2020年ACCA考试财务管理基础知识辅导资料(4)

发布时间:2020-10-18

距离ACCA考试还有45天的时间,各位小伙伴备考的如何了啊,今日51题库考试学习网为大家分享“2020年ACCA考试财务管理基础知识辅导资料(4)”的相关知识点,一起过来复习巩固一下吧。

Payback method

The payback method is used to determine how long it

will take for future cash inflows from the project to equal the initial cost of

the project. The method as the name implies establishes the payback period of

each project. As the method stands, the shorter the payback period the better.

It is often argued that industries where products get outdated quickly such as

fashion and computers will prefer to use the payback method. The reason being

that it is critical that the initial cost of the project is recovered quickly.

In any case, most organizations have a set of standard payback periods for each

investment project. They will in most cases compare the payback period from

each investment project with the pre-determined payback period. Any project

that falls short of the standard payback period will be rejected.

Evidence has shown that apart from this fact, managers

will prefer to use the method as an initial screening process because it is

easy to use and understand by them. One important disadvantage of the method is

that it ignores the time value of money. It also ignores profitability of the

project but stresses the importance of liquidity. Whether this is an advantage

or not will depend on the area of interest to the individual concerned.

Accounting Rate of Return (ARR)

This method ARR is also referred to by some other

names such as Return on Investment (ROI), Return on Capital Employed (ROCE).

The most important thing to remember about this method is that it establishes

rates of return on projects. There are different ways of determining a rate of

return. For the purposes of this article, we will use Average Accounting

Profits divided by Average Capital Employed multiplied by 100.

When there are two or more investment projects, rates

of return are compared. A project, which has a higher rate, will be

recommended, as this is an indication that it will give a higher return to the

investing entity compared with the one with a lower rate.

以上就是51题库考试学习网带给大家的全部内容,相信小伙伴们都了解清楚。预祝大家在ACCA考试中取得满意的成绩,如果想要了解更多关于ACCA考试的资讯,敬请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

6 The explosive growth of investing and raising capital in the global markets has put new emphasis on the development

of international accounting, auditing and ethical standards. The International Federation of Accountants (IFAC) has

been at the forefront of the development of the worldwide accountancy profession through its activities in ethics,

auditing and education.

Required:

Explain the developments in each of the following areas and indicate how they affect Chartered Certified

Accountants:

(a) IFAC’s ‘Code of Ethics for Professional Accountants’; (5 marks)

6 DEVELOPMENTS AND CERTIFIED CHARTERED ACCOUNTANTS

Tutorial note: The answer which follows is indicative of the range of points which might be made. Other relevant material will

be given suitable credit.

(a) IFAC’s ‘Code of Ethics for Professional Accountants’

Since its issue in 1996, IFAC’s ‘Code of Ethics for Professional Accountants’ (‘The Code’) has undergone several revisions

(1996, 1998, 2001, 2004 and 2005). IFAC holds the view that due to national differences (of culture, language, legal and

social systems) the task of preparing detailed ethical requirements is primarily that of the member bodies in each country

concerned (and that they also have the responsibility to implement and enforce such requirements).

In recognizing the responsibilities of the accountancy profession, IFAC considers its own role to be in providing guidance and

promoting harmonization. IFAC has established ‘The Code’ to provide a basis on which the ethical requirements for

professional accountants in each country should be founded.

IFAC’s conceptual approach is principles-based. It provides a route to convergence that emphasises the profession’s integrity.

This approach may be summarised as:

■ identifying and evaluating circumstances and relationships that create threats (e.g. to independence); and

■ taking appropriate action to:

– eliminate these threats; or

– reduce them to an acceptable level by the application of safeguards.

If no safeguards are available to reduce a threat to an acceptable level an assurance engagement must be refused or

discontinued.

This approach was first introduced to Section 8 of The Code, on independence, and is applicable to assurance engagements

when the assurance report is dated on or after 31 December 2004.

Further to the cases of Enron, Worldcom and Parmalat, IFAC issued a revised Code in July 2005 that applies to all professional

accountants, whether in public practice, business, industry or government2.

A member body of IFAC may not apply less stringent standards than those stated in the Code. The Code is effective from

30 June 2006.

Practicing accountants and members in business must maintain the high standards of professional ethics that are expected

by their professional bodies (such as ACCA). These developments codify current best practice in the wake of the

aforementioned recent corporate scandals.

The developments in The Code have wider application in that it:

■ applies to all assurance services (not just audit);

■ considers the standpoints of the firm and of the assurance team.

Since ACCA is a member-body of IFAC the elevation of The Code to a standard will affect all Chartered Certified Accountants.

.

Big Cheese Chairs (BCC) manufactures and sells executive leather chairs. They are considering a new design of massaging chair to launch into the competitive market in which they operate.

They have carried out an investigation in the market and using a target costing system have targeted a competitive selling price of $120 for the chair. BCC wants a margin on selling price of 20% (ignoring any overheads).

The frame. and massage mechanism will be bought in for $51 per chair and BCC will upholster it in leather and assemble it ready for despatch.

Leather costs $10 per metre and two metres are needed for a complete chair although 20% of all leather is wasted in the upholstery process.

The upholstery and assembly process will be subject to a learning effect as the workers get used to the new design.

BCC estimates that the first chair will take two hours to prepare but this will be subject to a learning rate (LR) of 95%.

The learning improvement will stop once 128 chairs have been made and the time for the 128th chair will be the time for all subsequent chairs. The cost of labour is $15 per hour.

The learning formula is shown on the formula sheet and at the 95% learning rate the value of b is -0·074000581.

Required:

(a) Calculate the average cost for the first 128 chairs made and identify any cost gap that may be present at

that stage. (8 marks)

(b) Assuming that a cost gap for the chair exists suggest four ways in which it could be closed. (6 marks)

The production manager denies any claims that a cost gap exists and has stated that the cost of the 128th chair will be low enough to yield the required margin.

(c) Calculate the cost of the 128th chair made and state whether the target cost is being achieved on the 128th chair. (6 marks)

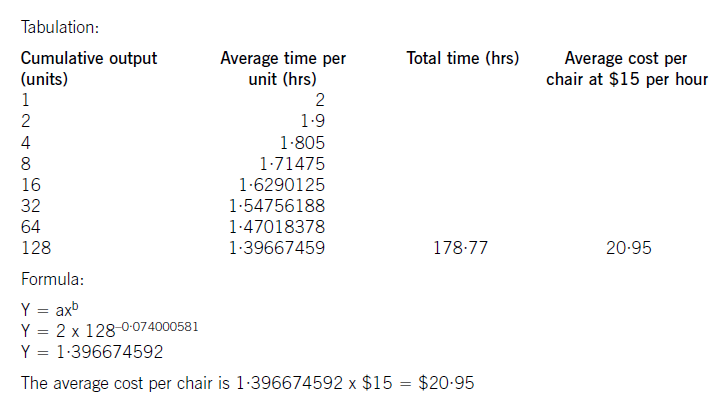

(W1)

The cost of the labour can be calculated using learning curve principles. The formula can be used or a tabular approach would

also give the average cost of 128 chairs. Both methods are acceptable and shown here.

(b) To reduce the cost gap various methods are possible (only four are needed for full marks)

– Re-design the chair to remove unnecessary features and hence cost

– Negotiate with the frame. supplier for a better cost. This may be easier as the volume of sales improve as suppliers often

are willing to give discounts for bulk buying. Alternatively a different frame. supplier could be found that offers a better

price. Care would be needed here to maintain the required quality

– Leather can be bought from different suppliers or at a better price also. Reducing the level of waste would save on cost.

Even a small reduction in waste rates would remove much of the cost gap that exists

– Improve the rate of learning by better training and supervision

– Employ cheaper labour by reducing the skill level expected. Care would also be needed here not to sacrifice quality or

push up waste rates.

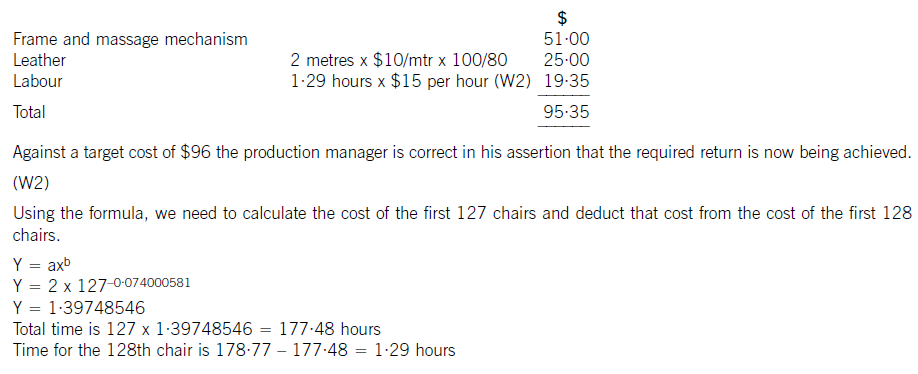

(c) The cost of the 128th chair will be:

(c) the deferred tax implications (with suitable calculations) for the company which arise from the recognition

of a remuneration expense for the directors’ share options. (7 marks)

4 A properly conducted appraisal interview is fundamental in ensuring the success of an organisation’s performance

appraisal system.

Required:

(a) Describe three approaches to conducting the appraisal interview. (5 marks)

4 Appraisal systems are central to human resource management and understanding the difficulties of such schemes and the correct

approach to them is necessary if the appraisal process is to be successful and worthwhile.

(a) The manager conducting the interview might base it on one of three approaches.

The Tell and Sell Method. The manager explains to the employee being appraised how the appraisal assessment is to be undertaken and gains acceptance of the evaluation and improvement plan from the employee. Human resource skills are important with this approach in order for the manager to be able to provide constructive criticism and to motivate the employee.

The Tell and Listen Method. The manager invites the employee to respond to the way that the interview is to be conducted.This approach requires counselling skills and encouragement to allow the employee to participate fully in the interview. A particular feature of this approach is the encouragment of feedback from the employee.

The Problem Solving Method. With this method the manager takes a more helpful approach and concentrates on the work problems of the employee, who is encouraged to think through his or her problems and to provide their own intrinsic motivation.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-10-10

- 2020-10-18

- 2020-10-18

- 2020-10-18

- 2019-11-28

- 2020-10-10

- 2020-10-18

- 2020-10-18

- 2020-10-10

- 2020-10-10

- 2020-10-18

- 2020-10-18

- 2020-10-10

- 2020-10-18

- 2020-10-10

- 2020-10-10

- 2020-10-10

- 2020-10-18

- 2019-11-28

- 2020-10-18

- 2020-10-18

- 2020-10-10

- 2020-10-18

- 2020-10-18

- 2019-11-28

- 2020-10-18

- 2020-10-18

- 2020-10-10

- 2020-10-18

- 2020-10-10