速看!ACCA考试怎么在线报名,报名时应该注意什么

发布时间:2020-01-28

很多人都觉得ACCA考试报名的流程是比较繁杂的,为了方便大家完成报名环节,今天分享ACCA注册报考的相关内容,一起来看看吧。

ACCA考试报名流程步骤一:注册

考生请登陆http://www.accaglobal.com进行网上注册,并根据个人情况提交下列材料:

①学历/学位证明(高校在校生需提交学校出具的在校证明函及所有课程考试合格的成绩单)的原件、复印件和译文。

②身份证的原件、复印件和译文;或提供护照,不需提交翻译件。

③一张两寸照片(黑白彩色均可)

④注册报名费(银行汇票或信用卡支付),请确认信用卡可以从国外付款,否则会影响注册返回时间;如果不能确定建议用汇票交纳注册费。

ACCA考试报名流程步骤二:报名

1.登录ACCA全球官网http://www.accaglobal.com/

2.点击My ACCA登录,输入您的学员号和密码,进入您的个人空间。

3.选择EXAM ENTER,按照页面相关提示,进入考试报名界面,选择相关报考科目,报名即可。

ACCA考试报名流程步骤三:打印准考证

1、在ACCA官网主页http://www.accaglobal.com/en.html点击MY ACCA,进入登录页面:

2、进入MY ACCA账户后点击左侧的EXAM ENTRY:

3、进入考试信息页面,在Exam attendance docket中点击Download Docket,确认准考证信息无误后,下载并打印PDF准考证即可。一般在考前两周左右即开放打印。

ACCA考试报名流程注意事项

报考科目规定:学员在每个考季最多可报考4个科目(包括新科目和重考科目)并且每年报考不超过8门新科目。另外,学员必须按照以下3个阶段的顺序来报考ACCA相关科目。

知识模块的科目F1-F3

技能模块的科目F4-F9(F4ENG/GLO有即时机考)专业阶段的科目,SBL&SBR核心模块;P4-P7选修模块以上3个阶段内的考试科目可不分先后顺序报考,但如前一阶段有未通过的科目,将不能跳开此科目仅报后阶段科目。

考试费用缴纳:ACCA考试有早报优惠,学员可使用双币信用卡(支持人民币及英镑结算)或者支付宝完成费用支付,如果使用汇票方式交纳考试费用,您需等待收到总部的纸质考试报名表,填写完整的考试报名表及办理汇票后一起邮寄到英国进行考试报名。

成绩有效期:专业阶段考试的时限将为7年,ACCA资格考试的基础阶段F1-F9考试将不再有通过时限。学员有七年的时间通过专业阶段的考试(即SBL&SBR,以及P4-P7中的任选两门)。如果学员不能在七年内通过所有专业阶段考试,超过七年的已通过专业阶段科目的成绩将作废,须重新考试。七年时限从学员通过*9门专业阶段考试之日算起。

说明:以上信息来源于网络,仅供ACCA考生学习和参考。如有问题,请以ACCA官方最终通知为准!

今天的分享就到此结束了,相信各位对ACCA报考都有一定了解了,如需了解更多ACCA考试的其他资讯,请继续关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) State the immediate tax implications of the proposed gift of the share portfolio to Avril and identify an

alternative strategy that would achieve Crusoe’s objectives whilst avoiding a possible tax liability in the

future. State any deadline(s) in connection with your proposed strategy. (5 marks)

(b) Gift of the share portfolio to Avril

Inheritance tax

The gift would be a potentially exempt transfer at market value. No inheritance tax would be due at the time of the gift.

Capital gains tax

The gift would be a disposal by Crusoe deemed to be made at market value for the purposes of capital gains tax. No gain

would arise as the deemed proceeds will equal Crusoe’s base cost of probate value.

Stamp duty

There is no stamp duty on a gift of shares for no consideration.

Strategy to avoid a possible tax liability in the future

Crusoe should enter into a deed of variation directing the administrators to transfer the shares to Avril rather than to him. This

will not be regarded as a gift by Crusoe. Instead, provided the deed states that it is intended to be effective for inheritance tax

purposes, it will be as if Noland had left the shares to Avril in a will.

This strategy is more tax efficient than Crusoe gifting the shares to Avril as such a gift would be a potentially exempt transfer

and inheritance tax may be due if Crusoe were to die within seven years.

The deed of variation must be entered into by 1 October 2009, i.e. within two years of the date of Noland’s death.

(b) (i) Explain the matters you should consider, and the evidence you would expect to find in respect of the

carrying value of the cost of investment of Dylan Co in the financial statements of Rosie Co; and

(7 marks)

(b) (i) Cost of investment on acquisition of Dylan Co

Matters to consider

According to the schedule provided by the client, the cost of investment comprises three elements. One matter to

consider is whether the cost of investment is complete.

It appears that no legal or professional fees have been included in the cost of investment (unless included within the

heading ‘cash consideration’). Directly attributable costs should be included per IFRS 3 Business Combinations, and

there is a risk that these costs may be expensed in error, leading to understatement of the investment.

The cash consideration of $2·5 million is the least problematical component. The only matter to consider is whether the

cash has actually been paid. Given that Dylan Co was acquired in the last month of the financial year it is possible that

the amount had not been paid before the year end, in which case the amount should be recognised as a current liability

on the statement of financial position (balance sheet). However, this seems unlikely given that normally control of an

acquired company only passes to the acquirer on cash payment.

IFRS 3 states that the cost of investment should be recognised at fair value, which means that deferred consideration

should be discounted to present value at the date of acquisition. If the consideration payable on 31 January 2009 has

not been discounted, the cost of investment, and the corresponding liability, will be overstated. It is possible that the

impact of discounting the $1·5 million payable one year after acquisition would be immaterial to the financial

statements, in which case it would be acceptable to leave the consideration at face value within the cost of investment.

Contingent consideration should be accrued if it is probable to be paid. Here the amount is payable if revenue growth

targets are achieved over the next four years. The auditor must therefore assess the probability of the targets being

achieved, using forecasts and projections of Maxwell Co’s revenue. Such information is inherently subjective, and could

have been manipulated, if prepared by the vendor of Maxwell Co, in order to secure the deal and maximise

consideration. Here it will be crucial to be sceptical when reviewing the forecasts, and the assumptions underlying the

data. The management of Rosie Co should have reached their own opinion on the probability of paying the contingent

consideration, but they may have relied heavily on information provided at the time of the acquisition.

Audit evidence

– Agreement of the monetary value and payment dates of the consideration per the client schedule to legal

documentation signed by vendor and acquirer.

– Agreement of $2·5 million paid to Rosie Co’s bank statement and cash book prior to year end. If payment occurs

after year end confirm that a current liability is recognised on the individual company and consolidated statement

of financial position (balance sheet).

– Board minutes approving the payment.

– Recomputation of discounting calculations applied to deferred and contingent consideration.

– Agreement that the discount rate used is pre-tax, and reflects current market assessment of the time value of money

(e.g. by comparison to Rosie Co’s weighted average cost of capital).

– Revenue and profit projections for the period until January 2012, checked for arithmetic accuracy.

– A review of assumptions used in the projections, and agreement that the assumptions are comparable with the

auditor’s understanding of Dylan Co’s business.

Tutorial note: As the scenario states that Chien & Co has audited Dylan Co for several years, it is reasonable to rely on

their cumulative knowledge and understanding of the business in auditing the revenue projections.

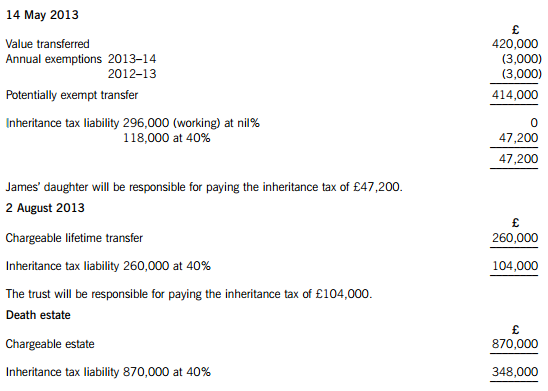

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.

(c) Advise Alan on the proposed disposal of the shares in Mobile Ltd. Your answer should include calculations

of the potential capital gain, and explain any options available to Alan to reduce this tax liability. (7 marks)

However, an exemption from corporation tax exists for any gain arising when a trading company (or member of a trading

group) sells the whole or any part of a substantial shareholding in another trading company.

A substantial shareholding is one where the investing company holds 10% of the ordinary share capital and is beneficially

entitled to at least 10% of the

(i) profits available for distribution to equity holders and

(ii) assets of the company available for distribution to equity holders on a winding up.

In meeting the 10% test, shares owned by a chargeable gains group may be amalgamated. The 10% test must have been

met for a continuous 12 month period during the 2 years preceding the disposal.

The companies making the disposals must have been trading companies (or members of a trading group) throughout the

12 month period, as well as at the date of disposal. In addition, they must also be trading companies (or members of a trading

group) immediately after the disposal.

The exemption is given automatically, and acts to deny losses as well as eliminate gains.

While Alantech Ltd has owned its holding in Mobile Ltd for 33 months, its ownership of the Boron holding has only lasted

for 10 months (at 1 June 2005) since Boron was acquired on 1 July 2004. Selling the shares in June 2005 will fail the

12 month test, and the gain will become chargeable.

It would be better for the companies to wait for a further month until July 2005 before selling the amalgamated shareholding.

By doing so, they will both be able to take advantage of the substantial shareholdings relief, thereby saving tax of £29,625

assuming a corporation tax rate of 19%.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-03-28

- 2020-09-03

- 2020-02-27

- 2020-01-10

- 2020-01-28

- 2020-07-04

- 2020-08-15

- 2020-01-09

- 2020-01-03

- 2020-01-10

- 2020-01-09

- 2021-04-08

- 2020-07-15

- 2020-01-10

- 2020-01-10

- 2020-09-03

- 2020-01-09

- 2020-04-19

- 2020-02-28

- 2020-01-10

- 2020-01-30

- 2021-01-16

- 2020-01-03

- 2020-01-08

- 2020-01-09

- 2021-09-12

- 2021-01-13

- 2021-01-13

- 2020-02-27

- 2020-09-03