我在宁波,想要报考ACCA,请问考试的流程是什...

发布时间:2021-01-03

我在宁波,想要报考ACCA,请问考试的流程是什么呀?

最佳答案

我也是宁波的,可以帮你解答你的问题。考试的流程如下:考试流程编辑一、填写注册表1.请登陆ACCA官方网站填写英文注册信息,进行网上注册。网上注册指南请见:ACCA网上注册指引( 文件下载)2.获得英文注册编号后,登录ACCA官方中文网站请用中文填写中文学员登记表。二、提供注册所需资料①学历/学位证明(高校在校生需提交学校出具的在校证明函及第一年所有课程考试合格的成绩单)的原件、复印件和译文;外地申请者不要邮寄原件,请把您的申请材料复印件加盖公司或学校公章,或邮寄公证件既可。②身份证的原件、复印件和译文;或提供护照,不需提交翻译件。③一张两寸照片;(黑白彩色均可)④注册报名费(银行汇票或信用卡支付),请确认信用卡可以从国外付款,否则会影响您的注册返回时间;如果不能确定建议您用汇票交纳注册费。(信用卡支付请在英文网站上注册时直接输入信用卡详细信息,英国总部收到您的书面注册材料后才会从您的信用卡上划账)。三、交纳报名注册费报名注册费以双币信用卡或者银行汇票的方式交纳。具体办理汇票方法如下:凭身份证到有外汇业务和英镑汇票业务的银行办理换汇和汇票业务。其中\汇款回单\"中左上方请选择\"票汇D/D\"

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Prepare a consolidated statement of financial position of the Ribby Group at 31 May 2008 in accordance

with International Financial Reporting Standards. (35 marks)

(c) Discuss the factors that might influence whether the initial bid is likely to be accepted by the shareholders of Wragger plc.

(c) The type of payment might influence the success of the bid. Paxis is proposing a share for share exchange which offers a continuation in ownership of the entity, albeit as part of the successful bidder. However, relative share prices will change during the period of the bid, and the owner of shares in the potential victim company will not know the precise postacquisition value of the bid. An alternative might be cash payments which provides a known, precise sum, and might be favoured for this reason. However, in some countries payment in cash might lead to an immediate capital gains tax liability for the investor.

The effective price offered would of course be a major influence. Paxis would need to offer a premium over the existing share price, but the size of the premium that would be acceptable is unknown. Informal discussions with major shareholders of Wragger might assist in determining this (subject to such discussions being permitted by the regulatory authorities).

(c) In April 2006, Keffler was banned by the local government from emptying waste water into a river because the

water did not meet minimum standards of cleanliness. Keffler has made a provision of $0·9 million for the

technological upgrading of its water purifying process and included $45,000 for the penalties imposed in ‘other

provisions’. (5 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Keffler Co for the year ended

31 March 2006.

NOTE: The mark allocation is shown against each of the three issues.

(c) Ban on emptying waste water

(i) Matter

■ $0·9m provision for upgrading the process represents 45% PBT and is very material. This provision is also

material to the balance sheet (2·7% of total assets).

■ The provision for penalties is immaterial (2·2% PBT and 0·1% total assets).

■ The ban is an adjusting post balance sheet event in respect of the penalties (IAS 10). It provides evidence that at

the balance sheet date Keffler was in contravention of local government standards. Therefore it is correct (in

accordance with IAS 37) that a provision has been made for the penalties. As the matter is not material inclusion

in ‘other provisions’ is appropriate.

■ However, even if Keffler has a legal obligation to meet minimum standards, there is no obligation for upgrading the

purifying process at 31 March 2006 and the $0·9m provision should be written back.

■ If the provision for upgrading is not written back the audit opinion should be qualified ‘except for’ (disagreement).

■ Keffler does not even have a contingent liability for upgrading the process because there is no present obligation to

do so. The obligation is to stop emptying unclean water into the river. Nor is there a possible obligation whose

existence will be confirmed by an uncertain future event not wholly within Keffler’s control.

Tutorial note: Consider that Keffler has alternatives wholly within its control. For example, it could ignore the ban

and incur fines, or relocate/close this particular plant/operation or perhaps dispose of the water by alternative

means.

■ The need for a technological upgrade may be an indicator of impairment. Management should have carried out

an impairment test on the carrying value of the water purifying process and recognised any impairment loss in the

profit for the year to 31 March 2006.

■ Management’s intention to upgrade the process is more appropriate to an environmental responsibility report (if

any).

■ Whether there is any other information in documents containing financial statements.

(ii) Audit evidence

■ Penalty notices of fines received to confirm amounts and period/dates covered.

■ After-date payment of fines agreed to the cash book.

■ A copy of the ban and any supporting report on the local government’s findings.

■ Minutes of board meetings at which the ban was discussed confirming management’s intentions (e.g. to upgrade

the process).

Tutorial note: This may be disclosed in the directors’ report and/or as a non-adjusting post balance sheet event.

■ Any tenders received/costings for upgrading.

Tutorial note: This will be relevant if, for example, capital commitment authorised (by the board) but not

contracted for at the year end are disclosed in the notes to the financial statements.

■ Physical inspection of the emptying point at the river to confirm that Keffler is not still emptying waste water into

it (unless the upgrading has taken place).

Tutorial note: Thereby incurring further penalties.

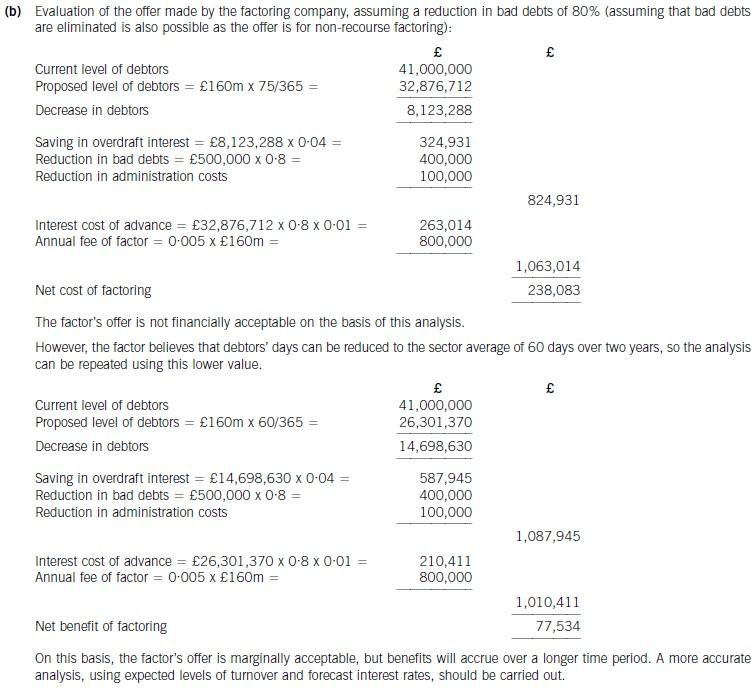

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-05-21

- 2021-03-12

- 2021-03-13

- 2021-01-02

- 2021-06-24

- 2021-03-11

- 2021-07-01

- 2021-06-05

- 2021-04-22

- 2021-03-11

- 2021-03-11

- 2021-03-13

- 2021-03-12

- 2021-01-04

- 2021-03-11

- 2021-05-11

- 2021-03-11

- 2021-04-16

- 2021-05-11

- 2021-02-15

- 2021-03-12

- 2021-06-01

- 2021-01-04

- 2021-04-25

- 2021-04-24

- 2021-01-04

- 2021-05-09

- 2021-06-24

- 2021-03-12

- 2021-03-11