of the financial information

technology systems. It has come to your attention that while working on the audit planning of CF Co, Jin Sayed,

one of the juniors on the audit team, who is a recent information technology graduate, spent three hours

providing advice to the internal audit team about how to improve the system. As far as you know, this advice has

not been used by the internal audit team.

(3) LA Shots Co is a manufacturer of bottled drinks, and has been an audit client of Nate & Co for five years. Two

audit juniors attended the annual inventory count last Monday. They reported that Brenda Mangle, the new

production manager of LA Shots Co, wanted the inventory count and audit procedures performed as quickly as

possible. As an incentive she offered the two juniors ten free bottles of ‘Super Juice’ from the end of the

production line. Brenda also invited them to join the LA Shots Co office party, which commenced at the end of

the inventory count. The inventory count and audit procedures were completed within two hours (the previous

year’s procedures lasted a full day), and the juniors then spent four hours at the office party.

Required:

(a) Define ‘money laundering’ and state the procedures specific to money laundering that should be considered

before, and on the acceptance of, the audit appointment of Fisher Co. (5 marks)

4 NATE & CO

(a) – Money laundering is the process by which criminals attempt to conceal the true origin and ownership of the proceeds

of criminal activity, allowing them to maintain control over the proceeds, and ultimately providing a legitimate cover for

their sources of income. The objective of money laundering is to break the connection between the money, and the crime

that it resulted from.

– It is widely defined, to include possession of, or concealment of, the proceeds of any crime.

– Examples include proceeds of fraud, tax evasion and benefits of bribery and corruption.

Client procedures should include the following:

– Client identification:

? Establish the identity of the entity and its business activity e.g. by obtaining a certificate of incorporation

? If the client is an individual, obtain official documentation including a name and address, e.g. by looking at

photographic identification such as passports and driving licences

? Consider whether the commercial activity makes business sense (i.e. it is not just a ‘front’ for illegal activities)

? Obtain evidence of the company’s registered address e.g. by obtaining headed letter paper

? Establish the current list of principal shareholders and directors.

– Client understanding:

? Pre-engagement communication may be considered, to explain to Marcellus Fisher and the other directors the

nature and reason for client acceptance procedures.

? Best practice recommends that the engagement letter should also include a paragraph outlining the auditor’s

responsibilities in relation to money laundering.

(iv) Tyre recently undertook a sales campaign whereby customers can obtain free car accessories, by presenting a

coupon, which has been included in an advertisement in a national newspaper, on the purchase of a vehicle.

The offer is valid for a limited time period from 1 January 2006 until 31 July 2006. The management are unsure

as to how to treat this offer in the financial statements for the year ended 31 May 2006.

(5 marks)

Required:

Advise the directors of Tyre on how to treat the above items in the financial statements for the year ended

31 May 2006.

(The mark allocation is shown against each of the above items)

(iv) Car accessories

An obligation should not be recognised for the coupons and no provision created under IAS37 ‘Provisions, Contingent

Liabilities and Contingent Assets’. A provision should only be recognised where there is an obligating event. There has to be

a present obligation (legal or constructive), the probability of an outflow of resources and the ability to make a reliable estimate

of the amount of the obligation. These conditions do not seem to have been met. Until the vehicle is purchased the

accessories cannot be obtained. That is the point at which the present obligation arises, the outflow of resources occurs and

an estimate of the amount of the obligation can be made. When the car is purchased, the accessories become part of the

cost of the sale. The revenue recognised will be the amount received from the customer (the sales price). The revenue will

not be grossed up to include the value of the accessories.

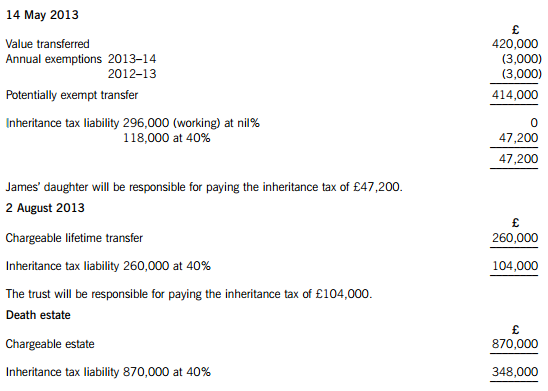

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-06-19

- 2019-07-19

- 2020-05-08

- 2020-03-05

- 2020-08-15

- 2020-03-14

- 2019-07-19

- 2019-07-19

- 2020-03-05

- 2020-05-14

- 2020-02-21

- 2020-01-01

- 2020-08-08

- 2021-05-12

- 2021-05-14

- 2019-07-19

- 2021-05-02

- 2019-07-19

- 2020-03-13

- 2020-03-08

- 2020-03-14

- 2019-07-19

- 2020-05-14

- 2020-03-05

- 2020-01-01

- 2019-07-19

- 2021-06-19

- 2020-03-13

- 2020-03-13

- 2020-03-13