湖南省考生注意:2020年ACCA国际会计师考试报名时间!

发布时间:2020-01-10

想要报考2020年ACCA考试的考生要抓紧时间报名了哦!51题库考试学习网帮助大家汇总了ACCA官网上发布的2020年所有报名时间的内容,看看你还有多少备考的时间呢?温馨提示大家,ACCA考试前两个周会发布准考证打印通道,因此建议大家注意相关打印准考证的时间哟,提前打印和准备相关考试材料,以防出现不必要的麻烦导致未能参加考试。

2020年3月ACCA考试报名时间报名周期

提前报名截止 2019年11月11日

常规报名截止 2020年1月27日

后期报名截止 2020年2月3日

2020年6月ACCA考试报名时间报名周期

提前报名截止 2020年2月10日

常规报名截止 2020年4月27日

后期报名截止 2020年5月4日

2020年9月ACCA考试报名时间报名周期

提前报名截止 2020年5月11日

常规报名截止: 2020年7月27日

后期报名截止 2020年8月3日

2020年12月ACCA考试报名时间报名周期

提前报名截止 2020年8月10日

常规报名截止 2020年10月26日

后期报名截止 2020年11月2日

最后,告诉一个大家省钱的小妙招,ACCA考试出具了相关规定,就是报名费用的多少与考生时间的前后是有关系的,意思是你在提前报名阶段报名的考试报名费用就是最便宜的。相反,你在后期报名阶段报名的话,费用也就越高。所以,51题库考试学习网建议各位考生谨慎考虑自己是否需要考取ACCA证书,一旦决定下来了就尽快报名。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

4 (a) The purpose of ISA 510 ‘Initial Engagements – Opening Balances’ is to establish standards and provide guidance

regarding opening balances when the financial statements are audited for the first time or when the financial

statements for the prior period were audited by another auditor.

Required:

Explain the auditor’s reporting responsibilities that are specific to initial engagements. (5 marks)

4 JOHNSTON CO

(a) Reporting responsibilities specific to initial engagements

For initial audit engagements, the auditor should obtain sufficient appropriate audit evidence that:

■ the opening balances do not contain misstatements that materially affect the current period’s financial statements;

■ the prior period’s closing balances have been correctly brought forward to the current period (or, where appropriate, have

been restated); and

■ appropriate accounting policies are consistently applied or changes in accounting policies have been properly accounted

for (and adequately presented and disclosed).

If the auditor is unable to obtain sufficient appropriate audit evidence concerning opening balances there will be a limitation

on the scope of the audit. The auditor’s report should include:

■ a qualified (‘except for’) opinion;

■ a disclaimer of opinion; or

■ in those jurisdictions where it is permitted, an opinion which is:

– qualified (or disclaimed) regarding the results of operations (i.e. on the income statement); and

– unqualified regarding financial position (i.e. on the balance sheet).

If the effect of a misstatement in the opening balances is not properly accounted for and adequately presented and disclosed,

the auditor should express a qualified (‘except for’ disagreement) opinion or an adverse opinion, as appropriate.

If the current period’s accounting policies have not been consistently applied in relation to opening balances and if the change

has not been properly accounted for and adequately presented and disclosed, the auditor should similarly express

disagreement (‘except for’ or adverse opinion as appropriate).

However, if a modification regarding the prior period’s financial statements remains relevant and material to the current

period’s financial statements, the auditor should modify the current auditor’s report accordingly.

5 Astrodome Sports Ltd was formed in December 2000 by seven engineers who comprise the board of directors of the

company. The seven engineers previously worked together for ‘Telstar’, a satellite navigation company.

In conjunction with one of the three largest construction companies within their country they constructed the ‘365

Sports Complex’ which has a roof that opens and uses revolutionary satellite technology to maintain grass surfaces

within the complex. The complex facilities, which are available for use on each day of the year, include two tennis

courts, a cricket pitch, an equestrian centre and six bowling greens. The tennis courts and cricket pitch are suitable

for use as venues for national competitions. The equestrian centre offers horse-riding lessons to the general public and

is also a suitable venue for show-jumping competitions. The equestrian centre and bowling greens have increased in

popularity as a consequence of regular television coverage of equestrian and bowling events.

In spite of the high standard of the grass surfaces within the sports complex, the directors are concerned by reduced

profit levels as a consequence of both falling revenues and increasing costs. The area in which the ‘365 Sports

Complex’ is located has high unemployment but is served by all public transport services.

The directors of Astrodome Sports Ltd have different views about the course of action that should be taken to provide

a strategy for the future improvement in the performance of the complex. Each director’s view is based on his/her

individual perception as to the interpretation of the information contained in the performance measurement system of

the complex. These are as follows:

Director

(a) ‘There is no point whatsoever in encouraging staff to focus on interaction with customers in efforts to create a

‘user friendly’ environment. What we need is to maintain the quality of our grass surfaces at all costs since that

is the distinguishing feature of our business.’

(b) ‘Buy more equipment which can be hired out to users of our facilities. This will improve our utilisation ratios

which will lead to increased profits.’

(c) ‘We should focus our attention on maximising the opening hours of our facilities. Everything else will take care

of itself.’

(d) ‘Recent analysis of customer feedback forms indicates that most of our customers are satisfied with the facilities.

In fact, the only complaints are from three customers – the LCA University which uses the cricket pitch for

matches, the National Youth Training Academy which held training sessions on the tennis courts, and a local

bowling team.’

(e) ‘We should reduce the buildings maintenance budget by 25% and spend the money on increased advertising of

our facilities which will surely attract more customers.’

(f) ‘We should hold back on our efforts to overcome the shortage of bowling equipment for hire. Recent rumours are

that the National Bowling Association is likely to offer large financial grants next year to sports complexes who

can show they have a demand for the sport but have deficiencies in availability of equipment.’

(g) ‘Why change our performance management system? Our current areas of focus provide us with all the

information we need to ensure that we remain a profitable and effective business.’

As management accountant of Astrodome Sports Ltd you have recently read an article which discussed the following

performance measurement problems:

(i) Tunnel vision

(ii) Sub-optimisation

(iii) Misinterpretation

(iv) Myopia

(v) Measure fixation

(vi) Misrepresentation

(vii) Gaming

(viii) Ossification.

Required:

(a) Explain FOUR of the above-mentioned performance measurement problems (i-viii) and discuss which of the

views of the directors (a-g) illustrate its application in each case. (12 marks)

(a) Candidates may choose FOUR problems with performance measures from those listed below:

Tunnel vision may be seen as undue focus on performance measures to the detriment of other areas. For example ‘There is

no point whatsoever in encouraging staff to focus on interaction with customers in efforts to create a ‘user friendly’

environment. What we need is to maintain the quality of our grass surfaces at all costs since that is the distinguishing feature

of our business.’

Sub-optimisation may occur where undue focus on some objectives will leave others not achieved. For example, ‘We should

focus our attention upon maximising the opening hours of our facilities. Everything else will take care of itself.’ This strategy

ignores the importance of a number of other issues, such as the possible need to increase the availability of horse-riding and

bowling equipment for hire.

Misinterpretation involves failure to recognise the complexity of the environment in which the organisation operates.

Management views have focused on a number of performance measures such as ‘spend the money on increased advertising

of our facilities which will surely attract more customers.’ This fails to recognise the more complex problems that exist. The

town is suffering from high unemployment which may cause population drift and economic decline. This will negate many

of the initiatives that are being suggested by management. This may to some extent be offset by the good transport links to

the ‘365 sports complex’.

Myopia refers to short-sightedness leading to the neglect of longer-term objectives. An example would be ‘We should reduce

the buildings maintenance budget by 25% and spend the money on increased advertising of our facilities which will surely

attract more customers.’

Measure fixation implies behaviour and activities in order to achieve specific performance indicators which may not be

effective. For example, ‘Buy more equipment which can be hired out to users of our facilities. This will improve our utilisation

ratios which will lead to increased profits.’ Problems of unemployment and lack of complaints from customers may mean that

more equipment will not improve profit levels.

Misrepresentation refers to the tendency to indulge in ‘creative’ reporting in order to suggest that a performance measure

result is acceptable. For example ‘Recent analysis of customer feedback forms indicate that most of our customers are satisfied

with the facilities. In fact, the only complaints are from three customers – the LCA University who use the cricket pitch for

matches, the National Youth Training Academy who hold training sessions on the tennis courts, and a local bowling team.’

This ignores the likely size of capacity share occupied by these three customers. In this regard it should be acknowledged

that complaints represent a significant threat to the business since ‘bad news often travels fast’ and other customers may then

‘vote with their feet’.

Gaming is where there is a deliberate distortion of the measure in order to secure some strategic advantage. This may involve

deliberately under performing in order to achieve some objective. For example, ‘We should hold back on our efforts to

overcome the shortage of bowling equipment for hire. Recent rumours are that the National Bowling Association are likely to

offer large financial grants next year to sports complexes who can show they have a demand for the sport but have deficiencies

in availability of equipment.’

Ossification which by definition means ‘a hardening’ refers to an unwillingness to change the performance measure scheme

once it has been set up. An example could be ‘Why change our performance management system? Our current areas of focus

provide us with all the information that we need to ensure that we remain a profitable and effective business.’ This ignores

issues/problems raised in the other comments provided in the question.

(d) Corporate annual reports contain both mandatory and voluntary disclosures.

Required:

(i) Distinguish, using examples, between mandatory and voluntary disclosures in the annual reports of

public listed companies. (6 marks)

(d) (i) Mandatory and voluntary disclosures

Mandatory disclosures

These are components of the annual report mandated by law, regulation or accounting standard.

Examples include (in most jurisdictions) statement of comprehensive income (income or profit and loss statement),

statement of financial position (balance sheet), cash flow statement, statement of changes in equity, operating segmental

information, auditors’ report, corporate governance disclosure such as remuneration report and some items in the

directors’ report (e.g. summary of operating position). In the UK, the business review is compulsory.

Voluntary disclosures

These are components of the annual report not mandated in law or regulation but disclosed nevertheless. They are

typically mainly narrative rather than numerical in nature.

Examples include (in most jurisdictions) risk information, operating review, social and environmental information, and

the chief executive’s review.

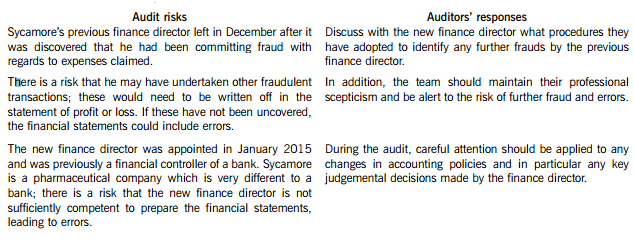

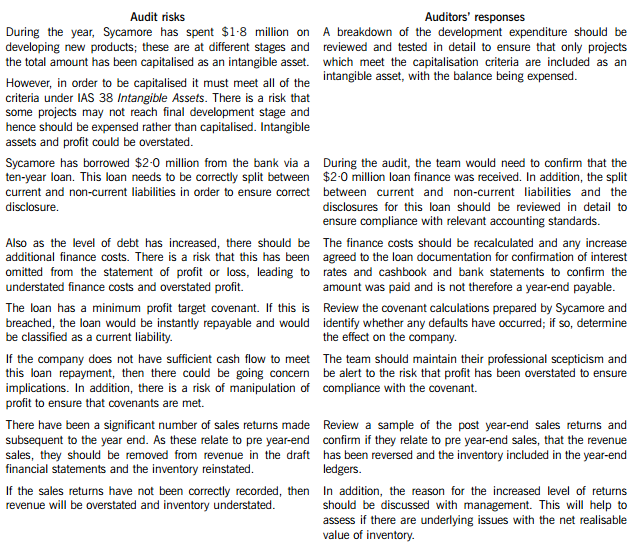

You are the audit supervisor of Maple & Co and are currently planning the audit of an existing client, Sycamore Science Co (Sycamore), whose year end was 30 April 2015. Sycamore is a pharmaceutical company, which manufactures and supplies a wide range of medical supplies. The draft financial statements show revenue of $35·6 million and profit before tax of $5·9 million.

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

(a) Fraud responsibility

Maple & Co must conduct an audit in accordance with ISA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements and are responsible for obtaining reasonable assurance that the financial statements taken as a whole are free from material misstatement, whether caused by fraud or error.

In order to fulfil this responsibility, Maple & Co is required to identify and assess the risks of material misstatement of the financial statements due to fraud.

They need to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses. In addition, Maple & Co must respond appropriately to fraud or suspected fraud identified during the audit.

When obtaining reasonable assurance, Maple & Co is responsible for maintaining professional scepticism throughout the audit, considering the potential for management override of controls and recognising the fact that audit procedures which are effective in detecting error may not be effective in detecting fraud.

To ensure that the whole engagement team is aware of the risks and responsibilities for fraud and error, ISAs require that a discussion is held within the team. For members not present at the meeting, Sycamore’s audit engagement partner should determine which matters are to be communicated to them.

(b) Audit risks and auditors’ responses

(c) (i) Review engagements

Review engagements are often undertaken as an alternative to an audit, and involve a practitioner reviewing financial data, such as six-monthly figures. This would involve the practitioner undertaking procedures to state whether anything has come to their attention which causes the practitioner to believe that the financial data is not in accordance with the financial reporting framework.

A review engagement differs to an external audit in that the procedures undertaken are not nearly as comprehensive as those in an audit, with procedures such as analytical review and enquiry used extensively. In addition, the practitioner does not need to comply with ISAs as these only relate to external audits.

(ii) Levels of assurance

The level of assurance provided by audit and review engagements is as follows:

External audit – A high but not absolute level of assurance is provided, this is known as reasonable assurance. This provides comfort that the financial statements present fairly in all material respects (or are true and fair) and are free of material misstatements.

Review engagements – where an opinion is being provided, the practitioner gathers sufficient evidence to be satisfied that the subject matter is plausible; in this case negative assurance is given whereby the practitioner confirms that nothing has come to their attention which indicates that the subject matter contains material misstatements.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-08

- 2020-03-25

- 2020-08-14

- 2020-01-09

- 2020-01-09

- 2020-01-02

- 2019-12-28

- 2021-01-13

- 2021-04-25

- 2020-01-09

- 2020-04-18

- 2020-07-04

- 2020-05-02

- 2020-02-19

- 2020-01-09

- 2020-01-03

- 2021-05-14

- 2020-01-03

- 2020-01-05

- 2020-01-10

- 2020-09-03

- 2020-01-30

- 2020-07-04

- 2020-02-26

- 2020-01-09

- 2020-05-21

- 2021-01-13

- 2020-01-10

- 2020-01-09

- 2020-01-01