带你了解ACCA证书含金量有多高?

发布时间:2020-02-21

关于ACCA证书含金量有多高?你知道吗?不知道的小伙伴快跟着51题库考试学习网一起来了解一下吧!

ACCA适用的是国际会计准则,在经济全球化加速发展的今天,很多在中国的外企和走出去的国企都需要ACCA持证人,因此ACCA的含金量也与日俱增。

在我国ACCA认可的雇主已超越700家,包含微软、壳牌、联合利华、可口可乐、通用电气等著名的跨国公司,也有“四大”世界管帐师事务所中的德勤、普华永道以及平安保险公司、岳华管帐师事务所等国内大公司。

ACCA对咱们最大协助在于它的权威性和通用性能够协助这些名企办理人员对自己的才能和执业资历有更准确的确定,这也就更增添了ACCA的含金量。因而,挑选ACCA在对其进行体系学习的一起能够学习到最新的商务社会对财会以及有关人员的实践需求,培养自己的分析才能和在杂乱条件下的决议计划、判断才能;在学成后能习惯各种环境,并使会员变成具有全面办理本质的高档财政、办理专家。那么,考完ACCA都会为我们提供哪些优势呢?

1、ACCA工作领域无限制

在英国本土有六个会计师协会ACCA、ICAEW、ICAI、ICAF、CIMA、CIPFA。在英国本土ACCA工作领域没有限制,会员统计在工商企业和会计师事务所都占30%-40%,不是概念中认为的只能在事务所工作。剩下的是在公用事业单位、教育机构等。ACCA工作领域就像其他那几个会计师事务所的交集。

2、年薪多集中在15~30万

ACCA学员到企业工作平均年薪能在15~30万之间。一些猎头公司在帮助企业找人的时候都明确表示首先要ACCA学员,然后看相关工作经验,如果有外资公司、四大会计师事务所工作经验的更受青睐。如果有会计师事务所培训的背景,容易拿到高薪,一般都能做到财务经理以上这样的职位。

3、ACCA是职业晋升的重要砝码

虽然在中国ACCA是没有签字权,但是被看好是因为ACCA是晋升的途径。在会计师事务所工作分工明确,因为这样有利于吸引客户。但作为自己晋升这方面,ACCA还是被很多海外回来的人认可。同时,事务所有持有国际证书的人,也有利于服务客户,例如海外上市的时候,因为海外上市报表必须按国际会计准则来编制,国内会计师无法胜任。

以上就是51题库考试学习网带给大家的内容,如果遇到其他不能解决的问题,请及时反馈给51题库考试学习网,我们会尽快帮你解答。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) Explain whether or not Carver Ltd will become a close investment-holding company as a result of

acquiring either the office building or the share portfolio and state the relevance of becoming such a

company. (2 marks)

(ii) Close investment holding company status

Carver Ltd will not become a close investment-holding company if it purchases the office building as, although it will no

longer be a trading company, it intends to rent out the building to a number of tenants none of whom is connected to

the company.

Carver Ltd will become a close investment holding company if it purchases a portfolio of quoted shares as it will no

longer be a trading company. As a result it will pay corporation tax at the full rate of 30% regardless of the level of its

profits.

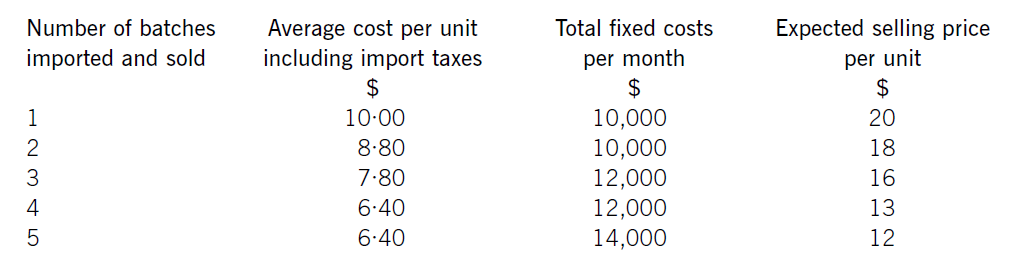

Jewel Co is setting up an online business importing and selling jewellery headphones. The cost of each set of headphones varies depending on the number purchased, although they can only be purchased in batches of 1,000 units. It also has to pay import taxes which vary according to the quantity purchased.

Jewel Co has already carried out some market research and identified that sales quantities are expected to vary depending on the price charged. Consequently, the following data has been established for the first month:

Required:

(a) Calculate how many batches Jewel Co should import and sell. (6 marks)

(b) Explain why Jewel Co could not use the algebraic method to establish the optimum price for its product.

(4 marks)

(b)Thealgebraicmodelrequiresseveralassumptionstobetrue.First,theremustbeaconsistentrelationshipbetweenprice(P)anddemand(Q),sothatademandequationcanbeestablished,usuallyintheform.P=a–bQ.Here,althoughthereisaclearrelationshipbetweenthetwo,itisnotaperfectlylinearrelationshipandsomorecomplicatedtechniquesarerequiredtocalculatethedemandequation.ItalsocannotbeassumedthatalinearrelationshipwillholdforallvaluesofPandQotherthanthefivegiven.Similarly,theremustbeaclearrelationshipbetweendemandandmarginalcost,usuallysatisfiedbyconstantvariablecostperunitandconstantfixedcosts.Thechangingvariablecostsperunitagaincomplicatetheissue,butitisthechangesinfixedcostswhichmakethealgebraicmethodlessusefulinJewel’scase.Thealgebraicmodelisonlysuitableforcompaniesoperatinginamonopolyanditisnotclearherewhetherthisisthecase,butitseemsunlikely,soany‘optimum’pricemightbecomeirrelevantifJewel’scompetitorschargesignificantlylowerprices.Othermoregeneralfactorsnotconsideredbythealgebraicmodelarepoliticalfactorswhichmightaffectimports,socialfactorswhichmayaffectcustomertastesandeconomicfactorswhichmayaffectexchangeratesorcustomerspendingpower.Thereliabilityoftheestimatesthemselves–forsalesprices,variablecostsandfixedcosts–couldalsobecalledintoquestion.

(c) Identify and discuss the implications for the audit report if:

(i) the directors refuse to disclose the note; (4 marks)

(c) (i) Audit report implications

Audit procedures have shown that there is a significant level of doubt over Dexter Co’s going concern status. IAS 1

requires that disclosure is made in the financial statements regarding material uncertainties which may cast significant

doubt on the ability of the entity to continue as a going concern. If the directors refuse to disclose the note to the financial

statements, there is a clear breach of financial reporting standards.

In this case the significant uncertainty is caused by not knowing the extent of the future availability of finance needed

to fund operating activities. If the note describing this uncertainty is not provided, the financial statements are not fairly

presented.

The audit report should contain a qualified or an adverse opinion due to the disagreement. The auditors need to make

a decision as to the significance of the non-disclosure. If it is decided that without the note the financial statements are

not fairly presented, and could be considered misleading, an adverse opinion should be expressed. Alternatively, it could

be decided that the lack of the note is material, but not pervasive to the financial statements; then a qualified ‘except

for’ opinion should be expressed.

ISA 570 Going Concern and ISA 701 Modifications to the Independent Auditor’s Report provide guidance on the

presentation of the audit report in the case of a modification. The audit report should include a paragraph which contains

specific reference to the fact that there is a material uncertainty that may cast significant doubt about the entity’s ability

to continue as a going concern. The paragraph should include a clear description of the uncertainties and would

normally be presented immediately before the opinion paragraph.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-01-10

- 2021-06-26

- 2020-01-10

- 2020-02-27

- 2020-03-07

- 2020-05-12

- 2021-10-05

- 2020-01-10

- 2020-01-10

- 2020-08-16

- 2007-05-15

- 2020-08-14

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-02-21

- 2020-01-10

- 2020-01-09

- 2020-04-10

- 2020-01-29

- 2020-01-10

- 2020-01-09

- 2020-05-14

- 2020-01-10

- 2020-05-17

- 2020-04-29

- 2020-05-08