福建省考生想知道的ACCA国际会计师考试的几种题型

发布时间:2020-01-10

截止今日,关于2020年3月份ACCA考试的题型暂未公布,通常来说主要分为客观题、案例客观题、主观题三个部分,近些年一些相关的政策正在改革,所以一切要以ACCA官方发布的考试大纲为主。对于F阶段的机考,51题库考试学习网为大家做出了相应的解答:

ACCA 机考题型介绍

(一)客观题(Objective test questions/ OT questions)客观题是指这些单一的,题干较短的,并且自动判分的题目。每道客观题的分值为2分,考生必须回答的完全正确才可以得分,即使回答正确一部分,也不能得到分数。

(二)案例客观题 (OT case questions)

案例客观题是ACCA引入的新题型,每道案例客观题都是由一组与一个案例相关的客观题组成的,因此要求考生从多个角度来思考一个案例。这种题型能很好的反映出考生将如何在实践中完成这些任务。

(三) 主观题 (Constructed response questions/ CR

qustions)考生将使用电子表格程序和文字处理程序去完成主观题的回答。就像笔试中的主观题一样,答案最终将由专家判分。

ACCA考试各个科目的具体的考试题型介绍(以2016年9月的考试为例)

ACCA F1 (机考)考试科目 : 企业会计

时间 : 2 hours ;通过分数 : 50 ,F1 考试包含2个sections:

Section A

:46 道题目,其中30道题,每题2分;16道题,每题1分。总分值是76分。

Section B

:6道题目,每道题目4分。总分值24分。所有的题目都是必做题

ACCA F2 (机考)考试科目 : 管理会计

时间 : 2 hours 通过分数 : 50 ; F2 考试包含2个sections:

Section A

:25道题目,每道题目2分。总分值是70分。

Section B

:3道题目,每道题目10分。总分值是30分。

ACCA F3

(机考)考试科目 : 财务会计

时间 : 2 hours 通过分数 : 50,F3 考试包含2个sections

Section A

:25道题目,每道题目2分。总分值是70分。

Section B

:3道题目,每道题目10分。总分值是30分。

ACCA F4 (机考 & 纸考)考试科目 : 企业法和商法

时间 : 2 hours 通过分数 : 50 ,F4包含2个sections

Section A

:45道题目,其中25道题,每题2分;20道题,每题1分,总分值是70分。

Section B

:5道题目,每道题目6分。总分值30分。

ACCA F5 (机考 & 纸考)考试科目 : 绩效管理

时间 : 3 hours 通过分数 : 50,F5包含了3个sections

Section A

: 15道客观题,每题2分,总分30分。

Section B

: 3道案例题,每道案例题由5道客观题构成,每题2分,总分30分

Section C

: 2道案例分析题,每题20分,总分40分

ACCA F6 (机考 & 纸考)考试科目 : 税法 (UK版本)

时间 : 3 hours 通过分数 : 50,F6包含了3个sections:

Section A

:15道客观题,每题2分。Section A 总分30分。

Section B

:3道案例题,每道案例题由5道客观题构成,每题2分。Section B 总分30分

Section C

:3道案例分析题,每题10或 15分。Section C 总分40分

ACCA F7 (机考 & 纸考)考试科目 :财务报告

时间 :3 hours 通过分数 : 50 F7包含了3个sections

Section A

:15道客观题,每题2分。Section A 总分30分。

Section B

: 3道案例题,每道案例题由5道客观题构成,每题2分。Section B 总分30分

Section C

: 2道案例分析题,每题20分。Section C 总分40分。

ACCA F8 (机考 & 纸考)考试科目 :审计

时间 :3 hours 通过分数 : 50,F8包含了2个sections:

Section A:3道案例题,每道案例题由5道客观题构成,每题2分。Section A 总分30分

Section B:3道案例分析题,每道题目20或30分。Section B 总分 70分。

ACCA F9 (机考 & 纸考)考试科目 : 财务管理

时间 :3 hours 通过分数 : 50,F9包含了3个sections:

Section A

:15道客观题,每题2分。Section A 总分30分。

Section B

:3道案例题,每道案例题由5道客观题构成,每题2分。Section B 总分30分

Section C

:2道案例分析题,每题20分。Section C 总分40分。

P1 公司治理、P2 高级财务报告、P3 战略管理、P4 高级财务管理、P5 高级绩效管理

这几个paper,考试都分为2个section:

Section A

50分必做题;

Section B

3道25分的选做题,选2道,总分50分。

P6 高级税法、P7 高级审计 分为2个section:

Section A

2道必做题 总分60分。

Section B

3道选做题,选2道,总分40份。

看完以上的这些信息之后,相信大家对ACCA国际注册师也有了一定的了解,对此类考试感兴趣的小伙伴们可以持续关注51题库考试学习网哟~

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) Assuming the relief in (i) is available, advise Sharon on the maximum amount of cash she could receive

on incorporation, without triggering a capital gains tax (CGT) liability. (3 marks)

(ii) As Sharon is entitled to the full rate of business asset taper relief, any gain will be reduced by 75%. The position is

maximised where the chargeable gain equals Sharon’s unused capital gains tax annual exemption of £8,500. Thus,

before taper relief, the gain she requires is £34,000 (1/0·25 x £8,500).

The amount to be held over is therefore £46,000 (80,000 – 34,000). Where part of the consideration is in the form

of cash, the gain eligible for incorporation relief is calculated using the formula:

Gain deferred = Gain x value of shares issued/total consideration

The formula is manipulated on the following basis:

£46,000 = £80,000 x (shares/120,000)

Shares/120,000 = £46,000/80,000

Shares = £46,000 x 120,000/80,000

i.e. £69,000.

As the total consideration is £120,000, this means that Sharon can take £51,000 (£120,000 – £69,000) in cash

without any CGT consequences.

(b) While the refrigeration units were undergoing modernisation Lamont outsourced all its cold storage requirements

to Hogg Warehousing Services. At 31 March 2007 it was not possible to physically inspect Lamont’s inventory

held by Hogg due to health and safety requirements preventing unauthorised access to cold storage areas.

Lamont’s management has provided written representation that inventory held at 31 March 2007 was

$10·1 million (2006 – $6·7 million). This amount has been agreed to a costing of Hogg’s monthly return of

quantities held at 31 March 2007. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Lamont Co for the year ended

31 March 2007.

NOTE: The mark allocation is shown against each of the three issues.

(b) Outsourced cold storage

(i) Matters

■ Inventory at 31 March 2007 represents 21% of total assets (10·1/48·0) and is therefore a very material item in the

balance sheet.

■ The value of inventory has increased by 50% though revenue has increased by only 7·5%. Inventory may be

overvalued if no allowance has been made for slow-moving/perished items in accordance with IAS 2 Inventories.

■ Inventory turnover has fallen to 6·6 times per annum (2006 – 9·3 times). This may indicate a build up of

unsaleable items.

Tutorial note: In the absence of cost of sales information, this is calculated on revenue. It may also be expressed

as the number of days sales in inventory, having increased from 39 to 55 days.

■ Inability to inspect inventory may amount to a limitation in scope if the auditor cannot obtain sufficient audit

evidence regarding quantity and its condition. This would result in an ‘except for’ opinion.

■ Although Hogg’s monthly return provides third party documentary evidence concerning the quantity of inventory it

does not provide sufficient evidence with regard to its valuation. Inventory will need to be written down if, for

example, it was contaminated by the leakage (before being moved to Hogg’s cold storage) or defrosted during

transfer.

■ Lamont’s written representation does not provide sufficient evidence regarding the valuation of inventory as

presumably Lamont’s management did not have access to physically inspect it either. If this is the case this may

call into question the value of any other representations made by management.

■ Whether, since the balance sheet date, inventory has been moved back from Hogg’s cold storage to Lamont’s

refrigeration units. If so, a physical inspection and roll-back of the most significant fish lines should have been

undertaken.

Tutorial note: Credit will be awarded for other relevant accounting issues. For example a candidate may question

whether, for example, cold storage costs have been capitalised into the cost of inventory. Or whether inventory moves

on a FIFO basis in deep storage (rather than LIFO).

(ii) Audit evidence

■ A copy of the health and safety regulation preventing the auditor from gaining access to Hogg’s cold storage to

inspect Lamont’s inventory.

■ Analysis of Hogg’s monthly returns and agreement of significant movements to purchase/sales invoices.

■ Analytical procedures such as month-on-month comparison of gross profit percentage and inventory turnover to

identify any trend that may account for the increase in inventory valuation (e.g. if Lamont has purchased

replacement inventory but spoiled items have not been written off).

■ Physical inspection of any inventory in Lamont’s refrigeration units after the balance sheet date to confirm its

condition.

■ An aged-inventory analysis and recalculation of any allowance for slow-moving items.

■ A review of after-date sales invoices for large quantities of fish to confirm that fair value (less costs to sell) exceed

carrying amount.

■ A review of after-date credit notes for any returns of contaminated/perished or otherwise substandard fish.

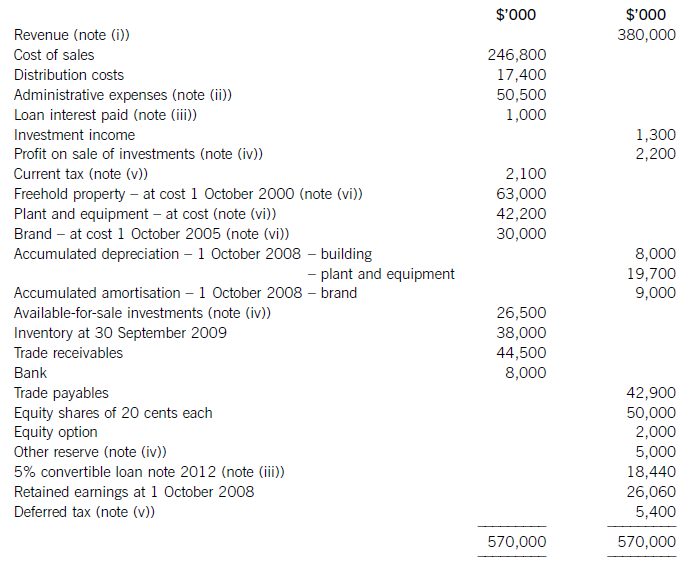

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-01

- 2020-02-20

- 2020-03-30

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-05-09

- 2020-01-10

- 2020-05-11

- 2020-01-10

- 2020-01-09

- 2020-03-27

- 2020-01-10

- 2019-07-20

- 2020-01-10

- 2020-01-10

- 2019-07-20

- 2020-03-27

- 2020-05-20

- 2020-01-09

- 2020-01-05

- 2020-01-10

- 2019-07-20

- 2020-02-21

- 2020-05-21

- 2020-01-10

- 2021-07-28

- 2020-01-10

- 2020-03-01

- 2020-05-07