ACCA会员有多牛?

发布时间:2020-03-07

随着我国经济发展,ACCA也开始进入更多的视线当中。由于ACCA考试科目较多,且采用全英文答题模式,一些小伙伴在了解ACCA考试的详细信息后,不免在网上询问ACCA会员含金量究竟有多高。鉴于此,51题库考试学习网在下面为大家带来有关2020年ACCA会员就业前景的相关信息,以供参考。

首先,ACCA培养出的会员能力较强。ACCA的课程就是根据现时商务社会对财会人员的实际要求进行开发、设计的,尤其是注意培养学员的分析能力和在复杂条件下的决策、判断能力。因此,ACCA课程所带来的系统的、高质量的培训会给予学生真才实学,让学员学成后能适应各种环境,并使会员成为具有全面管理素质的高级财务管理专家。也就是说, ACCA会员几乎拥有财会人员的所有能力。

除了培养方向外,ACCA会员的就业方向也是非常不错的。ACCA属于国际专业会计师组织,在国际上享有很高的声誉,与众多国际知名企业建立了密切的合作关系,比如跨国企业、各国地方企业、其他会计师组织、教育机构、以及联合国、世界银行等世界性组织。ACCA会员在这些组织和企业就职的岗位,都有良好的薪资待遇以及较高的社会地位。

那么,ACCA会员的就职方法是哪些呢?ACCA学员毕业后的就职方向:外资银行金融投资分析师;跨国公司的财务、内审、金融、风险控制岗位;国际会计师事务所的审计师、咨询师岗位;国内境外上市公司的财务、金融分析岗位;国内审计师事务所的涉外部门主管等。无一例外,这些岗位都属于涉外岗位,拥有很好的薪资待遇。

另外,ACCA会员的高含金量还体现在这些方面:

首先,ACCA会员资格在国际上得到广泛认可,尤其得到欧盟立法以及许多国家公司法的承认。因此可以说,拥有ACCA会员资格,就拥有了在世界各地就业的“通行证”。在世界上的很多国家,ACCA会员都能轻松获得一份好的工作。

其次,ACCA会员在工商企业财务部门、(四大)审计/会计师事务所、金融机构和财政、税务部门从事财务以及财务管理工作,ACCA会员中有很多在世界各地大公司担任高级职位(财务经理、财务总监CFO,甚至总裁CEO)。因此,ACCA会员的就业前景是非常好的。

此外,ACCA还受到在中国的跨国公司、大型企业和国际“五大”会计公司全面认可。总的来说,ACCA学员年薪在中国50-100万RMB。

以上就是关于ACCA就业前景的相关情况。51题库考试学习网提醒:ACCA考试难度大多是来源于全英文考试模式和坚持,尤其是后者,想要顺利取得ACCA会员证书,需要小伙伴们不断的坚持哦。最后,51题库考试学习网预祝准备参加2020年ACCA考试的小伙伴都能顺利通过。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(c) Discuss the practical problems that may be encountered in the implementation of an activity-based system

of product cost management. (5 marks)

(c) The benefits of an activity-based system as the basis for product cost/profit estimation may not be straightforward. A number

of problems may be identified.

The selection of relevant activities and cost drivers may be complicated where there are many activities and cost drivers in

complex business situations.

There may be difficulty in the collection of data to enable accurate cost driver rates to be calculated. This is also likely to

require an extensive data collection and analysis system.

The problem of ‘cost driver denominator level’ may also prove difficult. This is similar to the problem in a traditional volume

related system. This is linked to the problem of fixed/variable cost analysis. For example the cost per batch may be fixed. Its

impact may be reduced, however, where the batch size can be increased without a proportionate increase in cost.

The achievement of the required level of management skill and commitment to change may also detract from the

implementation of the new system. Management may feel that the activity based approach contains too many assumptions

and estimates about activities and cost drivers. There may be doubt as to the degree of increased accuracy which it provides.

(alternative relevant examples and discussion would be acceptable)

3 Better budgeting in recent years may have been seen as a movement from ‘incremental budgeting’ to alternative

budgeting approaches.

However, academic studies (e.g. Beyond Budgeting – Hope & Fraser) argue that the annual budget model may be

seen as (i) having a number of inherent weaknesses and (ii) acting as a barrier to the effective implementation of

alternative models for use in the accomplishment of strategic change.

Required:

(a) Identify and comment on FIVE inherent weaknesses of the annual budget model irrespective of the budgeting

approach that is applied. (8 marks)

(a) The weaknesses of traditional budgeting processes include the following:

– many commentators, including Hope and Fraser, contend that budgets prepared under traditional processes add little

value and require far too much valuable management time which would be better spent elsewhere.

– too heavy a reliance on the ‘agreed’ budget has an adverse impact on management behaviour which can become

dysfunctional having regard to the objectives of the organisation as a whole.

– the use of budgeting as base for communicating corporate goals, setting objectives, continuous improvement, etc is seen

as contrary to the original purpose of budgeting as a financial control mechanism.

– most budgets are not based on a rational causal model of resource consumption but are often the result of protracted

internal bargaining processes.

– conformance to budget is not seen as compatible with a drive towards continuous improvement.

– budgeting has an insufficient external focus.

You are the audit supervisor of Maple & Co and are currently planning the audit of an existing client, Sycamore Science Co (Sycamore), whose year end was 30 April 2015. Sycamore is a pharmaceutical company, which manufactures and supplies a wide range of medical supplies. The draft financial statements show revenue of $35·6 million and profit before tax of $5·9 million.

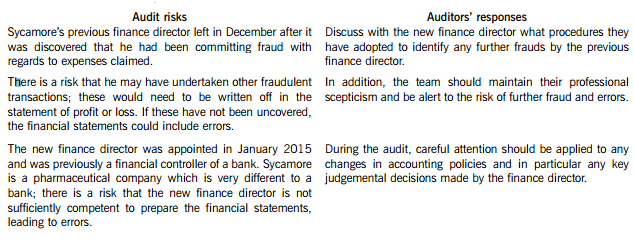

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

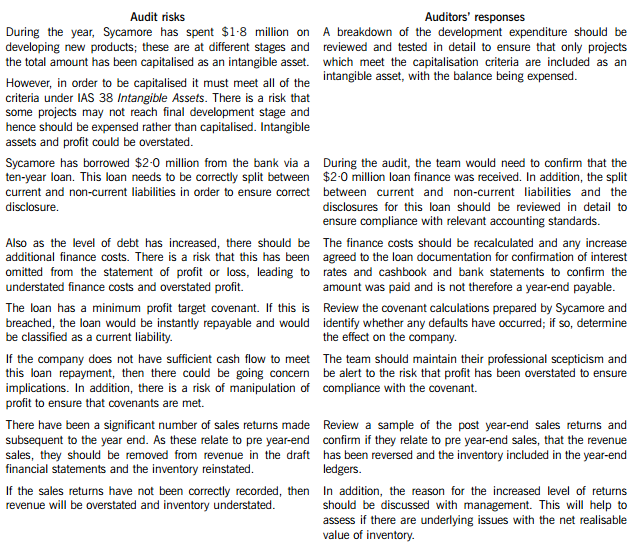

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

(a) Fraud responsibility

Maple & Co must conduct an audit in accordance with ISA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements and are responsible for obtaining reasonable assurance that the financial statements taken as a whole are free from material misstatement, whether caused by fraud or error.

In order to fulfil this responsibility, Maple & Co is required to identify and assess the risks of material misstatement of the financial statements due to fraud.

They need to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses. In addition, Maple & Co must respond appropriately to fraud or suspected fraud identified during the audit.

When obtaining reasonable assurance, Maple & Co is responsible for maintaining professional scepticism throughout the audit, considering the potential for management override of controls and recognising the fact that audit procedures which are effective in detecting error may not be effective in detecting fraud.

To ensure that the whole engagement team is aware of the risks and responsibilities for fraud and error, ISAs require that a discussion is held within the team. For members not present at the meeting, Sycamore’s audit engagement partner should determine which matters are to be communicated to them.

(b) Audit risks and auditors’ responses

(c) (i) Review engagements

Review engagements are often undertaken as an alternative to an audit, and involve a practitioner reviewing financial data, such as six-monthly figures. This would involve the practitioner undertaking procedures to state whether anything has come to their attention which causes the practitioner to believe that the financial data is not in accordance with the financial reporting framework.

A review engagement differs to an external audit in that the procedures undertaken are not nearly as comprehensive as those in an audit, with procedures such as analytical review and enquiry used extensively. In addition, the practitioner does not need to comply with ISAs as these only relate to external audits.

(ii) Levels of assurance

The level of assurance provided by audit and review engagements is as follows:

External audit – A high but not absolute level of assurance is provided, this is known as reasonable assurance. This provides comfort that the financial statements present fairly in all material respects (or are true and fair) and are free of material misstatements.

Review engagements – where an opinion is being provided, the practitioner gathers sufficient evidence to be satisfied that the subject matter is plausible; in this case negative assurance is given whereby the practitioner confirms that nothing has come to their attention which indicates that the subject matter contains material misstatements.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-04-28

- 2020-04-07

- 2020-01-09

- 2020-01-10

- 2019-07-20

- 2020-05-21

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-02-07

- 2020-01-10

- 2020-05-09

- 2019-12-28

- 2020-03-08

- 2020-01-10

- 2020-01-09

- 2020-01-09

- 2021-06-26

- 2020-01-31

- 2020-05-09

- 2020-04-24

- 2020-04-20

- 2020-01-10

- 2020-01-10

- 2020-01-01

- 2020-03-07

- 2020-01-09

- 2020-04-15

- 2020-01-10