大专学历可以参加ACCA考试吗?速看!

发布时间:2020-03-21

关于大专学历可以参加ACCA考试吗?很多的小伙伴都还不是很清楚,下面就跟着51题库考试学习网一起来看看吧!

ACCA国际注册会计师考试是一个门槛相对较低的证书,根据ACCA官方的政策来看,持有国家教育部认可的高等专科院校的毕业证即可参加考试。

除此之外,满足以下3条中的1条也可报名ACCA考试:

1、教育部认可的高等院校在校生,顺利完成大一的课程考试,即可报名成为ACCA的正式学员;

2、未符合以上报名资格的申请者,可以先申请参加FIA(Foundations in Accountancy)基础财务资格考试。在完成FAB(基础商业会计)、FMA(基础管理会计)、FFA(基础财务会计)3门课程后,可以豁免ACCA前三门课程的考试,直接进入ACCA技能课程的考试

虽然,ACCA共有13门科目考试,但ACCA是极少数能在大学就能考的含金量高的证书,因此,很多刚刚毕业的大学生或者在读的学生都会报考ACCA。

ACCA在国内称为"国际注册会计师",实际上是英国的注册会计师协会之一(英国有多家注册会计师协会),但它是英国具有特许头衔的4家注册会计师协会之一,也是当今知名的国际性会计师组织之一。

ACCA是国际会计准则委员会(IASC)的创始成员,也是国际会计师联合会(IFAC)的主要成员。ACCA在欧洲会计专家协会(FEE)、亚太会计师联合会(CAPA)和加勒比特许会计师协会(ICAC)等会计组织中起着非常重要的作用。

ACCA考试是按现代企业财务人员需要具备的技能和技术的要求而设计的,共有13门课程,两门选修课,课程分为3个阶段:

第一阶段(知识阶段)(AB MA FA)分涉及基本会计学原理、管理学原理、管理会计基础;

第二阶段(技能阶段)(LW PM TX FR AA FM)涵盖专业财会人员应具备的核心专业技能;

第三阶段(高级阶段)(SBL SBR APM AFM ATX AAA)培养学员以专业知识对信息进行评估,并提出合理的经营建议和忠告。

以上就是关于考试的全部内容了,如果想要了解更多关于考试的信息,大家可以关注51题库考试学习网哦!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Explain by reference to Hira Ltd’s loss position why it may be beneficial for it not to claim any capital

allowances for the year ending 31 March 2007. Support your explanation with relevant calculations.

(6 marks)

(b) The advantage of Hira Ltd not claiming any capital allowances

In the year ending 31 March 2007 Hira Ltd expects to make a tax adjusted trading loss, before deduction of capital

allowances, of £55,000 and to surrender the maximum amount possible of trading losses to Belgrove Ltd and Dovedale Ltd.

For the first nine months of the year from 1 April 2006 to 31 December 2006 Hira Ltd is in a loss relief group with Belgrove

Ltd. The maximum surrender to Belgrove Ltd for this period is the lower of:

– the available loss of £41,250 (£55,000 x 9/12); and

– the profits chargeable to corporation tax of Belgrove of £28,500 (£38,000 x 9/12).

i.e. £28,500. This leaves losses of £12,750 (£41,250 – £28,500) unrelieved.

For the remaining three months from 1 January 2007 to 31 March 2007 Hira Ltd is a consortium company because at least

75% of its share capital is owned by companies, each of which own at least 5%. It can surrender £8,938 (£55,000 x 3/12

x 65%) to Dovedale Ltd and £4,812 (£55,000 x 3/12 x 35%) to Belgrove Ltd as both companies have sufficient taxable

profits to offset the losses. Accordingly, there are no losses remaining from the three-month period.

The unrelieved losses from the first nine months must be carried forward as Hira Ltd has no income or gains in that year or

the previous year. However, the losses cannot be carried forward beyond 1 January 2007 (the date of the change of

ownership of Hira Ltd) if there is a major change in the nature or conduct of the trade of Hira Ltd. Even if the losses can be

carried forward, the earliest year in which they can be relieved is the year ending 31 March 2009 as Hira Ltd is expected to

make a trading loss in the year ending 31 March 2008.

Any capital allowances claimed by Hira Ltd in the year ending 31 March 2007 would increase the tax adjusted trading loss

for that year and consequently the unrelieved losses arising in the first nine months.

If the capital allowances are not claimed, the whole of the tax written down value brought forward of £96,000 would be

carried forward to the year ending 31 March 2008 thus increasing the capital allowances and the tax adjusted trading loss,

for that year. By not claiming any capital allowances, Hira Ltd can effectively transfer a current period trading loss, which

would be created by capital allowances, of £24,000 (25% x £96,000) from the year ending 31 March 2007 to the following

year where it can be surrendered to the two consortium members.

(c) Explain how the introduction of an ERPS could impact on the role of management accountants. (5 marks)

(c) The introduction of ERPS has the potential to have a significant impact on the work of management accountants. The use of

ERPS causes a substantial reduction in the gathering and processing of routine information by management accountants.

Instead of relying on management accountants to provide them with information, managers are able to access the system to

obtain the information they require directly via a suitable electronic access medium.

ERPS integrate separate business functions in one system for the entire organisation and therefore co-ordination is usually

undertaken centrally by information management specialists who have a dual responsibility for the implementation and

operation of the system.

ERPS perform. routine tasks that not so long ago were seen as an essential part of the daily routines of management

accountants, for example perpetual inventory valuation. Therefore if the value of the role of management accountants is not

to be diminished then it is of necessity that management accountants should seek to expand their roles within their

organisations.

The management accountant will also control and audit the ERPS data input and analysis. Hence the implementation of ERPS

provides the management accountant with an opportunity to change the emphasis of their role from information gathering

and processing to that of the role of advisers and internal consultants to their organisations. This new role will require

management accountants to be involved in interpreting the information generated from the ERPS and to provide business

support for all levels of management within an organisation.

(c) Calculate the theoretical ex rights price per share and the net funds to be raised by the rights issue, and

determine and discuss the likely effect of the proposed expansion on:

(i) the current share price of Merton plc;

(ii) the gearing of the company.

Assume that the price–earnings ratio of Merton plc remains unchanged at 12 times. (11 marks)

(c) Rights issue price = 2·45 x 0·8 = £1·96

Theoretical ex rights price = ((2 x 2·45) + (1 x 1·96))/3 = 6·86/3 = £2·29

New shares issued = 20m x 1/2 = 10 million

Funds raised = 1·96 x 10m = £19·6 million

After issue costs of £300,000 funds raised will be £19·3 million

Annual after-tax return generated by these funds = 19·3 x 0·09 = £1,737,000

New earnings of Merton plc = 1,737,000 + 4,500,000 = £6,237,000

New number of shares = 20m + 10m = 30 million

New earnings per share = 100 x 6,237,000/30,000,000 = 20·79 pence

New share price = 20·79 x 12 = £2·49

The weaknesses in this estimate are that the predicted return on investment of 9% may or may not be achieved: the priceearnings

ratio depends on the post investment share price, rather than the post investment share price depending on the

price-earnings ratio; the current earnings seem to be declining and this share price estimate assumes they remain constant;

in fact current earnings are likely to decline because the overdraft and annual interest are increasing but operating profit is

falling.

Expected gearing = 38/(60 + 19·3) = 47·9% compared to current gearing of 63%.

Including the overdraft, expected gearing = 46/(60 + 19·3) = 58% compared to 77%.

The gearing is predictably lower, but if the overdraft is included in the calculation the gearing of the company is still higher

than the sector average. The positive effect on financial risk could have a positive effect on the company’s share price, but

this is by no means certain.

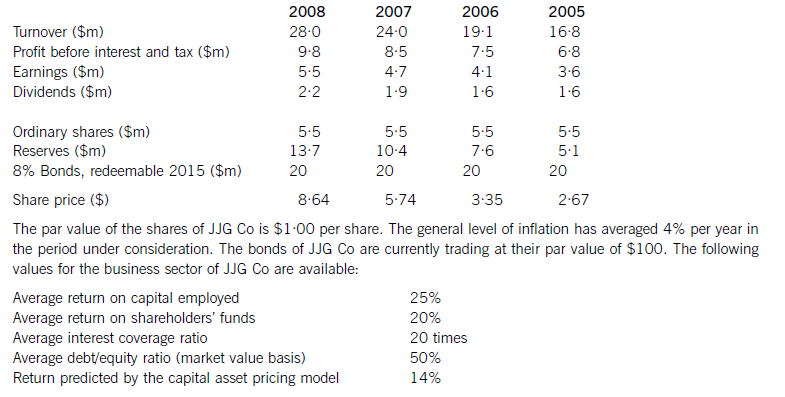

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-05-14

- 2020-01-10

- 2020-05-20

- 2020-03-19

- 2020-01-31

- 2020-04-03

- 2020-01-29

- 2020-03-13

- 2020-03-21

- 2020-02-21

- 2021-05-12

- 2020-03-04

- 2020-03-12

- 2020-01-08

- 2020-01-10

- 2020-01-30

- 2020-01-10

- 2020-01-10

- 2020-05-01

- 2020-10-08

- 2020-03-08

- 2020-01-09

- 2020-04-18

- 2020-04-14

- 2020-08-13

- 2020-03-27

- 2020-01-10

- 2020-01-14

- 2020-05-17