51题库考试学习网提醒你查看:2020三月ACCA通过率分析

发布时间:2020-04-19

通过率是反应考试难度的最好信息,对acca考试感兴趣的朋友,可以来51题库考试学习网看看具体内容,对你可能有帮助。

1、AB-LW前四科目通过率依旧保持乐观,考试难度相对较低。

2、PM难度进一步增加,单科通过率仅有35%,创2009年以来的新低,仅比战略阶段的最难的选修课高1%~2%。

PM业绩管理一直是历年技能课程考试中难度较大的科目,历年通过率约在38%~43%之间。但从今年首次考季的整体结果来看,本次考试要比往年最低点38%再低3个百分点,由此可见该科目在难度上不容小觑,甚至在实施新大纲后难度还会有所提升。

3、TX为2018年以来最低水平。虽然为最低点,但TX通过率波动较小,自2018年来,始终维持在46%~51%之间。

4、FR为2015年以来最低水平,为44%。PR往年通过率同TX一样,约为46%~51%。

5、AA本次通过率为36%,同2019年9月考季相同,同为2015年以来最低点。与之相较,FM一科的通过率则处在正常偏低的位置。

6、对于战略阶段的课程来说,SBL/SBR以及除高级税务之外的三门选修课程,通过率相对较为稳定,与以往相差无几。不过,在本次考季当中,ATX一科目的通过率却创造了近年来最高纪录,高达44%。

总得来说,在本次考季当中TX、FR、AA等科目的通过率不尽理想,均为近年来最低水平,不过,这并不一定代表着ACCA考试的整体难度上升了。众所周知,ACCA中国区通过率是要高于全球的,因中国区考试的全部取消,导致全球通过率略有降低,也是情理之中的事。希望大家不要过度担忧,只要依照自己的步骤和计划进行复习和备考就好。

关于ACCA官方对于本次考试有何总结和评价,同学们可以点击“官方解析”进行查看。随着Covid-19大流行的继续,ACCA宣布取消6月份的考试——包括在英国、西欧和美洲,并将国内的6月考季延期至7月举行。考试被取消,学生考试费用将退回他们的MyACCA帐户,可以重新预约以后的考试。考试时间延期的考生可以照常进行报考,具体考试的时间,ACCA官方将会邮件通知,请大家留意!

以上就是51题库考试学习网为大家分享的全部内容了,看完了通过率,结合自己的情况,是不是对考试已经有了一定的认识了呢,那就认真备考,争取获得一个好成绩吧。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) Analyse why moving to a ‘no frills’ low-cost strategy would be inappropriate for ONA.

Note: requirement (b) (ii) includes 3 professional marks (16 marks)

(ii) ‘No frills’ low-cost budget airlines are usually associated with the following characteristics. Each of these characteristics

is considered in the context of Oceania National Airlines (ONA).

– Operational economies of scale

Increased flight frequency brings operational economies and is attractive to both business and leisure travellers. In

the international sector where ONA is currently experiencing competition from established ‘no frills’ low-cost budget

airlines ONA has, on average, one flight per day to each city. It would have to greatly extend its flight network, flight

frequency and the size of its aircraft fleet if it planned to become a ‘no frills’ carrier in this sector. This fleet

expansion appears counter to the culture of an organisation that has expanded very gradually since its formation.

Table 1 shows only three aircraft added to the fleet in the period 2004–2006. It is likely that the fleet size would

have to double for ONA to become a serious ‘no frills’ operator in the international sector. In the regional sector, the

flight density, an average of three flights per day, is more characteristic of a ‘no frills’ airline. However, ONA would

have to address the relatively low utilisation of its aircraft (see Tables 1 and 2) and the cost of maintenance

associated with a relatively old fleet of aircraft.

– Reduced costs through direct sales

On-line booking is primarily aimed at eliminating commission sales (usually made through travel agents). ‘No frills’

low-cost budget airlines typically achieve over 80% of their sales on-line. The comparative figure for ONA (see

Table 2) is 40% for regional sales and 60% for international sales, compared with an average of 84% for their

competitors. Clearly a major change in selling channels would have to take place for ONA to become a ‘no frills’

low-cost budget airline. It is difficult to know whether this is possible. The low percentage of regional on-line sales

seems to suggest that the citizens of Oceania may be more comfortable buying through third parties such as travel

agents.

– Reduced customer service

‘No frills’ low-cost budget airlines usually do not offer customer services such as free meals, free drinks and the

allocation of passengers to specific seats. ONA prides itself on its in-flight customer service and this was one of the

major factors that led to its accolade as Regional Airline of the Year. To move to a ‘no frills’ strategy, ONA would

have to abandon a long held tradition of excellent customer service. This would require a major cultural change

within the organisation. It would also probably lead to disbanding the award winning (Golden Bowl) catering

department and the redundancies of catering staff could prove difficult to implement in a heavily unionised

organisation.

Johnson, Scholes and Whittington have suggested that if an organisation is to ‘achieve competitive advantage through

a low price strategy then it has two basic choices. The first is to try and identify a market segment which is unattractive

(or inaccessible) to competitors and in this way avoid competitive pressures to erode price.’ It is not possible for ONA to

pursue this policy in the international sector because of significant competition from established continental ‘no frills’

low-cost budget airlines. It may be a candidate strategy for the regional sector, but the emergence of small ‘no frills’ lowcost

budget airlines in these countries threaten this. Many of these airlines enter the market with very low overheads

and use the ‘no frills’ approach as a strategy to gain market share before progressing to alternative strategies.

Secondly, a ‘no frills’ strategy depends for its success on margin. Johnson, Scholes and Whittington suggest that ‘in the

long run, a low price strategy cannot be pursued without a low-cost base’. Evidence from the scenario suggests that ONA

does not have a low cost base. It continues to maintain overheads (such as a catering department) that its competitors

have either disbanded or outsourced. More fundamentally (from Table 2), its flight crew enjoy above average wages and

the whole company is heavily unionised. The scenario acknowledges that the company pays above industry salaries and

offers excellent benefits such as a generous non-contributory pension. Aircraft utilisation and aircraft age also suggest a

relatively high cost base. The aircraft are older than their competitors and presumably incur greater maintenance costs.

ONA’s utilisation of its aircraft is also lower than its competitors. It seems highly unlikely that ONA can achieve the

changes required in culture, cost base and operations required for it to become a ‘no frills’ low-cost budget airline. Other

factors serve to reinforce this. For example:

– Many ‘no frills’ low-cost budget airlines fly into airports that offer cheaper taking off and landing fees. Many of these

airports are relatively remote from the cities they serve. This may be acceptable to leisure travellers, but not to

business travellers – ONA’s primary market in the regional sector.

– Most ‘no frills’ low-cost budget airlines have a standardised fleet leading to commonality and familiarity in

maintenance. Although ONA has a relatively small fleet it is split between three aircraft types. This is due to

historical reasons. The Boeing 737s and Airbus A320s appear to be very similar aircraft. However, the Boeings

were inherited from OceaniaAir and the Airbuses from Transport Oceania.

In conclusion, the CEO’s decision to reject a ‘no frills’ strategy for ONA appears to be justifiable. It would require major

changes in structure, cost and culture that would be difficult to justify given ONA’s current position. Revolution is the

term used by Baligan and Hope to describe a major rapid strategic change. It is associated with a sudden transformation

required to react to extreme pressures on the organisation. Such an approach is often required when the company is

facing a crisis and needs to quickly change direction. There is no evidence to support the need for a radical

transformation. This is why the CEO brands the change to a ‘no frills’ low-cost budget airline as ‘unnecessary’. The

financial situation (Table 3) is still relatively healthy and there is no evidence of corporate predators. It can be argued

that a more incremental approach to change would be beneficial, building on the strengths of the organisation and the

competencies of its employees. Moving ONA to a ‘no frills’ model would require seismic changes in cost and culture. If

ONA really wanted to move into this sector then they would be better advised to start afresh with a separate brand andairline and to concentrate on the regional sector where it has a head start over many of its competitors.

(b) A recruitment service offered to clients. (7 marks)

(b) Recruitment service

IFAC’s Code of Ethics for Professional Accountants does not prohibit firms from offering a recruitment service to client

companies. However several ethical problems could arise if the service were offered. The severity of these problems would

depend on the exact nature of the service provided, and the role of the person recruited into the client’s organisation.

Specific ethical threats could include:

Self-interest – clearly the motive for Becker & Co to offer this service is to generate income from audit clients, thereby creating

a financial self-interest threat. The amount received for the recruitment service depends on the magnitude of the salary of the

person employed. The more senior the person recruited, the higher their salary is likely to be, and therefore the higher the

fee to be paid to Becker & Co.

In addition, the firm could be tempted to advise positively on the recruitment of an individual merely to receive the relevant

recruitment fee, without properly considering the suitability of the person for the role.

Familiarity – when performing the audit, the auditors may be less likely to criticise or challenge the work performed by a

person they helped to recruit, as any significant problems discovered may make the recruitment appear ill-advised.

Management involvement – there is also a threat that the audit firm could be perceived to be making management decisions

by selecting employees. The firm could offer services such as reviewing the professional qualifications of a number of

applicants, and providing advice on the applicant’s suitability for the post. In addition the firm could draw up a shortlist of

candidates for interview, using criteria specified by the client. However in all cases, the final decision as to whom to hire must

be made by the client, as the audit firm should not make, or be perceived to be making, management decisions.

The threats discussed above would increase in significance if the recruitee took on a role in key management pertaining to

the finance function, such as finance director or financial controller. The threats would be less severe if the audit firm advised

on the recruitment of a junior member of the client’s finance function.

If these threats could not be reduced to a level less than clearly insignificant, then the recruitment service should not be

offered.

Commercial evaluation

The firm should consider whether there is likely to be much demand for the potential service before developing such a

resource. Some form. of market research is essential.

Offering this type of service represents a significant departure from normal audit services. The firm should consider whether

there is sufficient knowledge and expertise to offer a recruitment service. Ingrid Sharapova seems to have some experience,

but her skills may be out of date, and may not be specifically relevant to the recruitment of finance professionals. It may be

that considerable training and possibly the attainment of a new professional qualification relevant to recruitment may be

necessary for a credible service to be offered to clients.

If the recruitment service proved successful, then Ingrid could be faced with too much work as she is the only person with

relevant experience, and has no one to delegate to. If the firm decides to offer this service, then one other person should

receive appropriate training, to cover for Ingrid’s holidays and any sick leave, and to provide someone for Ingrid to delegate

to. The financial cost of such training should be considered.

Finally, Becker & Co should consider the potential damage to the firm’s reputation if the service offered is not of a high quality.

If the partners decide to pursue this business opportunity, they may wish to consider setting it up as a separate entity, so that

if the business fails or its reputation is questioned, the damage to Becker & Co would be minimised.

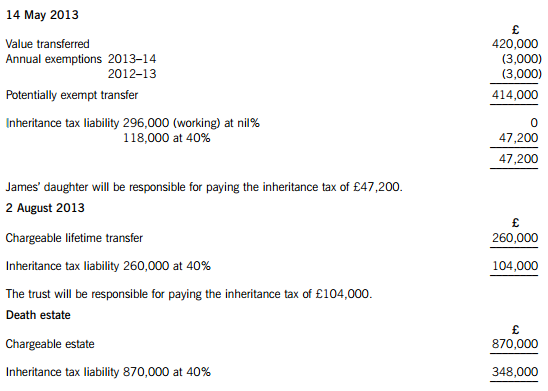

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-03-05

- 2020-03-08

- 2020-02-29

- 2020-02-27

- 2020-02-26

- 2020-01-09

- 2020-03-20

- 2020-03-04

- 2020-08-01

- 2020-04-16

- 2020-02-06

- 2020-02-28

- 2019-07-21

- 2020-01-10

- 2020-10-08

- 2020-01-09

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-04-10

- 2019-07-21

- 2020-01-10

- 2020-03-05

- 2020-02-22

- 2021-09-12

- 2020-02-28

- 2020-04-21

- 2020-02-29

- 2020-04-15

- 2020-02-11