速看!ACCA证书如何打印又如何申请ACCA会员证书呢

发布时间:2020-04-14

ACCA证书如何打印?如何申请ACCA会员证书呢?一起跟随51题库考试学习网来看看以下内容吧。

ACCA证书打印需要在ACCA官方网站才能进行打印,证书版本为PDF。

当你做完每个阶段的线上测试之后,等待三五天的时间,ACCA官方审核通过后,就会自动生成这个证书,证书为PDF版本,可自行下载打印。

1.登录MYACCA,点击Exam Status&Results。

2.点击右边的Print a

Certificate,会出现以下页面,点击View Certificate选择证书点击下载即可。

ACCA会员证书

当你学完了ACCA的13门课程,且通过了考试,并在线完成相应的Professionalism and ethics学习和测试,还需要拥有至少三年的工作经验,才可以进行申请。

如何申请:

登录ACCA网站下载并填写《ACCA会员申请表》,并在满足会员必要条件后向ACCA递交ACCA会员申请表。ACCA总部审核资料通过后,会为申请人颁发ACCA会员证书,一般这个过程需要两个月的时间。

关于Frm与 ACCA的区别,一起来看看。

Frm是金融领域里比较知名的证书,而ACCA则是会计领域里比较有含金量的证书。ACCA是一个综合型的证书,知识包括会计、金融、管理。Frm主要是针对金融风险的证书。

Frm-金融风险管理师:

Frm全称Financial Risk

Manager(金融风险管理师),是金融风险领域里比较知名的专业认证证书,适用于广泛的行业领域。

Frm为全球风险管控在道德操守、专业标准及知识体系等方面设立了规范与标准。是全球风险领域里含金量很高的资格认证。

Frm证书是由全球风险管理专业人士协会(Global

Association of Risk Professionals,简称GARP)设立。

ACCA-特许公认会计师:

ACCA特许公认会计师公会是全球较具规模的国际专业会计师组织,为全世界有志投身于财务、会计以及管理领域的专才提供优选的资格认证。

ACCA当中的Chartered全称为RoyalCharter,指的是其会员得到英国皇室授予皇家特许名衔,这个只有部分高级的组织和机构才会被授予。

ACCA运用统一的标准以强化国际会计行业的发展。这些标准不仅能够为全球商业发展提供强有力的支持,还能满足渴望成功的国际化人才的需求。

愉快的时光总是很短暂,以上就是今天51题库考试学习网为大家分享的全部内容,如有其他疑问请继续关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

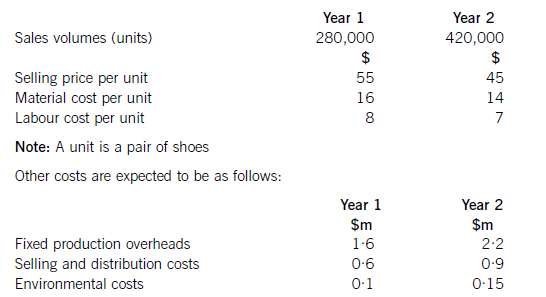

Shoe Co, a shoe manufacturer, has developed a new product called the ‘Smart Shoe’ for children, which has a built-in tracking device. The shoes are expected to have a life cycle of two years, at which point Shoe Co hopes to introduce a new type of Smart Shoe with even more advanced technology. Shoe Co plans to use life cycle costing to work out the total production cost of the Smart Shoe and the total estimated profit for the two-year period.

Shoe Co has spent $5·6m developing the Smart Shoe. The time spent on this development meant that the company missed out on the opportunity of earning an estimated $800,000 contribution from the sale of another product.

The company has applied for and been granted a ten-year patent for the technology, although it must be renewed each year at a cost of $200,000. The costs of the patent application were $500,000, which included $20,000 for the salary costs of Shoe Co’s lawyer, who is a permanent employee of the company and was responsible for preparing the application.

The following information is also available for the next two years:

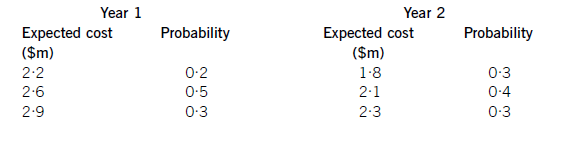

Shoe Co is still negotiating with marketing companies with regard to its advertising campaign, so is uncertain as to what the total marketing costs will be each year. However, the following information is available as regards the probabilities of the range of costs which are likely to be incurred:

Required:

Applying the principles of life cycle costing, calculate the total expected profit for Shoe Co for the two-year period.

(10 marks)

Totalsalesrevenue=(280,000x$55)+(420,000x$45)=$15·4m+18·9m=$34·3m.NoteTheexpectedprofithasbeencalculatedusinglifecyclecostingnotrelevantcosting.Hence,the$20,000salarycostincludedinpatentcostsshouldbeincludedinthelifecyclecost.Similarly,theopportunitycostof$800,000isnotincludedusinglifecyclecostingwhereasifrelevantcostingwasbeingusedtodecideonaparticularcourseofaction,theopportunitycostwouldbeincluded.Working1Expectedmarketingcostinyear1:(0·2x$2·2m)+(0·5x$2·6m)+(0·3x$2·9m)=$2·61mExpectedmarketingcostyear2:(0·3x$1·8m)+(0·4x$2·1m)+(0·3x$2·3m)=$2·07mTotalexpectedmarketingcost=$4·68m

(b) Explain how the process of developing scenarios might help John better understand the macro-environmental

factors influencing Airtite’s future strategy. (8 marks)

(b) Carrying out a systematic PESTEL analysis is a key step in developing alternative scenarios about the future. Johnson and

Scholes define scenarios as ‘detailed and plausible views of how the business environment of an organisation might develop

in the future based on groupings of key environmental influences and drivers of change about which there is a high level of

uncertainty’. In developing scenarios it is necessary to isolate the key drivers of change, which have the potential to have a

significant impact on the company and are associated with high levels of uncertainty. Development of scenarios enables

managers to share assumptions about the future and the key variables shaping that future. This provides an opportunity for

real organisational learning. They are then in a position to monitor these key variables and amend strategies accordingly. It

is important to note that different stakeholder groups will have different expectations about the future and each may provide

a key input to the process of developing scenarios. By their very nature scenarios should not attempt to allocate probabilities

to the key factors and in so doing creating ‘spurious accuracy’ about those factors. A positive scenario is shown below and

should provide a shared insight into the external factors most likely to have a significant impact on Airtite‘s future strategy.

For most companies operating in global environments the ability to respond flexibly and quickly to macro-environmental

change would seem to be a key capability.

The scenario as illustrated below, clearly could have a major impact on the success or otherwise of Airtite’s strategy for the

future. The key drivers for change would seem to be the link between technology and global emissions, fuel prices and the

stability of the global political environment. Through creating a process which considers the drivers which will have most

impact on Airtite and which are subject to the greatest uncertainty, Airtite will have a greater chance of its strategy adaptingto changing circumstances.

(c) Discuss TWO limitations of the Boston Consulting Group matrix as a strategic planning tool. (4 marks)

(c) There are numerous criticisms that have been made regarding the BCG growth share matrix. Two such criticisms are as

follows:

– It is a model and the weakness of any model is inherent in its assumptions. For example many strategists are of the

opinion that the axes of the model are much too simplistic. The model implies that competitive strength is indicated by

relative market share. However other factors such as strength of brands, perceived product/service quality and costs

structures also contribute to competitive strength.

Likewise the model implies that the attractiveness of the marketplace is indicated by the growth rate of the market. This

is not necessarily the case as organisations that lack the necessary capital resources may find low-growth markets an

attractive proposition especially as they tend to have a lower risk profile than high-growth markets.

– There are problems with defining the market. The model requires management to define the marketplace within which

a business is trading in order that its rate of growth and relative market share can be calculated. This can prove

problematic in comparing competitors since if they supply different products and services then the absence of a

consistent basis for comparison impairs the usefulness of the model.

Other valid criticisms include the following:

The application of the BCG matrix may prove costly and time-consuming since it necessitates the collection of a large

amount of data. The use of the model may also lead to unfortunate consequences, such as:

– Moving into areas where there is little experience

– Over-milking of cash cows

– Abandonment of potentially healthy businesses labelled as problem children

– Neglect of interrelationships among businesses, and

– Too many problem children within the business portfolio largely as a consequence of incorrect focus of

management attention.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-01-10

- 2020-05-09

- 2020-01-10

- 2020-05-06

- 2020-05-01

- 2020-01-10

- 2020-08-16

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-04-29

- 2020-01-10

- 2020-01-10

- 2020-05-07

- 2020-02-25

- 2020-01-10

- 2020-01-09

- 2020-04-11

- 2019-07-28

- 2020-01-09

- 2020-04-30

- 2020-01-10

- 2019-04-17

- 2020-01-01

- 2020-01-10

- 2020-01-10

- 2020-03-27

- 2020-01-10

- 2020-03-14