ACCA考试的免考科目有什么规定呢?

发布时间:2021-03-12

ACCA考试的免考科目有什么规定呢?

最佳答案

教育部认可高校毕业生

1.会计学专业获得学士学位或硕士学位(金融、财务管理、审计专业也享受等同于会计学专业的免试政策,下同),免试5门课程(BT-LW,TX)

2.会计学辅修专业,免试3门课程(BT-FA)

3.法律专业,免试1门课程(LW)

4.商务及管理专业,免试1门课程(BT)

5.MPAcc专业(获得MPAcc学位或完成MPAcc大纲规定的所有课程、只有论文待完成),免试5门课程(BT-LW,TX)

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

Big Cheese Chairs (BCC) manufactures and sells executive leather chairs. They are considering a new design of massaging chair to launch into the competitive market in which they operate.

They have carried out an investigation in the market and using a target costing system have targeted a competitive selling price of $120 for the chair. BCC wants a margin on selling price of 20% (ignoring any overheads).

The frame. and massage mechanism will be bought in for $51 per chair and BCC will upholster it in leather and assemble it ready for despatch.

Leather costs $10 per metre and two metres are needed for a complete chair although 20% of all leather is wasted in the upholstery process.

The upholstery and assembly process will be subject to a learning effect as the workers get used to the new design.

BCC estimates that the first chair will take two hours to prepare but this will be subject to a learning rate (LR) of 95%.

The learning improvement will stop once 128 chairs have been made and the time for the 128th chair will be the time for all subsequent chairs. The cost of labour is $15 per hour.

The learning formula is shown on the formula sheet and at the 95% learning rate the value of b is -0·074000581.

Required:

(a) Calculate the average cost for the first 128 chairs made and identify any cost gap that may be present at

that stage. (8 marks)

(b) Assuming that a cost gap for the chair exists suggest four ways in which it could be closed. (6 marks)

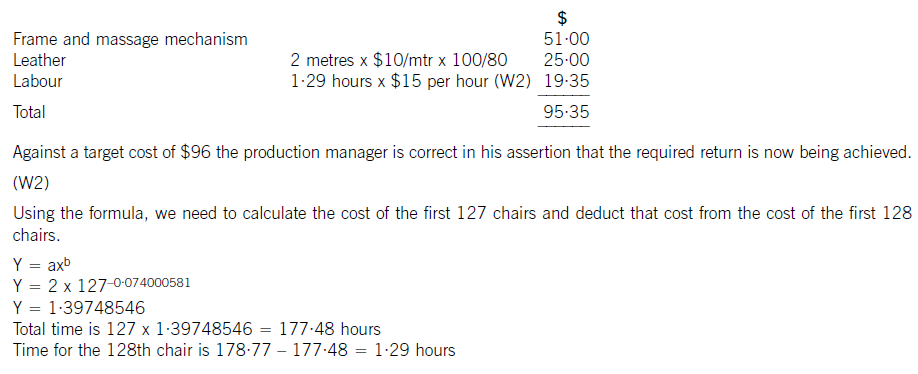

The production manager denies any claims that a cost gap exists and has stated that the cost of the 128th chair will be low enough to yield the required margin.

(c) Calculate the cost of the 128th chair made and state whether the target cost is being achieved on the 128th chair. (6 marks)

(W1)

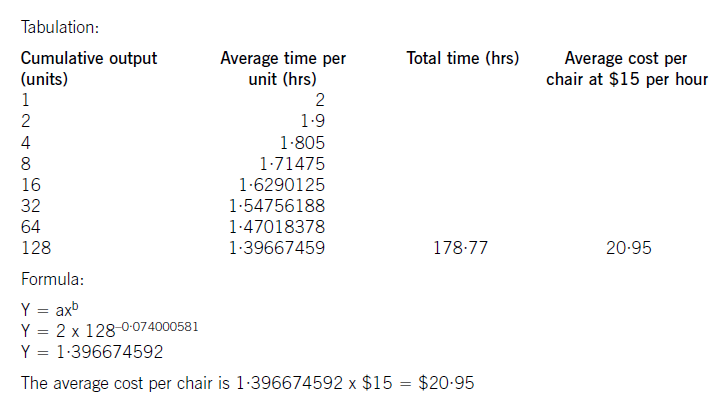

The cost of the labour can be calculated using learning curve principles. The formula can be used or a tabular approach would

also give the average cost of 128 chairs. Both methods are acceptable and shown here.

(b) To reduce the cost gap various methods are possible (only four are needed for full marks)

– Re-design the chair to remove unnecessary features and hence cost

– Negotiate with the frame. supplier for a better cost. This may be easier as the volume of sales improve as suppliers often

are willing to give discounts for bulk buying. Alternatively a different frame. supplier could be found that offers a better

price. Care would be needed here to maintain the required quality

– Leather can be bought from different suppliers or at a better price also. Reducing the level of waste would save on cost.

Even a small reduction in waste rates would remove much of the cost gap that exists

– Improve the rate of learning by better training and supervision

– Employ cheaper labour by reducing the skill level expected. Care would also be needed here not to sacrifice quality or

push up waste rates.

(c) The cost of the 128th chair will be:

5 Financial statements have seen an increasing move towards the use of fair values in accounting. Advocates of ‘fair

value accounting’ believe that fair value is the most relevant measure for financial reporting whilst others believe that

historical cost provides a more useful measure.

Issues have been raised over the reliability and measurement of fair values, and over the nature of the current level

of disclosure in financial statements in this area.

Required:

(a) Discuss the problems associated with the reliability and measurement of fair values and the nature of any

additional disclosures which may be required if fair value accounting is to be used exclusively in corporate

reporting. (13 marks)

(a) Reliability and Measurement

Fair value can be defined as the price that would be received to sell an asset or paid to transfer a liability. The fair value can

be thought of as an ‘exit price’. A fair value measurement assumes that the transaction to sell the asset or transfer the liability

occurs in the principal market for the asset or liability or, in the absence of a principal market, the most advantageous market

for the asset or liability which is the market in which the reporting entity would sell the asset or transfer the liability with the

price that maximises the amount that would be received or minimises the amount that would be paid. IAS39 ‘Financial

Instruments: Recognition and Measurement’ requires an entity to use the most advantageous active market in measuring the

fair value of a financial asset or liability when multiple markets exist whereas IAS41 ‘Agriculture’ requires an entity to use the

most relevant market. Thus there can be different approaches for estimating exit prices. Additionally valuation techniques and

current replacement cost could be used.

A hierarchy of fair value measurements would have to be developed in order to convey information about the nature of the

information used in creating the fair values. For example quoted prices (unadjusted) in active markets would provide better

quality information than quoted prices for similar assets and liabilities in active markets which would provide better quality

information than prices which reflect the reporting entity’s own thinking about the assumptions that market participants would

use in pricing the asset or liability. Enron made extensive use of what it called ‘mark-to-market’ accounting which was based

on valuation techniques and estimates. IFRSs currently do not have a single hierarchy that applies to all fair value measures.

Instead individual standards indicate preferences for certain inputs and measures of fair value over others, but this guidance

is not consistent among all IFRSs.

Some companies, in order to effectively manage their businesses, have already developed models for determining fair values.

Businesses manage their operations by managing risks. A risk management process often requires measurement of fair values

of contracts, financial instruments, and risk positions.

If markets were liquid and transparent for all assets and liabilities, fair value accounting clearly would give reliable information

which is useful in the decision making process. However, because many assets and liabilities do not have an active market,

the inputs and methods for estimating their fair value are more subjective and, therefore, the valuations are less reliable. Fair

value estimates can vary greatly, depending on the valuation inputs and methodology used. Where management uses

significant judgment in selecting market inputs when market prices are not available, reliability will continue to be an issue.

Management can use significant judgment in the valuation process. Management bias, whether intentional or unintentional,

may result in inappropriate fair value measurements and consequently misstatements of earnings and equity capital. Without

reliable fair value estimates, the potential for misstatements in financial statements prepared using fair value measurements

will be even greater.

Consideration must be given to revenue recognition issues in a fair value system. It must be ensured that unearned revenue

is not recognised early as it recently was by certain high-tech companies.

As the variety and complexity of financial instruments increases, so does the need for independent verification of fair value

estimates. However, verification of valuations that are not based on observable market prices is very challenging. Users of

financial statements will need to place greater emphasis on understanding how assets and liabilities are measured and how

reliable these valuations are when making decisions based on them.

Disclosure

Fair values reflect point estimates and do not result in transparent financial statements. Additional disclosures are necessary

to bring meaning to these fair value estimates. These disclosures might include key drivers affecting valuations, fair-valuerange

estimates, and confidence levels. Another important disclosure consideration relates to changes in fair value amounts.

For example, changes in fair values on securities can arise from movements in interest rates, foreign-currency rates, and credit

quality, as well as purchases and sales from the portfolio. For users to understand fair value estimates, they must be given

adequate disclosures about what factors caused the changes in fair value. It could be argued that the costs involved in

determining fair values may exceed the benefits derived therefrom. When considering how fair value information should be

presented in the financial statements, it is important to consider what type of financial information investors want. There are

indications that some investors desire both fair value information and historical cost information. One of the issues affecting

the credibility of fair value disclosures currently is that a number of companies include ‘health warnings’ with their disclosures

indicating that the information is not used by management. This language may contribute to users believing that the fair value

disclosures lack credibility.

3 Joe Lawson is founder and Managing Director of Lawson Engineering, a medium sized, privately owned family

business specialising in the design and manufacture of precision engineering products. Its customers are major

industrial customers in the aerospace, automotive and chemical industries, many of which are globally recognised

companies. Lawson prides itself on the long-term relationships it has built up with these high profile customers. The

strength of these relationships is built on Lawson’s worldwide reputation for engineering excellence, which has

tangible recognition in its gaining prestigious international awards for product and process innovation and quality

performance. Lawson Engineering is a company name well known in its chosen international markets. Its reputation

has been enhanced by the awarding of a significant number of worldwide patents for the highly innovative products

it has designed. This in turn reflects the commitment to recruiting highly skilled engineers, facilitating positive staff

development and investing in significant research and development.

Its products command premium prices and are key to the superior performance of its customers’ products. Lawson

Engineering has also established long-term relationships with its main suppliers, particularly those making the exotic

materials built into their advanced products. Such relationships are crucial in research and development projects,

some of which take a number of years to come to fruition. Joe Lawson epitomises the ‘can do’ philosophy of the

company, always willing to take on the complex engineering challenges presented by his demanding customers.

Lawson Engineering now faces problems caused by its own success. Its current location, premises and facilities are

inadequate to allow the continued growth of the company. Joe is faced with the need to fund a new, expensive,

purpose-built facility on a new industrial estate. Although successful against a number of performance criteria, Lawson

Engineering’s performance against traditional financial measures has been relatively modest and unlikely to impress

the financial backers Joe wants to provide the necessary long-term capital.

Joe has become aware of the increasing attention paid to the intangible resources of a firm in a business. He

understands that you, as a strategy consultant, can advise him on the best way to show that his business should be

judged on the complete range of assets it possesses.

Required:

(a) Using models where appropriate, provide Joe with a resource analysis showing why the company’s intangible

resources and related capabilities should be taken into account when assessing Lawson Engineering’s case

for financial support. (12 marks)

(a) To: Joe Lawson, Managing Director, Lawson Engineering

From:

Business case for financial support

The treatment of intangible resources is an area of considerable concern to the financial community and in many ways the

situation that Lawson Engineering finds itself, is typical of the current confusion surrounding the value placed on intangible

resources. This in turn reflects a traditional concern that the strategic health and the financial health of a business are not

one and the same thing. Intangible resources cover a wide variety of assets and skills found in the business. These include

the intellectual property rights of patents; brands; trademarks; trade secrets etc through to people-determined assets such as

know-how; internal and external networks; organisational culture and the reputation of the company.

It is important for you to present a case which shows how the investment in intangible resources is just as important a source

of value creation for the customer as is investment in tangible assets such as plant and finance which are traditionally focused

on in financial statements of the firm’s well being. As one source expresses it, ‘for most companies, intangible resources

contribute much more to total asset value’. Kaplan and Norton in a 2004 article on intangible assets go further and argue

that ‘measuring the value of such intangible assets is the holy grail of accounting’. The increasing importance of service

businesses and service activities in the firm’s value chain compound the problems faced in getting a true reflection of the

firm’s ability to create value. One view is that the key value creation activity lies in the relationships a firm has with its key

stakeholders – its customers, suppliers and employees. These relationships develop into distinctive capabilities, defined as

‘something it can do that its competitors cannot’. These distinctive capabilities only become competitive advantage(s) when

the capability is applied to a relevant market. Firms attain a sustainable competitive advantage when they consistently

produce products or services with attributes that align with the key buying criteria for the majority of customers in the chosen

market.

Competitive advantage, to be strategically significant, must have the twin virtues of sustainability and appropriability.

Sustainability means the ability to sustain an advantage over a period of time. Fairly obviously, assets such as plant and

technology may be easily obtainable in the open market, however it is only when they are combined with less tangible

resources that advantages become sustainable over time because competitors cannot easily copy them. Equally significant

are intangible resources such as reputation and organisational culture in that they influence the firm’s ability to hold on to

or appropriate some of the value it creates. If other stakeholders both inside and outside the firm are able to take more than

their fair share of value created – for example customers forcing down prices or employees demanding excessive wage

increases – this will reduce the funds available for the firm to invest in further development of its intangible resources, and

as a consequence begin to weaken its competitive advantage.

Essentially, intangible resources can be separated into those capabilities that are based on assets and those that are based

on skills. As one source puts it asset based advantages are derived from ‘having’ a particular asset and skills based advantages

stem from the ability to be ‘doing’ things competitors are unable to do. Assets are those things that the firms ‘owns’ – the

intellectual property as embodied in patents, trademarks and associated brands, copyrights, recognised by law and

defendable against copying under that law. It is worth noting the effort and investment that many companies are putting into

defending their intellectual property against the threat of copying and piracy. A more recent asset that many firms spend

considerable time and effort in developing are databases on key activities in the firm’s value chain – customer databases are

only one of the possible sources of firm information and know-how. One of the most prized intangible assets is that of the

firm’s reputation which may reflect the power of the brands it has created. Reputation may be easier to maintain than create

and meets the key tests of sustainability. The capability to produce innovation consistently may be instrumental in creating

in the minds of customers the longer-term competitive advantage of reputation. Reputation is argued to represent the

knowledge and emotions the customer may associate with a firm’s product range and can therefore be a major factor in

securing the competitive advantage derived through effective differentiation.

A positive organisational culture, staff know-how and networks are equally important intangible sources of competitive

advantage. These by their very nature may be more dynamic than asset based intangibles and the know-how of employees

in particular is an intangible resource that results in the distinctive capabilities which differentiate the firm from its competitors.

Much has been written about the significance of organisational culture and the way it reflects the style. of top management,

the ‘can do’ culture of Lawson Engineering clearly creates a competitive advantage. One interesting study of how chief

executive officers rate their intangible resources in terms of their contribution to the overall success of the business showed

that company reputation, product reputation and employee know-how were the most highly regarded intangible resources.

Hamel and Prahalad argue that core competences rather than market position are the real source of competitive advantage.

They gave three tests to identify a core competence – firstly the competence should provide potential access to a wide variety

of markets and thus be capable of being leveraged to good effect, secondly, it should be relevant to the customer’s key buying

criteria and thirdly, it should be difficult for competitors to imitate.

The disadvantages of intangibles stem from the differing value placed on such assets and competences by the various

interested stakeholders. How should a company’s reputation be measured? How long will that reputation yield competitive

advantage, particularly in view of how swiftly such reputations can disappear? It seems likely that the financial markets with

their ability to reflect all knowledge and information about the firm in its share price increasingly will take the contribution of

intangibles into account.

Overall the case should be clearly made that the strengths of the company rests in its unique combination of intangible

resources and the capabilities – both internal and external – that it has. Financial health is not always the same as strategichealth and by any objective measure Lawson Engineering is worthy of support.

Yours,

Strategy consultant

(ii) Explain THREE strategies that might be adopted in order to improve the future prospects of Diverse

Holdings Plc. (6 marks)

(ii) The forecast situation of Diverse Holdings Plc is not without its problems. KAL and OPL require the immediate attention

of management. The position of KAL is precarious to say the least. There is a choice of strategies for it:

(i) Outsource the manufacture of appliances

(ii) Set up a manufacturing operation overseas

(ii) Withdraw from the market.

Each alternative must be assessed. Whatever decision is taken it is unlikely to affect the other four subsidiaries.

PSL is also independent of the other subsidiaries. A strategic decision to widen its range of products and outlets must

surely help. Hence management should endeavour to find new markets for its products, which are separate and distinct

from those markets served by its appointed distributors.

21

In order to improve the prospects of OPL management need to adopt appropriate strategies since at the present time the

company appears to be in a high growth market but is unable to capture a reasonable market share. Perhaps the answer

lies in increased or more effective advertising of the endorsement of the product range by health and safety experts.

Management should endeavour to develop a strategy to integrate further its subsidiaries so that they can benefit from

each other and also derive as much synergy as possible from the acquisition of HTL.

It is of paramount importance that management ensure that sufficient funds are channelled into growing OFL and HTL,

which are both showing a rising trend in profitability. The group has depleted cash reserves which must to some extent

be attributable to the purchase of HTL. It is possible that the divestment of KAL would provide some much needed

funding.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-03-10

- 2021-05-08

- 2021-06-09

- 2021-01-03

- 2021-01-04

- 2021-05-26

- 2021-03-12

- 2021-03-12

- 2021-03-11

- 2021-05-13

- 2021-07-18

- 2021-03-12

- 2021-04-14

- 2021-12-31

- 2021-01-29

- 2021-05-08

- 2021-12-31

- 2021-03-12

- 2021-05-11

- 2021-03-11

- 2021-12-31

- 2021-01-03

- 2021-03-13

- 2021-12-31

- 2021-06-09

- 2021-03-12

- 2021-12-31

- 2021-04-20

- 2021-03-12

- 2021-03-10