通知: ACCA发布COVID-19疫情商业影响最新全球报告

发布时间:2020-04-21

ACCA发布COVID-19疫情商业影响最新全球报告,不知道的也没关系,下面就跟着51题库考试学习网一起来了解一下吧!

ACCA(特许公认会计师公会)近日就COVID-19疫情的商业影响发布最新全球调研报告。调研显示,公私领域的各类组织对于疫情在人力、生产力以及现金流方面造成的影响非常担忧。这项全球调研旨在了解各类组织机构目前面临的业务和财务挑战。全球超过10,000名财会专业人士,包括260名来自中国内地的财务专家参与了此次调研。

问卷调研在2020年3月13日至3月26日之间展开,这一期间疫情在中国已经得到有效控制,而在欧美等国则正是疫情持续蔓延之际。因此,调研的结果也充分反映了这种地区差别。

中国:人员、现金流和采购受影响最大

44%的中国受访者表示,疫情对员工生产力造成的影响最为严重。由于中国较早控制住了疫情,这一数据优于全球水平(57%)。34%的中国受访者表示由于所在地区受疫情影响,他们的客户已经停止或减少采购,而33%的受访者则表示他们正面临现金流问题。

尽管如此,79%的受访者表示已对余下财年重新进行了财务预测,这表明他们正在以积极的态度应对未来可能出现的状况,而全球仅有53%的受访者这样做。基于新的财务预测,在最有可能出现的情景假设下,有30%的中国受访者表示预计将出现25%以上的收入负增长,这一数据略优于全球水平(34%)。

全球:现金流短缺引发企业生存危机

从全球的调研结果来看,现金流短缺对企业生存造成的影响最为严重。其中有近一半的受访者(48%)表示现金流问题可能导致企业在未来12个月、甚至6个月内倒闭。此外,约六成的企业表示确定推迟或正在积极考虑推迟投资。约五分之一(21%)的企业已经停止招聘。

全球调研的主要发现包括:

·57%的企业员工生产力受到负面影响;

·37%的企业遇到现金流问题;

·29%的企业因所在区域受到疫情影响,客户停止或减少采购;

·24%的企业因供应链中断,客户停止或减少采购;

·24%的企业不得不延期推出新产品或服务;

·53%的企业尚未重新进行财务预测,这可能是由于COVID-19疫情迅速扩散和持续时间加长,以及政府颁布的必要社交隔离规定,为企业带来了巨大的不确定性。

ACCA这项全球调研衡量了疫情的短期和中期影响,同时审视了企业已经采取或考虑采取哪些措施来减少损失。此外,调研还分析了我们能够共同从这场全球疫情中吸取的经验教训。

ACCA建议组织机构遵循“三A”危机应对原则:应对行动(Act)应遵守可持续发展原则,以员工和利益相关者的利益为重;分析(Analyse)不同信息来源,确保组织机构的安全;预测(Anticipate)业务影响和未来趋势。

以上就是51题库考试学习网带给大家的内容,如果还有其他不清楚的问题,请及时反馈给51题库考试学习网,我们会尽快帮您解答。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

Big Cheese Chairs (BCC) manufactures and sells executive leather chairs. They are considering a new design of massaging chair to launch into the competitive market in which they operate.

They have carried out an investigation in the market and using a target costing system have targeted a competitive selling price of $120 for the chair. BCC wants a margin on selling price of 20% (ignoring any overheads).

The frame. and massage mechanism will be bought in for $51 per chair and BCC will upholster it in leather and assemble it ready for despatch.

Leather costs $10 per metre and two metres are needed for a complete chair although 20% of all leather is wasted in the upholstery process.

The upholstery and assembly process will be subject to a learning effect as the workers get used to the new design.

BCC estimates that the first chair will take two hours to prepare but this will be subject to a learning rate (LR) of 95%.

The learning improvement will stop once 128 chairs have been made and the time for the 128th chair will be the time for all subsequent chairs. The cost of labour is $15 per hour.

The learning formula is shown on the formula sheet and at the 95% learning rate the value of b is -0·074000581.

Required:

(a) Calculate the average cost for the first 128 chairs made and identify any cost gap that may be present at

that stage. (8 marks)

(b) Assuming that a cost gap for the chair exists suggest four ways in which it could be closed. (6 marks)

The production manager denies any claims that a cost gap exists and has stated that the cost of the 128th chair will be low enough to yield the required margin.

(c) Calculate the cost of the 128th chair made and state whether the target cost is being achieved on the 128th chair. (6 marks)

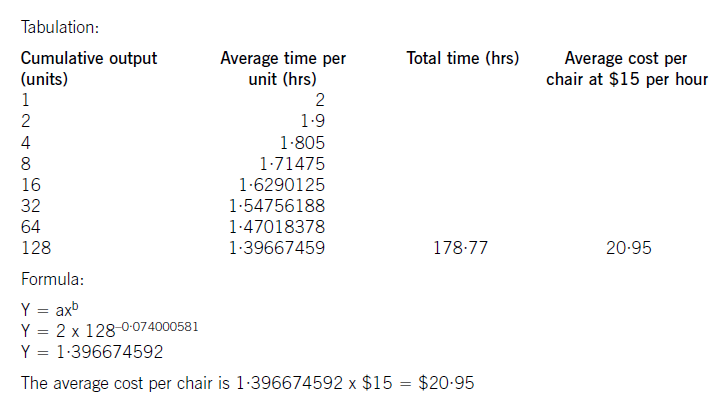

(W1)

The cost of the labour can be calculated using learning curve principles. The formula can be used or a tabular approach would

also give the average cost of 128 chairs. Both methods are acceptable and shown here.

(b) To reduce the cost gap various methods are possible (only four are needed for full marks)

– Re-design the chair to remove unnecessary features and hence cost

– Negotiate with the frame. supplier for a better cost. This may be easier as the volume of sales improve as suppliers often

are willing to give discounts for bulk buying. Alternatively a different frame. supplier could be found that offers a better

price. Care would be needed here to maintain the required quality

– Leather can be bought from different suppliers or at a better price also. Reducing the level of waste would save on cost.

Even a small reduction in waste rates would remove much of the cost gap that exists

– Improve the rate of learning by better training and supervision

– Employ cheaper labour by reducing the skill level expected. Care would also be needed here not to sacrifice quality or

push up waste rates.

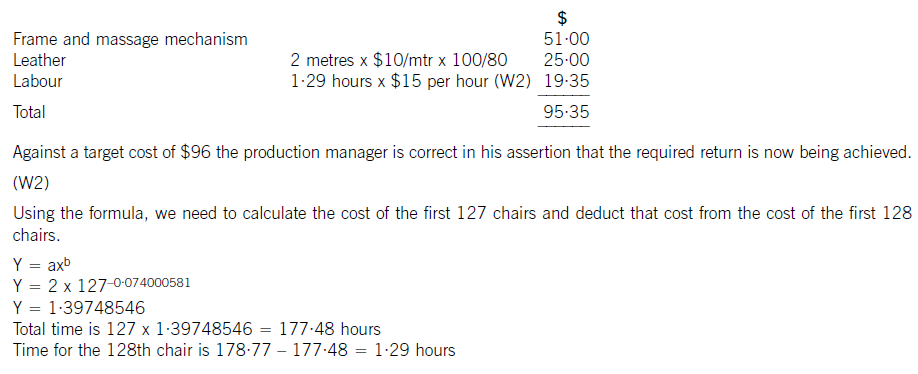

(c) The cost of the 128th chair will be:

(c) Issue of bond

The club proposes to issue a 7% bond with a face value of $50 million on 1 January 2007 at a discount of 5%

that will be secured on income from future ticket sales and corporate hospitality receipts, which are approximately

$20 million per annum. Under the agreement the club cannot use the first $6 million received from corporate

hospitality sales and reserved tickets (season tickets) as this will be used to repay the bond. The money from the

bond will be used to pay for ground improvements and to pay the wages of players.

The bond will be repayable, both capital and interest, over 15 years with the first payment of $6 million due on

31 December 2007. It has an effective interest rate of 7·7%. There will be no active market for the bond and

the company does not wish to use valuation models to value the bond. (6 marks)

Required:

Discuss how the above proposals would be dealt with in the financial statements of Seejoy for the year ending

31 December 2007, setting out their accounting treatment and appropriateness in helping the football club’s

cash flow problems.

(Candidates do not need knowledge of the football finance sector to answer this question.)

(c) Issue of bond

This form. of financing a football club’s operations is known as ‘securitisation’. Often in these cases a special purpose vehicle

is set up to administer the income stream or assets involved. In this case, a special purpose vehicle has not been set up. The

benefit of securitisation of the future corporate hospitality sales and season ticket receipts is that there will be a capital

injection into the club and it is likely that the effective interest rate is lower because of the security provided by the income

from the receipts. The main problem with the planned raising of capital is the way in which the money is to be used. The

use of the bond for ground improvements can be commended as long term cash should be used for long term investment but

using the bond for players’ wages will cause liquidity problems for the club.

This type of securitisation is often called a ‘future flow’ securitisation. There is no existing asset transferred to a special purpose

vehicle in this type of transaction and, therefore, there is no off balance sheet effect. The bond is shown as a long term liability

and is accounted for under IAS39 ‘Financial Instruments: Recognition and Measurement’. There are no issues of

derecognition of assets as there can be in other securitisation transactions. In some jurisdictions there are legal issues in

assigning future receivables as they constitute an unidentifiable debt which does not exist at present and because of this

uncertainty often the bond holders will require additional security such as a charge on the football stadium.

The bond will be a financial liability and it will be classified in one of two ways:

(i) Financial liabilities at fair value through profit or loss include financial liabilities that the entity either has incurred for

trading purposes and, where permitted, has designated to the category at inception. Derivative liabilities are always

treated as held for trading unless they are designated and effective as hedging instruments. An example of a liability held

for trading is an issued debt instrument that the entity intends to repurchase in the near term to make a gain from shortterm

movements in interest rates. It is unlikely that the bond will be classified in this category.

(ii) The second category is financial liabilities measured at amortised cost. It is the default category for financial liabilities

that do not meet the criteria for financial liabilities at fair value through profit or loss. In most entities, most financial

liabilities will fall into this category. Examples of financial liabilities that generally would be classified in this category are

account payables, note payables, issued debt instruments, and deposits from customers. Thus the bond is likely to be

classified under this heading. When a financial liability is recognised initially in the balance sheet, the liability is

measured at fair value. Fair value is the amount for which a liability can be settled between knowledgeable, willing

parties in an arm’s length transaction. Since fair value is a market transaction price, on initial recognition fair value will

usually equal the amount of consideration received for the financial liability. Subsequent to initial recognition financial

liabilities are measured using amortised cost or fair value. In this case the company does not wish to use valuation

models nor is there an active market for the bond and, therefore, amortised cost will be used to measure the bond.

The bond will be shown initially at $50 million × 95%, i.e. $47·5 million as this is the consideration received. Subsequentlyat 31 December 2007, the bond will be shown as follows:

(b) The management of Division C has identified the need to achieve cost savings in order to become more

competitive. They have decided that an analysis and investigation of quality costs into four sub-categories will

provide a focus for performance measurement and improvement.

Required:

Identify the FOUR sub-categories into which quality costs can be analysed and provide examples (which

must relate to Division C) of each of the four sub-categories of quality cost that can be investigated in order

that overall cost savings might be achieved and hence the performance improved. (8 marks)

(b) Quality costs may be monitored by measuring costs of non-conformance and costs of conformance.

Costs of non-conformance occur when the product fails to reach the design quality standards. Such costs may be subdivided

into internal failure costs and external failure costs.

Internal failure costs occur when the failure is detected before the transfer of the product to the customer.

External failure costs occur when the failure to reach the required standards is not detected until after the product has been

transferred to the customer.

Costs of conformance are those incurred in reducing or eliminating the costs of non-conformance. Such costs may be

subdivided into appraisal costs and prevention costs.

Appraisal costs are those associated with the evaluation of items such as purchased material and services in order to ensure

that they conform. to the agreed specification.

Prevention costs are those associated with the implementation of a quality improvement programme. Such costs are planned

in advance and their implementation should lead to continuous improvement.

Examples of quality costs relevant to Division C may include:

Internal failure costs: cost of materials scrapped due to poor receipt and storage procedures or losses of CC output due to poor

processing routines.

External failure costs: cost of quality problems with batch of CC not detected until it has reached Division B. This may require

free replacement of the batch and compensation for loss of output by Division B.

Appraisal costs: evaluation of purchased material and services in relation to the manufacture of CC to ensure that it conforms

to the agreed specification; e.g. inspection and testing before use.

Prevention costs: the cost of implementation of staff training and the costs of equipment testing to ensure that it conforms to

the specification standards required for the production of CC.

(Alternative relevant examples would be accepted)

(b) The chief executive of Xalam Co, an exporter of specialist equipment, has asked for advice on the accounting

treatment and disclosure of payments made for security consultancy services. The payments, which aim to

ensure that consignments are not impounded in the destination country of a major customer, may be material to

the financial statements for the year ending 30 June 2006. Xalam does not treat these payments as tax

deductible. (4 marks)

Required:

Identify and comment on the ethical and other professional issues raised by each of these matters and state what

action, if any, Dedza should now take.

NOTE: The mark allocation is shown against each of the three situations.

(b) Advice on payments

■ As compared with (a) there is no obvious tax issue. Xalam is not overstating expenditure for tax purposes.

■ The payments being made for security consultancy services amount to a bribe. Corruption and bribery (and extortion)

are designated categories of money laundering offence under ‘The Forty Recommendations’ of the Financial Action Task

Force on Money Laundering (FATF).

■ Xalam clearly benefits from the payments as it receives income from the contract with the major customer. This is

criminal property and possession of it is a money laundering offence.

■ Dedza should consider the seriousness of the disclosure made by the chief executive in the context of domestic law.

■ Dedza should consider its knowledge of import duties etc in the destination country before recommending a course of

action to Xalam.

■ Dedza may be guilty of a money laundering offence if the matter is not reported. If a report to the FIU is considered

necessary then Dedza should encourage Xalam to make voluntary disclosure. If Xalam does not, Dedza will not be in

breach of client confidentiality for reporting knowledge of a suspicious transaction.

Tutorial note: Making a report takes precedence over client confidentiality.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-05-20

- 2021-06-30

- 2020-01-10

- 2019-07-20

- 2020-01-10

- 2020-01-09

- 2020-04-23

- 2020-05-14

- 2020-04-23

- 2020-05-08

- 2020-03-25

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-02-05

- 2020-02-06

- 2020-01-09

- 2020-04-15

- 2020-01-10

- 2020-02-05

- 2020-01-10

- 2020-04-08

- 2020-04-07

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2021-02-26

- 2021-06-26