出国继续考ACCA,你知道以前的成绩承认吗?

发布时间:2020-02-05

因为备考ACCA大部分都需要花费2-3年的时间,很多人因出国留学和移民等问题而导致无法持续在国内学习ACCA。那么,继续在国外报考ACCA的话,之前国内的ACCA考试成绩还有效吗?一起来看看吧!

一、国内的ACCA考试成绩还有效吗?

承认。每个学员注册后拥有一个唯一的注册号,可以凭此在全球任意一个ACCA考点更换、选择适合自己的考点。学员不论在何地参加考试,其成绩都会记录在ACCA学员系统中。

二、ACCA报名时间

1、2020年5月11日,《Early exam entry deadline date》

2、2020年7月27日,《Standard exam entry deadline》

3、2020年8月3日,《Late exam entry deadline》

三、ACCA考试通过时间:

1、已毕业的获得教育部承认的大专以上学历,成功注册后可直接报考ACCA考试,基本可在3年内完成ACCA13门考试。

2、非大一级在校生,顺利完成大一的课程考试,成功注册后可直接报考ACCA考试,基本可在3年内完成ACCA13门考试。

3、大一在校生,先申请参加FIA(Foundations in Accountancy)基础财务资格考试。在完成基础商业会计(FAB)、基础管理会计(FMA)、基础财务会计(FFA)3门课程,并完成基础职业模块,可获得ACCA商业会计师资格证书(Diploma in Accounting and

Business),资格证书后可豁免ACCAF1-F3三门课程的考试,直接进入技能课程的考试。基本可在3年内完成ACCA13门考试。

四、注意事项

ACCA学员通过基础阶段考试不设有效期。也就是专业资格基础阶段F1-F9科目考试完成后不设有效期,但是ACCA将对专业阶段考试的有效期设置为七年。

这就要求学员有七年时间通过专业阶段考试。如果学员无法在七年内通过所有专业阶段考试,那么超过七年的已通过科目成绩都将作废,必须重考。七年有效期的起始日期为学员通过第一门专业阶段考试的时间。

五、关于ACCA考试的安排

1、自2017年开始,ACCA考试F1-F4实行随时机考制度,ACCA官方将不再统一安排考试时间,由考试自己到ACCA认定的机考中心自行考试。

2、F5-P7依旧实行一年四次的分季机考制度,每年考试季为3、6、9、12四个月的月初,每次考试最多可以同时报考四门。

以上就是51题库考试学习网今天分享的全部内容啦,大家看完之后,希望可以帮助到你哦!想了解更多相关信息,请关注51题库考试学习网。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

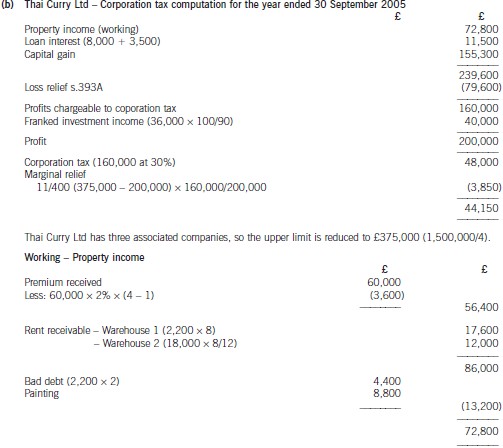

(b) Assuming that Thai Curry Ltd claims relief for its trading loss against total profits under s.393A ICTA 1988,calculate the company’s corporation tax liability for the year ended 30 September 2005. (10 marks)

There is considerable evidence that small firms are reluctant to carry out strategic planning in their businesses.

(b) What are the advantages and disadvantages for Gould and King Associates in creating and implementing a

strategic plan? (8 marks)

(b) Clearly, there is a link between the ability to write a business plan and the willingness, or otherwise, of small firms to carry

out strategic planning. Whilst writing a business plan may be a necessity in order to acquire financial support, there is much

more question over the benefits to the existing small business, such as Gould and King, of carrying out strategic planning.

One of the areas of greatest debate is whether carrying out strategic planning leads to improved performance. Equally

contentious is whether the formal rational planning model is worthwhile or whether strategy is much more of an emergent

process, with the firm responding to changes in its competitive environment.

One source argues that small firms may be reluctant to create a strategic plan because of the time involved; small firms may

find day-to-day survival and crisis management prevents them having the luxury of planning where they mean to be over the

next few years. Secondly, strategic plans may also be viewed as too restricting, stopping the firm responding flexibly and

quickly to opportunities and threats. Thirdly, many small firms may feel that they lack the necessary skills to carry out strategic

planning. Strategic planning is seen as a ‘big’ firm process and inappropriate for small firms. Again, there is evidence to

suggest that owner-managers are much less aware of strategic management tools such as SWOT, PESTEL and mission

statements than their managers. Finally, owner-managers may be reluctant to involve others in the planning process, which

would necessitate giving them access to key information about the business. Here there is an issue of the lack of trust and

openness preventing the owner-manager developing and sharing a strategic plan. Many owner-managers may be quite happy

to limit the size of the business to one which they can personally control.

On the positive side there is evidence to show that a commitment to strategic planning results in speedier decision making,

a better ability to introduce change and innovation and being good at managing change. This in turn results in better

performance including higher rates of growth and profits, clear indicators of competitive advantage. If Gould and King arelooking to grow the business as suggested, this means some strategic planning will necessarily be involved

(b) Assuming that the acquisition proceeds, what steps will Datum Paper Products need to take to build a shared

culture in the two companies? (10 marks)

(b) Developing a shared culture will be one of the key determinants of whether the anticipated benefits of the acquisition actually

materialise. Due diligence procedures before the merger should have established the key people issues. This will include

reviewing the two management styles and cultures. Clearly these are very different, looking at internal communication pre

and post acquisition, understanding the nature of reward systems in the firm to be acquired, assessing the nature of training

programmes in the firm both before and after the acquisition and attempting to gauge existing employee attitudes towards

Papier Presse and the likely reaction to the acquisition. Reviewing areas where there have been significant staff problems and

consequent negotiations will also be an important clue as to employee attitudes and morale. ‘Hard’ people issues including

pensions, management rewards, health insurance and redundancy terms will need to be realistically assessed and the

implications for both the price paid for the company and subsequent integration fully understood. All too often the compelling

strategic vision for the enlarged company ignores the people costs involved and the time needed to develop shared HR

systems.

Many models on culture and culture management could help to achieve a successful transition. Mintzberg’s cultural or

organisational configuration model, which would facilitate an understanding of the difference in structures and systems, could

be a useful starting point. DPP comes from a divisionalised company where the middle line managers are given considerable

autonomy in achieving agreed levels of performance. Papier Presse, with its dominance by family ownership and

management, could be argued to be entrepreneurial in character, where the owner/managers at the strategic apex of the

company operate a ‘hands-on’ approach and direct control of subordinates. Reconciling these different cultures and structures

will not be an easy task.

Lewin’s 3-step model of change can be used in helping a positive culture emerge from the combining of the two companies.

There is a need to unfreeze the current situation in which employees of both organisations are likely to be reluctant or resistant

to change. There needs to be a clear understanding of who does what in the new organisation – leadership and the role of

the French owners will be a critical factor in successfully changing the culture. Robbins emphasises the need for positive top

management role models in promoting and communicating the need for a change in culture. Policies to affect change on both

the hard and soft factors referred to above need to be in place to move the integration forward. A clear timescale and vision

for change will be a key part of the change process. Finally the systems will need to be in place to re-freeze or rather reinforce

the attitudes and behaviours necessary to achieve success in the merged organisation. Operating across national borderscreates real culture issues to be solved as shown in studies by Hofstede and Bartlett and Ghoshal.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-03-14

- 2020-01-07

- 2019-07-19

- 2020-04-11

- 2020-01-04

- 2020-01-09

- 2020-03-28

- 2020-01-09

- 2020-01-09

- 2020-01-30

- 2020-04-09

- 2020-04-08

- 2020-05-17

- 2020-02-13

- 2020-01-09

- 2020-05-15

- 2019-07-19

- 2020-02-20

- 2020-03-13

- 2020-05-10

- 2020-05-17

- 2020-05-17

- 2020-03-07

- 2020-03-26

- 2020-01-09

- 2020-02-27

- 2020-04-21

- 2020-02-20

- 2019-07-19

- 2020-02-28