如何帮助全国考生高效的学习ACCA考试?

发布时间:2020-01-10

2020年已经到来,第一次ACCAer们对考试已经了解了多少了呢?一点也不了解也不用担心,51题库考试学习网帮助大家收集到了一些关于考试的高效学习技巧,希望对备考的你有多帮助,现在且随51题库考试学习网,告诉你怎有哪些技巧吧:

复习的首要任务是巩固和加深对所学知识的理解和记忆。首先,要根据教材的知识体系确定好一个中心内容,把主要精力集中在教材的中心、重点和难点上,不真正搞懂,决不放松。其次,要及时巩固,防止遗忘。复习最好在遗忘之前,倘若在遗忘之后,效率就低了。复习还要经常,不能一曝十寒。

对于一个新人而言,刚刚学ACCA,肯定都在想:我是报班呢还是报班呢?报班的话该选择什么样的辅导班?其次,如果自学的话有没有希望?

首先,明确一点,无论是否报班学习,最终决定成败的还是自己。

其次ACCA学习是一个由浅入深、由简到难的过程。对于学习能力好的大神来说,选择自学也是没有问题的!但是这个过程会耗时耗力,难抓住重点,如果有高顿经验丰富的老师身经百战总结出来的重要知识点,将会如虎添翼!

最后自学备考ACCA的过程重在坚持,但是大多数人都会被周围的事情分散注意力而导致备考意志力不够坚定,最后的结果也很失败。而报高顿ACCA面授课,除了有专业讲师系统性的讲解,针对性的答疑,能遇到许多志同道合的小伙伴,互相鼓励,互相监督,更有负责的学管团队全程及时提醒沟通,帮你克服意志力薄弱的问题,早日全科通关。

学习acca是否有必要参加辅导班

根据每个人的基础来判别,有些基础比较好的考生,简单的科目完全自学,难点科目自己看看网课就可以顺利通过了;基础一般的同学大部分科目需要借助网课的帮助来通过考试;基础较差的同学可能就需要面授课老师来帮忙了。不管哪个级别的考生,基本上是不太可能不借助任何辅导通过的。

基础较差的考生参加ACCA辅导班跟着老师学习,会轻松很多,也会节省很多时间,自己自学不知道重点,遇到知识点要弄很久才弄明白,比较费劲。

所以考生们可以根据自己的情况来安排辅导的力度哦。

具体的备考步骤分为以下四步:

第一步是拿2-3套ACCA真题,自己扫一遍所有的题干,可以不看题目,然后用这几套真题总结一下出题的套路和重点的知识点。ACCA的考试中重要的知识点一定是每年都出的,用这几套完全可以总结出重要知识点。当然如果真的基础不错,可以拿一套真题先做一下,然后你就有动力去进行后续的复习了。

第二步是看书,不过是先根据课本的目录,给自己梳理出来一个框架图,然后结合第一步的总结,所有的重点都一目了然。

第三步就是看书了,ACCA的教材一般会分为16-18个章节,一个章节如果完全投入进去阅读,两个小时完全可以搞明白。更何况最开始还整理出来了重点,那么复习详略得当,这个时间是足够的。还要注意一下就是每个章节如果真题中有考到这个章节的知识点,BPP的教材是会给出提示的,务必保证每个章节在学习完做一道题,总结答题思路。

最后一步是真题,一具体就要做的真题数目决定。51题库考试学习网建议大家有时间就尽量多做题,虽然题海战术不算什么高端的战术,但它却是最有用的。用来检测知识点是否掌握,如果是重要知识点没掌握,务必要回去复习了。

总结必考题的答题套路,就想F7/P2的合并报表,一定有它必备的一些步骤一样,这些必考题一定有每年都要做的相同部分。

完全的考前模拟,看看考试的时候如何安排时间比较合理。

以上就是关于备考ACCA考试的相关经验分享,你Get到了吗?俗话说,好的开始是成功的一半,大家要积极地认真地备考ACCA考试哦,要相信你所付出的一定会得到结果的~

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(c) Temporary staff assignments. (6 marks)

(c) Temporary staff assignments

Lending staff on a temporary basis to an audit client will create the following ethical threats:

Management involvement – Assuming that the manager or senior is seconded to the finance function of the audit client, it

is likely that the individual would be in some way involved in decision making in relation to the accounting systems,

management accounts or financial statements.

Self-review – On returning to the audit firm, a seconded individual could be a member of the audit team for the client to

which they seconded. This would create a self- review threat whereby they would be unlikely to be critical of their own work

performed or decisions made. Even if the individual were not assigned to the client where they performed a temporary

assignment, the audit team assigned may tend to over rely on areas worked on by a colleague during the period of their

temporary assignment.

Familiarity – if the individual is working at the client at any time during the audit, there will be a familiarity threat, whereby

audit team members will be unlikely to sufficiently challenge, and therefore not exercise enough professional scepticism when

dealing with work performed by the seconded individual.

In addition, due to the over-staffing problem of Becker & Co, the seconded individuals may feel that if they were not on the

secondment, they could be made redundant. This may cause them to act in such as way as not to jeopardise the secondment,

even if the action were not in the best interests of the firm.

The threats discussed above are increased where a senior person likely to make significant decisions is involved with the

temporary assignment, as in this case where audit managers or seniors will be the subjects of the proposed secondment.

In practice, assistance can be provided to clients, especially in emergency situations, but only on the understanding that the

firm’s personnel will not be involved with:

– Making management decisions,

– Approving or signing agreements or similar documents, and

– Having the authority to enter into commitments on behalf of the company.

In addition, the individual seconded to a client should not then be involved in any way with the audit of that client when they

return to the audit firm. This may be a difficult area, as presumably the client would prefer to have an individual seconded

to them who has knowledge and experience of their business, i.e. a member of the audit team, and most likely in this scenario

to be the audit manager. If this were the case the manager would then have to be reassigned to a different client, causing

internal problems for the audit firm. This problem is likely to outweigh any benefits, financial or otherwise, to Becker & Co.

If the temporary staff assignment were to a non-finance department of the client then the threats would be reduced.

If Becker & Co decides to go ahead with the secondment programme, the firm must ensure that the staff are suitably

experienced and qualified to carry out the work given to them by the client. There could be a risk to the reputation of Becker

& Co if the seconded staff are not competent or do not perform. as well as expected by the client.

One advantage of a secondment is that the individual concerned can benefit from exposure to a different type of work and

work environment. This will provide some valuable insights into accounting within a business and the individual may bring

some new skills and ideas back into the audit firm.

However, the staff seconded could be offered a permanent position at the client. This would lead to the loss of key members

of staff, and be detrimental for Becker & Co in the long run.

The other benefit for the audit firm is that a programme of secondments will ease the problem of an over-staffed audit

department, and should have cash flow benefits.

Tutorial note: In answering this question it is relevant to briefly mention corporate governance implications i.e. the client may

not be able to accept the services offered by their auditor for ethical, particularly objectivity, reasons.

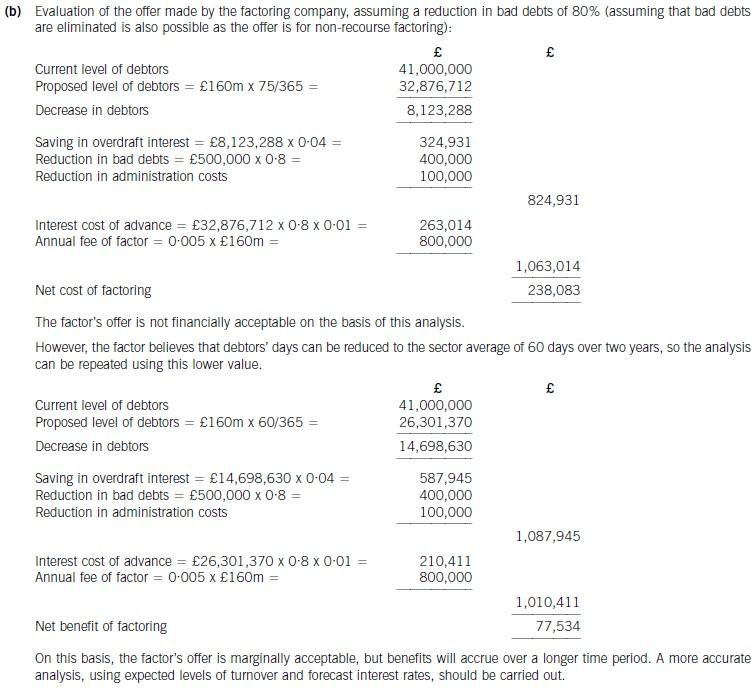

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

2 The draft financial statements of Choctaw, a limited liability company, for the year ended 31 December 2004 showed

a profit of $86,400. The trial balance did not balance, and a suspense account with a credit balance of $3,310 was

included in the balance sheet.

In subsequent checking the following errors were found:

(a) Depreciation of motor vehicles at 25 per cent was calculated for the year ended 31 December 2004 on the

reducing balance basis, and should have been calculated on the straight-line basis at 25 per cent.

Relevant figures:

Cost of motor vehicles $120,000, net book value at 1 January 2004, $88,000

(b) Rent received from subletting part of the office accommodation $1,200 had been put into the petty cash box.

No receivable balance had been recognised when the rent fell due and no entries had been made in the petty

cash book or elsewhere for it. The petty cash float in the trial balance is the amount according to the records,

which is $1,200 less than the actual balance in the box.

(c) Bad debts totalling $8,400 are to be written off.

(d) The opening accrual on the motor repairs account of $3,400, representing repair bills due but not paid at

31 December 2003, had not been brought down at 1 January 2004.

(e) The cash discount totals for December 2004 had not been posted to the discount accounts in the nominal ledger.

The figures were:

$

Discount allowed 380

Discount received 290

After the necessary entries, the suspense account balanced.

Required:

Prepare journal entries, with narratives, to correct the errors found, and prepare a statement showing the

necessary adjustments to the profit.

(10 marks)

(iii) Can internal audit services be undertaken for an audit client? (4 marks)

Required:

For each of the three questions, explain the threats to objectivity that may arise and the safeguards that

should be available to manage them to an acceptable level.

NOTE: The mark allocation is shown against each of the three questions above.

(iii) Internal audit services

A self-review threat may be created when a firm, or network firm, provides internal audit services to a financial statement

audit client. Internal audit services may comprise:

■ an extension of the firm’s audit service beyond requirements of International Standards on Auditing (ISAs);

■ assistance in the performance of a client’s internal audit activities; or

■ outsourcing of the activities.

The nature of the service must be considered in evaluating any threats to independence. (For this purpose, internal audit

services do not include operational internal audit services unrelated to the internal accounting controls, financial systems

or financial statements.)

Services involving an extension of the procedures required to conduct a financial statement audit in accordance with

ISAs would not be considered to impair independence with respect to the audit client provided that the firm’s or network

firm’s personnel do not act or appear to act in a capacity equivalent to a member of audit client management.

When the firm, or a network firm, provides an audit client with assistance in the performance of internal audit activities

or undertakes the outsourcing, any self-review threat created may be reduced to an acceptable level by a clear separation

of:

■ the management and control of the internal audit by client management;

■ the internal audit activities.

Performing a significant portion of an audit client’s internal audit activities may create a self-review threat. Appropriate

safeguards should include the audit client’s acknowledgement of its responsibilities for establishing, maintaining and

monitoring the system of internal controls.

Other safeguards include:

■ the audit client designating a competent employee, preferably within senior management, to be responsible for

internal audit activities;

■ the audit client, audit committee or supervisory body approving the scope, risk and frequency of internal audit

work;

■ the audit client being responsible for evaluating and determining which recommendations of the firm should be

implemented;

■ the audit client evaluating the adequacy of the internal audit procedures performed and the resultant findings by

obtaining and acting on reports from the firm; and

■ appropriate reporting of findings and recommendations resulting from the internal audit activities to the audit

committee or supervisory body.

Consideration should also be given to whether such non-assurance services should be provided only by personnel not

involved in the financial statement audit engagement and with different reporting lines within the firm.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-04-10

- 2021-08-05

- 2020-02-05

- 2020-03-11

- 2020-04-15

- 2020-05-09

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-05-15

- 2020-05-06

- 2020-01-10

- 2020-01-09

- 2020-01-09

- 2020-02-06

- 2020-01-10

- 2020-04-16

- 2020-01-10

- 2021-02-14

- 2020-04-28

- 2020-02-21

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-04-17

- 2020-02-20