你要的2020年ACCA报考时间来了

发布时间:2020-04-18

相信大家都或多或少的听说过ACCA。那么什么是ACCA呢?由51题库考试学习网为您进行解答。ACCA是目前财经领域认可度最高的资格证书,也是世界上拥有学员和会员最多的,为此还被我国称之为“国际注册会计师”。最近,报考ACCA的时间出来了,不知道的朋友们快跟着51题库考试学习网给大家带来的这篇文章吧!

2020年最后一个考试季将在12月初举行,历时五天。计划报考的同学请在规定时间内完成报名。

报名的时间安排如下:

2020年8月10日 Early

exam entry deadline date

2020年11月2日 Standard

exam entry deadline

2020年11月9日 Late

exam entry deadline

ACCA报名都分为三个时段,分别为早期、中期、晚期报考时段。但什么是ACCA早、中、晚报考阶段呢?三者又有什么区别呢? 其实,所谓的ACCA早期、中期和晚期报考阶段指的是,每个考季的ACCA考试都是需要提前进行预约报考的,ACCA官方为学员设定了三个报考时间段,在不同报考时间段内进行报考的话,那么,每科的考试费用是有所不同的。 ACCA不同时段报名费用差异为: 科目 各科目考试费用 AB, MA,

FA, LW 机考,详询当地考试中心 机考,详询当地考试中心 机考,详询当地考试中心 PM, TX,

FR, AA and FM £114 £120 £307 SBL £188 £199 £321 SBR £147 £155 £350 AFM, APM,

ATX, AAA £147 £155 £350 *ACCA各科目报名费用可能会有所调整,如有差异,请以官方的最终账单信息和官方通知为准!看了报名时间,那关于ACCA的其他内容你知道吗?要不接着看下去吧!

缴费情况:

在ACCA官网缴费是支持使用银联卡和支付宝的。但ACCA总部推荐学员使用双币信用卡在线考试报名。这样将可以及时确认报名成功并且可以享受提前考试报名时段的优惠价格。 但如果在我们缴纳ACCA报名费时,网页显示报名成功,但未收到银行扣款通知怎么办?如果其他步骤都没有出错,并且有显示报考成功的话,有可能是由于因为报名时ACCA使用的信用卡预授权消费,信用卡发卡行会先把你这笔缴费款冻结住,一般银行过1-2个工作日会跟ACCA官方对账,确定这笔款项真的没问题时,才会把费用真正扣除。所以,当出现上述情况时,先检查自己的各项信息,没错的话,可以过两天再查询具体情况吧!

就业前景:

国际知名机构建立了密切的合作关系,包括跨国企业、各国地方企业、其他会计师组织、教育机构、以及联合国、世界银行等世界性组织。全球共有7000多家ACCA认证雇主,其中在中国有超过700家ACCA认证雇主,这些认证雇主企业将优先录用及提升ACCA会员及毕业生。

ACCA未来的就业方向和行业主要集中在以下公司:

国际国内大型银行及投资银行:花旗银行、汇丰银行、渣打银行、中国工商银行、中国银行等。

保险及金融投资机构:中国国际金融公司、美国高盛、美国友邦保险、鼎辉投资等。

国际知名企业:可口可乐(中国)有限公司、微软(中国)有限公司、西门子中国有限公司等。

中国大型国有及民营企业:中国移动通信集团、中国石油天然气集团、阿里巴巴、联想集团等。

国际知名咨询企业及会计师事务所:麦肯锡、埃森哲、四大国际会计师事务所。

以上就是由51题库考试学习网为您带来的有关AACA的相关信息了,想要获取更多信息的同学,请持续关注51题库考试学习网。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) Explain whether or not Carver Ltd will become a close investment-holding company as a result of

acquiring either the office building or the share portfolio and state the relevance of becoming such a

company. (2 marks)

(ii) Close investment holding company status

Carver Ltd will not become a close investment-holding company if it purchases the office building as, although it will no

longer be a trading company, it intends to rent out the building to a number of tenants none of whom is connected to

the company.

Carver Ltd will become a close investment holding company if it purchases a portfolio of quoted shares as it will no

longer be a trading company. As a result it will pay corporation tax at the full rate of 30% regardless of the level of its

profits.

(b) On 1 April 2004 Volcan introduced a ‘reward scheme’ for its customers. The main elements of the reward

scheme include the awarding of a ‘store point’ to customers’ loyalty cards for every $1 spent, with extra points

being given for the purchase of each week’s special offers. Customers who hold a loyalty card can convert their

points into cash discounts against future purchases on the basis of $1 per 100 points. (6 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Volcan for the year ended

31 March 2005.

NOTE: The mark allocation is shown against each of the three issues.

(b) Reward scheme

(i) Matters

■ If the entire year’s revenue ($303m) attracted store points then the cost of the reward scheme in the year is at

most $3·03m. This represents 1% of revenue, which is material to the income statement and very material

(31·9%) to profit before tax (PBT).

■ The proportion of customers who register for loyalty cards and the percentage of revenue (and profit) which they

represent (which may vary from store to store depending on customer profile).

■ In accordance with the assumption of accruals, which underlies the preparation and presentation of financial

statements (The Framework/IAS 1 ‘Presentation of Financial Statements’), the expense and liability should be

recognised as revenue is earned. (It is of the nature of a discount.)

■ Any restrictions on the terms for converting points (e.g. whether they expire if not used within a specified time).

■ To the extent that points have been awarded but not redeemed at 31 March 2005, Volcan will have a liability at

the balance sheet date.

■ Agree the total balance due to customers at the year end under the reward scheme to the sum of the points on

individual customer reward cards.

■ The proportion of reward points awarded which are not expected to be claimed (e.g. the ‘take up’ of points awarded

may be only 80%, say).

■ Whether reward points are valued at selling price or cost. For example, if the average gross profit margin is 20%,

one point is equivalent to 0·8 cents of goods at cost.

(ii) Audit evidence

■ New/updated systems documentation explaining how:

– loyalty cards (and numbers) are issued to customers;

– points earned are recorded at the point of sale; and

– points are later redeemed on subsequent purchases.

■ Walk-through tests (e.g. on registering customer applications and issuing loyalty cards, awarding of points on

special offer items).

■ Tests of controls supporting the extent to which audit reliance is placed on the accounting and internal control

system. In particular, how points are extracted from the electronic tills (cash registers) and summarised into the

weekly/monthly financial data for each store which underlies the financial statements.

■ Analytical procedures on the value of points awarded by store per month with explanations of variations (‘variation

analysis’). For example, similar proportions (not exceeding 1% of revenue) of points in each month might be

expected by store – possibly increasing following any promotion of the ‘loyalty’ scheme.

Tutorial note: Within a close community, for example, a high proportion of customers might be expected to sign

up for the reward scheme. However, in big cities, where a large proportion of the customers might be transitory

(e.g. tourists or other visitors) the proportion may be much lower.

■ Tests of detail on a sample of transactions with customers undertaken at store visits. For example, for a sample of

copy till receipts:

– check the arithmetic accuracy of points awarded (1 per $1 spent + special offers);

– agree points awarded for special offers to that week’s special offers;

– for cash discounts taken confirm the conversion of points is against the opening balance of points awarded

(not against purchases just made).

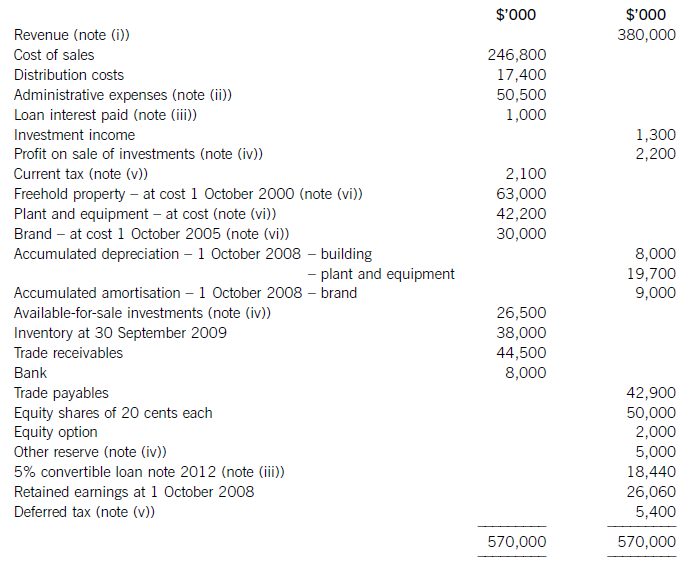

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-10-08

- 2020-01-09

- 2020-01-09

- 2020-02-10

- 2021-05-12

- 2020-04-30

- 2020-01-09

- 2020-03-19

- 2020-03-08

- 2020-02-29

- 2020-03-04

- 2020-03-08

- 2020-04-10

- 2019-12-28

- 2019-07-21

- 2020-05-15

- 2020-01-29

- 2020-03-05

- 2020-01-10

- 2020-02-14

- 2020-01-10

- 2020-04-11

- 2019-03-30

- 2020-02-15

- 2020-01-09

- 2020-03-06

- 2020-01-08

- 2021-04-23

- 2019-07-21

- 2020-01-10