解答:没有英语四六级证书,能不能报考ACCA?

发布时间:2020-02-27

其实大家不用太担心自己的英语水平,影响自己ACCA考试的成绩,其实英语水平没有那么重要,只要你对ACCA的知识足够了解,都是能够获得好成绩的。

ACCA是国际专业会计师组织为全球有志投身于财会、金融以及管理领域的人提供的资格认证,目前已经在全球范围内被多家大型跨国企业认可,也可视为是财会界的黄金通行证。但ACCA是一个全英文的考试,我们的学习、备考都是在英语环境中进行的,因此很多人都担心自己英语水平不高,无法通过考试。

其实,关于ACCA报考注册,对英语水平并没有绝对的要求,不要求提供英语水平证书。但ACCA专业资格考试全世界统一标准,教材、试卷、答题均采用全英形式,所以学员最好有大学英语考试四、六级左右的英文程度,当然没有达到英语四六级的也可以报考ACCA。只是需要在后期的报考过程中,需要多加掌握ACCA考试中的专业词汇。但庆幸的是ACCA词汇量很有限,很多单词都是重复出现的,因此会大大降低我们的考试难度。

课程设置

ACCA考试是按现代企业财务人员需要具备的技能和技术的要求而设计的,共有13门课程,两门选修课,课程分为3个阶段:

第一阶段(知识阶段)(AB MA FA)分涉及基本会计学原理、管理学原理、管理会计基础;

第二阶段(技能阶段)(LW PM TX FR AA FM)涵盖专业财会人员应具备的核心专业技能;

第三阶段(高级阶段)(SBL SBR APM AFM ATX AAA)培养学员以专业知识对信息进行评估,并提出合理的经营建议和忠告。

注册资格

a.具有教育部认可的大专以上学历,既可以报名成为ACCA的正式学员。

b.教育部认可的高等院校在校生,且顺利通过第一学年的所有课程考试,既可报名成为ACCA正式学员。

c.未符合以上报名资格的申请者,但年龄在18岁以上,可以先注册为FIA,并通过FAB,FMA,FFA三门考试(该三门考试与AB、MA、FA一致)便可以转为ACCA正式学员(需要在账户中选择转换路径),并获得前三门免试,直接进入ACCA技能课程阶段的考试。

以上就是关于ACCA考试的全部内容,大家看完之后,就不要担心自己的英语水平不高了,自己在复习ACCA考试的同时,多看看关于英语相关的书籍,提升一下,就没问题啦。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) Explain the ethical tensions between these roles that Anne is now experiencing. (4 marks)

(ii) Tensions in roles

On one hand, Anne needs to cultivate and manage her relationship with her manager (Zachary) who seems convinced

that Van Buren, and Frank in particular, are incapable of bad practice. He shows evidence of poor judgment and

compromised independence. Anne must decide how to deal with Zachary’s poor judgment.

On the other hand, Anne has a duty to both the public interest and the shareholders of Van Buren to ensure that the

accounts do contain a ‘true and fair view’. Under a materiality test, she may ultimately decide that the payment in

question need not hold up the audit signoff but the poor client explanation (from Frank) is also a matter of concern to

Anne as a professional accountant.

(b) Advise the management of SCC Ltd of THREE strategies that should be considered in order to improve the

future performance of SCC Ltd. (6 marks)

(b) The four quadrants of the Boston-growth share matrix summarise expected profits and resultant cash flows and recommends

an outline strategy to follow which rather simplistically may be summarised as invest in stars, scrutinise the problem children,

milk the cows and divest the dogs.

Value Chain Analysis

It is vital that the management of SCC Ltd undertake a value chain analysis of each of its divisions in order to identify and

eliminate all non-value added activities, thereby improving profitability and cash flow without necessarily increasing turnover

or market share.

Divestment of the Footwear division

Serious consideration should be given to the divestment of the Footwear division. This will enable resources to be redirected

to divisions categorised as problem children i.e. the Industrial and Children’s divisions.

Support the Stars

As far as the Fashion division is concerned, it is obviously in a growth market and currently performing well. It is vital, given

the forecast performance of the other subsidiaries that the management of SCC Ltd do not concentrate on the poor performers

to the detriment of its only star.

(ii) Deema Co. (4 marks)

(ii) Deema Co

The claim is an event after the balance sheet date. If the accident occurred prior to the year end of 30 September 2007,

the claim gives additional evidence of a year end condition, and thus meets the definition of an adjusting post balance

sheet event. In this case the matter appears to have been properly disclosed in the notes to the financial statements per

IAS 10 Events After the Balance Sheet Date and IAS 37 Provisions, Contingent Liabilities and Contingent Assets. A

provision would only be necessary if the claim was probable to succeed and there is sufficient appropriate evidence that

this is not the case. There is therefore no disagreement, and no limitation on scope.

Therefore the senior is correct to propose an unqualified opinion.

However, it is not necessary for the audit report to contain an emphasis of matter paragraph.

ISA 701 Modifications to the Independent Auditor’s Report states that an emphasis of matter paragraph should be used

to highlight a matter where there is significant uncertainty.

Uncertainties are normally only regarded as significant if they involve a level of concern about the going concern status

of the company or would have an unusually great effect on the financial statements. This is not the case here as there

is enough cash to pay the damages in the unlikely event that the claim goes against Deema Co. This appears to be a

one-off situation with a low risk of the estimate being subject to change and thus there is no significant uncertainty.

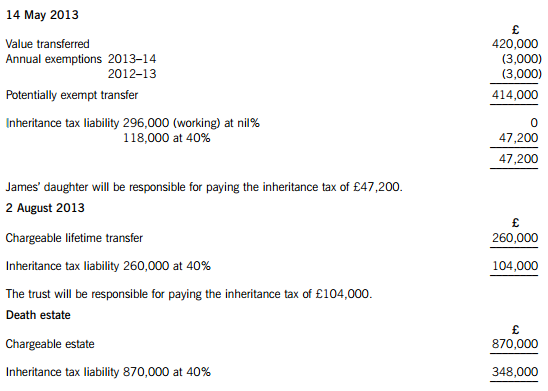

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2019-12-29

- 2020-05-15

- 2020-04-04

- 2020-04-19

- 2020-03-17

- 2020-01-09

- 2020-03-28

- 2020-01-01

- 2020-01-09

- 2020-03-07

- 2020-03-12

- 2020-03-22

- 2020-01-09

- 2020-01-01

- 2020-04-22

- 2020-03-07

- 2020-04-07

- 2020-01-09

- 2020-01-09

- 2020-05-10

- 2019-07-19

- 2020-05-12

- 2020-05-02

- 2020-01-09

- 2020-01-09

- 2020-05-07

- 2020-01-09

- 2019-12-29

- 2020-05-20

- 2020-01-09