2020年ACCA考试财务管理基础知识辅导资料(2)

发布时间:2020-10-18

又到了每日分享小课堂,各位赶快集合。今天51题库考试学习网分享的内容是2020年ACCA考试财务管理基础知识辅导资料(2),相关考点都清楚了吗?还未了解的小伙伴一起来看看吧。

Basic information

To appraise an investment project, the appraiser must

have information about the following relevant areas:

1. Cost of investment project.

2. Estimated life of project.

3. Estimated net cash inflows from project.

4. Estimated residual value of project at the end of

its life if applicable.

5. Costofcapital.

6. Taxation implications of project.

7. Inflation rates and effect on project.

Anyone who has had to plan for a future activity/event

should understand that the future is never certain. Bearing this in mind, one

must try to predict the future by drawing from experience and using available

information either from published statistics or from other sources. Some of the

data required about the project would have to be estimated taking into

consideration all available information. The accuracy of these estimated data

would have a consequential effect on the result of the decision; as such, care

must be taken in making these estimates.

Methods of investment appraisal

When the decision-maker has at his/her disposal basic

information about the project as stated above, he/she is then ready to use one

or more of the four main methods used in appraising investment projects.

Background

There is no unequivocal definition of what is meant by

an SME. McLane (2000) identifies three characteristics:

1. Firms are likely to be unquoted;

2. Ownership of the business is restricted to few

individuals, typically a family group.

3. They are not micro businesses that are normally

regarded as those very small businesses that act as a medium for

self-employment of the owners. However, this too is an important sub-group.

The characteristics of SME’s can change as the

business develops. Thus, for growing businesses a floatation on a market like

AIM is a possibility in order to secure appropriate financing. In fact, venture

capital support is usually preconditioned on such an assumption.

The SME sector is important in terms of contribution

to the economy and this is likely to be a characteristic of SME’s across the

world. According to the Bank of England (1998), SME’s accounted for 45% of UK

employment and 40% of sales turnover of all UK firms. This situation is similar

across the EU.

Future developments mean that the importance of the

SME sector will continue, if not develop. The growth in small, new technology

businesses servicing particular market segments and the shift from manufacturing

to service industries, at least in Western economies, means that economies of

scale are no longer as important as they once were and, hence, the necessity

for scale in operations is no longer an imperative. We know, also, that

innovation flourishes in the smaller organization and that this will be an

important characteristic of the business in the future.

以上就是51题库考试学习网带给大家的全部内容,相信小伙伴们都了解清楚。预祝大家在ACCA考试中取得满意的成绩,如果想要了解更多关于ACCA考试的资讯,敬请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Describe the potential benefits for Hugh Co in choosing to have a financial statement audit. (4 marks)

(b) There are several benefits for Hugh Co in choosing a voluntary financial statement audit.

An annual audit will ensure that any material mistakes made by the part-qualified accountant in preparing the year end

financial statements will be detected. This is important as the directors will be using the year end accounts to review their

progress in the first year of trading and will need reliable figures to assess performance. An audit will give the directors comfort

that the financial statements are a sound basis for making business decisions.

Accurate first year figures will also enable more effective budgeting and forecasting, which will be crucial if rapid growth is to

be achieved.

The auditors are likely to use the quarterly management accounts as part of normal audit procedures. The auditors will be

able to advise Monty Parkes of any improvements that could be made to the management accounts, for example, increased

level of detail, more frequent reporting. Better quality management accounts will help the day-to-day running of the business

and enable a speedier response to any problems arising during the year.

As a by-product of the audit, a management letter (report to those charged with governance) will be produced, identifying

weaknesses and making recommendations on areas such as systems and controls which will improve the smooth running of

the business.

It is likely that Hugh Co will require more bank funding in order to expand, and it is likely that the bank would like to see

audited figures for review, before deciding on further finance. It will be easier and potentially cheaper to raise finance from

other providers with an audited set of financial statements.

As the business deals in cash sales, and retails small, luxury items there is a high risk of theft of assets. The external audit

can act as both a deterrent and a detective control, thus reducing the risk of fraud and resultant detrimental impact on the

financial statements.

Accurate financial statements will be the best basis for tax assessment and tax planning. An audit opinion will enhance the

credibility of the figures.

If the business grows rapidly, then it is likely that at some point in the future, the audit exemption limit will be exceeded and

thus an audit will become mandatory.

Choosing to have an audit from the first year of incorporation will reduce potential errors carried down to subsequent periods

and thus avoid qualifications of opening balances.

(b) As a newly-qualified Chartered Certified Accountant, you have been asked to write an ‘ethics column’ for a trainee

accountant magazine. In particular, you have been asked to draft guidance on the following questions addressed

to the magazine’s helpline:

(i) What gifts or hospitality are acceptable and when do they become an inducement? (5 marks)

Required:

For each of the three questions, explain the threats to objectivity that may arise and the safeguards that

should be available to manage them to an acceptable level.

NOTE: The mark allocation is shown against each of the three questions above.

(b) Draft guidance

(i) Gifts and hospitality

Gifts and hospitality may be offered as an inducement i.e. to unduly influence actions or decisions, encourage illegal or

dishonest behaviour or to obtain confidential information. An offer of gifts and/or hospitality from a client ordinarily gives

rise to threats to compliance with the fundamental principles, for example:

■ self-interest threats to objectivity and/or confidentiality may be created if a gift from a client is accepted;

■ intimidation threats to objectivity and/or confidentiality may arise through the possibility of such offers being made

public and damaging the reputation of the professional accountant (or close family member).

The significance of such threats will depend on the nature, value and intent behind the offer. There may be no significant

threat to compliance with the fundamental principles if a reasonable and informed third party would consider gifts and

hospitality to be clearly insignificant. For example, if the offer of gifts or hospitality is made in the normal course of

business without the specific intent to influence decision making or to obtain information.

If evaluated threats are other than clearly insignificant, safeguards should be considered and applied as necessary to

eliminate them or reduce them to an acceptable level.

Offers of gifts and hospitality should not be accepted if the threats cannot be eliminated or reduced to an acceptable

level through the application of safeguards.

As the real or apparent threats to compliance with the fundamental principles do not merely arise from acceptance of

an inducement but, sometimes, merely from the fact of the offer having been made, additional safeguards should be

adopted. For example:

■ immediately informing higher levels of management or those charged with governance that an inducement has

been offered;

■ informing third parties (e.g. a professional body) of the offer (after seeking legal advice);

■ advising immediate or close family members of relevant threats and safeguards where they are potentially in

positions that might result in offers of inducements (e.g. as a result of their employment situation); and

■ informing higher levels of management or those charged with governance where immediate or close family

members are employed by competitors or potential suppliers of that organisation.

(c) Explain what ‘fiduciary responsibility’ means and construct the case for broadening the football club board’s

fiduciary responsibility in this case. (7 marks)

(c) Fiduciary responsibility

Definition of ‘fiduciary responsibility’

A fiduciary responsibility is a duty of trust and care towards one or more constituencies. It describes direction of accountability

in that one party has a fiduciary duty to another. In terms of the case, the question refers to whose interests the directors of

the football club should act in. Traditionally, the fiduciary duty of directors in public companies is to act in the economic

interests of shareholders who invest in the company but are unable to manage the company directly. The case raises a number

of issues concerning broadening the fiduciary duties of the directors of the football club with regard to the building of the new

stadium, to other stakeholder groups.

The case for extending fiduciary responsibility

Although the primary fiduciary duty of directors in large public companies will be to shareholders, directors in businesses such

as the football club described in the case may have good reason to broaden their views on fiduciary responsibility. This would

involve taking into account, and acting in the interests of, the local wildlife centre, the residents, the school, the local

government authority and the fans. The stakeholders in the case are not in agreement on the outcome for the new stadium

and the club will need to privilege some stakeholders over others, which is a common situation whenever a proposal involving

multiple impacts is considered. The specific arguments for broadening the fiduciary duties in this case include the following:

Such an acceptance of claims made on the football club would clearly demonstrate that the club values the community of

which it considers itself a part.

It would help to maintain and manage its local reputation, which is important in progressing the stadium project.

To broaden the fiduciary responsibility in this case would be to an important part of the risk management strategy, especially

with regard to risks that could arise from the actions of local stakeholders.

It could be argued that there is a moral case for all organisations to include other stakeholders’ claims in their strategies as it

enfranchises and captures the views of those affected by an organisation’s policies and actions.

Big Cheese Chairs (BCC) manufactures and sells executive leather chairs. They are considering a new design of massaging chair to launch into the competitive market in which they operate.

They have carried out an investigation in the market and using a target costing system have targeted a competitive selling price of $120 for the chair. BCC wants a margin on selling price of 20% (ignoring any overheads).

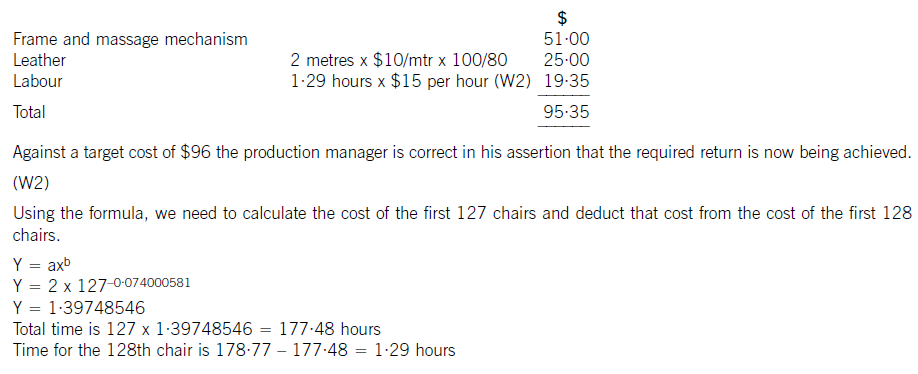

The frame. and massage mechanism will be bought in for $51 per chair and BCC will upholster it in leather and assemble it ready for despatch.

Leather costs $10 per metre and two metres are needed for a complete chair although 20% of all leather is wasted in the upholstery process.

The upholstery and assembly process will be subject to a learning effect as the workers get used to the new design.

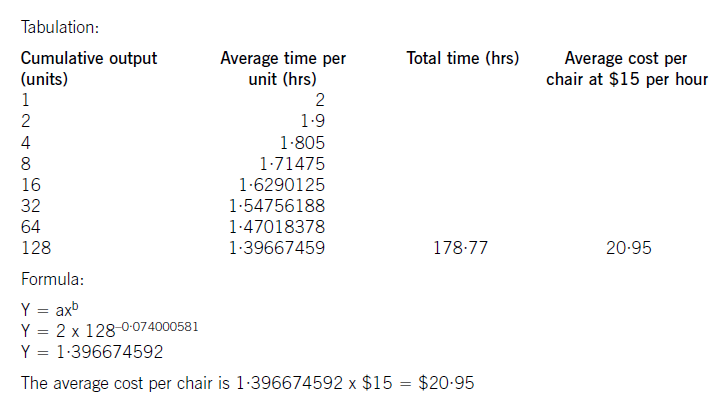

BCC estimates that the first chair will take two hours to prepare but this will be subject to a learning rate (LR) of 95%.

The learning improvement will stop once 128 chairs have been made and the time for the 128th chair will be the time for all subsequent chairs. The cost of labour is $15 per hour.

The learning formula is shown on the formula sheet and at the 95% learning rate the value of b is -0·074000581.

Required:

(a) Calculate the average cost for the first 128 chairs made and identify any cost gap that may be present at

that stage. (8 marks)

(b) Assuming that a cost gap for the chair exists suggest four ways in which it could be closed. (6 marks)

The production manager denies any claims that a cost gap exists and has stated that the cost of the 128th chair will be low enough to yield the required margin.

(c) Calculate the cost of the 128th chair made and state whether the target cost is being achieved on the 128th chair. (6 marks)

(W1)

The cost of the labour can be calculated using learning curve principles. The formula can be used or a tabular approach would

also give the average cost of 128 chairs. Both methods are acceptable and shown here.

(b) To reduce the cost gap various methods are possible (only four are needed for full marks)

– Re-design the chair to remove unnecessary features and hence cost

– Negotiate with the frame. supplier for a better cost. This may be easier as the volume of sales improve as suppliers often

are willing to give discounts for bulk buying. Alternatively a different frame. supplier could be found that offers a better

price. Care would be needed here to maintain the required quality

– Leather can be bought from different suppliers or at a better price also. Reducing the level of waste would save on cost.

Even a small reduction in waste rates would remove much of the cost gap that exists

– Improve the rate of learning by better training and supervision

– Employ cheaper labour by reducing the skill level expected. Care would also be needed here not to sacrifice quality or

push up waste rates.

(c) The cost of the 128th chair will be:

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-10-18

- 2020-10-10

- 2020-10-18

- 2020-10-18

- 2020-10-18

- 2020-10-10

- 2020-10-18

- 2020-10-18

- 2020-10-10

- 2020-10-10

- 2020-10-18

- 2020-10-18

- 2020-10-18

- 2020-10-10

- 2020-10-18

- 2020-10-18

- 2019-11-28

- 2020-10-10

- 2020-10-18

- 2020-10-18

- 2020-10-18

- 2020-10-18

- 2020-10-10

- 2020-10-18

- 2020-10-18

- 2020-10-18

- 2020-10-18

- 2019-11-28

- 2020-10-10

- 2020-10-10