贵州省考生:ACCA考试成绩有效期是多久?

发布时间:2020-01-10

当人生面对许多选择的时候,我们需要谨慎;当我们没有选择的时候,就把压力当挑战,给自己一个信心,近日,参加ACCA考试的小伙伴来咨询我一些关于ACCA考试成绩有效期的问题,接下来51题库考试学习网将一一为其解答,建议大家收藏起来哟~

ACCA F阶段(AB-FM)课程考试已正式取消考试期限,换句话说,已经考完的各F阶段科目的考试成绩永久有效,不必重新考试。

不过,对于ACCA核心课程(P阶段)的考试成绩还是设置了7年的有效期。每位学员必须在通过第一科战略课程之日起,7年内完成所有的P阶段科目考试。(超出规定年限就只能重新考试)

ACCA考完一般都需要多久?

ACCA每年有4次考季,每次最多可以报考4门,每年最多报考8门,而ACCA考试全科共需要通过13门考试,所以,全部都能一次通过考试的情况下,考完ACCA最快也要近两年的时间。

ACCA一般都能考多久呢?

以ACCA近年的考试通过率来看,在无免考的情况下,从F1-P阶段完成考试的时间大致是2年-3年的时间。当然,如果你有相应的免考机会,比如拥有CPA、MPAcc等证书的话则可以免除部分科目的考试。如此一来,就能大大缩短你通过考试的时间了。

ACCA免考政策如下:

教育部认可高校毕业生

1)会计学专业 - 获得学士或硕士学位(金融/财务管理/审计专业也享受等同会计学专业的免试政策,下同) 免试5门课程;(即是本科或者研究生毕业)

2)会计学 - 辅修专业 免试3门课程;(双学位的,且第二专业是会计的)

3)法律专业 免试1门课程;

4)商务及管理专业 免试1门课程;

5)MPAcc专业(获得MPAcc学位或完成MPAcc大纲规定的所有课程、只有论文待完成) 免试5门课程*;

6)MBA - 获得MBA学位 免试3门课程;

7)非相关专业 无免试课程。

*注:部分院校的MPAcc专业已专门申请ACCA总部的免试审核,因此有多于5门的免试,具体请查询 ACCA总部官网。

教育部认可高校在校生(本科)

1)会计学专业 - 完成第一学年课程 可以注册为ACCA正式学员 无免试;

2)会计学专业 - 完成第二学年课程 免试3门课程;

3)其他专业 - 在校生 ACCA全球网站查询。

中国注册会计师资格

1)CICPA - 2009年“6+1”制度前获得全科合格证或者会员资格证 免试5门课程;

2)CICPA - 2009年“6+1”制度后获得全科合格证或者会员资格证 免试9门课程;

3)FIA(Foundation in

Accountancy) 通过FIA(Foundation in Accountancy)所有考试并取得相关工作经验 免试4门课程。

关于ACCA有效期的介绍

ACCA考试期限跟CPA一样实行轮废制,即需要在一定的时间里面考完规定的科目,否则成绩将会无效。那么这个时间怎么算的呢?

根据以前的规则,学员必须在首次报名注册后10年内通过所有考试,否则将注销其学员资格。后特许公认会计师公会ACCA对学员通过ACCA资格认证所有考试的时限做出了重要调整。F段成绩永久有效,P段要在7年内考完。根据新规则,专业阶段考试的时限将为7年。因此,国际财会基础资格(Foundations in Accountancy,简称FIA)的考试以及ACCA资格考试的基础阶段F1-F9考试将不再有通过时限。

“7年政策”意味着从你通过P阶段的第一门科目开始,7年内需完成P阶段所要求的所有ACCA考试科目。否则,从第8年开始,你第1年所考过的P阶段科目成绩将会被视为过期作废,须重新考试。

以上就是关于ACCA考试的相关信息,51题库考试学习网想告诉大家的是,其实一个证书好不好考并不是绝对的,这取决于你自己的努力程度。俗话说,有志者事竟成,相信只要通过自己的不懈努力,通过看似很困难的ACCA考试也不是太大的问题。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(iv) critiques the performance measurement system at TSC. (5 marks

(iv) The performance measurement system used by TSC appears simplistic. However, it may be considered to be measuring

the right things since the specific measures used cover a range of dimensions designed to focus the organisation on

factors thought to be central to corporate success, and not confined to traditional financial measures.

Internal benchmarking is used at TSC in order to provide sets of absolute standards that all depots are expected to attain.

This should help to ensure that there is a continual focus upon the adoption of ‘best practice’ at all depots. Benchmarks

on delivery performance place an emphasis upon quality of service whereas benchmarks on profitability are focused

solely upon profitability!

Incentive schemes are used throughout the business, linking the achievement of company targets with financial rewards.

It might well be the case that the profit incentive would act as a powerful motivator to each depot management team.

However, what is required for the prosperity of TSC is a focus of management on the determinants of success as opposed

to the results of success.

(Alternative relevant discussion would be acceptable)

You are an audit manager responsible for providing hot reviews on selected audit clients within your firm of Chartered

Certified Accountants. You are currently reviewing the audit working papers for Pulp Co, a long standing audit client,

for the year ended 31 January 2008. The draft statement of financial position (balance sheet) of Pulp Co shows total

assets of $12 million (2007 – $11·5 million).The audit senior has made the following comment in a summary of

issues for your review:

‘Pulp Co’s statement of financial position (balance sheet) shows a receivable classified as a current asset with a value

of $25,000. The only audit evidence we have requested and obtained is a management representation stating the

following:

(1) that the amount is owed to Pulp Co from Jarvis Co,

(2) that Jarvis Co is controlled by Pulp Co’s chairman, Peter Sheffield, and

(3) that the balance is likely to be received six months after Pulp Co’s year end.

The receivable was also outstanding at the last year end when an identical management representation was provided,

and our working papers noted that because the balance was immaterial no further work was considered necessary.

No disclosure has been made in the financial statements regarding the balance. Jarvis Co is not audited by our firm

and we have verified that Pulp Co does not own any shares in Jarvis Co.’

Required:

(b) In relation to the receivable recognised on the statement of financial position (balance sheet) of Pulp Co as

at 31 January 2008:

(i) Comment on the matters you should consider. (5 marks)

(b) (i) Matters to consider

Materiality

The receivable represents only 0·2% (25,000/12 million x 100) of total assets so is immaterial in monetary terms.

However, the details of the transaction could make it material by nature.

The amount is outstanding from a company under the control of Pulp Co’s chairman. Readers of the financial statements

would be interested to know the details of this transaction, which currently is not disclosed. Elements of the transaction

could be subject to bias, specifically the repayment terms, which appear to be beyond normal commercial credit terms.

Paul Sheffield may have used his influence over the two companies to ‘engineer’ the transaction. Disclosure is necessary

due to the nature of the transaction, the monetary value is irrelevant.

A further matter to consider is whether this is a one-off transaction, or indicative of further transactions between the two

companies.

Relevant accounting standard

The definitions in IAS 24 must be carefully considered to establish whether this actually constitutes a related party

transaction. The standard specifically states that two entities are not necessarily related parties just because they have

a director or other member of key management in common. The audit senior states that Jarvis Co is controlled by Peter

Sheffield, who is also the chairman of Pulp Co. It seems that Peter Sheffield is in a position of control/significant influence

over the two companies (though this would have to be clarified through further audit procedures), and thus the two

companies are likely to be perceived as related.

IAS 24 requires full disclosure of the following in respect of related party transactions:

– the nature of the related party relationship,

– the amount of the transaction,

– the amount of any balances outstanding including terms and conditions, details of security offered, and the nature

of consideration to be provided in settlement,

– any allowances for receivables and associated expense.

There is currently a breach of IAS 24 as no disclosure has been made in the notes to the financial statements. If not

amended, the audit opinion on the financial statements should be qualified with an ‘except for’ disagreement. In

addition, if practicable, the auditor’s report should include the information that would have been included in the financial

statements had the requirements of IAS 24 been adhered to.

Valuation and classification of the receivable

A receivable should only be recognised if it will give rise to future economic benefit, i.e. a future cash inflow. It appears

that the receivable is long outstanding – if the amount is unlikely to be recovered then it should be written off as a bad

debt and the associated expense recognised. It is possible that assets and profits are overstated.

Although a representation has been received indicating that the amount will be paid to Pulp Co, the auditor should be

sceptical of this claim given that the same representation was given last year, and the amount was not subsequently

recovered. The $25,000 could be recoverable in the long term, in which case the receivable should be reclassified as

a non-current asset. The amount advanced to Jarvis Co could effectively be an investment rather than a short term

receivable. Correct classification on the statement of financial position (balance sheet) is crucial for the financial

statements to properly show the liquidity position of the company at the year end.

Tutorial note: Digressions into management imposing a limitation in scope by withholding evidence are irrelevant in this

case, as the scenario states that the only evidence that the auditors have asked for is a management representation.

There is no indication in the scenario that the auditors have asked for, and been refused any evidence.

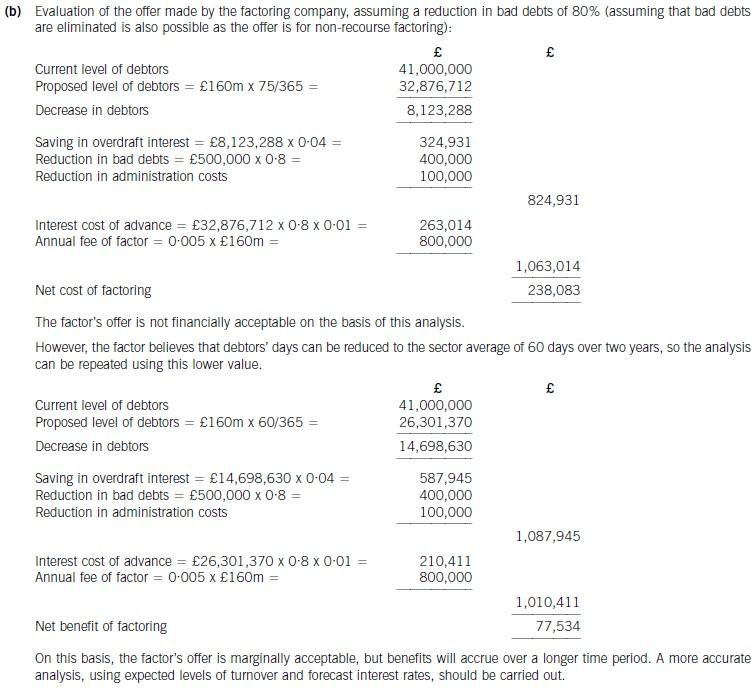

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-04-28

- 2020-01-10

- 2020-01-10

- 2020-04-25

- 2020-01-10

- 2020-04-15

- 2020-01-09

- 2020-01-10

- 2020-01-11

- 2020-01-09

- 2020-01-10

- 2020-01-09

- 2020-04-22

- 2020-05-21

- 2020-01-09

- 2020-04-09

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-04-11

- 2020-04-18

- 2020-01-09

- 2020-08-13

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-01-09

- 2019-07-20

- 2020-01-10

- 2019-11-28