ACCA准会员&学员如何获得工作经验,快来看看本文!

发布时间:2019-12-31

ACCA官方要求要成为一名合格的ACCA会员,除了完成考试和职业道德与技能模块,还必须完成三年实践经验要求(PER)。这是因为ACCA一直致力于为雇主提供与时俱进的、能满足实际工作需求的高端人才。那么,我们如何才能获得这些工作经验呢?以下几种方式供大家参考:

借调

借调是一种改变经验的好方法。员工经常定期调到其他岗位(或部门),这是获得不同级别责任和新挑战的绝佳机会。我们可以在工作环境中寻找合适的借调机会,以便掌握更多的工作技能;例如有人请了长期的病假或者休产假,你可以主动申请借调到该部门或该岗位,主动学习这个岗位的工作技能并承担相应的工作责任。你的领导可能没有考虑过借调,而是通过招聘来弥补人员的缺失。也许你提出借调可以有效的为公司节约成本,优化资源配置。

项目工作

项目工作是获取新经验的另一种方式。这涉及到团队或部门间项目的合作。一般来说,自愿参加项目工作是一个非常好的机会,因为在一次项目经历中可以尝试不同的工作内容,获得多方面的经验。诸如谈判、撰写报告、主持会议、提前规划和协调他人活动等任务可以锻炼个人管理技能,这是强制性的实践经验要求。

工作观摩

工作观摩也可以给出非常宝贵的新视角和见解。在你还不能单独承担一项工作之前,通过参观、观摩一个更有经验的同事的工作实践,通过观察和倾听同事的话学到很多东西,前提是他们有时间在工作中讲解自己的工作行为。工作观摩将对同事的干扰降至最低,在观摩的过程中最好可以通过提问来了解能多的内容,有经验的同事也是非常乐意分享的。

创造性思维

创造性地思考和积极主动地与工作场所中的导师和同事在一起通常是非常有必要的。除了满足ACCA的会员资格标准之外,还有更多的实践经验。当你亲眼目睹不同的技术如何应用到不同的任务或业务领域时,你会应该自己对于工作的满意度在提高,同时你还可以逐步积累未来成为一名有效管理者或工作场所导师的技能。

ACCA对于三年工作经验的要求,可以是考试之前的,可以是考试的过程中积累的,也可以是全部考完之后才有的相关工作经验。即使对于在校学生或者跨行业转型的人来说,积累工作经验的机会也是非常多的。

首先,有很多雇主愿意提供志愿者、助理或实习机会,并且他们会提供后续的发展,即使以前没有相关的工作经验或者很少相关的经验。其次,也可以浏览一下自己的交际圈或者社交媒体,看看有哪些人可能有自己的公司或者在这些公司中工作,询问是否可以提供相关的工作机会,全职或兼职皆可。另外,也可以考虑当地的非政府组织和志愿者团体。志愿者行动或者不计报酬的工作机会是比较容易获得的,雇主通常不会拒绝对公司和职业表现出足够的热情的人。一旦你有一只脚迈进这个组织,通过表现出愿意工作更长时间、自愿做更多工作等方式来增加最终获得报酬的机会。

希望本篇文章能够帮助到大家,如果大家还遇到其他不能解决的问题,可以反馈给51题库考试学习网,我们会尽快帮您解决。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

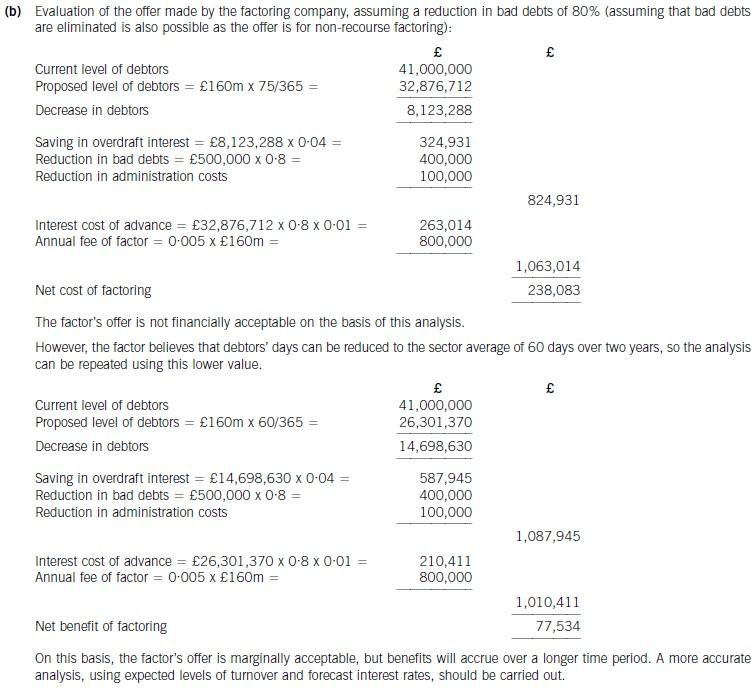

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

(b) Using the information contained in Appendix 1.1, discuss the financial performance of HLP and MAS,

incorporating details of the following in your discussion:

(i) Overall client fees (total and per consultation)

(ii) Advisory protection scheme consultation ‘utilisation levels’ for both property and commercial clients

(iii) Cost/expense levels. (10 marks)

(ii) As far as annual agreements relating to property work are concerned, HLP had a take up rate of 82·5% whereas MAS

had a take up rate of only 50%. Therefore, HLP has ‘lost out’ to competitor MAS in relative financial terms as regards

the ‘take-up’ of consultations relating to property work. This is because both HLP and MAS received an annual fee from

each property client irrespective of the number of consultations given. MAS should therefore have had a better profit

margin from this area of business than HLP. However, the extent to which HLP has ‘lost out’ cannot be quantified since

we would need to know the variable costs per consultation and this detail is not available. What we do know is that

HLP earned actual revenue per effective consultation amounting to £90·90 whereas the budgeted revenue per

consultation amounted to £100. MAS earned £120 per effective consultation.

The same picture emerges from annual agreements relating to commercial work. HLP had a budgeted take up rate of

50%, however the actual take up rate during the period was 90%. MAS had an actual take up rate of 50%. The actual

revenue per effective consultation earned by HLP amounted to £167 whereas the budgeted revenue per consultation

amounted to £300. MAS earned £250 per effective consultation.

There could possibly be an upside to this situation for HLP in that it might be the case that the uptake of 90% of

consultations without further charge by clients holding annual agreements in respect of commercial work might be

indicative of a high level of customer satisfaction. It could on the other hand be indicative of a mindset which says ‘I

have already paid for these consultations therefore I am going to request them’.

(iii) Budgeted and actual salaries in HLP were £50,000 per annum, per advisor. Two additional advisors were employed

during the year in order to provide consultations in respect of commercial work. MAS paid a salary of £60,000 to each

advisor which is 20% higher than the salary of £50,000 paid to each advisor by HLP. Perhaps this is indicative that

the advisors employed by MAS are more experienced and/or better qualified than those employed by HLP.

HLP paid indemnity insurance of £250,000 which is £150,000 (150%) more than the amount of £100,000 paid by

MAS. This excess cost may well have arisen as a consequence of successful claims against HLP for negligence in

undertaking commercial work. It would be interesting to know whether HLP had been the subject of any successful

claims for negligent work during recent years as premiums invariably reflect the claims history of a business. Rather

worrying is the fact that HLP was subject to three such claims during the year ended 31 May 2007.

Significant subcontract costs were incurred by HLP during the year probably in an attempt to satisfy demand and retain

the goodwill of its clients. HLP incurred subcontract costs in respect of commercial properties which totalled £144,000.

These consultations earned revenue amounting to (320 x £150) = £48,000, hence a loss of £96,000 was incurred

in this area of the business.

HLP also paid £300,000 for 600 subcontract consultations in respect of litigation work. These consultations earned

revenue amounting to (600 x £250) = £150,000, hence a loss of £150,000 was incurred in this area of the business.

In contrast, MAS paid £7,000 for 20 subcontract consultations in respect of commercial work and an identical amount

for 20 subcontract consultations in respect of litigation work. These consultations earned revenue amounting to

20 x (£150 + £200) =£7,000. Therefore, a loss of only £7,000 was incurred in respect of subcontract consultations

by MAS.

Other operating expenses were budgeted at 53·0% of sales revenue. The actual level incurred was 40·7% of sales

revenue. The fixed/variable split of such costs is not given but it may well be the case that the fall in this percentage is

due to good cost control by HLP. However, it might simply be the case that the original budget was flawed. Competitor

MAS would appear to have a slightly superior cost structure to that of HLP since its other operating expenses amounted

to 38·4% of sales revenue. Further information is required in order to draw firmer conclusions regarding cost control

within both businesses.

(c) You have just been advised of management’s intention to publish its yearly marketing report in the annual report

that will contain the financial statements for the year ending 31 December 2005. Extracts from the marketing

report include the following:

‘Shire Oil Co sponsors national school sports championships and the ‘Shire Ward’ at the national teaching

hospital. The company’s vision is to continue its investment in health and safety and the environment.

‘Our health and safety, security and environmental policies are of the highest standard in the energy sector. We

aim to operate under principles of no-harm to people and the environment.

‘Shire Oil Co’s main contribution to sustainable development comes from providing extra energy in a cleaner and

more socially responsible way. This means improving the environmental and social performance of our

operations. Regrettably, five employees lost their lives at work during the year.’

Required:

Suggest performance indicators that could reflect the extent to which Shire Oil Co’s social and environmental

responsibilities are being met, and the evidence that should be available to provide assurance on their

accuracy. (6 marks)

(c) Social and environmental responsibilities

Performance indicators

■ Absolute ($) and relative (%) level of investment in sports sponsorship, and funding to the Shire Ward.

■ Increasing number of championship events and participating schools/students as compared with prior year.

■ Number of medals/trophies sponsored at events and/or number awarded to Shire sponsored schools/students.

■ Number of patients treated (successfully) a week/month. Average bed occupancy (daily/weekly/monthly and cumulative

to date).

■ Staffing levels (e.g. of volunteers for sports events, Shire Ward staff and the company):

? ratio of starters to leavers/staff turnover;

? absenteeism (average number of days per person per annum).

1 Withdrawal of the new licence would not create a going concern issue.

2 May also be described as ‘exploration and evaluation’ costs or ‘discovery and assessment’.

■ Number of:

– breaches of health and safety regulations and environmental regulations;

– oil spills;

– accidents and employee fatalities;

– insurance claims.

Evidence

Tutorial note: As there is a wide range of performance indicators that candidates could suggest, there is always a wide range

of possible sources of audit evidence. As the same evidence may contribute to providing assurance on more than one

measure they are not tabulated here, to avoid duplication. However, candidates may justifiably adopt a tabular layout. Also

note, that where measures may be expressed as evidence (e.g. trophies awarded) marks should be awarded only once.

■ Actual level of investment ($) compared with budget and budget compared with prior period.

Tutorial note: Would expect actual to be at least greater than prior year if performance in these areas (health and

safety) has improved.

■ Physical evidence of favourable increases on prior year, for example:

? medals/cups sponsored;

? number of beds available.

■ Increase in favourable press coverage/reports of sponsored events. (Decrease in adverse press about

accidents/fatalities.)

■ Independent surveys (e.g. by marine conservation organisations, welfare groups, etc) comparing Shire favourably with

other oil producers.

■ A reduction in fines paid compared with budget (and prior year).

■ Reduction in legal fees and claims being settled as evidenced by fee notes and correspondence files.

■ Amounts settled on insurance claims and level of insurance cover as compared with prior period.

2 Marrgrett, a public limited company, is currently planning to acquire and sell interests in other entities and has asked

for advice on the impact of IFRS3 (Revised) ‘Business Combinations’ and IAS27 (Revised) ‘Consolidated and Separate

Financial Statements’. The company is particularly concerned about the impact on earnings, net assets and goodwill

at the acquisition date and any ongoing earnings impact that the new standards may have.

The company is considering purchasing additional shares in an associate, Josey, a public limited company. The

holding will increase from 30% stake to 70% stake by offering the shareholders of Josey, cash and shares in

Marrgrett. Marrgrett anticipates that it will pay $5 million in transaction costs to lawyers and bankers. Josey had

previously been the subject of a management buyout. In order that the current management shareholders may remain

in the business, Marrgrett is going to offer them share options in Josey subject to them remaining in employment for

two years after the acquisition. Additionally, Marrgrett will offer the same shareholders, shares in the holding company

which are contingent upon a certain level of profitability being achieved by Josey. Each shareholder will receive shares

of the holding company up to a value of $50,000, if Josey achieves a pre-determined rate of return on capital

employed for the next two years.

Josey has several marketing-related intangible assets that are used primarily in marketing or promotion of its products.

These include trade names, internet domain names and non-competition agreements. These are not currently

recognised in Josey’s financial statements.

Marrgrett does not wish to measure the non-controlling interest in subsidiaries on the basis of the proportionate

interest in the identifiable net assets, but wishes to use the ‘full goodwill’ method on the transaction. Marrgrett is

unsure as to whether this method is mandatory, or what the effects are of recognising ‘full goodwill’. Additionally the

company is unsure as to whether the nature of the consideration would affect the calculation of goodwill.

To finance the acquisition of Josey, Marrgrett intends to dispose of a partial interest in two subsidiaries. Marrgrett will

retain control of the first subsidiary but will sell the controlling interest in the second subsidiary which will become

an associate. Because of its plans to change the overall structure of the business, Marrgrett wishes to recognise a

re-organisation provision at the date of the business combination.

Required:

Discuss the principles and the nature of the accounting treatment of the above plans under International Financial

Reporting Standards setting out any impact that IFRS3 (Revised) ‘Business Combinations’ and IAS27 (Revised)

‘Consolidated and Separate Financial Statements’ might have on the earnings and net assets of the group.

Note: this requirement includes 2 professional marks for the quality of the discussion.

(25 marks)

2 IFRS3 (Revised) is a further development of the acquisition model and represents a significant change in accounting for business

combinations. The consideration is the amount paid for the business acquired and is measured at fair value. Consideration will

include cash, assets, contingent consideration, equity instruments, options and warrants. It also includes the fair value of all equity

interests that the acquirer may have held previously in the acquired business. The principles to be applied are that:

(a) a business combination occurs only in respect of the transaction that gives one entity control of another

(b) the identifiable net assets of the acquiree are re-measured to their fair value on the date of the acquisition

(c) NCI are measured on the date of acquisition under one of the two options permitted by IFRS3 (Revised).

An equity interest previously held in the acquiree which qualified as an associate under IAS28 is similarly treated as if it were

disposed of and reacquired at fair value on the acquisition date. Accordingly, it is re-measured to its acquisition date fair value, and

any resulting gain or loss compared to its carrying amount under IAS28 is recognised in profit or loss. Thus the 30% holding in

the associate which was previously held will be included in the consideration. If the carrying amount of the interest in the associate

is not held at fair value at the acquisition date, the interest should be measured to fair value and the resulting gain or loss should

be recognised in profit or loss. The business combination has effectively been achieved in stages.

The fees payable in transaction costs are not deemed to be part of the consideration paid to the seller of the shares. They are not

assets of the purchased business that are recognised on acquisition. Therefore, they should be expensed as incurred and the

services received. Transaction costs relating to the issue of debt or equity, if they are directly attributable, will not be expensed but

deducted from debt or equity on initial recognition.

It is common for part of the consideration to be contingent upon future events. Marrgrett wishes some of the existing

shareholders/employees to remain in the business and has, therefore, offered share options as an incentive to these persons. The

issue is whether these options form. part of the purchase consideration or are compensation for post-acquisition services. The

conditions attached to the award will determine the accounting treatment. In this case there are employment conditions and,

therefore, the options should be treated as compensation and valued under IFRS2 ‘Share based payment’. Thus a charge will

appear in post-acquisition earnings for employee services as the options were awarded to reward future services of employees

rather than to acquire the business.

The additional shares to a fixed value of $50,000 are contingent upon the future returns on capital employed. Marrgrett only wants

to make additional payments if the business is successful. All consideration should be fair valued at the date of acquisition,

including the above contingent consideration. The contingent consideration payable in shares where the number of shares varies

to give the recipient a fixed value ($50,000) meets the definition of a financial liability under IAS32 ‘Financial Instruments:

Presentation’. As a result the liability will have to be fair valued and any subsequent remeasurement will be recognised in the

income statement. There is no requirement under IFRS3 (Revised) for the payments to be probable.

Intangible assets should be recognised on acquisition under IFRS3 (Revised). These include trade names, domain names, and

non-competition agreements. Thus these assets will be recognised and goodwill effectively reduced. The additional clarity in

IFRS3 (Revised) could mean that more intangible assets will be recognised on acquisition. As a result of this, the post-combination

income statement may have more charges for amortisation of the intangibles than was previously the case.

The revised standard gives entities the option, on a transaction by transaction basis, to measure non-controlling interests (NCI) at

the fair value of the proportion of identifiable net assets or at full fair value. The first option results in measurement of goodwill on

consolidation which would normally be little different from the previous standard. The second approach records goodwill on the

NCI as well as on the acquired controlling interest. Goodwill is the residual but may differ from that under the previous standard

because of the nature of the valuation of the consideration as previously held interests are fair valued and also because goodwill

can be measured in the above two ways (full goodwill and partial goodwill). The standard gives entities a choice for each separate

business combination of recognising full or partial goodwill. Recognising full goodwill will increase reported net assets and may

result in any future impairment of goodwill being of greater value. Measuring NCI at fair value may have some difficulties but

goodwill impairment testing may be easier under full goodwill as there is no need to gross-up goodwill for partly-owned

subsidiaries. The type of consideration does not affect goodwill regardless of how the payment is structured. Consideration is

recognised in total at its fair value at the date of acquisition. The form. of the consideration will not affect goodwill but the structure

of the payments can affect post-acquisition profits. Contingent payments which are deemed to be debt instruments will be

remeasured at each reporting date with the change going to the income statement.

Marrgrett has a maximum period of 12 months to finalise the acquisition accounting but will not be able to recognise the

re-organisation provision at the date of the business combination. The ability of the acquirer to recognise a liability for reducing or

changing the activities of the acquiree is restricted. A restructuring provision can only be recognised in a business combination

when the acquiree has at the acquisition date, an existing liability which complies with IAS37 ‘Provisions, contingent liabilities and

contingent assets’. These conditions are unlikely to exist at the acquisition date. A restructuring plan that is conditional on the

completion of a business combination is not recognised in accounting for the acquisition but the expense will be met against

post-acquisition earnings.

IAS27 (Revised) uses the economic entity model whereas previous practice used the parent company approach. The economic

entity model treats all providers of equity capital as shareholders of the entity even where they are not shareholders in the parent.

A partial disposal of an interest in a subsidiary in which control is still retained is seen as a treasury transaction and accounted for

in equity. It does not result in a gain or loss but an increase or decrease in equity. However, where a partial disposal in a subsidiary

results in a loss of control but the retention of an interest in the form. of an associate, then a gain or loss is recognised in the whole

interest. A gain or loss is recognised on the portion that has been sold, and a holding gain or loss is recognised on the interest

retained being the difference between the book value and fair value of the interest. Both gains/losses are recognised in the income

statement.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2019-07-19

- 2020-01-09

- 2020-04-22

- 2020-05-10

- 2020-02-14

- 2020-04-18

- 2020-01-09

- 2020-02-27

- 2020-03-13

- 2019-07-19

- 2020-05-17

- 2020-03-07

- 2020-04-19

- 2020-01-09

- 2020-02-28

- 2020-04-22

- 2020-01-29

- 2021-06-13

- 2020-01-01

- 2020-04-05

- 2020-04-22

- 2020-03-22

- 2020-02-01

- 2020-01-09

- 2020-03-21

- 2020-05-12

- 2020-04-03

- 2020-01-09

- 2020-02-01

- 2020-03-14