看过来!带你了解ACCA如何获得OBU学位!

发布时间:2020-03-26

很多小伙伴报考了ACCA考试后咨询ACCA如何获得OBU学位?今天51题库考试学习网带大家去了解一下。

学员需全部完成以下工作,即可申请获得OBU学位:

在参加F7、F8、F9任意一科考试前提交相关英文证明获得OBU学位申请资格;完成F1至F9的考试,其中F7/F8/F9不可通过免试完成,一阶段(即前三门课程)可以是FIA渠道通过;完成在线Professional Ethics module 职业道德模块;提交一份7500字《研究分析报告》(即论文)给牛津布鲁克斯大学商学院。

论文通过后,即可获得牛津布鲁克斯大学学士学位。

英国牛津布鲁克斯大学学士学位是否有用?

牛津布鲁克斯大学位于世界学术名城牛津。这里学风浓郁、精英荟萃,历来为求学圣地。布鲁克斯大学历史悠久,始建于1865年以其授课和课程设置的不断创新和高质量而享有国际声誉(多门课程教学评比获得满分);在教学和科研上,以结合实际应用解决现实世界的课题而著称(多个研究领域位于世界前沿)。目前已发展成为英国*2特色的综合性大学,被授予英女王高等教育奖;连续8年被《泰晤士报》评为*3秀的英国新大学;牛津布鲁克斯大学在2003年《卫报大学指南》(The Guardian University Guide 2003)的一百二十个大学中排列第二十四位;在2003年《泰晤士报优秀大学指南》(The Times Good Univetsity Guide 2003)的一百个大学中排列第四十八位;20多门学科在全英名列前茅,毕业生就业率全英第8名等。

该大学的应用会计(荣誉)理学士学位由于其充分考虑会计职业、实际工作及雇主对财会方面的要求,而受到高度评价。它不仅使学员证明他们专业方面的能力,还展示了他们实际的操作技能,这对ACCA的考试起到了补充作用,大大增强了学员的就业机会。

商学院师资雄厚,拥有150多位各学科带头人和研究人员,既是欧洲管理学会(EFMD)的创始成员,又是全球项尖商学院联盟(AACSB)成员,以及全球*5的专业会计师协会ACCA和牛津国际金融中心(Oxford Centre for International Finance)战略伙伴。布鲁克斯的毕业生尤其是财务专业的毕业生备受大型跨国公司的青睐,就业率一直高居榜首。同时布鲁克斯大学的校友之间联系非常紧密,许多学生通过校友的推荐介绍成功迈入跨国企业。在英国ZF历年的教学研究质量评估中,牛津布鲁克斯大学商学院的很多专业都被评为满分。

好了,以上便是今天51题库考试学习网分享的全部内容了,相信只要你们耐心的看完51题库考试学习网的这篇文章,那你们心中的疑问一定会得到解答。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Examine how adopting a Six Sigma approach would help address the quality problems at UPC.

(10 marks)

(b) In many ways Six Sigma started out as a quality control methodology. It focused on measurement and the minimisation of

faults through pursuing Six Sigma as a statistical measure of some aspects of organisational performance. However, Six Sigma

has developed into something much more than a process control technique. It includes a problem-solving process called

DMAIC and a comprehensive toolkit ranging from brainstorming to balanced scorecards and process dashboards. It also has

defined team roles for managers and employees, often with martial arts names such as Black Belt, Green Belt and Master

Black Belt.

Six Sigma was first used in organisations in the early 1990s. However, it was its adoption and promotion by Jack Welch, the

CEO of GE that brought Six Sigma wider publicity. He announced that ‘Six Sigma is the most important initiative GE has ever

undertaken’. As Paul Harmon comments, ‘Welch’s popularity with the business press, and his dynamic style, guaranteed that

Six Sigma would become one of the hot management techniques of the late 1990s’.

Six Sigma uses an approach called DMAIC in its problem solving process. This stands for Define, Measure, Analyse, Improve

and Control. Three aspects of this are considered below in the context of how they would address the problems at UPC.

Defining the problem

Part of defining the problem is the identification of the customer. It is important to understand what customers really want

and value and one of the main themes of Six Sigma is its focus on the customer. Six Sigma explicitly recognises the ‘voice of

the customer’ (VOC) in its approach. In the UPC situation quality requirements are currently defined by the physical condition

of the goods and by the alignment of the image. However, this may be a limiting view of quality because there is no evidence

of any systematic investigation of the requirements of the customer. Solving these problems may not lead to any significant

long-term gain; they may be quickly replaced by other ‘quality issues’. Furthermore, the customer is also perceived in a limited

way. These quality requirements are in the eye of the gift shop owner who is interested in saleable products. The end customer

– the consumer – who buys and uses the product may have other requirements which can also be addressed at this time.

By considering the VOC the problem and scope of the project becomes re-defined and the solution of the problems potentially

more valuable.

Measurement

Measurement is fundamental to Six Sigma. This includes the gathering of data to validate and quantify the problem. The

creation of the inspection team was based on initial evidence about an increase in breakages. This needs to be quantified.

The inaccurate printing of the image had been quantified as 500 units per month, out of the 250,000 shipped out of the

company. This equates to a failure rate of 0·2%, so that 99·8% of items are shipped with a correctly aligned image. This

sounds quite reasonable but it still raises issues and complaints that have to be dealt with, as well as creating wastage costs

of $10,000 per month. The problem is that even a relatively low percentage of defects can lead to a lot of unhappy customers.

Aiming for Six Sigma would reduce defects down to about one faulty item per month, reducing the wastage cost to $20.

Analysis

Analysis is concerned with understanding the process to find the root cause. Six Sigma focuses on processes and their

analysis. Analysis concerns methods, machines, materials, measures, Mother Nature and people. The alignment problem

needs investigation to find out what causes the imaging machine to irregularly produce misaligned images. Management

currently appear to blame the machine but it may be due to the way that certain people load the machine. The analysis of

the breakages is particularly important. It is unclear at present where these breakages occur (for example, are some of the

items broken before they leave UPC’s despatch facility) or are they all broken in transit? Neither is it understood why the

breakages occur. Management appear to blame the packers for packing incorrectly and not following the correct method.

However, it may be that the material is just not strong enough to withstand heavy handling by couriers who are outside the

control of UPC. Additionally, the breakages may be due to some manufacturing problem or raw material imperfection in the

items that break. Six Sigma stresses understanding the problem before solving it.

Although DMAIC has been selected as the framework for the sample answer, focusing on other aspects of Six Sigma would

be acceptable – as long as they are presented in the context of the UPC scenario.

5 The directors of Blaina Packaging Co (BPC), a well-established manufacturer of cardboard boxes, are currently

considering whether to enter the cardboard tube market. Cardboard tubes are purchased by customers whose

products are wound around tubes of various sizes ranging from large tubes on which carpets are wound, to small

tubes around which films and paper products are wound. The cardboard tubes are usually purchased in very large

quantities by customers. On average, the cardboard tubes comprise between 1% and 2% of the total cost of the

customers’ finished product.

The directors have gathered the following information:

(1) The cardboard tubes are manufactured on machines which vary in size and speed. The lowest cost machine is

priced at $30,000 and requires only one operative for its operation. A one-day training course is required in order

that an unskilled person can then operate such a machine in an efficient and effective manner.

(2) The cardboard tubes are made from specially formulated paper which, at times during recent years, has been in

short supply.

(3) At present, four major manufacturers of cardboard tubes have an aggregate market share of 80%. The current

market leader has a 26% market share. The market shares of the other three major manufacturers, one of which

is JOL Co, are equal in size. The product ranges offered by the four major manufacturers are similar in terms of

size and quality. The market has grown by 2% per annum during recent years.

(4) A recent report on the activities of a foreign-based multinational company revealed that consideration was being

given to expanding operations in their packaging division overseas. The division possesses large-scale automated

machinery for the manufacture of cardboard tubes of any size.

(5) Another company, Plastic Tubes Co (PTC) produces a narrow, but increasing, range of plastic tubes which are

capable of housing small products such as film and paper-based products. At present, these tubes are on average

30% more expensive than the equivalent sized cardboard tubes sold in the marketplace.

Required:

(a) Using Porter’s five forces model, assess the attractiveness of the option to enter the market for cardboard

tubes as a performance improvement strategy for BPC. (10 marks)

(a) In order to assess the attractiveness of the option to enter the market for spirally-wound paper tubes, the directors of BPC

could make use of Michael Porter’s ‘five forces model’.

In applying this model to the given scenario one might conclude that the relatively low cost of the machine together with the

fact that an unskilled person would only require one day’s training in order to be able to operate a machine, constitute

relatively low costs of entry to the market. Therefore one might reasonably conclude that the threat of new entrants might be

high. This is especially the case where the market is highly fragmented.

The fact that products are usually purchased in very large quantities by customers together with the fact that there is little real

difference between the products of alternative suppliers suggests that customer (buyer) power might well be very high. The

fact that the paper tubes on average only comprise between 1% and 2% of the total cost of the purchaser’s finished product

also suggests that buyer power may well be very high.

The threat from suppliers could be high due to the fact that the specially formulated paper from which the tubes are made is

sometimes in short supply. Hence suppliers might increase their prices with consequential diminution in gross margin of the

firms in the marketplace.

The threat from competitive rivals will be strong as the four major players in the market are of similar size and that the market

is a slow growing market. The market leader currently has 26% of the market and the three nearest competitors hold

approximately 18% of the market.

The fact that Plastic Tubes Co (PTC) produces a narrow range of plastic tubes constitutes a threat from a substitute product.

This threat will increase if the product range of PTC is extended and the price of plastic tubes is reduced.

The fact that a foreign-based multinational company is considering entering this market represents a significant threat from a

potential new entrant as it would appear that the multinational company might well be able to derive economies of scale from

large scale automated machinery and has manufacturing flexibility.

Low capital barriers to entry might appeal to BPC but they would also appeal to other potential entrants. The low growth

market, the ease of entry, the existence of established competitors, a credible threat of backward vertical integration by

suppliers, the imminent entry by a multi-national, a struggling established competitor and the difficulty of differentiating an

industrial commodity should call into question the potential of BPC to achieve any sort of competitive advantage. If BPC can

achieve the position of lowest cost producer within the industry then entry into the market might be a good move. In order

to assess whether this is possible BPC must consider any potential synergies that would exist between its cardboard business

and that of the tubes operation.

From the information available, the option to enter the market for cardboard tubes appears to be unattractive. The directors

of BPC should seek alternative performance improvement strategies.

Shoe Co, a shoe manufacturer, has developed a new product called the ‘Smart Shoe’ for children, which has a built-in tracking device. The shoes are expected to have a life cycle of two years, at which point Shoe Co hopes to introduce a new type of Smart Shoe with even more advanced technology. Shoe Co plans to use life cycle costing to work out the total production cost of the Smart Shoe and the total estimated profit for the two-year period.

Shoe Co has spent $5·6m developing the Smart Shoe. The time spent on this development meant that the company missed out on the opportunity of earning an estimated $800,000 contribution from the sale of another product.

The company has applied for and been granted a ten-year patent for the technology, although it must be renewed each year at a cost of $200,000. The costs of the patent application were $500,000, which included $20,000 for the salary costs of Shoe Co’s lawyer, who is a permanent employee of the company and was responsible for preparing the application.

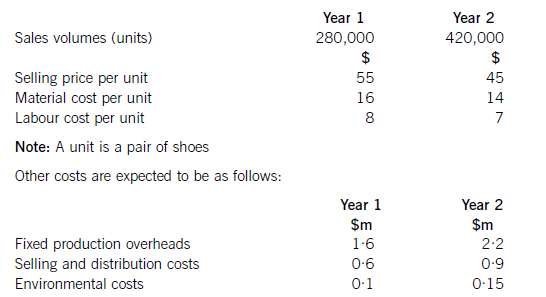

The following information is also available for the next two years:

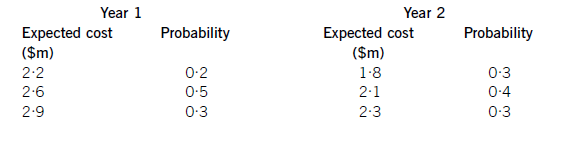

Shoe Co is still negotiating with marketing companies with regard to its advertising campaign, so is uncertain as to what the total marketing costs will be each year. However, the following information is available as regards the probabilities of the range of costs which are likely to be incurred:

Required:

Applying the principles of life cycle costing, calculate the total expected profit for Shoe Co for the two-year period.

(10 marks)

Totalsalesrevenue=(280,000x$55)+(420,000x$45)=$15·4m+18·9m=$34·3m.NoteTheexpectedprofithasbeencalculatedusinglifecyclecostingnotrelevantcosting.Hence,the$20,000salarycostincludedinpatentcostsshouldbeincludedinthelifecyclecost.Similarly,theopportunitycostof$800,000isnotincludedusinglifecyclecostingwhereasifrelevantcostingwasbeingusedtodecideonaparticularcourseofaction,theopportunitycostwouldbeincluded.Working1Expectedmarketingcostinyear1:(0·2x$2·2m)+(0·5x$2·6m)+(0·3x$2·9m)=$2·61mExpectedmarketingcostyear2:(0·3x$1·8m)+(0·4x$2·1m)+(0·3x$2·3m)=$2·07mTotalexpectedmarketingcost=$4·68m

(b) Discuss ways in which the traditional budgeting process may be seen as a barrier to the achievement of the

aims of EACH of the following models for the implementation of strategic change:

(i) benchmarking;

(ii) balanced scorecard; and

(iii) activity-based models. (12 marks)

(b) Benchmarking

Benchmarks enable goals to be set that may be based on either external measures of ‘best practice’ organisations or internal

cross-functional comparisons which exhibit ‘best practice’. A primary aim of the traditional budgeting process is the setting of

realistic targets that can be achieved within the budget period. The setting of realistic targets means that the extent of

underperformance against ‘best practice’ standards loses visibility, and thus short-term financial targets remain the

predominant focus of the traditional budgeting process. It is arguable that because the budgetary reporting system purports

to give managers ‘control’, there is very little real incentive to seek out benchmarks which may be used to raise budgeted

performance targets. Much depends upon the prevailing organisational culture since benchmarking may be viewed as an

attempt by top management to impose impossible targets upon operational managers. The situation is further exacerbated

where organisations do not measure their success relative to their competition.

Balanced scorecard

The Balanced scorecard is often misunderstood as a consequence of the failure by top management to ensure that it is

implemented effectively within the organisation. Thus it may be viewed as the addition of a few non-financial measures to

the conventional budget. In an attempt to overcome this misperception many management teams now establish a

performance-rewards linkage based upon the achievement of Scorecard targets for the forthcoming budget period.

Unfortunately this can precipitate dysfunctional behaviour at every level within the organisation.

Even in situations where the Scorecard has been well-designed and well-implemented it is difficult for it to gain widespread

acceptance. This is because all too often there exists a culture which places a very high value upon the achievement of the

fixed annual targets in order to avoid the loss of status, recognition and rewards.

A well-constructed Scorecard contains a mix of long-term and short-term measures and therefore drives the company in the

direction of medium-term strategic goals which are supported by cross-functional initiatives. On the other hand, the budgeting

process focuses the organisation on the achievement of short-term financial goals supported by the initiatives of individual

departments. Budgets can also act as an impediment to the acceptance of responsibility by local managers for the

achievement of the Scorecard targets. This is often the case in situations where a continued emphasis exists on meeting shortterm

e.g. quarterly targets.

Activity-based models

Traditional budgets show the costs of functions and departments (e.g. staff costs and establishment costs) instead of the costs

of those activities that are performed by people (e.g. receipt of goods inwards, processing and dispatch of orders etc). Thus

managers have no visibility of the real ‘cost drivers’ of their business. In addition, it is probable that a traditional budget

contains a significant amount of non-value-added costs that are not visible to the managers. The annual budget also tends

to fix capacity for the forthcoming budget period thereby undermining the potential of Activity-based management (ABM)

analysis to determine required capacity from a customer demand perspective. Those experienced in the use of ABM

techniques are used to dealing with such problems, however their tasks would be much easier to perform. and their results

made more reliable if these problems were removed.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-03-01

- 2020-01-10

- 2020-01-10

- 2020-03-07

- 2020-01-09

- 2020-01-31

- 2020-03-07

- 2020-01-09

- 2020-01-10

- 2019-07-20

- 2020-01-10

- 2020-01-30

- 2020-02-01

- 2020-05-20

- 2020-05-15

- 2020-01-10

- 2020-01-10

- 2020-04-16

- 2020-04-15

- 2020-05-11

- 2020-02-27

- 2020-01-09

- 2019-07-20

- 2020-03-18

- 2020-04-17

- 2020-01-10

- 2020-01-10

- 2020-01-05

- 2020-04-20

- 2020-04-19