注意!中国区ACCA客户服务热线来了!

发布时间:2020-04-02

小伙伴看过来!想知道中国区ACCA客户服务热线来吗?这里有详细的说明哦,相信很多考生们都想知道,赶快跟着51题库考试学习网一起来看看吧!

如果您需要咨询ACCA相关事宜,可致电:ACCA中国客户服务热线:4008333338,或联系电子邮件:customerservicechina@accaglobal.com。

工作时间:星期一至星期五:8:00am - 8:00pm,周六、周日及中国法定节假日 9:30am -6 :00pm。

请留意:如果您希望通过电话进行付款请联系: +44 (0)141582 2000。

1、填写注册表

请登陆ACCA官网进行网上注册。网上注册指南请见:ACCA网上注册指引(文件下载),登陆后在线填写中文学员登记表,(点开即可)请用中文填写。(请务必如实填写每一项内容,完成后直接在网上直接提交即可,如信息填写不完整/错误可能会造成注册延误)。

提供注册所需资料:

①学历/学位证明(高校在校生需提交学校出具的在校证明函及第一年所有课程考试合格的成绩单)的原件、复印件和译文;外地申请者不要邮寄原件,请把您的申请材料复印件加盖公司或学校公章,或邮寄公证件既可。

②身份证的原件、复印件和译文;或提供护照,不需提交翻译件。

③两张张两寸照片;(黑白彩色均可)

④注册报名费(银行汇票或信用卡支付),请确认信用卡可以从国外付款,否则会影响您的注册返回时间;如果不能确定建议您用汇票交纳注册费。(信用卡支付请在英文网站上注册时直接输入信用卡详细信息,英国总部收到您的书面注册材料后才会从您的信用卡上划账)。

2、缴纳ACCA报名注册费

报名注册费以双币信用卡或者银行汇票的方式交纳。具体办理汇票方法如下:

凭身份证到有外汇业务和英镑汇票业务的银行办理换汇和汇票业务。其中“汇款回单”中左上方请选择“票汇D/D”,在“收款人”一栏中只要填入ACCA的全称(THE ASSOCIATION OF CHARTERED CERTIFIED

ACCOUNTANTS)或简称(ACCA)即可。不需填写英国方面的账号信息。

将填写完整的网上报名注册表(在英文网站上注册完成后可以打印出两页的PDF文件)、准备好的相关材料交至代表处或直接寄往英国总部。

北京、上海和广州的学员报名注册后,领取Post-Registration

Information(学员手册),外地学员或通过邮寄到代表处注册的学员由当地代表处寄发。您最晚会在注册截止日期后一个月收到相关资料。

3、报名注册结果反馈

一般通过代表处注册两个月后ACCA UK会将以下材料寄到代表处,由代表处转发给学员:

1.免试通知(如果有免试)。

2.Registration Card:有学员照片和学员注册号的学员身份证明,参加考试时出示给监考官。

3.确认函:学员注册号、密码及考卷类型的确认通过ACCA代表处注册成为ACCA学员以后,ACCA英国总部将按照学员在ACCA报名注册表中所填写的通讯地址直接通过邮寄材料和通知的形式与学员直接联系。

以上就是ACCA热线以及注册的全部内容啦,如果还有不清楚的小伙伴,欢迎您咨询51题库考试学习网,我们在这里等着你哦!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

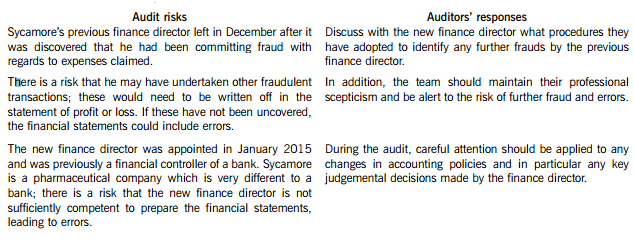

You are the audit supervisor of Maple & Co and are currently planning the audit of an existing client, Sycamore Science Co (Sycamore), whose year end was 30 April 2015. Sycamore is a pharmaceutical company, which manufactures and supplies a wide range of medical supplies. The draft financial statements show revenue of $35·6 million and profit before tax of $5·9 million.

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

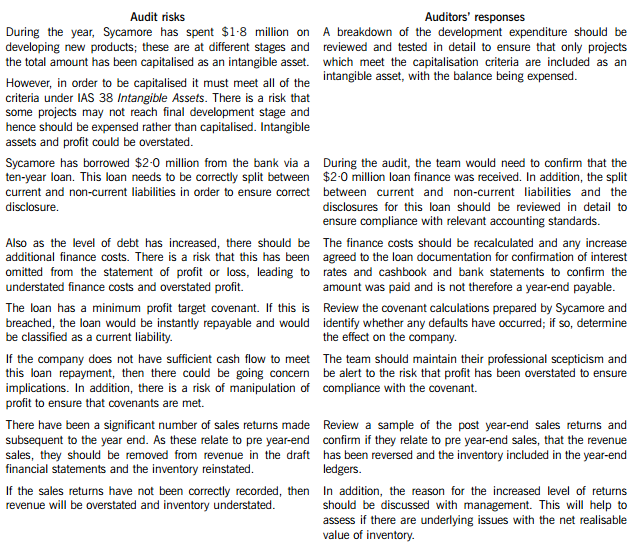

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

(a) Fraud responsibility

Maple & Co must conduct an audit in accordance with ISA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements and are responsible for obtaining reasonable assurance that the financial statements taken as a whole are free from material misstatement, whether caused by fraud or error.

In order to fulfil this responsibility, Maple & Co is required to identify and assess the risks of material misstatement of the financial statements due to fraud.

They need to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses. In addition, Maple & Co must respond appropriately to fraud or suspected fraud identified during the audit.

When obtaining reasonable assurance, Maple & Co is responsible for maintaining professional scepticism throughout the audit, considering the potential for management override of controls and recognising the fact that audit procedures which are effective in detecting error may not be effective in detecting fraud.

To ensure that the whole engagement team is aware of the risks and responsibilities for fraud and error, ISAs require that a discussion is held within the team. For members not present at the meeting, Sycamore’s audit engagement partner should determine which matters are to be communicated to them.

(b) Audit risks and auditors’ responses

(c) (i) Review engagements

Review engagements are often undertaken as an alternative to an audit, and involve a practitioner reviewing financial data, such as six-monthly figures. This would involve the practitioner undertaking procedures to state whether anything has come to their attention which causes the practitioner to believe that the financial data is not in accordance with the financial reporting framework.

A review engagement differs to an external audit in that the procedures undertaken are not nearly as comprehensive as those in an audit, with procedures such as analytical review and enquiry used extensively. In addition, the practitioner does not need to comply with ISAs as these only relate to external audits.

(ii) Levels of assurance

The level of assurance provided by audit and review engagements is as follows:

External audit – A high but not absolute level of assurance is provided, this is known as reasonable assurance. This provides comfort that the financial statements present fairly in all material respects (or are true and fair) and are free of material misstatements.

Review engagements – where an opinion is being provided, the practitioner gathers sufficient evidence to be satisfied that the subject matter is plausible; in this case negative assurance is given whereby the practitioner confirms that nothing has come to their attention which indicates that the subject matter contains material misstatements.

4 (a) Explain the auditor’s responsibilities for other information in documents containing audited financial

statements. (5 marks)

4 HEGAS

(a) Auditor’s responsibilities for ‘other information’

■ The auditor has a professional responsibility to read other information to identify material inconsistencies with the

audited financial statements (ISA 720 ‘Other Information in Documents Containing Audited Financial Statements’).

■ A ‘material inconsistency’ arises when other information contradicts that which is contained in the audited financial

statements. It may give rise to doubts about:

– the auditor’s conclusions drawn from audit evidence; and

– the basis for the auditor’s opinion on the financial statements.

■ In certain circumstances, the auditor may have a statutory obligation (under national legislation) to report on other

information (e.g. Management Report).

■ Even where there is no such obligation (e.g. chairman’s statement), the auditor should consider it, as the credibility of

the financial statements may be undermined by any inconsistency.

■ The auditor must arrange to have access to the other information on a timely basis prior to dating the auditor’s report.

Material inconsistency

■ If a material inconsistency is identified, the auditor should determine whether it is the audited financial statements or

the other information which needs amending.

■ If an amendment to the audited financial statements is required but not made, there will be disagreement, resulting in

the expression of a qualified or adverse opinion. (Such a situation would be extremely rare.)

■ Where an amendment to other information is necessary, but refused, the auditor’s report may include an emphasis of

matter paragraph (since the audit opinion cannot be other than unqualified with respect to this matter).

Material misstatement of fact

■ A material misstatement of fact in other information exists when information which is not related to matters appearing

in the audited financial statements is incorrectly stated or presented in a misleading manner.

■ If management do not act on advice to correct a material misstatement the auditors should document their concerns to

those charged with corporate governance and obtain legal advice.

Tutorial note: Marks would be awarded here for the implications for the auditor’s report. However, such marks, which are

for the restatement of knowledge would NOT be awarded again if repeated in answers to (b).

(e) Internal controls are very important in a complex civil engineering project such as the Giant Dam Project.

Required:

Describe the difficulties of maintaining sound internal controls in the Giant Dam Project created by working

through sub-contractors. (4 marks)

(e) Control and sub-contractors

Specifically in regard to the maintenance of internal controls when working with sub-contractors, the prominent difficulties

are likely to be in the following areas:

Configuring and co-ordinating the many activities of sub-contractors so as to keep progress on track. This may involve taking

the different cultures of sub-contractor organisations into account.

Loss of direct control over activities as tasks are performed by people outside R&M’s direct employment and hence its

management structure.

Monitoring the quality of work produced by the sub-contractors. Monitoring costs will be incurred and any quality problems

will be potentially costly.

Budget ‘creep’ and cost control. Keeping control of budgets can be a problem in any large civil engineering project (such the

construction of the new Wembley Stadium in the UK) and problems are likely to be made worse when the principal contractor

does not have direct control over all activities.

Time limit over-runs. Many projects (again, such as the new Wembley Stadium, but others also) over-run significantly on time.

Tutorial note: only four difficulties need to be described.

(b) Calculate Alvaro Pelorus’s capital gains tax liability for the tax year 2006/07 on the assumption that all

available reliefs are claimed. (8 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-05-21

- 2020-01-09

- 2019-12-27

- 2020-01-08

- 2020-03-11

- 2021-05-02

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-05-05

- 2019-12-06

- 2020-10-09

- 2020-01-10

- 2020-03-07

- 2020-03-25

- 2020-01-10

- 2019-07-21

- 2020-01-11

- 2020-01-08

- 2020-03-07

- 2020-03-19

- 2020-04-11

- 2020-01-09

- 2020-01-10

- 2020-01-09

- 2020-03-04

- 2020-01-10

- 2020-04-18

- 2020-01-09

- 2020-01-10