为什么建议考ACCA考试?

发布时间:2021-03-13

为什么建议考ACCA考试?

最佳答案

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

4 Hogg Products Company (HPC), based in a developing country, was recently wholly acquired by American Overseas

Investments (AOI), a North American holding company. The new owners took the opportunity to completely review

HPC’s management, culture and systems. One of the first things that AOI questioned was HPC’s longstanding

corporate code of ethics.

The board of AOI said that it had a general code of ethics that HPC, as an AOI subsidiary, should adopt. Simon Hogg,

the chief executive of HPC, disagreed however, and explained why HPC should retain its existing code. He said that

HPC had adopted its code of ethics in its home country which was often criticised for its unethical business behaviour.

Some other companies in the country were criticised for their ‘sweat shop’ conditions. HPC’s adoption of its code of

ethics, however, meant that it could always obtain orders from European customers on the guarantee that products

were made ethically and in compliance with its own highly regarded code of ethics. Mr Hogg explained that HPC had

an outstanding ethical reputation both locally and internationally and that reputation could be threatened if it was

forced to replace its existing code of ethics with AOI’s more general code.

When Ed Tanner, a senior director from AOI’s head office, visited Mr Hogg after the acquisition, he was shown HPC’s

operation in action. Mr Hogg pointed out that unlike some other employers in the industry, HPC didn’t employ child

labour. Mr Hogg explained that although it was allowed by law in the country, it was forbidden by HPC’s code of

ethics. Mr Hogg also explained that in his view, employing child labour was always ethically wrong. Mr Tanner asked

whether the money that children earned by working in the relatively safe conditions at HPC was an important source

of income for their families. Mr Hogg said that the money was important to them but even so, it was still wrong to

employ children, as it was exploitative and interfered with their education. He also said that it would alienate the

European customers who bought from HPC partly on the basis of the terms of its code of ethics.

Required:

(a) Describe the purposes and typical contents of a corporate code of ethics. (9 marks)

(a) Purposes of codes of ethics

To convey the ethical values of the company to interested audiences including employees, customers, communities and

shareholders.

To control unethical practice within the organisation by placing limits on behaviour and prescribing behaviour in given

situations.

To be a stimulant to improved ethical behaviour in the organisation by insisting on full compliance with the code.

[Tutorial note: other purposes, if relevant, will be rewarded]

Contents of a corporate code of ethics

The typical contents of a corporate code of ethics are as follows:

Values of the company. This might include notes on the strategic purpose of the organisation and any underlying beliefs,

values, assumptions or principles. Values may be expressed in terms of social and environmental perspectives, and

expressions of intent regarding compliance with best practice, etc.

Shareholders and suppliers of finance. In particular, how the company views the importance of sources of finances, how it

intends to communicate with them and any indications of how they will be treated in terms of transparency, truthfulness and

honesty.

Employees. Policies towards employees, which might include equal opportunities policies, training and development,

recruitment, retention and removal of staff. In the case of HPC, the policy on child labour will be covered by this part of the

code of ethics.

Customers. How the company intends to treat its customers, typically in terms of policy of customer satisfaction, product mix,

product quality, product information and complaints procedure.

Supply chain/suppliers. This is becoming an increasingly important part of ethical behaviour as stakeholders scrutinise where

and how companies source their products (e.g. farming practice, GM foods, fair trade issues, etc). Ethical policy on supply

chain might include undertakings to buy from certain approved suppliers only, to buy only above a certain level of quality, to

engage constructively with suppliers (e.g. for product development purposes) or not to buy from suppliers who do not meet

with their own ethical standards.

Community and wider society. This section concerns the manner in which the company aims to relate to a range of

stakeholders with whom it does not have a direct economic relationship (e.g. neighbours, opinion formers, pressure groups,

etc). It might include undertakings on consultation, ‘listening’, seeking consent, partnership arrangements (e.g. in community

relationships with local schools) and similar.

[Tutorial note: up to six points to be identified and described but similar valid general contents are acceptable]

(ii) The sales director has suggested to Damian, that to encourage the salesmen to accept the new arrangement,

the company should increase the value of the accessories of their own choice that can be fitted to the low

emission cars.

State, giving reasons, whether or not Damian should implement the sales director’s suggestion.

(2 marks)

(ii) Damian should not agree to the sales director’s suggestion. The salesmen will each make a significant annual income

tax saving under the proposal, whereas the company will also be offset (at least partly) by the reduction in the dealer’s

bulk discount. Further, 100% first year allowance tax incentive for low emission cars is not guaranteed beyond 31 March

2008, and it is unlikely that any change in policy with regards to the provision of additional accessories will, once

implemented, be easily reversible.

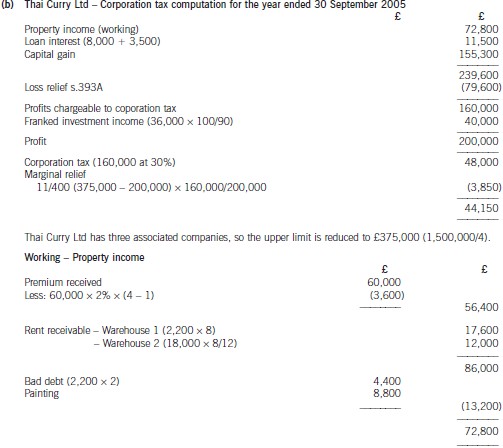

(b) Assuming that Thai Curry Ltd claims relief for its trading loss against total profits under s.393A ICTA 1988,calculate the company’s corporation tax liability for the year ended 30 September 2005. (10 marks)

6 Andrew is aged 38 and is single. He is employed as a consultant by Bestadvice & Co and pays income tax at the

higher rate.

Andrew is considering investing in a new business, and to provide funds for this investment he has recently disposed

of the following assets:

(1) A short leasehold interest in a residential property. Andrew originally paid £50,000 for a 47 year lease of the

property in May 1995, and assigned the lease in May 2006 for £90,000.

(2) His holding of £10,000 7% Government Stock, on which interest is payable half-yearly on 20 April and

20 October. Andrew originally purchased this holding on 1 June 1999 for £9,980 and he sold it for £11,250

on 14 March 2005.

Andrew intends to subscribe for ordinary shares in a new company, Scalar Limited, which will be a UK based

manufacturing company. Three investors (including Andrew) have been identified, but a fourth investor may also be

invited to subscribe for shares. The investors are all unconnected, and would subscribe for shares in equal measure.

The intention is to raise £450,000 in this manner. The company will also raise a further £50,000 from the investors

in the form. of loans. Andrew has been told that he can take advantage of some tax reliefs on his investment in Scalar

Limited, but does not know anything about the details of these reliefs

Andrew’s employer, Bestadvice & Co, is proposing to change the staff pension scheme from a defined benefit scheme

to which the firm and the employees each contribute 6% of their annual salary, to a defined contribution scheme, to

which the employees will continue to contribute 6%, but the firm will contribute 8% of their annual salary. The

majority of Andrew’s colleagues are opposed to this move, but, given the increase in the firm’s contribution rate

Andrew himself is less sure that the proposal is without merit.

Required:

(a) (i) Calculate the chargeable gain arising on the assignment of the residential property lease in May 2006.

(2 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-03-12

- 2021-12-30

- 2021-03-12

- 2021-03-12

- 2021-06-09

- 2021-01-05

- 2021-05-09

- 2021-01-03

- 2021-03-10

- 2021-01-12

- 2021-03-10

- 2021-01-04

- 2021-01-04

- 2021-03-10

- 2021-03-10

- 2021-03-11

- 2021-06-08

- 2021-05-27

- 2021-01-06

- 2021-06-02

- 2021-06-08

- 2021-05-20

- 2021-05-08

- 2021-03-13

- 2021-01-01

- 2021-07-15

- 2021-05-07

- 2021-04-14

- 2021-01-06

- 2021-06-10