ACCA该如何考?合理选择科目,提高执行力!

发布时间:2020-02-28

ACCA考试科目较多,且考试难度较高,因此在新年到来之后,准备参加2020年ACCA考试的小伙伴就开始在网上查询相关的报名信息。比如,ACCA考试科目该如何搭配。鉴于此,51题库考试学习网在下面为大家带来2020年ACCA考试科目搭配的相关信息,以供参考。

ACCA考试四大课程必须按照顺序,但是课程内的各科目如何安排就成为了许多小伙伴的难题。事实上。ACCA官方建议学员只需按照科目顺序从F1考到P7是非常合理的。同时,因为一年只能考8门,所以平均下来每次报2科目就非常简单合理了。不过,由于2020年第一考试季的ACCA考试已经取消(中国地区),因此小伙伴们也可以在剩下的考试季适当增加一科。

以上就是关于ACCA考试科目搭配的相关情况。51题库考试学习网提醒:各ACCA考试科目之间都有一定关联,因此小伙伴们在学习时也要注意复习。最后,51题库考试学习网预祝准备参加2020年ACCA考试的小伙伴都能顺利通过。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

2 Your firm was appointed as auditor to Indigo Co, an iron and steel corporation, in September 2005. You are the

manager in charge of the audit of the financial statements of Indigo, for the year ending 31 December 2005.

Indigo owns office buildings, a workshop and a substantial stockyard on land that was leased in 1995 for 25 years.

Day-to-day operations are managed by the chief accountant, purchasing manager and workshop supervisor who

report to the managing director.

All iron, steel and other metals are purchased for cash at ‘scrap’ prices determined by the purchasing manager. Scrap

metal is mostly high volume. A weighbridge at the entrance to the stockyard weighs trucks and vans before and after

the scrap metals that they carry are unloaded into the stockyard.

Two furnaces in the workshop melt down the salvageable scrap metal into blocks the size of small bricks that are then

stored in the workshop. These are sold on both credit and cash terms. The furnaces are now 10 years old and have

an estimated useful life of a further 15 years. However, the furnace linings are replaced every four years. An annual

provision is made for 25% of the estimated cost of the next relining. A by-product of the operation of the furnaces is

the production of ‘clinker’. Most of this is sold, for cash, for road surfacing but some is illegally dumped.

Indigo’s operations are subsidised by the local authority as their existence encourages recycling and means that there

is less dumping of metal items. Indigo receives a subsidy calculated at 15% of the market value of metals purchased,

as declared in a quarterly return. The return for the quarter to 31 December 2005 is due to be submitted on

21 January 2006.

Indigo maintains manual inventory records by metal and estimated quality. Indigo counted inventory at 30 November

2005 with the intention of ‘rolling-forward’ the purchasing manager’s valuation as at that date to the year-end

quantities per the manual records. However, you were not aware of this until you visited Indigo yesterday to plan

your year-end procedures.

During yesterday’s tour of Indigo’s premises you saw that:

(i) sheets of aluminium were strewn across fields adjacent to the stockyard after a storm blew them away;

(ii) much of the vast quantity of iron piled up in the stockyard is rusty;

(iii) piles of copper and brass, that can be distinguished with a simple acid test, have been mixed up.

The count sheets show that metal quantities have increased, on average, by a third since last year; the quantity of

aluminium, however, is shown to be three times more. There is no suitably qualified metallurgical expert to value

inventory in the region in which Indigo operates.

The chief accountant disappeared on 1 December, taking the cash book and cash from three days’ sales with him.

The cash book was last posted to the general ledger as at 31 October 2005. The managing director has made an

allegation of fraud against the chief accountant to the police.

The auditor’s report on the financial statements for the year ended 31 December 2004 was unmodified.

Required:

(a) Describe the principal audit procedures to be carried out on the opening balances of the financial statements

of Indigo Co for the year ending 31 December 2005. (6 marks)

2 INDIGO CO

(a) Opening balances – principal audit procedures

Tutorial note: ‘Opening balances’ means those account balances which exist at the beginning of the period. The question

clearly states that the prior year auditor’s report was unmodified therefore any digression into the prior period opinion being

other than unmodified or the prior period not having been audited will not earn marks.

■ Review of the application of appropriate accounting policies in the financial statements for the year ended 31 December

2004 to ensure consistent with those applied in 2005.

■ Where permitted (e.g. if there is a reciprocal arrangement with the predecessor auditor to share audit working papers

on a change of appointment), a review of the prior period audit working papers.

Tutorial note: There is no legal, ethical or other professional duty that requires a predecessor auditor to make available

its working papers.

■ Current period audit procedures that provide evidence concerning the existence, measurement and completeness of

rights and obligations. For example:

? after-date receipts (in January 2005 and later) confirming the recoverable amount of trade receivables at

31 December 2004;

? similarly, after-date payments confirming the completeness of trade and other payables (for services);

? after-date sales of inventory held at 31 December 2004;

? review of January 2005 bank reconciliation (confirming clearance of reconciling items at 31 December 2004).

■ Analytical procedures on ratios calculated month-on-month from 31 December 2004 to date and further investigation

of any distortions identified at the beginning of the current reporting period. For example:

? inventory turnover (by category of metal);

? average collection payment;

? average payment period;

? gross profit percentage (by metal).

■ Examination of historic accounting records for non-current assets and liabilities (if necessary). For example:

? agreeing balances on asset registers to the client’s trial balance as at 31 December 2004;

? agreeing statements of balances on loan accounts to the financial statements as at 31 December 2004.

■ If the above procedures do not provide sufficient evidence, additional substantive procedures should be performed. For

example, if additional evidence is required concerning inventory at 31 December 2004, cut-off tests may be

reperformed.

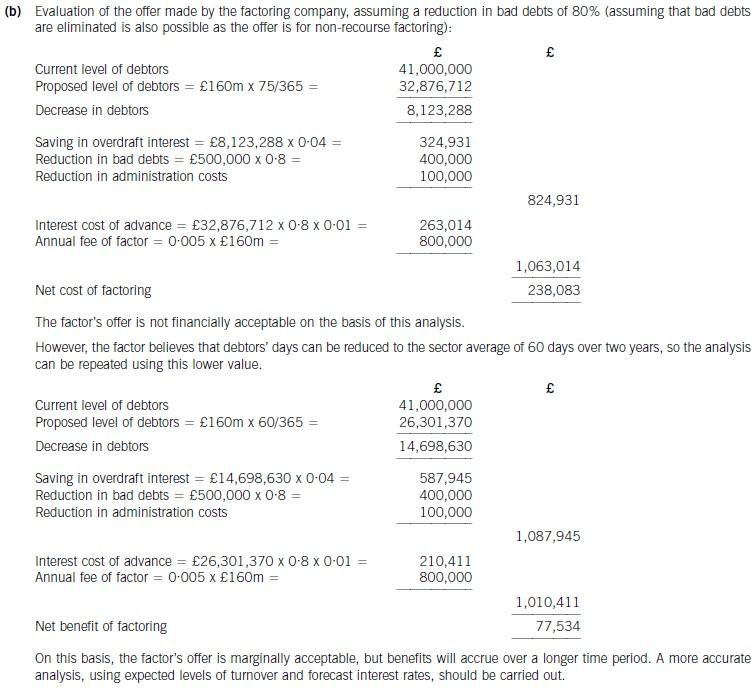

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

2 Your audit client, Prescott Co, is a national hotel group with substantial cash resources. Its accounting functions are

well managed and the group accounting policies are rigorously applied. The company’s financial year end is

31 December.

Prescott has been seeking to acquire a construction company for some time in order to bring in-house the building

and refurbishment of hotels and related leisure facilities (e.g. swimming pools, squash courts and restaurants).

Prescott’s management has recently identified Robson Construction Co as a potential target and has urgently requested

that you undertake a limited due diligence review lasting two days next week.

Further to their preliminary talks with Robson’s management, Prescott has provided you with the following brief on

Robson Construction Co:

The chief executive, managing director and finance director are all family members and major shareholders. The

company name has an established reputation for quality constructions.

Due to a recession in the building trade the company has been operating at its overdraft limit for the last 18

months and has been close to breaching debt covenants on several occasions.

Robson’s accounting policies are generally less prudent than those of Prescott (e.g. assets are depreciated over

longer estimated useful lives).

Contract revenue is recognised on the percentage of completion method, measured by reference to costs incurred

to date. Provisions are made for loss-making contracts.

The company’s management team includes a qualified and experienced quantity surveyor. His main

responsibilities include:

(1) supervising quarterly physical counts at major construction sites;

(2) comparing costs to date against quarterly rolling budgets; and

(3) determining profits and losses by contract at each financial year end.

Although much of the labour is provided under subcontracts all construction work is supervised by full-time site

managers.

In August 2005, Robson received a claim that a site on which it built a housing development in 2002 was not

properly drained and is now subsiding. Residents are demanding rectification and claiming damages. Robson

has referred the matter to its lawyers and denied all liability, as the site preparation was subcontracted to Sarwar

Services Co. No provisions have been made in respect of the claims, nor has any disclosure been made.

The auditor’s report on Robson’s financial statements for the year to 30 June 2005 was signed, without

modification, in March 2006.

Required:

(a) Identify and explain the specific matters to be clarified in the terms of engagement for this due diligence

review of Robson Construction Co. (6 marks)

2 PRESCOTT CO

(a) Terms of engagement – matters to be clarified

Tutorial note: This one-off assignment requires a separate letter of engagement. Note that, at this level, a standard list of

contents will earn few, if any, marks. Any ‘ideas list’ must be tailored to generate answer points specific to the due diligence

review of this target company.

■ Objective of the review: for example, to find and report facts relevant to Prescott’s decision whether to acquire Robson.

The terms should confirm whether Prescott’s interest is in acquiring the company (i.e. the share capital) or its trading

assets (say), as this will affect the nature and scope of the review.

Tutorial note: This is implied as Prescott ‘has been seeking to acquire ... to bring building … in-house’.

■ Prescott’s management will be solely responsible for any decision made (e.g. any offer price made to purchase Robson).

■ The nature and scope of the review and any standards/guidelines in accordance with which it will be conducted. That

investigation will consist of enquiry (e.g. of the directors and the quantity surveyor) and analytical procedures (e.g. on

budgeted information and prior period financial statements).

Tutorial note: This is not going to be a review of financial statements. The prior year financial statements have only

recently been audited and financial statements for the year end 30 June 2006 will not be available in time for the

review.

■ The level of assurance will be ‘negative’. That is, that the material subject to review is free of material misstatement. It

should be stated that an audit is not being performed and that an audit opinion will not be expressed.

■ The timeframe. for conducting the investigation (two days next week) and the deadline for reporting the findings.

■ The records, documentation and other information to which access will be unrestricted. This will be the subject of

agreement between Prescott and Robson.

■ A responsibility/liability disclaimer that the engagement cannot be relied upon to disclose errors, illegal acts or other

irregularities (e.g. fraudulent financial reporting or misappropriations of Robson’s assets).

Tutorial note: Third party reliance on the report seems unlikely as Prescott has ‘substantial cash resources’ and may not

need to obtain loan finance.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-03-13

- 2020-01-09

- 2020-01-10

- 2020-01-09

- 2019-12-30

- 2020-03-21

- 2020-04-05

- 2020-01-10

- 2020-03-27

- 2020-03-10

- 2020-02-28

- 2021-04-23

- 2020-05-14

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-03-04

- 2020-03-12

- 2020-02-29

- 2020-03-13

- 2020-01-10

- 2019-12-30

- 2020-03-04

- 2020-01-10

- 2020-04-16

- 2020-01-08

- 2020-01-10

- 2020-01-10

- 2020-10-09

- 2020-01-09