陕西省考生:如何利用零散时间学习ACCA?

发布时间:2020-01-10

在我国职称会计师考试中,ACCA考试属于难度比较大的考试,由于严苛的报考条件,备考ACCA考试的朋友大多数都是工作比较忙碌的上班族,那么如何在繁忙的工作中合理安排备考时间对于考生来说就非常重要了。除去完整系统的备考时间外,生活中零散时间也是能够备考的,今天就来教大家如何高效利用零散时间学习ACCA考试,大家可以作为参考。

每天至少一道题

ACCA考试的类型有很多种,主要考察应试人员分析、解决财务工作的能力,同时对计算能力和语言能力也是极大的挑战。所以在平时的备考中是一定缺少不了习题的辅助的。建议大家每天至少要做一套ACCA真题训练,每道小问控制在8分钟左右,这就足够大家利用空闲时间进行做题。

生活空档看考点

在上班路上看新闻时间,午休后的看剧时间在备考期间大家都可以转换成“高会学习时间”,带上《轻松过关》辅导书,看里面的“考点精讲”,让你在短时间内了解学习内容。你可以选择将学过的知识点复习一遍,或者将要学习的知识点提前预习一遍,要知道只有多一份努力才能多一份胜算。

备考笔记随身带

很多考生在备考中有记笔记或者是记错题本的好习惯,将整理的内容随身携带,空闲时间可以随时拿出来进行学习也是不错的选择。选择自己整理的笔记可以加深学习的印象,在考试的过程中也能当成考试资料带入考场,寻找知识点也会更快。

用完整时间来学习,用零散时间来备考,两者结合高效备考!

以上就是为大家准备的备考方法,希望对大家有所帮助,预祝大家都能轻松过ACCA考试~加油~

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

5 Which of the following factors could cause a company’s gross profit percentage on sales to fall below the expected

level?

1 Understatement of closing inventories.

2 The incorrect inclusion in purchases of invoices relating to goods supplied in the following period.

3 The inclusion in sales of the proceeds of sale of non-current assets.

4 Increased cost of carriage charges borne by the company on goods sent to customers.

A 3 and 4

B 2 and 4

C 1 and 2

D 1 and 3

(e) Internal controls are very important in a complex civil engineering project such as the Giant Dam Project.

Required:

Describe the difficulties of maintaining sound internal controls in the Giant Dam Project created by working

through sub-contractors. (4 marks)

(e) Control and sub-contractors

Specifically in regard to the maintenance of internal controls when working with sub-contractors, the prominent difficulties

are likely to be in the following areas:

Configuring and co-ordinating the many activities of sub-contractors so as to keep progress on track. This may involve taking

the different cultures of sub-contractor organisations into account.

Loss of direct control over activities as tasks are performed by people outside R&M’s direct employment and hence its

management structure.

Monitoring the quality of work produced by the sub-contractors. Monitoring costs will be incurred and any quality problems

will be potentially costly.

Budget ‘creep’ and cost control. Keeping control of budgets can be a problem in any large civil engineering project (such the

construction of the new Wembley Stadium in the UK) and problems are likely to be made worse when the principal contractor

does not have direct control over all activities.

Time limit over-runs. Many projects (again, such as the new Wembley Stadium, but others also) over-run significantly on time.

Tutorial note: only four difficulties need to be described.

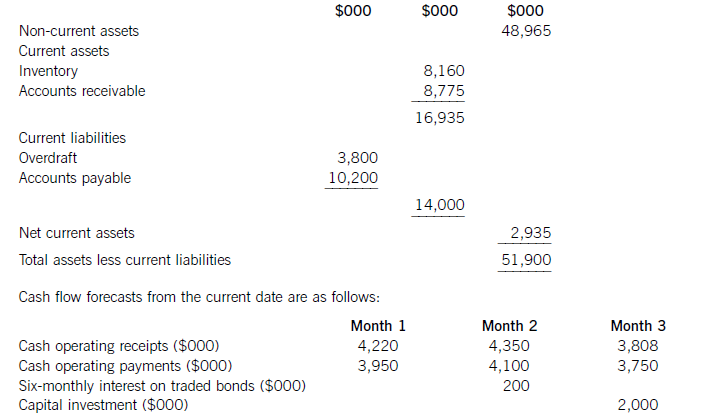

The following financial information relates to HGR Co:

Statement of financial position at the current date (extracts)

The finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements, which he believes will reduce accounts receivable days to the average sector value of 53 days. This reduction would take six months to achieve from the current date, with an equal reduction in each month. He has also proposed changes to inventory management methods, which he hopes will reduce inventory days by two days per month each month over a three-month period from the current date. He does not expect any change in the current level of accounts payable.

HGR Co has an overdraft limit of $4,000,000. Overdraft interest is payable at an annual rate of 6·17% per year, with payments being made each month based on the opening balance at the start of that month. Credit sales for the year to the current date were $49,275,000 and cost of sales was $37,230,000. These levels of credit sales and cost of sales are expected to be maintained in the coming year. Assume that there are 365 working days in each year.

Required:

(a) Discuss the working capital financing strategy of HGR Co. (7 marks)

(b) For HGR Co, calculate:

(i) the bank balance in three months’ time if no action is taken; and

(ii) the bank balance in three months’ time if the finance director’s proposals are implemented.

Comment on the forecast cash flow position of HGR Co and recommend a suitable course of action.

(10 marks)

(c) Discuss how risks arising from granting credit to foreign customers can be managed and reduced.

(8 marks)

(a)Whenconsideringthefinancingofworkingcapital,itisusefultodividecurrentassetsintofluctuatingcurrentassetsandpermanentcurrentassets.Fluctuatingcurrentassetsrepresentchangesinthelevelofcurrentassetsduetotheunpredictabilityofbusinessactivity.Permanentcurrentassetsrepresentthecorelevelofinvestmentincurrentassetsneededtosupportagivenlevelofturnoverorbusinessactivity.Asturnoverorlevelofbusinessactivityincreases,thelevelofpermanentcurrentassetswillalsoincrease.Thisrelationshipcanbemeasuredbytheratioofturnovertonetcurrentassets.Thefinancingchoiceasfarasworkingcapitalisconcernedisbetweenshort-termandlong-termfinance.Short-termfinanceismoreflexiblethanlong-termfinance:anoverdraft,forexample,isusedbyabusinessorganisationastheneedarisesandvariableinterestischargedontheoutstandingbalance.Short-termfinanceisalsomoreriskythanlong-termfinance:anoverdraftfacilitymaybewithdrawn,orashort-termloanmayberenewedonlessfavourableterms.Intermsofcost,thetermstructureofinterestratessuggeststhatshort-termdebtfinancehasalowercostthanlong-termdebtfinance.Thematchingprinciplesuggeststhatlong-termfinanceshouldbeusedforlong-terminvestment.Applyingthisprincipletoworkingcapitalfinancing,long-termfinanceshouldbematchedwithpermanentcurrentassetsandnon-currentassets.Afinancingpolicywiththisobjectiveiscalleda‘matchingpolicy’.HGRCoisnotusingthisfinancingpolicy,sinceofthe$16,935,000ofcurrentassets,$14,000,000or83%isfinancedfromshort-termsources(overdraftandtradepayables)andonly$2,935,000or17%isfinancedfromalong-termsource,inthiscaseequityfinance(shareholders’funds)ortradedbonds.ThefinancingpolicyorapproachtakenbyHGRCotowardsthefinancingofworkingcapital,whereshort-termfinanceispreferred,iscalledanaggressivepolicy.Relianceonshort-termfinancemakesthisriskierthanamatchingapproach,butalsomoreprofitableduetothelowercostofshort-termfinance.Followinganaggressiveapproachtofinancingcanleadtoovertrading(undercapitalisation)andthepossibilityofliquidityproblems.(b)Bankbalanceinthreemonths’timeifnoactionistaken:Workings:ReductioninaccountsreceivabledaysCurrentaccountsreceivabledays=(8,775/49,275)x365=65daysReductionindaysoversixmonths=65–53=12daysMonthlyreduction=12/6=2daysEachreceivablesdayisequivalentto8,775,000/65=$135,000(Alternatively,eachreceivablesdayisequivalentto49,275,000/365=$135,000)Monthlyreductioninaccountsreceivable=2x135,000=$270,000ReductionininventorydaysCurrentinventorydays=(8,160/37,230)x365=80daysEachinventorydayisequivalentto8,160,000/80=$102,000(Alternatively,eachinventoryday=37,230,000/365=$102,000)Monthlyreductionininventory=102,000x2=$204,000OverdraftinterestcalculationsMonthlyoverdraftinterestrate=1·06171/12=1·005or0·5%Ifnoactionistaken:Period1interest=3,800,000x0·005=$19,000Period2interest=3,549,000x0·005=$17,745or$18,000Period3interest=3,517,000x0·005=$17,585or$18,000Ifactionistaken:Period1interest=3,800,000x0.005=$19,000Period2interest=3,075,000x0.005=$15,375or$15,000Period3interest=2,566,000x0.005=$12,830or$13,000DiscussionIfnoactionistaken,thecashflowforecastshowsthatHGRCowillexceeditsoverdraftlimitof$4millionby$1·48millioninthreemonths’time.Ifthefinancedirector’sproposalsareimplemented,thereisapositiveeffectonthebankbalance,buttheoverdraftlimitisstillexceededinthreemonths’time,althoughonlyby$47,000ratherthanby$1·47million.Ineachofthethreemonthsfollowingthat,thecontinuingreductioninaccountsreceivabledayswillimprovethebankbalanceby$270,000permonth.Withoutfurtherinformationonoperatingreceiptsandpayments,itcannotbeforecastwhetherthebankbalancewillreturntolessthanthelimit,orevencontinuetoimprove.Themainreasonfortheproblemwiththebankbalanceisthe$2millioncapitalexpenditure.Purchaseofnon-currentassetsshouldnotbefinancedbyanoverdraft,butalong-termsourceoffinancesuchasequityorbonds.Ifthecapitalexpenditurewereremovedfromtheareaofworkingcapitalmanagement,theoverdraftbalanceattheendofthreemonthswouldbe$3·48millionifnoactionweretakenand$2·05millionifthefinancedirector’sproposalswereimplemented.GiventhatHGRCohasalmost$50millionofnon-currentassetsthatcouldpossiblybeusedassecurity,raisinglong-termdebtthrougheitherabankloanorabondissueappearstobesensible.Assumingabondinterestrateof10%peryear,currentlong-termdebtintheform.oftradedbondsisapproximately($200mx2)/0·1=$4m,whichismuchlessthantheamountofnoncurrentassets.AsuitablecourseofactionforHGRCotofollowwouldthereforebe,firstly,toimplementthefinancedirector’sproposalsand,secondly,tofinancethecapitalexpenditurefromalong-termsource.Considerationcouldalsobegiventousingsomelong-termdebtfinancetoreducetheoverdraftandtoreducethelevelofaccountspayable,currentlystandingat100days.(c)Whencreditisgrantedtoforeigncustomers,twoproblemsmaybecomeespeciallysignificant.First,thelongerdistancesoverwhichtradetakesplaceandthemorecomplexnatureoftradetransactionsandtheirelementsmeansforeignaccountsreceivableneedmoreinvestmentthantheirdomesticcounterparts.Longertransactiontimesincreaseaccountsreceivablebalancesandhencetheleveloffinancingandfinancingcosts.Second,theriskofbaddebtsishigherwithforeignaccountsreceivablethanwiththeirdomesticcounterparts.Inordertomanageandreducecreditrisks,therefore,exportersseektoreducetheriskofbaddebtandtoreducethelevelofinvestmentinforeignaccountsreceivable.Manyforeigntransactionsareon‘openaccount’,whichisanagreementtosettletheamountoutstandingonapredetermineddate.Openaccountreflectsagoodbusinessrelationshipbetweenimporterandexporter.Italsocarriesthehighestriskofnon-payment.Onewaytoreduceinvestmentinforeignaccountsreceivableistoagreeearlypaymentwithanimporter,forexamplebypaymentinadvance,paymentonshipment,orcashondelivery.Thesetermsoftradeareunlikelytobecompetitive,however,anditismorelikelythatanexporterwillseektoreceivecashinadvanceofpaymentbeingmadebythecustomer.Onewaytoacceleratecashreceiptsistousebillfinance.Billsofexchangewithasignedagreementtopaytheexporteronanagreedfuturedate,supportedbyadocumentaryletterofcredit,canbediscountedbyabanktogiveimmediatefunds.Thisdiscountingiswithoutrecourseifbillsofexchangehavebeencountersignedbytheimporter’sbank.Documentarylettersofcreditareapaymentguaranteebackedbyoneormorebanks.Theycarryalmostnorisk,providedtheexportercomplieswiththetermsandconditionscontainedintheletterofcredit.Theexportermustpresentthedocumentsstatedintheletter,suchasbillsoflading,shippingdocuments,billsofexchange,andsoon,whenseekingpayment.Aseachsupportingdocumentrelatestoakeyaspectoftheoveralltransaction,lettersofcreditgivesecuritytotheimporteraswellastheexporter.Companiescanalsomanageandreduceriskbygatheringappropriateinformationwithwhichtoassessthecreditworthinessofnewcustomers,suchasbankreferencesandcreditreports.Insurancecanalsobeusedtocoversomeoftherisksassociatedwithgivingcredittoforeigncustomers.Thiswouldavoidthecostofseekingtorecovercashduefromforeignaccountsreceivablethroughaforeignlegalsystem,wheretheexportercouldbeatadisadvantageduetoalackoflocalorspecialistknowledge.Exportfactoringcanalsobeconsidered,wheretheexporterpaysforthespecialistexpertiseofthefactorasawayofreducinginvestmentinforeignaccountsreceivableandreducingtheincidenceofbaddebts.

(b) Provide an example that illustrates a structured application of the terms contained in the above statement in

respect of a profit-seeking organisation OR a not-for-profit organisation of your own choice. (6 marks)

(b) An illustration of the features detailed above, framed in the context of a University as an organisation in the not-for-profit sector

might be as follows:

The Overall objective might well be stated in the mission statement of a University. An example of such a mission statement

might be as follows:

‘To provide a quality educational environment in a range of undergraduate and post-graduate disciplines and a quality

educational focus for students and the business community.’

More specifically, objectives may be seen as the achievement of ‘value for money’ thereby ensuring effectiveness in areas such

as:

– The provision of high added value to students;

– The establishment of a reputation for recognised expertise in specific areas of research work within the wider community;

and

– The provision of a high quality service to industry and commerce.

Strategies may focus on aspects such as:

– The recruitment and retention of high quality academic staff;

– The development of IT equipment and skills within the institution;

– The mentoring of students in order to ensure high added value and low drop-out rates in intermediate years of study;

and

– The close liaison with employers as to qualities in graduate/post-graduate employees that they will value highly.

The determinants used to measure the results of strategies might include:

– Competitiveness – cost per graduate compared to other institutions; growth in student numbers; number of staff holding

a PhD qualification;

– Financial performance – average cost per graduate; income generation from consultancy work;

– Quality – range of awards (percentages of 1st class degrees); employer responses; measures of quality of delivery of

education, advice to students, etc;

– Flexibility – variable entry and exit points to courses; modular structure; the variety of full-time, part-time and distance

learning modes;

– Resource Utilisation – staff:student ratios; quotas met by each course; accommodation filled;

– Innovation – latest IT provision in linking lecture theatres to information databases; increased provision of flexilearning/

mixed mode course provision.

The application of business change techniques might include the following:

BPR with a focus on IT developments, flexible-learning or mixed mode course provision.

JIT with a focus on moves towards student-centred uptake of educational opportunities e.g. via intranet availability of lecture

and tutorial material linked to more flexible access to staff rather than a ‘push’ system of pre-structured times of

lectures/tutorials.

TQM with a focus on moves to improve quality in all aspects of the learning environment including delivery of lectures, access

to staff and pastoral care issues.

ABM with a focus on activities on a per student basis (both planned and actual) with a view to eliminating activities that do

not add value e.g. cost per lecture per student.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2019-07-20

- 2020-04-18

- 2020-01-09

- 2020-01-29

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-09-03

- 2020-01-10

- 2020-08-05

- 2020-03-21

- 2020-01-10

- 2020-01-10

- 2019-12-28

- 2019-04-03

- 2020-01-09

- 2020-05-02

- 2020-03-12

- 2020-01-10

- 2020-05-14

- 2020-01-10

- 2020-03-08

- 2020-01-10

- 2020-01-10

- 2020-04-09

- 2020-04-15

- 2020-04-21

- 2019-04-17