解答!ACCA资格证在中国大陆有用吗,受到认可吗

发布时间:2020-04-04

ACCA资格证在中国大陆有用吗?受到认可吗?今天51题库考试学习网就大家的问题为大家一一解答。

ACCA在国内属于短缺人才,ACCA资格在国内很有用,在未来10年里,无论在中国还是全球,对具有国际视野的高素质财会人才的需求会继续增加。

ACCA会员资格也在国际上得到广泛认可,尤其得到欧盟立法以及许多国家公司法的承认。所以拥有ACCA会员资格,就拥有了在世界各地就业的"通行证"。

尽管ACCA在国内确实无法去取代CPA“注册”“执业资质”的法律地位,但是ACCA考试,或者说ACCA资质的地位其实是向未来的雇主企业反应个人“职业能力”的极佳标准。尤其是对于没有工作经验的大学生来说,这一点尤其重要。

ACCA学员的就业主要方向:

国际、国内金融机构、大型银行、投资银行。如:中国工商银行、中国银行、中国国际金融公司、交通银行、汇丰银行、花旗银行、渣打银行、法国兴业银行、荷兰银行、高盛等。

跨国企业,国内大型企业。如:宝洁、联合利华、壳牌石油、微软、强生、GE、中石化、阿里巴巴集团、中国移动等大型企业。

国际大型金融咨询机构或专业会计师事务所。如埃森哲咨询等国际金融咨询机构、普华永道、毕马威、德勤、安永"四大"会计师事务所等国际会计师事务所。

ACCA考试报名条件:

1、教育部认可的高等院校在校生(本科在校),顺利完成大一的课程考试,即可报名成为ACCA的正式学员;

2、凡具有教育部承认的大专以上学历,即可报名成为ACCA的正式学员;

3、未符合1、2项报名资格的申请者,可以先申请参加FIA(Foundations in

Accountancy)基础财务资格考试。在完成FAB(基础商业会计)、FMA(基础管理会计)、FFA(基础财务会计)3门课程后,可以豁免ACCA AB-MA-FA三门课程的考试,直接进入ACCA技能课程的考试。

今日分享时间到此结束啦,以上就是今天51题库考试学习网为大家分享的全部内容,希望以上的资讯能够帮助到所有的考生,如果还有什么疑问,欢迎大家继续向51题库考试学习网进行提问,我们也会及时的回复大家的问题!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

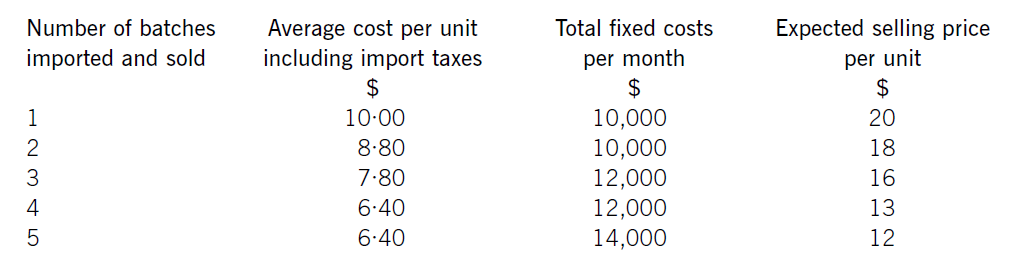

Jewel Co is setting up an online business importing and selling jewellery headphones. The cost of each set of headphones varies depending on the number purchased, although they can only be purchased in batches of 1,000 units. It also has to pay import taxes which vary according to the quantity purchased.

Jewel Co has already carried out some market research and identified that sales quantities are expected to vary depending on the price charged. Consequently, the following data has been established for the first month:

Required:

(a) Calculate how many batches Jewel Co should import and sell. (6 marks)

(b) Explain why Jewel Co could not use the algebraic method to establish the optimum price for its product.

(4 marks)

(b)Thealgebraicmodelrequiresseveralassumptionstobetrue.First,theremustbeaconsistentrelationshipbetweenprice(P)anddemand(Q),sothatademandequationcanbeestablished,usuallyintheform.P=a–bQ.Here,althoughthereisaclearrelationshipbetweenthetwo,itisnotaperfectlylinearrelationshipandsomorecomplicatedtechniquesarerequiredtocalculatethedemandequation.ItalsocannotbeassumedthatalinearrelationshipwillholdforallvaluesofPandQotherthanthefivegiven.Similarly,theremustbeaclearrelationshipbetweendemandandmarginalcost,usuallysatisfiedbyconstantvariablecostperunitandconstantfixedcosts.Thechangingvariablecostsperunitagaincomplicatetheissue,butitisthechangesinfixedcostswhichmakethealgebraicmethodlessusefulinJewel’scase.Thealgebraicmodelisonlysuitableforcompaniesoperatinginamonopolyanditisnotclearherewhetherthisisthecase,butitseemsunlikely,soany‘optimum’pricemightbecomeirrelevantifJewel’scompetitorschargesignificantlylowerprices.Othermoregeneralfactorsnotconsideredbythealgebraicmodelarepoliticalfactorswhichmightaffectimports,socialfactorswhichmayaffectcustomertastesandeconomicfactorswhichmayaffectexchangeratesorcustomerspendingpower.Thereliabilityoftheestimatesthemselves–forsalesprices,variablecostsandfixedcosts–couldalsobecalledintoquestion.

(b) Describe to the Beth Group the possible advantages of producing a separate environmental report.

(8 marks)

(b) An environmental report allows an organisation to communicate with different stakeholders. The benefits of an environmental

report include:

(i) evaluating environmental performance can highlight inefficiencies in operations and help to improve management

systems. Beth could identify opportunities to reduce resource use, waste and operating costs.

(ii) communicating the efforts being made to improve social and environmental performance can foster community support

for a business and can also contribute towards its reputation as a good corporate citizen. At present Beth has a poor

reputation in this regard.

(iii) reporting efforts to improve the organisation’s environmental, social and economic performance can lead to increased

consumer confidence in its products and services.

(iv) commitment to reporting on current impacts and identifying ways to improve environmental performance can improve

relationships with regulators, and could reduce the potential threat of litigation which is hanging over Beth.

(v) investors, financial analysts and brokers increasingly ask about the sustainability aspects of operations. A high quality

report shows the measures the organisation is taking to reduce risks, and will make Beth more attractive to investors.

(vi) disclosing the organisation’s environmental, social and economic best practices can give a competitive market edge.

Currently Beth’s corporate image is poor and this has partly contributed to its poor stock market performance.

(vii) the international trend towards improved corporate sustainability is growing and access to international markets will

require increasing transparency, and this will help Beth’s corporate image.

(viii) large organisations are increasingly requiring material and service suppliers and contractors to submit performance

information to satisfy the expectations of their own shareholders. Disclosing such information can make the company a

more attractive supplier than their competitors, and increase Beth’s market share.

It is important to ensure that the policies are robust and effective and not just compliance based.

(d) Explain the term ‘environmental management accounting’ and the benefits that may accrue to organisations

which adopt it. (4 marks)

(d) Environmental management accounting (EMA) involves the generation and analysis of both financial and non-financial

information in order to support internal environmental management processes. It is complementary to the conventional

management accounting approach, with the aim to develop appropriate mechanisms that assist the management of

organisations in the identification and allocation of environmentally related costs.

Organisations that alter their management accounting practices to incorporate environmental concerns will have greater

awareness of the impact of environment-related activities on their profit and loss accounts and balance sheets. This is because

conventional management accounting systems tend to attribute many environmental costs to general overhead accounts with

the result that they are ‘hidden’ from management. It follows that organisations which adopt EMA are more likely to identify

and take advantage of cost reduction and other improvement opportunities. A concern with environmental costs will also

reduce the chances of employing incorrect pricing of products and services and taking the wrong options in terms of mix and

development decisions. This in turn may lead to enhanced customer value whilst reducing the risk profile attaching to

investments and other decisions which have long term consequences.

Reputational risk will also be reduced as a consequence of adopting (EMA) since management will be seen to be acting in

an environmentally responsible manner. Organisations can learn from the Shell Oil Company whose experience in the much

publicised Brent Spar incident cost the firm millions in terms of lost revenues as a result of a consumer boycott.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-08

- 2020-03-05

- 2020-03-18

- 2020-01-08

- 2020-01-10

- 2020-01-09

- 2020-03-13

- 2020-01-10

- 2019-07-21

- 2020-03-04

- 2020-03-05

- 2020-01-10

- 2020-01-09

- 2020-03-15

- 2020-01-09

- 2020-03-05

- 2020-05-05

- 2020-01-10

- 2020-05-20

- 2020-03-08

- 2020-01-10

- 2020-04-19

- 2020-01-09

- 2020-05-15

- 2020-01-10

- 2019-10-13

- 2020-03-27

- 2020-03-04

- 2020-01-09

- 2020-04-15