速看:ACCA F阶段的考试是怎样的?你知道吗?

发布时间:2020-09-05

各位小伙伴注意了!大家了解ACCA考试吗?有很多同学想了解一下ACCA F阶段的考试,51题库考试学习网为大家带来了相关内容,让我们一起来看看吧!

ACCA考试1年中共有4个考季,分别在3月,6月,9月和12月。如此密集的考季,对于复习备考的考生来说有利也有弊。对于学霸们来说,当然是加快了ACCA通过的时间周期。对于不好好复习的同学来说,复习时间大大压缩,疲于应付每个考季,还没从上一个考季的阴影中走出来,就又要进入到下一个考季。但是,总的来说,4个考季增加了选择自由度,也能够更好地督促大家复习的节奏。

作为ACCA考试中的基础阶段,9门考试,分为知识课程和技能课程两个部分。

其中F1-F3主要涉及财务会计、管理会计相关的核心知识,而这三个科目同时也是以FIA方式注册学员所学习的FAB、FMA、FFA科目。F4-F9涵盖了一名会计师所涉及的知识领域及必须掌握的财报、财管、税务等方面的技能。

以下是部分F阶段的科目分析,让我们一起来看看吧!

F1:会计师与企业

作为基础中的基础,F1偏向于管理方面,涉及很多常识性知识点,涵盖企业组织、公司管理、内部财务控制、会计职业道德等各个方面。难度不大,但对于英语基础一般的同学来说,需要对每章知识点进行梳理总结,结合知识点框架进行理解。

F2:管理会计

总体难度一般,差异分析、财务比率计算是需要熟练掌握的难点。需要学会处理基本的成本信息,并向管理层提供能做预算和决策的有用信息。

F3:财务会计

通过这门科目的学习,需要学会如何利用财务会计准则,运用复式记账法,以及简单编制财务报表。学习的内容中会涉及到会计科目、试算平衡表、会计分录、丁字账等等一系列会计基础知识,对于跨专业考ACCA的考生来说,会是一个需要熟练掌握,打基础的科目。

ACCA考试科目不同时间也可能不一样:

1、ACCA F1-F4随时机考,当场知成绩,随报随考,费用固定。考试时间:2小时。及格成绩为50分(百分制)。

2、F5-F9科目只有分季机考,每年3、6、9、12月4个考季,机考时间:3小时,另有10分钟时间阅读考前须知,及格成绩为50分(百分制)。

以上就是今天分享的全部内容了,各位小伙伴根据自己的情况进行查阅,希望本文对各位有所帮助,预祝各位取得满意的成绩,如需了解更多相关内容,请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Explain the principal audit procedures to be performed during the final audit in respect of the estimated

warranty provision in the balance sheet of Island Co as at 30 November 2007. (5 marks)

(b) ISA 540 Audit of Accounting Estimates requires that auditors should obtain sufficient audit evidence as to whether an

accounting estimate, such as a warranty provision, is reasonable given the entity’s circumstances, and that disclosure is

appropriate. One, or a combination of the following approaches should be used:

Review and test the process used by management to develop the estimate

– Review contracts or orders for the terms of the warranty to gain an understanding of the obligation of Island Co

– Review correspondence with customers during the year to gain an understanding of claims already in progress at the

year end

– Perform. analytical procedures to compare the level of warranty provision year on year, and compare actual to budgeted

provisions. If possible disaggregate the data, for example, compare provision for specific types of machinery or customer

by customer

– Re-calculate the warranty provision

– Agree the percentage applied in the calculation to the stated accounting policy of Island Co

– Review board minutes for discussion of on-going warranty claims, and for approval of the amount provided

– Use management accounts to ascertain normal level of warranty rectification costs during the year

– Discuss with Kate Shannon the assumptions she used to determine the percentage used in her calculations

– Consider whether assumptions used are consistent with the auditors’ understanding of the business

– Compare prior year provision with actual expenditure on warranty claims in the accounting period

– Compare the current year provision with prior year and discuss any fluctuation with Kate Shannon.

Review subsequent events which confirm the estimate made

– Review any work carried out post year end on specific faults that have been provided for. Agree that all costs are included

in the year end provision.

– Agree cash expended on rectification work in the post balance sheet period to the cash book

– Agree cash expended on rectification work post year end to suppliers’ invoices, or to internal cost ledgers if work carried

out by employees of Island Co

– Read customer correspondence received post year end for any claims received since the year end.

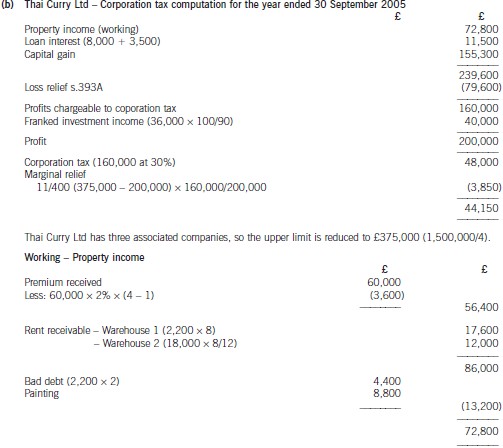

(b) Assuming that Thai Curry Ltd claims relief for its trading loss against total profits under s.393A ICTA 1988,calculate the company’s corporation tax liability for the year ended 30 September 2005. (10 marks)

4 A properly conducted appraisal interview is fundamental in ensuring the success of an organisation’s performance

appraisal system.

Required:

(a) Describe three approaches to conducting the appraisal interview. (5 marks)

4 Appraisal systems are central to human resource management and understanding the difficulties of such schemes and the correct

approach to them is necessary if the appraisal process is to be successful and worthwhile.

(a) The manager conducting the interview might base it on one of three approaches.

The Tell and Sell Method. The manager explains to the employee being appraised how the appraisal assessment is to be undertaken and gains acceptance of the evaluation and improvement plan from the employee. Human resource skills are important with this approach in order for the manager to be able to provide constructive criticism and to motivate the employee.

The Tell and Listen Method. The manager invites the employee to respond to the way that the interview is to be conducted.This approach requires counselling skills and encouragement to allow the employee to participate fully in the interview. A particular feature of this approach is the encouragment of feedback from the employee.

The Problem Solving Method. With this method the manager takes a more helpful approach and concentrates on the work problems of the employee, who is encouraged to think through his or her problems and to provide their own intrinsic motivation.

You are an audit manager responsible for providing hot reviews on selected audit clients within your firm of Chartered

Certified Accountants. You are currently reviewing the audit working papers for Pulp Co, a long standing audit client,

for the year ended 31 January 2008. The draft statement of financial position (balance sheet) of Pulp Co shows total

assets of $12 million (2007 – $11·5 million).The audit senior has made the following comment in a summary of

issues for your review:

‘Pulp Co’s statement of financial position (balance sheet) shows a receivable classified as a current asset with a value

of $25,000. The only audit evidence we have requested and obtained is a management representation stating the

following:

(1) that the amount is owed to Pulp Co from Jarvis Co,

(2) that Jarvis Co is controlled by Pulp Co’s chairman, Peter Sheffield, and

(3) that the balance is likely to be received six months after Pulp Co’s year end.

The receivable was also outstanding at the last year end when an identical management representation was provided,

and our working papers noted that because the balance was immaterial no further work was considered necessary.

No disclosure has been made in the financial statements regarding the balance. Jarvis Co is not audited by our firm

and we have verified that Pulp Co does not own any shares in Jarvis Co.’

Required:

(b) In relation to the receivable recognised on the statement of financial position (balance sheet) of Pulp Co as

at 31 January 2008:

(i) Comment on the matters you should consider. (5 marks)

(b) (i) Matters to consider

Materiality

The receivable represents only 0·2% (25,000/12 million x 100) of total assets so is immaterial in monetary terms.

However, the details of the transaction could make it material by nature.

The amount is outstanding from a company under the control of Pulp Co’s chairman. Readers of the financial statements

would be interested to know the details of this transaction, which currently is not disclosed. Elements of the transaction

could be subject to bias, specifically the repayment terms, which appear to be beyond normal commercial credit terms.

Paul Sheffield may have used his influence over the two companies to ‘engineer’ the transaction. Disclosure is necessary

due to the nature of the transaction, the monetary value is irrelevant.

A further matter to consider is whether this is a one-off transaction, or indicative of further transactions between the two

companies.

Relevant accounting standard

The definitions in IAS 24 must be carefully considered to establish whether this actually constitutes a related party

transaction. The standard specifically states that two entities are not necessarily related parties just because they have

a director or other member of key management in common. The audit senior states that Jarvis Co is controlled by Peter

Sheffield, who is also the chairman of Pulp Co. It seems that Peter Sheffield is in a position of control/significant influence

over the two companies (though this would have to be clarified through further audit procedures), and thus the two

companies are likely to be perceived as related.

IAS 24 requires full disclosure of the following in respect of related party transactions:

– the nature of the related party relationship,

– the amount of the transaction,

– the amount of any balances outstanding including terms and conditions, details of security offered, and the nature

of consideration to be provided in settlement,

– any allowances for receivables and associated expense.

There is currently a breach of IAS 24 as no disclosure has been made in the notes to the financial statements. If not

amended, the audit opinion on the financial statements should be qualified with an ‘except for’ disagreement. In

addition, if practicable, the auditor’s report should include the information that would have been included in the financial

statements had the requirements of IAS 24 been adhered to.

Valuation and classification of the receivable

A receivable should only be recognised if it will give rise to future economic benefit, i.e. a future cash inflow. It appears

that the receivable is long outstanding – if the amount is unlikely to be recovered then it should be written off as a bad

debt and the associated expense recognised. It is possible that assets and profits are overstated.

Although a representation has been received indicating that the amount will be paid to Pulp Co, the auditor should be

sceptical of this claim given that the same representation was given last year, and the amount was not subsequently

recovered. The $25,000 could be recoverable in the long term, in which case the receivable should be reclassified as

a non-current asset. The amount advanced to Jarvis Co could effectively be an investment rather than a short term

receivable. Correct classification on the statement of financial position (balance sheet) is crucial for the financial

statements to properly show the liquidity position of the company at the year end.

Tutorial note: Digressions into management imposing a limitation in scope by withholding evidence are irrelevant in this

case, as the scenario states that the only evidence that the auditors have asked for is a management representation.

There is no indication in the scenario that the auditors have asked for, and been refused any evidence.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-05-29

- 2019-12-29

- 2019-12-29

- 2020-10-10

- 2021-02-13

- 2019-03-17

- 2021-05-29

- 2020-09-05

- 2020-08-14

- 2020-10-21

- 2019-12-29

- 2021-02-13

- 2021-05-29

- 2020-09-05

- 2020-08-15

- 2020-09-05

- 2020-10-10

- 2020-09-05

- 2021-02-13

- 2020-09-04

- 2021-02-21

- 2020-08-14

- 2020-10-21

- 2021-02-13

- 2020-01-02

- 2021-02-13

- 2021-05-29

- 2019-03-24

- 2020-09-05

- 2021-05-29