江苏省考生:ACCA考试的科目和报考规定是什么呀?

发布时间:2020-01-10

当有些小伙伴正在如火如荼地备考ACCA考试的时候,千万不要忘了最重要的一个步骤,那就是考试报名。目前正处于ACCA考试常规报名阶段,51题库考试学习网提醒大家想要报考2020年ACCA考试的考生要抓紧时间报名了哦!51题库考试学习网帮助大家汇总了ACCA官网上发布的部分内容,来看看是不是你所需要的呢?

按照规定,学员在每个考季最多可报考4个科目(包括重考科目和新科目)并且每年报考不超过8门新科目,保证每门课程都有充足的学习时间。另外,学员必须按照以下3个阶段的顺序来报考ACCA科目。

知识模块的科目:F1-F3;

技能模块的科目:F4-F9(F4ENG/GLO 开启随时机考);

专业阶段的科目:P1, P2, P3 (and any two from P4, P5, P6 and P7)。

以上3个阶段内的考试科目可不分先后顺序报考,但如前一阶段有未通过的科目,将不能跳开此科目仅报后阶段科目。

ACCA每年会根据会计准则及事实的需要调整教学大纲,当年的考试会以最新的教学大纲作为考核内容,ACCA考官也会不定期的在ACCA官方网站上发表考官文章,帮助学生解析考试当中的一些难点和重点,ACCA教材也应随着考试大纲的不断变化,每年出最新版本,历年考题答案应随着教材变更后,调整最新答案。

学生在拿到最新教材后可以进行逐章逐节的学习,在掌握了每章节知识点后,将历年考题作为复习重点,充分的加以练习,达到熟练的程度,以保证考试的顺利通过。

与此同时,学生可以按照自身的需求,选择一些与教材紧密结合的辅导课程,由讲师为同学们总结考试重点及难点,深入分析、拓展思维,为学生节省时间,并且带领同学们一起做历年考题,学习考官文章,共同克服备课过程当中出现的各种困难增加学习效率及通过率。

除了认真备考熟练掌握知识点以外,ACCA对考试技巧,答题速度及考场的应试技巧也有很高的要求,很多同学复习阶段已经熟练的掌握知识点,但是考场应变能力差,考试时间没能合理分配,最终也很容易造成考试失败,正确的备考、应考方法也因此成为了考试顺利通过的关键,因此在备考经验不是很丰富的同学可以选择相关课程跟随老师一同学习。

以上信息就是关于ACCA的考试科目和报考规定的介绍,希望对正在努力备考的ACCAer们有所帮助。目前的ACCA证书含金量是相当高的,各位小伙伴不要觉得考试很难就放弃,付出的努力和得到的结果是成正比的,大家要坚持努力的复习学习,克服身边的一切诱惑!当你拿到证书的那一科你就明白所以的努力都是值得的。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

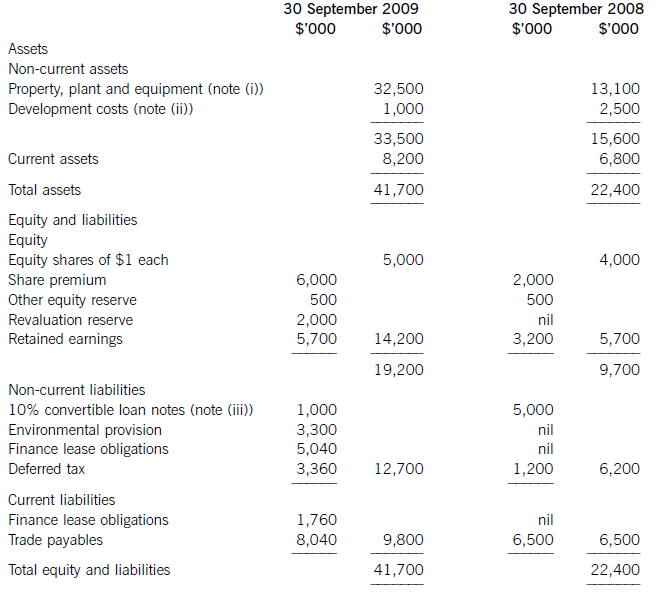

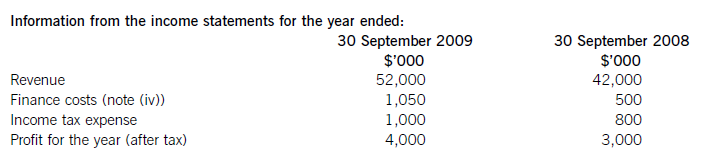

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

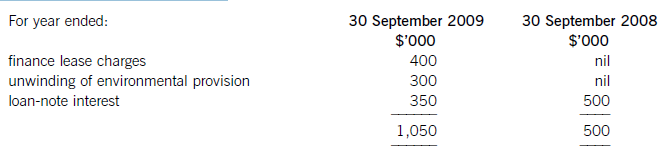

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced.

6 Assume today’s date is 16 April 2005.

Henry, aged 48, is the managing director of Happy Home Ltd, an unquoted UK company specialising in interior

design. He is wealthy in his own right and is married to Helen, who is 45 years old. They have two children – Stephen,

who is 19, and Sally who is 17.

As part of his salary, Henry was given 3,000 shares in Happy Home Ltd with an option to acquire a further 10,000

shares. The options were granted on 15 July 2003, shortly after the company started trading, and were not part of

an approved share option scheme. The free shares were given to Henry on the same day.

The exercise price of the share options was set at the then market value of £1·00 per share. The options are not

capable of being exercised after 10 years from the date of grant. The company has been successful, and the current

value of the shares is now £14·00 per share. Another shareholder has offered to buy the shares at their market value,

so Henry exercised his share options on 14 April 2005 and will sell the shares next week, on 20 April 2005.

With the company growing in size, Henry wishes to recruit high quality staff, but the company lacks the funds to pay

them in cash. Henry believes that giving new employees the chance to buy shares in the company would help recruit

staff, as they could share in the growth in value of Happy Home Ltd. Henry has heard that there is a particular share

scheme that is suitable for small, fast growing companies. He would like to obtain further information on how such

a scheme would work.

Henry has accumulated substantial assets over the years. The family house is owned jointly with Helen, and is worth

£650,000. Henry has a £250,000 mortgage on the house. In addition, Henry has liquid assets worth £340,000

and Helen has shares in quoted companies currently worth £125,000. Henry has no forms of insurance, and believes

he should make sure that his wealth and family are protected. He is keen to find out what options he should be

considering.

Required:

(a) (i) State how the gift of the 3,000 shares in Happy Home Ltd was taxed. (1 mark)

(a) (i) Gift of shares

Shares, which are given free or sold at less than market value, are charged to income tax on the difference between the

market value and the amount paid (if any) for the shares. Henry was given 3,000 shares with a market value of £1 at

the time of gift, so he was assessed to income tax on £3,000, in the tax year 2003/04.

(c) Critically evaluate Vincent Viola’s view that corporate governance provisions should vary by country.

(8 marks)

(c) Corporate governance provisions varying by country

There is a debate about the extent to which corporate governance provisions (in the form. of either written codes, laws or

general acceptances) should be global or whether they should vary to account for local differences. In this answer, Vincent

Viola’s view is critically evaluated.

In general terms, corporate governance provisions vary depending on such factors as local business culture, businesses’

capital structures, the extent of development of capital funding of businesses and the openness of stock markets. In Germany,

for example, companies have traditionally drawn much of their funding from banks thereby reducing their dependence on

shareholders’ equity. Stock markets in the Soviet Union are less open and less liquid than those in the West. In many

developing countries, business activity is concentrated among family-owned enterprises.

Against Vincent’s view

Although business cultures vary around the world, all business financed by private capital have private shareholders. Any

dilution of the robustness of provisions may ignore the needs of local investors to have their interests adequately represented.

This dilution, in turn, may allow bad practice, when present, to exist and proliferate.

Some countries suffer from a poor reputation in terms of endemic corruption and fraud and any reduction in the rigour with

which corporate governance provisions are implemented fail to address these shortcomings, notwithstanding the fact that they

might be culturally unexpected or difficult to implement.

In terms of the effects of macroeconomic systems, Vincent’s views ignore the need for sound governance systems to underpin

confidence in economic systems. This is especially important when inward investment needs are considered as the economic

wealth of affected countries are partly underpinned by the robustness, or not, of their corporate governance systems.

Supporting Vincent’s view

In favour of Vincent’s view are a number of arguments. Where local economies are driven more by small family businesses

and less by public companies, accountability relationships are quite different (perhaps the ‘family reasons’ referred to in the

case) and require a different type of accounting and governance.

There is a high compliance and monitoring cost to highly structured governance regimes that some developing countries may

deem unnecessary to incur.

There is, to some extent, a link between the stage of economic development and the adoption of formal governance codes.

It is generally accepted that developing countries need not necessarily observe the same levels of formality in governance as

more mature, developed economies.

Some countries’ governments may feel that they can use the laxity of their corporate governance regimes as a source of

international comparative advantage. In a ‘race to the bottom’, some international companies seeking to minimise the effects

of structured governance regimes on some parts of their operations may seek countries with less tight structures for some

operations.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-08

- 2020-01-10

- 2020-03-20

- 2020-02-29

- 2020-01-10

- 2020-01-08

- 2020-03-08

- 2020-01-09

- 2020-02-21

- 2020-01-08

- 2020-04-21

- 2020-01-09

- 2020-01-10

- 2021-08-29

- 2020-08-13

- 2020-01-08

- 2020-04-15

- 2020-03-05

- 2020-03-08

- 2020-03-08

- 2020-03-04

- 2020-04-15

- 2020-04-28

- 2020-02-28

- 2020-03-14

- 2020-08-01

- 2020-03-21

- 2019-07-21

- 2020-01-10

- 2020-01-09