你想了解会计acca的就业前景好不好吗?必看

发布时间:2020-02-02

虽然acca被称为国际注册会计师,但仍有很多人觉得acca在国内的就业前景并不好。那么,acca真实的情况是什么样的呢?一起跟51题库考试学习网来了解一下吧!

一、会计acca的就业前景:需求大

从数量上来说,ACCA相对于其他专业人士的数目来说,人数稀少,但需求量大。ACCA会员目前在国内尚少,而作为高层管理高端型人才,以及越来越多的企业趋于国际化全球化的大变革中,企业对于ACCA的需求量是极大的。

二、会计acca的就业前景:英语优势

从语言上来说,ACCA是纯英文教材与考试,优势明显。

尽管由于ACCA的纯英文教材和纯英文考试使得很多中国学生有些却步,然而也正是因为有纯英文这个门槛,使得ACCA的优势凸显。对于趋于国际化全球化的国内企业,一方面,企业做大就需要上市,通晓其他的会计制度以及税法商法的ACCA就很容易驾驭,帮助企业按照不同需求来做不同的上市准备。另一方面,即便企业没有做大到需要上市,但是对于死守国内市场已不是发展的现状,走出国门,做国外市场或者与外资企业合作就成了必经之路。在审核企业对于国外市场的入围资格以及企业的英文财务报表及报告是否符合外企合作条件,这些文件的制作以及审核对于ACCA来说是驾轻就熟的。

三、会计acca的就业前景:职业发展

从个人职业发展来说,ACCA属于宏观统筹型人才。

相对于传统会计,ACCA更偏重于管理以及统筹、预测及规划企业走向及企业未来发展。这对于中国传统的应试教育来说是个非常好的互补,在获取知识用以解决实际问题这方面对于传统教学教育出来的学生是一次拓展思维训练的机会。调查中发现,在招聘网站中,大部分要求具有ACCA资格的职位有财务总监(CFO)、总经理助理、董事长助理以及首席财务官。这些职位要求应聘者不仅需要计算财务方面的专业知识,还需要有对于财务分析、部门配合、以及做出专业的报告让非财务人员理解并执行的能力。且多数外企要求CFO需具备中英文两种语言能力,这对于中国学生来说也是极大的优势。

以上就是51题库考试学习网分享的全部内容了,希望可以帮助到你哟!想了解更多信息,请关注51题库考试学习网哦!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

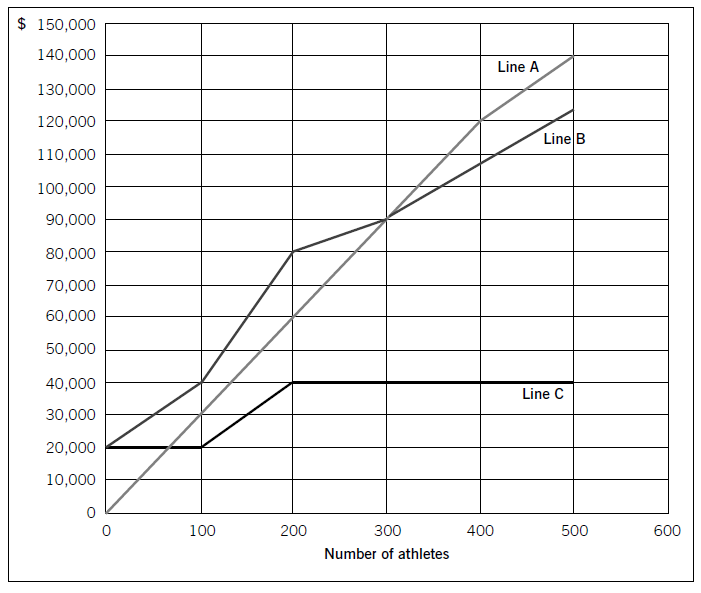

Swim Co offers training courses to athletes and has prepared the following breakeven chart:

Required:

(a) State the breakeven sales revenue for Swim Co and estimate, to the nearest $10,000, the company’s profit if 500 athletes attend a training course. (2 marks)

(b) Using the chart above, explain the cost and revenue structure of the company. (8 marks)

(a)ThebreakevensalesrevenueforSwimCois$90,000.Thecompany’sprofit,tothenearest$10,000,if500athletesattendthecourseis$20,000($140,000–$120,000).(Fromthegraph,itisclearthatthepreciseamountwillbenearer$17,000,i.e.$140,000–approximately$123,000.)(b)CoststructureFromthechart,itisclearthatLineCrepresentsfixedcosts,LineBrepresentstotalcostsandLineArepresentstotalrevenue.LineCshowsthatinitially,fixedcostsare$20,000evenifnoathletesattendthecourse.Thisleveloffixedcostsremainsthesameif100athletesattendbutoncethenumberofattendeesincreasesabovethislevel,fixedcostsincreaseto$40,000.LineBrepresentstotalcosts.If100athletesattend,totalcostsare$40,000($400perathlete).Since$20,000ofthisrelatestofixedcosts,thevariablecostperathletemustbe$200.Whenfixedcostsstepupbeyondthispointatthelevelof200athletes,totalcostsobviouslyincreaseaswellandLineBconsequentlygetsmuchsteeper.However,sincetherearenow200athletestoabsorbthefixedcosts,thecostperathleteremainsthesameat$400perathlete($80,000/200),eventhoughfixedcostshavedoubled.If300athletesattendthecourse,totalcostperathletebecomes$300each($90,000/300).Sincefixedcostsaccountfor$40,000ofthistotalcost,variablecoststotal$50,000,i.e.$166·67perathlete.So,economiesofscaleariseatthislevel,asdemonstratedbythefactthatLineBbecomesflatter.At400athletes,thegradientofthetotalcostslineisunchangedfrom300athleteswhichindicatesthatthevariablecostshaveremainedthesame.Thereisnofurtherchangeat500athletes;fixedandvariablecostsremainsteady.RevenuestructureAsregardstherevenuestructure,itcanbeseenfromLineAthatfor100–400athletesthepriceremainsthesameat$300perathlete.However,if500athletesattend,thepricehasbeenreducedasthetotalrevenuelinebecomesflatter.$140,000/500meansthatthepricehasgonedownto$280perathlete.Thiswasobviouslynecessarytoincreasethenumberofattendeesandatthispoint,profitismaximised.1

(b) Explain FIVE critical success factors to the performance of HSC on which the directors must focus if HSC is

to achieve success in its marketplace. (10 marks)

(b) Critical success factors are as follows:

Product quality

The fact that the production staff have no previous experience in a food production environment is likely to prove problematic.

It is vital that a comprehensive training programme is put in place at the earliest opportunity. HSC need to reach and maintain

the highest level of product quality as soon as possible.

Supply quality

The quality of delivery into SFG supermarkets assumes critical significance. Time literally will be of the essence since 90%

of all sandwiches are sold in SFG’s supermarkets before 2 pm each day. Hence supply chain management must be extremely

robust as there is very little scope for error.

Technical quality

Compliance with existing regulations regarding food production including all relevant factory health and safety requirements

is vital in order to establish and maintain the reputation of HSC as a supplier of quality products. The ability to store products

at the correct temperature is critical because sandwiches are produced for human consumption and in extreme circumstance

could cause fatalities.

External credibility

Accreditation by relevant trade associations/regulators will be essential if nationwide acceptance of HSC as a major producer

of sandwiches is to be established.

New product development

Whilst HSC have developed a range of healthy eating sandwiches it must be recognised that consumer tastes change and

that in the face of competition there will always be a need for a continuous focus on new product development.

Margin

Whilst HSC need to recognise all other critical success factors they should always be mindful that the need to obtain the

desired levels of gross and net margin remain of the utmost importance.

Notes: (i) Only five critical success factors were required.

(ii) Alternative relevant discussion and examples would be acceptable.

(b) Discuss the view that fair value is a more relevant measure to use in corporate reporting than historical cost.

(12 marks)

(b) The main disagreement over a shift to fair value measurement is the debate over relevance versus reliability. It is argued that

historical cost financial statements are not relevant because they do not provide information about current exchange values

for the entity’s assets which to some extent determine the value of the shares of the entity. However, the information provided

by fair values may be unreliable because it may not be based on arm’s-length transactions. Proponents of fair value

accounting argue that this measurement is more relevant to decision makers even if it is less reliable and would produce

balance sheets that are more representative of a company’s value. However it can be argued that relevant information that is

unreliable is of no use to an investor. One advantage of historical cost financial information is that it produces earnings

numbers that are not based on appraisals or other valuation techniques. Therefore, the income statement is less likely to be

subject to manipulation by management. In addition, historical cost balance sheet figures comprise actual purchase prices,

not estimates of current values that can be altered to improve various financial ratios. Because historical cost statements rely

less on estimates and more on ‘hard’ numbers, it can be said that historical cost financial statements are more reliable than

fair value financial statements. Furthermore, fair value measurements may be less reliable than historical costs measures

because fair value accounting provides management with the opportunity to manipulate the reported profit for the period.

Developing reliable methods of measuring fair value so that investors trust the information reported in financial statements is

critical.

Fair value measurement could be said to be more relevant than historical cost as it is based on market values and not entity

specific measurement on initial recognition, so long as fair values can be reliably measured. Generally the fair value of the

consideration given or received (effectively historical cost) also represents the fair value of the item at the date of initial

recognition. However there are many cases where significant differences between historical cost and fair value can arise on

initial recognition.

Historical cost does not purport to measure the value received. It cannot be assumed that the price paid can be recovered in

the market place. Hence the need for some additional measure of recoverable value and impairment testing of assets.

Historical cost can be an entity specific measurement. The recorded historical cost can be lower or higher than its fair value.

For example the valuation of inventory is determined by the costing method adopted by the entity and this can vary from

entity to entity. Historical cost often requires the allocation of costs to an asset or liability. These costs are attributed to assets,

liabilities and expenses, and are often allocated arbitrarily. An example of this is self constructed assets. Rules set out in

accounting standards help produce some consistency of historical cost measurements but such rules cannot improve

representational faithfulness.

Another problem with historical cost arises as regards costs incurred prior to an asset being recognised. Historical costs

recorded from development expenditure cannot be capitalised if they are incurred prior to the asset meeting the recognition

criteria in IAS38 ‘Intangible Assets’. Thus the historical cost amount does not represent the fair value of the consideration

given to create the asset.

The relevance of historical cost has traditionally been based on a cost/revenue matching principle. The objective has been to

expense the cost of the asset when the revenue to which the asset has contributed is recognised. If the historical cost of the

asset differs from its fair value on initial recognition then the matching process in future periods becomes arbitrary. The

measurement of assets at fair value will enhance the matching objective. Historical cost may have use in predicting future

net reported income but does not have any necessary implications for future cash flows. Fair value does embody the market’s

expectations for those future cash flows.

However, historical cost is grounded in actual transaction amounts and has existed for many years to the extent that it is

supported by practical experience and familiarity. Historical cost is accepted as a reliable measure especially where no other

relevant measurement basis can be applied.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-03-13

- 2020-02-10

- 2020-05-07

- 2020-01-10

- 2020-02-01

- 2020-05-15

- 2020-04-15

- 2019-12-06

- 2020-08-05

- 2020-04-30

- 2020-01-01

- 2020-02-06

- 2020-01-10

- 2020-04-24

- 2020-01-09

- 2019-07-20

- 2020-01-10

- 2020-05-16

- 2020-03-11

- 2020-03-14

- 2020-01-09

- 2020-04-29

- 2020-01-10

- 2020-04-09

- 2021-02-14

- 2019-07-20

- 2020-01-09

- 2020-03-11

- 2019-12-28

- 2020-02-05