宁夏考生想知道ACCA的科目F2怎么备考?

发布时间:2020-01-10

学习ACCA,不仅是为了给自己的简历上增添一个拿的出手的证书,更是因为ACCA完整的知识体系,充实自己的大学生活。我认为,每一份努力都会有回报,只要功夫下的多,就没有什么事情做不好。这一份ACCA MA(F2)的备考技巧请大家收藏起来哦~

报考建议

F2的考试一般建议大家在结课之后一个月左右考试,因为F2是一门刷题型的科目,需要留出足够的做题,并且考前也需要模拟考进行练习;但也不宜太晚考,有些需要记忆的知识点容易遗忘。因此,F2最简单也是最直截了当的复习技巧就是题海战术,当然大家可以根据自己的实际情况进行调整,如果备考时间充裕,也可以缩短备考时间,如果碰上了学校的考试周,或者有自己的比较忙的事情,也可以适当拉长。

备考建议

① 备考初期:F2主要以刷题为主。F2是管理会计,偏计算,但是计算水平要求其实也很低,重要的是细心点,把题看懂。

在ACCA的官网中也有样卷与模考卷可以练习,其中样卷是可以免费进入,进行练习的,模考卷的练习是需要付7英镑的费用。:

② 临考准备:如果大家已经看完网课,也做了一定量的习题了后,这个时候应该要明确自己薄弱的地方在哪里。哪部分知识点比较薄弱,就花费多一点的时间去复习,反之就少花费一点时间。建议大家可以像考试一样,在电脑上认真地花两个小时做一套模拟卷,并且进行批改,看看自己在考试中会遇到什么问题。

如果觉得两个小时的时间不够,做不完,说明做题的速度不够,需要提高做题速度。那么再做一遍题库,或者找其他的练习册再进行题海战略是必要的。

如果发现某个知识点的题目都需要花特别多的时间,或错误率非常高,那么说明对这部分的知识掌握的并不是很好,需要再次反复去巩固这部分的知识点,这部分有关的网课以及习题是需要再重新回顾1-2遍的。

如果觉得用电脑看题自己非常不适应,会非常影响自己的思路和速度,那么平时就不要在纸质的练习册上做题了,应该多练练,比如可以在电脑上做电子版的练习册或题库,使自己更适应机考。

总之大家可以通过模拟考的形式明确自己的弱点,进行加强后再在考试前练习一次,这样考试前就不会太紧张。但考试紧张也是会在所难的,所以就要要求大家及时调整心态,快速找回考试状态。

F2知识点总结

1. Data

and information:

Unprocessed

--->data; Processed --->information

2.

Quality of good information

“ACCURATE”

3.

Mission statement(abstract) ---> Objective(SMART) --->Strategy(Possible

course of action)

4.

Planning (establishing the objectives& selecting appropriate strategies)

5.

Control(compare plans with actual results, reviewed and made changes)

6. The

relationship between planning, decision making and control

7.

Management information Strategic information

幻想一步成功者突遭失败,会觉得浪费了时间,付出了精力,却认为没有任何收获;在失败面前,懦弱者痛苦迷茫,彷徨畏缩;而强者却坚持不懈,紧追不舍。各位ACCAer们加油,期待听到你们3月份考试成功的好消息~

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

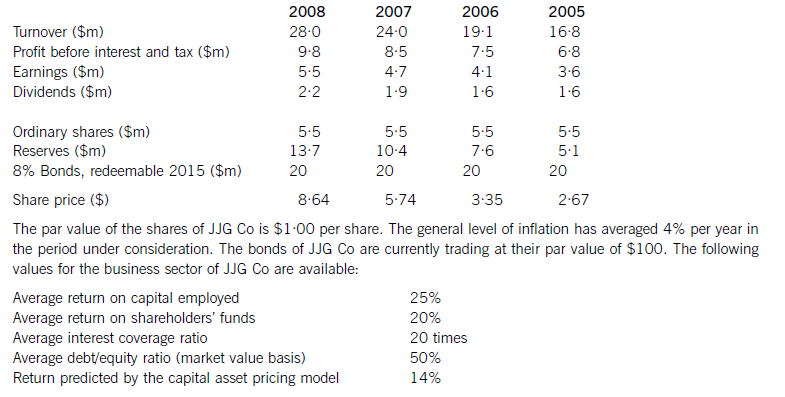

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion.

2 (a) Discuss the nature of the financial objectives that may be set in a not-for-profit organisation such as a charity

or a hospital. (8 marks)

2 (a) In the case of a not-for-profit (NFP) organisation, the limit on the services that can be provided is the amount of funds that

are available in a given period. A key financial objective for an NFP organisation such as a charity is therefore to raise as

much funds as possible. The fund-raising efforts of a charity may be directed towards the public or to grant-making bodies.

In addition, a charity may have income from investments made from surplus funds from previous periods. In any period,

however, a charity is likely to know from previous experience the amount and timing of the funds available for use. The same

is true for an NFP organisation funded by the government, such as a hospital, since such an organisation will operate under

budget constraints or cash limits. Whether funded by the government or not, NFP organisations will therefore have the

financial objective of keeping spending within budget, and budgets will play an important role in controlling spending and in

specifying the level of services or programmes it is planned to provide.

Since the amount of funding available is limited, NFP organisations will seek to generate the maximum benefit from available

funds. They will obtain resources for use by the organisation as economically as possible: they will employ these resources

efficiently, minimising waste and cutting back on any activities that do not assist in achieving the organisation’s non-financial

objectives; and they will ensure that their operations are directed as effectively as possible towards meeting their objectives.

The goals of economy, efficiency and effectiveness are collectively referred to as value for money (VFM). Economy is

concerned with minimising the input costs for a given level of output. Efficiency is concerned with maximising the outputs

obtained from a given level of input resources, i.e. with the process of transforming economic resources into desires services.

Effectiveness is concerned with the extent to which non-financial organisational goals are achieved.

Measuring the achievement of the financial objective of VFM is difficult because the non-financial goals of NFP organisations

are not quantifiable and so not directly measurable. However, current performance can be compared to historic performance

to ascertain the extent to which positive change has occurred. The availability of the healthcare provided by a hospital, for

example, can be measured by the time that patients have to wait for treatment or for an operation, and waiting times can be

compared year on year to determine the extent to which improvements have been achieved or publicised targets have been

met.

Lacking a profit motive, NFP organisations will have financial objectives that relate to the effective use of resources, such as

achieving a target return on capital employed. In an organisation funded by the government from finance raised through

taxation or public sector borrowing, this financial objective will be centrally imposed.

(b) Illustrate how you might use analytical procedures to provide audit evidence and reduce the level of detailed

substantive procedures. (7 marks)

(b) Illustration of use of analytical procedures as audit evidence

Tutorial note: Note that ‘as audit evidence’ requires consideration of substantive analytical procedures rather that the

identification of risks (relevant to part (a)).

Revenue

Analytical procedures may be used in testing revenue for completeness of recording (‘understatement’). The average selling

price of a vehicle in 2005 was $68,830 ($526·0 million ÷ 7,642 vehicles). Applying this to the number of vehicles sold

in 2006, might be projected to generate $698·8 million ($68,830 × 10,153) revenue from the sale of vehicles. The draft

financial statements therefore show a potential shortfall of $110·8 million ($(698·8 – 588·0) million) that is, 15·6%.

This should be investigated and substantiated through more detailed analytical procedures. For example, the number of

vehicles sold should be analysed into models and multiplied by the list price of each for a more accurate estimate of potential

revenue. The impact of discounts and other incentives (e.g. 0% finance) on the list prices should then be allowed for. If

recorded revenue for 2006 (as per draft income statement adjusted for cutoff and consignment inventories) is materially lower

than that calculated, detailed substantive procedures may be required in order to show that there is no material error.

‘Proof in total’/reasonableness tests

The material correctness, or otherwise, of income statement items (in particular) may be assessed through appropriate ‘proof

in total’ calculations (or ‘reasonableness’ tests). For example:

■ Employee benefits costs: the average number of employees by category (waged/salaried/apprenticed) × the average pay

rate for each might prove that in total $91·0 million (as adjusted to actual at 31 December 2006) is not materially

misstated. The average number of employees needs to be checked substantively (e.g. recalculated based on the number

of employees on each payroll) and the average pay rates (e.g. to rates agreed with employee representatives).

Tutorial note: An alternative reasonableness might be to take last year’s actual adjusted for 2006 numbers of

employees grossed-up for any pay increases during the year (pro-rated as necessary).

■ Depreciation: the cost (or net book value) of each category of asset × by the relevant straight-line (or reducing balance)

depreciation rate. If a ‘ballpark’ calculation for the year is materially different to the annual charge a more detailed

calculation can be made using monthly depreciation calculations. The cost (or net book value) on which depreciation

is calculated should be substantively tested, for example by agreeing brought forward balances to prior year working

papers and additions to purchase invoices (costings in respect of assets under construction).

Tutorial note: Alternatively, last year’s depreciation charge may be reconciled to this year’s by considering depreciation

rates applied to brought forward balances with adjustments for additions/disposals.

■ Interest income: an average interest rate for the year can be applied to the monthly balance invested (e.g. in deposit

accounts) and compared with the amount recognised for the year to 31 December 2006 (as adjusted for any accrued

interest per the bank letter for audit purposes). The monthly balances (or averages) on which the calculation is

performed should be substantiated to bank deposit statements.

■ Interest expense: if the cash balances do not go into overdraft then this may be similar expenses (e.g. prompt payment

discounts to customers). If this is to particular dealers then a proof in total might be to apply the discount rate to the

amounts invoiced to the dealer during the period.

Immaterial items

For immaterial items analytical procedures alone may provide sufficient audit evidence that amounts in the financial

statements are not materially misstated so that detailed substantive procedures are not required. For example, a comparison

of administration and distribution, maintenance and insurance costs for 2006 compared with 2005 may be sufficient to show

that material error is highly unlikely. If necessary, further reasonableness tests could be performed. For example, considering

insurance costs to value of assets insured or maintenance costs to costs of assets maintained.

Ratio analysis

Ratio analysis can provide substantive evidence that income statement and balance sheet items are not materially misstated

by considering their inter-relationships. For example:

■ Asset turnover: Based on the draft financial statements property, plant and equipment has turned over 5·2 times

($645·5/124·5) compared with 5·9 times in 2005. This again highlights that income may be overstated, or assets

overstated (e.g. if depreciation is understated).

■ Inventory turnover: Using cost of materials adjusted for changes in inventories this has remained stable at 10·9 times.

Tutorial note: This is to be expected as in (a) the cost in the income statement has increased by 9% and the value of

inventories by 8·5%.

Inventories represent the smallest asset value on the balance sheet at 31 December 2006 (7·8% of total assets).

Therefore substantive procedures may be limited to agreeing physical count of material items (vehicles) and agreeing

cutoff.

■ Average collection period: This has increased to 41 days (73·1/645·5 × 365) from 30 days. Further substantive analysis

is required, for example, separating out non-current amounts (for sales on 0% finance terms). Substantive procedures

may be limited to confirmation of amounts due from dealers (and/or receipt of after-date cash) and agreeing cutoff of

goods on consignment.

■ Payment periods: This has remained constant at 37 days (2005 – 38 days). Detailed substantive procedures may be

restricted to reconciling only major suppliers’ statements and agreeing the cutoff on parts purchased from them.

(b) You are the manager responsible for the audit of Poppy Co, a manufacturing company with a year ended

31 October 2008. In the last year, several investment properties have been purchased to utilise surplus funds

and to provide rental income. The properties have been revalued at the year end in accordance with IAS 40

Investment Property, they are recognised on the statement of financial position at a fair value of $8 million, and

the total assets of Poppy Co are $160 million at 31 October 2008. An external valuer has been used to provide

the fair value for each property.

Required:

(i) Recommend the enquiries to be made in respect of the external valuer, before placing any reliance on their

work, and explain the reason for the enquiries; (7 marks)

(b) (i) Enquiries in respect of the external valuer

Enquiries would need to be made for two main reasons, firstly to determine the competence, and secondly the objectivity

of the valuer. ISA 620 Using the Work of an Expert contains guidance in this area.

Competence

Enquiries could include:

– Is the valuer a member of a recognised professional body, for example a nationally or internationally recognised

institute of registered surveyors?

– Does the valuer possess any necessary licence to carry out valuations for companies?

– How long has the valuer been a member of the recognised body, or how long has the valuer been licensed under

that body?

– How much experience does the valuer have in providing valuations of the particular type of investment properties

held by Poppy Co?

– Does the valuer have specific experience of evaluating properties for the purpose of including their fair value within

the financial statements?

– Is there any evidence of the reputation of the valuer, e.g. professional references, recommendations from other

companies for which a valuation service has been provided?

– How much experience, if any, does the valuer have with Poppy Co?

Using the above enquiries, the auditor is trying to form. an opinion as to the relevance and reliability of the valuation

provided. ISA 500 Audit Evidence requires that the auditor gathers evidence that is both sufficient and appropriate. The

auditor needs to ensure that the fair values provided by the valuer for inclusion in the financial statements have been

arrived at using appropriate knowledge and skill which should be evidenced by the valuer being a member of a

professional body, and, if necessary, holding a licence under that body.

It is important that the fair values have been arrived at using methods allowed under IAS 40 Investment Property. If any

other valuation method has been used then the value recognised in the statement of financial position may not be in

accordance with financial reporting standards. Thus it is important to understand whether the valuer has experience

specifically in providing valuations that comply with IAS 40, and how many times the valuer has appraised properties

similar to those owned by Poppy Co.

In gauging the reliability of the fair value, the auditor may wish to consider how Poppy Co decided to appoint this

particular valuer, e.g. on the basis of a recommendation or after receiving references from companies for which

valuations had previously been provided.

It will also be important to consider how familiar the valuer is with Poppy Co’s business and environment, as a way to

assess the reliability and appropriateness of any assumptions used in the valuation technique.

Objectivity

Enquiries could include:

– Does the valuer have any financial interest in Poppy Co, e.g. shares held directly or indirectly in the company?

– Does the valuer have any personal relationship with any director or employee of Poppy Co?

– Is the fee paid for the valuation service reasonable and a fair, market based price?

With these enquiries, the auditor is gaining assurance that the valuer will perform. the valuation from an independent

point of view. If the valuer had a financial interest in Poppy Co, there would be incentive to manipulate the valuation in

a way best suited to the financial statements of the company. Equally if the valuer had a personal relationship with a

senior member of staff at Poppy Co, the valuer may feel pressured to give a favourable opinion on the valuation of the

properties.

The level of fee paid is important. It should be commensurate with the market rate paid for this type of valuation. If the

valuer was paid in excess of what might be considered a normal fee, it could indicate that the valuer was encouraged,

or even bribed, to provide a favourable valuation.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-01-09

- 2020-05-20

- 2019-04-10

- 2020-01-10

- 2020-01-10

- 2020-04-20

- 2020-01-09

- 2020-04-09

- 2020-01-10

- 2020-01-10

- 2020-05-01

- 2020-04-29

- 2020-01-10

- 2020-01-10

- 2020-02-21

- 2020-01-09

- 2020-03-27

- 2020-02-05

- 2020-02-18

- 2020-03-12

- 2020-04-24

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-04-22

- 2020-01-11

- 2019-07-20

- 2020-03-07

- 2020-01-10