重庆市ACCA考试真题下载步骤是怎么样的?

发布时间:2020-01-10

时光飞逝,刚来的2020年就快要过去半个月了,各位备考ACCA的同学们复习的怎么样了呢?目前,很多备考的同学来问51题库考试学习网:ACCA考试的真题在哪里下载?下载的步骤又是怎么样的呢?别担心,这些问题今天51题库考试学习网为大家通通解决,这份“真题下载宝典”请收入囊中:

首先为大家说一下真题在哪里下载,真题的下载通常有两种途径:

1.在百度上搜索ACCA真题,会有各大网校为大家已经准备好了的历年的真题,只需点击下载即可,这个方法是最常见也是最为简单的。

2.如果说一些同学不放心在网校机构的官网下载的话,也可以选择去ACCA官网,www.accaglobal.com下载最新的真题。这种途径的优点在于相比较第一种网校下载的真题而言更加有权威性和可信度,且能拿到一手的真题信息,对自己的备考复习会有更大的帮助。

(一些萌新不知道如何在ACCA官网下载真题?请跟随51题库考试学习网一起,了解更多官网下载步骤)

(1)登录www.accaglobal.com

(2)到页面最下方点击“past exam papers”

(3)可以根据需要选择相应的文件

举例:在exam下选择F5,在Resource type下选择“past exam papers”接着下方图表里就是F5的真题了

此外,在Resource type里还有其他的资料(如下图)大家可以根据自己的需要选择下载

以上就是关于真题下载的相关资讯,望大家采纳。

最后,51题库考试学习网想对大家说:“心在浩瀚时空可以替换成心怀天下,心怀梦想,心在追求真理的浩瀚时空。”各位备考ACCA的同学们,加油,成功在向你们招手~

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Explanations of the various matters. (11 marks)

(b) Related matters

(i) National insurance contributions in 2007/08

The profit for the period ending 31 March 2008 is expected to be £1,200 (£400 x 3).

No class 2 contributions will be due as the profit is less than the small earnings exception limit of £4,465.

No class 4 contributions will be due as the profit is less than the lower profits limit of £5,035.

Tutorial note

Adam will have paid class 1 contributions in respect of his earnings from Rheims Ltd, thus preserving his entitlement

to state benefits and pension, and therefore there is no disadvantage in claiming the small earnings exemption from

class 2 contributions.

(ii) Purchase and renovation of the theatre

The theatre is a capital purchase that does not qualify for capital allowances as it is a building but not an industrial

building. Accordingly, the cost of purchasing the theatre will not give rise to a tax deduction for the purpose of computing

AS’s taxable trading income.

The tax treatment of the renovation costs may be summarised as follows:

– The costs will be disallowed if the renovations are necessary before the theatre can be used for business purposes.

This is because they will be regarded as further capital costs of acquiring appropriate premises.

– Some of the costs may be allowable if the condition of the theatre is such that it can be used in its present state

and the renovations are more in the nature of cosmetic improvements.

(iii) VAT position

The grant of a right to occupy the theatre in exchange for rent is an exempt supply. Accordingly, as all of AS’s activities

will be regarded as one for VAT purposes, AS will become partially exempt once he begins to rent out the theatre.

AS will be able to recover the input tax that is directly attributable to his standard rated supplies, i.e. those in connection

with the supply of children’s parties. He will also be able to recover a proportion of the input tax on his overheads; the

proportion being that of his total supplies that are standard rated.

The remainder of his input tax will only be recoverable if it is no more than £625 per month on average and no more

than 50% of his total input tax.

If AS were to opt to tax the theatre, the right to occupy the theatre in exchange for rent would then be a standard rated

supply. AS could then recover all of his input tax, regardless of the amount attributable to the rent, but would have to

charge VAT on the rent and on any future sale of the building.

The decision as to whether or not to opt to tax the theatre will depend on:

– the amount of input tax at stake; and

– whether or not those who rent the theatre are in a position to recover any VAT charged.

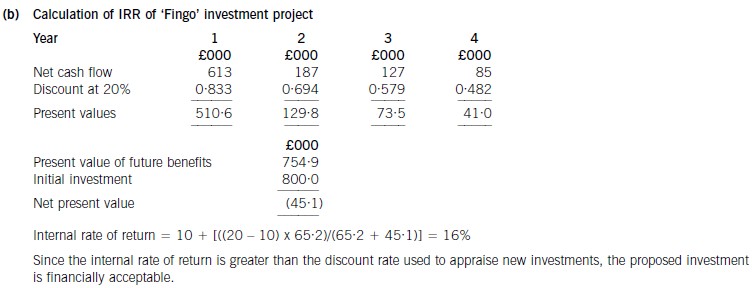

(b) Calculate the internal rate of return of the proposed investment and comment on your findings. (5 marks)

(ii) Assuming the new structure is implemented with effect from 1 August 2006, calculate the level of

management charge that should be made by Bold plc to Linden Limited for the year ended 31 July

2007, so as to minimise the group’s overall corporation tax (CT) liability for that year. (2 marks)

(ii) For the year ended 31 July 2007, there will be two associated companies in the group. Bold plc will count as an

associated company as it is not dormant throughout the period in question. As a result, the corporation tax limits will be

divided by two (i.e. the number of associates) giving an upper limit of £750,000 (£1·5 million/2). As Linden Limited

is anticipated to make profits of £1·4 million in the year to 31 July 2007 it will pay corporation tax at the rate of 30%.

Bold plc can earn trading profits up to £150,000 (£300,000/2) and pay tax at the rate of 19%. It will therefore

minimise the group’s corporation tax liability if maximum use is made of this small companies rate band, as it will save

£16,500 (150,000 x (30% – 19%)) of corporation tax for the year to 31 July 2007. Bold plc should therefore make

a management charge of sufficient size to give it profits for that year equal to £150,000.

While the transfer pricing legislation no longer applies to small and medium sized enterprises, Bold plc should

nevertheless ensure that there is evidence to support the actual charge made in terms of the services provided.

(c) Discuss TWO limitations of the Boston Consulting Group matrix as a strategic planning tool. (4 marks)

(c) There are numerous criticisms that have been made regarding the BCG growth share matrix. Two such criticisms are as

follows:

– It is a model and the weakness of any model is inherent in its assumptions. For example many strategists are of the

opinion that the axes of the model are much too simplistic. The model implies that competitive strength is indicated by

relative market share. However other factors such as strength of brands, perceived product/service quality and costs

structures also contribute to competitive strength.

Likewise the model implies that the attractiveness of the marketplace is indicated by the growth rate of the market. This

is not necessarily the case as organisations that lack the necessary capital resources may find low-growth markets an

attractive proposition especially as they tend to have a lower risk profile than high-growth markets.

– There are problems with defining the market. The model requires management to define the marketplace within which

a business is trading in order that its rate of growth and relative market share can be calculated. This can prove

problematic in comparing competitors since if they supply different products and services then the absence of a

consistent basis for comparison impairs the usefulness of the model.

Other valid criticisms include the following:

The application of the BCG matrix may prove costly and time-consuming since it necessitates the collection of a large

amount of data. The use of the model may also lead to unfortunate consequences, such as:

– Moving into areas where there is little experience

– Over-milking of cash cows

– Abandonment of potentially healthy businesses labelled as problem children

– Neglect of interrelationships among businesses, and

– Too many problem children within the business portfolio largely as a consequence of incorrect focus of

management attention.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-04-17

- 2020-05-09

- 2019-07-28

- 2020-04-15

- 2020-08-16

- 2020-04-10

- 2020-04-21

- 2020-01-09

- 2020-02-01

- 2020-01-09

- 2020-04-30

- 2020-01-14

- 2020-01-10

- 2020-02-20

- 2020-05-18

- 2020-01-10

- 2020-01-10

- 2020-05-16

- 2020-02-20

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-03-13

- 2020-04-15

- 2020-03-27