上海市考生进行ACCA报考的具体流程是什么样的

发布时间:2020-01-09

对于即将到来3月份的ACCA考试,ACCAer们是否在备考路上遇到了困难呢?目前,有很多萌新ACCAer们来咨询51题库考试学习网,想问一下ACCA考试报考的具体流程是什么样子的?接下来,就这一问题,51题库考试学习网为大家解答相关的疑惑,建议收藏哦~

首先大家得先知道一点的是:ACCA考试报名成功后不可以缓考。

考试要求:

1、所有课程满分为100分,50分及格。每年6月及12月为全球统考时间,每门考试时间为三小时。

2、单科成绩(除第三阶段核心课程的特殊要求外)有效期为七年,从学员注册成功年度开始算起。

3、课程考试应按顺序进行,一次考试最多可以考四门。若*9阶段有不及格的课程,该课程可与第二阶段的课程一起考,但不得与第三阶段的课程同考。

4、第三阶段3.5,3.6和3.7三门为核心课程,必须在同一次考试中进行,要求这三门课程同时通过。如果有两门课成绩合格,一门课成绩在30-49分之间,允许单独补考该课程两次,若不能通过,三门课需要重新考试。如果有两门不及格,或一门低于30分,三门课均须补考。

想要报名ACCA考试的学生,必须要具备以下条件之一:

1.凡具有教育部承认的大专以上学历,即可报名成为ACCA的正式学员;

2.教育部认可的高等院校在校生,顺利完成了大一全年的所有课程考试,即可报名成为ACCA的正式学员;

3.未符合1、2项报名资格的申请者,可以先申请参加FIA资格考试,通过FFA、FMA和FAB三门课程后,可以申请转入ACCA并且豁免F1-F3三门课程的考试,直接进入ACCA技能课程阶段的考试。(注:申请FIA资格考试的学员,可以不满足以上1、2项条件,并且没有相关年龄限制)

ACCA考试报名流程

凡想要报考ACCA的考生请登陆官方网站进行网上注册,并根据个人情况提交下列材料:

①ACCA报考条件中要带学历/学位证明(高校在校生需提交学校出具的在校证明函及第一年所有课程考试合格的成绩单)的原件、复印件和译文。

②身份证的原件、复印件和译文;或提供护照,不需提交翻译件。

③一张两寸照片(黑白彩色均可)

④注册报名费(支付宝、银行汇票或信用卡支付),请确认信用卡可以从国外付款,否则会影响注册返回时间;如果不能确定建议用汇票交纳注册费。

全英文ACCA官网,报名很吃力,不知道怎么弄?ACCA代报名(高顿免费服务)

ACCA报名步骤

1. 登录ACCA全球官网

2. 点击My ACCA登录,输入您的学员号和密码,进入您的个人空间。

3. 选择EXAM ENTER,按照页面相关提示,进入考试报名界面,选择相关报考科目,报名即可。

为什么要报考ACC呢?ACCA是面向国际的“职场黄金文凭”。ACCA就业前景来说目前国内人才缺口大,岗位年薪高,职业发展空间大,是外企招聘财务经理,财务总监等岗位优先录用的条件之一。

俗话说,辛勤耕作十二载,知识田里成果现。考场之上奋笔书,难易题目都做完。ACCAer,为了更好的明天,一起加油吧!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

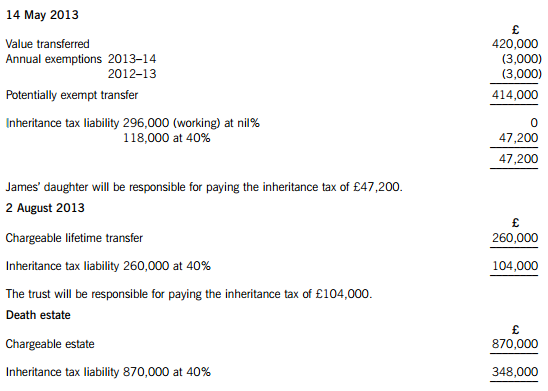

(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.

In January 2008 Arti entered in a contractual agreement with Bee Ltd to write a study manual for an international accountancy body’s award. The manual was to cover the period from September 2008 till June 2009, and it was a term of the contract that the text be supplied by 30 June 2008 so that it could be printed in time for September. By 30 May, Arti had not yet started on the text and indeed he had written to Bee Ltd stating that he was too busy to write the text.

Bee Ltd was extremely perturbed by the news, especially as it had acquired the contract to supply all of the

accountancy body’s study manuals and had already incurred extensive preliminary expenses in relation to the publication of the new manual.

Required:

In the context of the law of contract, advise Bee Ltd whether they can take any action against Arti.

(10 marks)

The essential issues to be disentangled from the problem scenario relate to breach of contract and the remedies available for such breach.

There seems to be no doubt that there is a contractual agreement between Arti and Bee Ltd. Normally breach of a contract occurs where one of the parties to the agreement fails to comply, either completely or satisfactorily, with their obligations under it. However, such a definition does not appear to apply in this case as the time has not yet come when Arti has to produce the text. He has merely indicated that he has no intention of doing so. This is an example of the operation of the doctrine of anticipatory breach.

This arises precisely where one party, prior to the actual due date of performance, demonstrates an intention not to perform. their contractual obligations. The intention not to fulfil the contract can be either express or implied.

Express anticipatory breach occurs where a party actually states that they will not perform. their contractual obligations (Hochster v De La Tour (1853)). Implied anticipatory breach occurs where a party carries out some act which makes performance impossible

Omnium Enterprises v Sutherland (1919)).

When anticipatory breach takes place the innocent party can sue for damages immediately on receipt of the notification of the other party’s intention to repudiate the contract, without waiting for the actual contractual date of performance as in Hochster v De La Tour. Alternatively, they can wait until the actual time for performance before taking action. In the latter instance, they are entitled to make preparations for performance, and claim the agreed contract price (White and Carter (Councils) v McGregor (1961)).

It would appear that Arti’s action is clearly an instance of express anticipatory breach and that Bee Ltd has the right either to accept the repudiation immediately or affirm the contract and take action against Arti at the time for performance (Vitol SA v Norelf Ltd (1996)). In any event Arti is bound to complete his contractual promise or suffer the consequences of his breach of contract.

Remedies for breach of contract

(i) Specific performance It will sometimes suit a party to break their contractual obligations, even if they have to pay damages. In such circumstances the court can make an order for specific performance to require the party in breach to complete their part of the contract. However, as specific performance is not available in respect of contracts of employment or personal service Arti cannot be legally required to write the book for Bee Ltd (Ryan v Mutual Tontine Westminster Chambers Association (1893)). This means that the only remedy against Arti lies in the award of damages.

(ii) Damages A breach of contract will result in the innocent party being able to sue for damages.

Bee Ltd, therefore, can sue Bob for damages, but the important issue relates to the extent of such damages.

The estimation of what damages are to be paid by a party in breach of contract can be divided into two parts: remoteness and measure.

Remoteness of damage

The rule in Hadley v Baxendale (1845) states that damages will only be awarded in respect of losses which arise naturally, or which both parties may reasonably be supposed to have contemplated when the contract was made, as a probable result of its breach.

The effect of the first part of the rule in Hadley v Baxendale is that the party in breach is deemed to expect the normal consequences of the breach, whether they actually expected them or not. Under the second part of the rule, however, the party in breach can only be held liable for abnormal consequences where they have actual knowledge that the abnormal consequences might follow (Victoria Laundry Ltd v Newham Industries Ltd (1949)).

Measure of damages

Damages in contract are intended to compensate an injured party for any financial loss sustained as a consequence of another party’s breach. The object is not to punish the party in breach, so the amount of damages awarded can never be greater than the actual loss suffered. The aim is to put the injured party in the same position they would have been in had the contract been properly performed. In order to achieve this end the claimant is placed under a duty to mitigate losses. This means that the injured party has to take all reasonable steps to minimise their loss (Payzu v Saunders (1919)). Although such a duty did not appear to apply in relation to anticipatory breach as decided in White and Carter (Councils) v McGregor (1961)(above).

Applying these rules to the fact situation in the problem it is evident that as Arti has effected an anticipatory breach of his contract with Bee Ltd he will be liable to them for damages suffered as a consequence, if indeed they suffer damage as a result of his breach. As Bee Ltd will be under a duty to mitigate their losses, they will have to commit their best endeavours to find someone else to produce the required text on time. If they can do so at no further cost then they would suffer no loss, but any additional costs in producing the text will have to be borne by Arti.

However, if Bee Ltd is unable to produce the required text on time the situation becomes more complicated.

(i) As regards the profits from the contract to supply the accountancy body with all its text, the issue would be as to whether this was normal profit or amounted to an unexpected gain, as it was not part of Bee Ltd’s normal market when the contract was signed. If Victoria Laundry Ltd v Newham Industries Ltd were to be applied it is unlikely that Bee Ltd would be able to claim that loss of profit from Arti. However, it is equally plausible that the contract was an ordinary commercial one and that Arti would have to recompense Bee Ltd for any losses suffered from its failure to complete contractual performance.

(ii) As for the extensive preliminary expenses Arti would certainly be liable for them, as long as they were in the ordinary course of Bee Ltd’s business and were not excessive (Anglia Television v Reed (1972)).

Section B – TWO questions ONLY to be attempted

Perkin manufactures electronic components for export worldwide, from factories in Ceeland, for use in smartphones and hand held gaming devices. These two markets are supplied with similar components by two divisions, Phones Division (P) and Gaming Division (G). Each division has its own selling, purchasing, IT and research and development functions, but separate IT systems. Some manufacturing facilities, however, are shared between the two divisions.

Perkin’s corporate objective is to maximise shareholder wealth through innovation and continuous technological improvement in its products. The manufacturers of smartphones and gaming devices, who use Perkin’s components, update their products frequently and constantly compete with each other to launch models which are technically superior.

Perkin has a well-established incremental budgeting process. Divisional managers forecast sales volumes and costs months in advance of the budget year. These divisional budgets are then scrutinised by the main board, and revised significantly by them in line with targets they have set for the business. The finalised budgets are often approved after the start of the accounting year. Under pressure to deliver consistent returns to institutional shareholders, the board does not tolerate failure by either division to achieve the planned net profit for the year once the budget is approved. Last year’s results were poor compared to the annual budget. Divisional managers, who are appraised on the financial performance of their own division, have complained about the length of time that the budgeting process takes and that the performance of their divisions could have been better but was constrained by the budgets which were set for them.

In P Division, managers had failed to anticipate the high popularity of a new smartphone model incorporating a large screen designed for playing games, and had not made the necessary technical modifications to the division’s own components. This was due to the high costs of doing so, which had not been budgeted for. Based on the original sales forecast, P Division had already committed to manufacturing large quantities of the existing version of the component and so had to heavily discount these in order to achieve the planned sales volumes.

A critical material in the manufacture of Perkin’s products is silver, which is a commodity which changes materially in price according to worldwide supply and demand. During the year supplies of silver were reduced significantly for a short period of time and G Division paid high prices to ensure continued supply. Managers of G Division were unaware that P Division held large inventories of silver which they had purchased when the price was much lower.

Initially, G Division accurately forecasted demand for its components based on the previous years’ sales volumes plus the historic annual growth rate of 5%. However, overall sales volumes were much lower than budgeted. This was due to a fire at the factory of their main customer, which was then closed for part of the year. Reacting to this news, managers at G Division took action to reduce costs, including closing one of the three R&D facilities in the division.

However, when the customer’s factory reopened, G Division was unwilling to recruit extra staff to cope with increased demand; nor would P Division re-allocate shared manufacturing facilities to them, in case demand increased for its own products later in the year. As a result, Perkin lost the prestigious preferred supplier status from their main customer who was unhappy with G Division’s failure to effectively respond to the additional demand. The customer had been forced to purchase a more expensive, though technically superior, component from an alternative manufacturer.

The institutional shareholders’ representative, recently appointed to the board, has asked you as a performance management expert for your advice. ‘We need to know whether Perkin’s budgeting process is appropriate for the business, and how this contributed to last year’s poor performance’, she said, ‘and more importantly, how do we need to change the process to prevent this happening in the future, such as a move to beyond budgeting.’

Required:

(a) Evaluate the weaknesses in Perkin’s current budgeting system and whether it is suitable for the environment in which Perkin operates. (13 marks)

(b) Evaluate the impact on Perkin of moving to beyond budgeting. (12 marks)

Tutor note: This is a detailed solution and candidates would not be expected to produce an answer of this length.

(a) Weaknesses in the current budget process at Perkin

Perkin uses a traditional approach to budgeting, which has a number of weaknesses.

First of all the budgeting system does not seem aligned with Perkin’s corporate objective which focuses on innovation and continuous product improvement. Innovation is a key competitive advantage to both component and device manufacturers in this industry and the products which incorporate Perkin’s components are subject to rapid technological change as well as changes in consumer trends. The markets in which the two divisions operate appear to be evolving, as seen by the high popularity of the smartphone model which was designed for playing games. This may mean the distinction between smartphone and gaming devices could be becoming less clear cut. Management time would probably be better spent considering these rapid changes and currently the budgeting process does not facilitate that.

In reality, the budget process at Perkin is time consuming and probably therefore a costly exercise. Divisional budgets go through a lengthy process of drafting and then revision by the main board before they are approved. The approval often happens after the start of the period to which they relate, at which point the budgets are already out of date. This also means divisional managers are trying to plan activities for the next financial year without a set of finalised targets agreed, which could impact the effectiveness of decisions made.

Another weakness is that the budgets are only prepared annually, which is clearly too infrequent for a business such as Perkin. The process is also rigid and inflexible as deviations from the planned targets are not tolerated. Sticking to rigid, annual budgets can lead to problems such as P Division not being able to cope with increasing popularity of a particular product and even other short-term changes in demand like those driven by seasonal factors, or one-off events such as the factory fire. Linked to this problem of budgetary constraints is that to cut costs to achieve the budgeted net profit, managers closed one of the three research and development facilities in G Division. As identified at the outset, a successful research and development function is a key source of long-term competitive advantage to Perkin.

It also appears that Perkin fails to flex the budgets and consequently the fixed budgets had discouraged divisional managers from deviating from the original plan. P Division did not make technical modifications to its components due to the cost of doing so, which meant they were unable to supply components for use in the new model of smartphone and had to discount the inventories of the old version. It is unclear why G Division did not take on additional staff to cope with increased demand following reopening of their customer’s factory, but it may be because managers felt constrained by the budget. This then caused long-term detriment to Perkin as they lost the preferred supplier status with their main customer.

Another problem created by annual budgeting is the management of short-term changes in costs and prices. A key component of Perkin’s products is silver, which fluctuates in price, and though it is not clear how much effect this has on Perkin’s costs, any problems in supply could disrupt production even if only a small amount of silver were required. Also Perkin exports goods worldwide and probably also purchases materials, including silver, from overseas. The business is therefore exposed to short-term movements in foreign currency exchange rates which may affect costs and selling prices.

Similarly, there also seems to be considerable uncertainty in sales volumes and prices which creates problems in the forecasting process for the two divisions. P Division did not anticipate the high demand for the new component which meant P Division had to discount products it had already manufactured in order to achieve its forecast sales volumes. G Division did correctly forecast the demand, but based on past growth in the market which may be too simplistic in a rapidly changing industry. Lack of up-to-date information will hinder decision-making and overall performance at Perkin. Perkin would perhaps be better adopting a rolling basis for forecasting.

The two divisions share manufacturing facilities and are likely to compete for other resources during the budgeting process. The current budgeting system does not encourage resource, information or knowledge sharing, for example, expertise in forecasting silver requirements. Divisional managers are appraised on the financial performance of their own division and hence are likely to prioritise the interests of their own division above those of Perkin as a whole. P Division would not re-allocate its manufacturing facilities to G Division, even though G Division needed this to cope with extra demand following reopening of the customer’s factory. The current system is therefore not encouraging goal congruence between the divisions and Perkin as a whole and a budgeting system, if done effectively, should encourage co-ordination and co-operation.

Managers may find the budgeting process demotivating because it is time-consuming for them and then the directors override the forecast which they had made. It is also unfair and demotivating to staff to appraise them on factors which are outside their control. This also identifies another weakness in Perkin’s budgeting system related to control as there does not seem to be any planning and operating variance analysis performed to assess exactly where performance is lacking and so no appropriate management information is provided. In fact it is not even clear just how often divisional managers receive reports on performance throughout the year. Any budgeting system without regular feedback would be ineffective. It should even be noted that for the industry in which Perkin operates the use of only budgetary targets as a measure of performance is narrow and internal. It should be utilising information from external sources as well to assess performance in a more relevant and contextual way.

Given the rapidly changing external environment and the emphasis on innovation and continuous product development, the current traditional budgeting method does not seem appropriate for Perkin.

(b) Beyond budgeting moves away from traditional budgeting processes and is suitable for businesses operating in a rapidly changing external environment and has the following features:

1. Encourages management to focus on the present and the future. Performance is assessed by reference to external benchmarks, utilising rolling forecasts and more non-financial information. This encourages a longer term view.

2. More freedom is given to managers to make decisions, which are consistent with the organisation’s goals and achieving competitive success.

3. Resources are made available on demand, for example, to enable a division to take advantage of an opportunity in the market, rather than being constrained by budgets.

4. Management focus is switched to the customer and managers are motivated towards actions which benefit the whole organisation, not just their own divisions.

5. Effective information systems are required to provide fast and easily accessible information across the whole organisation to allow for robust planning and control at all levels.

Taking each of the elements of beyond budgeting in turn, the impact of introducing this technique into Perkin can be assessed.

At Perkin, there are rapid technological changes in the products being produced by customers and competitors as a result of changes demanded by the market, which mean that Perkin must respond and continuously innovate and develop its products. This will support Perkin’s corporate objective. Consequently, this means that Perkin must change its plans frequently to be able to compete effectively with other component manufacturers and therefore will need to move away from annual incremental budgeting to introducing regular rolling forecasts. This process will need supporting by KPIs which will have a longer term focus. The impact of this will be that Perkin will need to develop a coherent set of strategies which supports its corporate objective, which will then need to be translated into targets and appropriate KPIs selected and developed. It will also mean that performance measures at the operational level will need to be revised from annual budgetary targets to these longer term objectives. Management at all levels will require training on the production of rolling forecasts and Perkin will need to assess if additional resources will also be required to run this new system.

Beyond budgeting focuses on the long-term success of the business by division managers working towards targets which may be non-financial. The use of external benchmarks and non-financial information will mean Perkin will need to put processes in place to collect this information and analyse it to assess performance. This will be a learning process as Perkin does not currently do this. The status of preferred supplier with key customers, for example, would be important to the long-term success of the business and this could be an objective which Perkin sets for its divisional managers.

Beyond budgeting allows authority to be delegated to suitably trained and supported managers to take decisions in the long-term interests of the business. It allows managers to respond quickly and effectively to changes in the external environment, and encourages them to develop innovative solutions to external change. In Perkin, budgets proposed by divisional managers are changed by the board to reflect its overall plans for the business. This means that a change in the approach to communication between the board and the divisions will be necessary as Perkin would need to switch from the top down process currently adopted to a more devolved decision-making structure. This will again require training for management to enable them to be ready to deal with this delegated authority as it will be very different from their existing approach.

Traditional budgeting may constrain managers who are not allowed to fail to meet the approved budget. This can be seen when P Division did not adapt its components because it did not want to incur the costs of doing so, which had not been budgeted for. Similarly, prices of raw materials are known to be volatile. Beyond budgeting makes resources available for managers to take advantage of opportunities in the market, such as the smartphone designed for playing games. Managers would also be able to react to changes in the price of materials or changes in foreign currency exchange rates, for example, by having the authority to purchase silver for inventory at times when the price of silver is low. This will mean that as a result there will be fewer budgetary constraints; however, these resources and targets will still need to be effectively managed. This management will mean that strategic initiatives invested in will need monitoring rather than closely scrutinising departmental budgets, which will be a significant change in Perkin.

In Perkin, the two divisions share some manufacturing facilities and are likely to compete for other resources, for example, when setting budgets. When manufacturing facilities are in short supply, each division will prioritise its own requirements rather than those of the business as a whole. Beyond budgeting encourages managers to work together for the good of the business and to share knowledge and resources. This is important in a business such as Perkin where product innovation is key and where the activities and products of the two divisions are similar. This coordinated approach will be new to Perkin so there will be a culture change. Also, the customer-oriented element of beyond budgeting is key here and will require the setup of customer focused teams which will require more harmonised actions in the divisions.

Each division currently has its own IT systems. In order to effectively share knowledge and to be able to respond to the external environment, which are key elements of beyond budgeting, it would be preferable for them to have shared IT facilities. This will mean that Perkin may have to invest in new technology capable of sharing information across the organisation in a rapid and open fashion but also be able to collect all relevant comparative data to allow for continuous monitoring of performance. This will facilitate better planning and control across all levels of Perkin.

With appropriate training of managers and investment in information systems, it would be relevant for Perkin to adopt beyond budgeting because of the rapid changes in the external environment in which it operates.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-05-20

- 2020-02-26

- 2020-01-10

- 2020-09-03

- 2020-01-10

- 2020-02-27

- 2020-01-08

- 2021-04-07

- 2021-05-22

- 2020-03-20

- 2021-06-19

- 2021-09-18

- 2020-01-08

- 2019-12-28

- 2020-01-08

- 2020-01-08

- 2020-01-09

- 2020-01-10

- 2021-08-19

- 2020-08-12

- 2020-08-15

- 2020-02-27

- 2020-07-04

- 2020-08-13

- 2020-01-09

- 2020-09-03

- 2020-07-15

- 2020-09-03

- 2020-01-09

- 2020-01-29