速看!2020年3月ACCA考试取消后,会不会影响6月的考试

发布时间:2020-02-11

目前,ACCA中国区(除台湾外)已全部取消原定于2020年3月的ACCA考试。很多人会问6月的考试是否会受影响呢?应不应该报考6月的ACCA考试呢?针对大家的相关问题,51题库考试学习网今天为大家一一解答。

1. 为何中国地区(包括中国内地,香港,澳门)3月的ACCA 考试会被全部取消?

鉴于COVID-19病毒疫情的爆发和持续的影响,中国地区(除台湾外)2020年3月的ACCA考试会被全部取消。此决定是ACCA与考试合作伙伴进行广泛讨论并依据中国政府的建议做出的。

2. 为何现在才做出此决定?

COVID-19病毒疫情的爆发导致在中国地区(包括中国内地,香港和澳门)难以安全地进行三月份的考试。

ACCA官方一直努力在可进行的地方举行考试,但在与我们的考试合作伙伴进行广泛讨论并依据中国政府的建议,ACCA 3月份在中国地区(中国内地,香港和澳门)举行的考试将被取消。做出此决定旨在给学员一个明确的信息,便于您对于自己的计划和学习做出相应的调整。

3. 如果情况有所改善,是否有可能在考试那周之前更改这个决定?

不会。一旦决定取消考试,这一决定将不会被撤销。即使COVID-19病毒疫情的状况将有明显地改善,取消考试仍是最终决定。

4. 如果举行考试的大学和机构在考试的第一天(3月2日)开放,考试还会继续进行吗?

不会,取消ACCA 2020年3月中国地区(中国内地,香港和澳门)所有考试是最终决定。

5. 如果疫情得到控制,3月份的考试会否重新安排在4月或5月举行?

不会。由于考试操作的性质和复杂性,ACCA无法重新安排任何考试。

下一次考试将于2020年6月举行。

6. 学员是否需要自行申请取消3月的考试?

不需要。对于报名参加2020年3月考试的学员,ACCA将取消并退还其所有3月考试报名费用。

7. 如何记录被取消的考试在学员中的考试记录?

您的 2020 年 3 月份考试报名将被取消,我们的记录将说明您的考试已被取消。

8. 学员的考试费用会全额退还吗?

会的。3月考试的所有费用将全额退还。

9. 退款将于何时以何种方式退还?

所有的退款都将退还至学员的myACCA账户。如果考试费用是由雇主支付的,考试费用将直接退还给雇主。

10. 退款所需时长约7~10个工作日。学员何时能知道已经安排退款?

当2020年3月的考试报名被正式取消并安排退款时,学员将会收到一份自动生成的确认通知。

11. 是否可以将考试费用退还到学员的银行账户而不是myACCA?

所有退款将退还到您的myACCA账户(学生已经支付了的考试费用)。

退款后,如果您想要退还到一个银行账户,那么请发送电邮至students@accaglobal.com与英国总部联系,同时附上您的诉求的详情。

12.是否会影响6月ACCA考试?

目前,所有的考试政策均会根据疫情的变化而有所调整,因此我们尚无法评估和确定本次疫情对于6月ACCA考试的影响。但假如疫情仍未好转,那么ACCA官方仍然会采取积极主动的措施来应对可能存在的危险。因此,大家可以优先报考,并及时关注ACCA官方的政策即可。

以上信息就是51题库考试学习网针对小伙伴们的问题做出的详细解答,相信小伙伴们看过之后也有了一定的了解了吧,如果大家还有什么疑问,欢迎大家前来咨询51题库考试学习网,我们会第一时间为大家答疑解惑。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

Moonstar Co is a property development company which is planning to undertake a $200 million commercial property development. Moonstar Co has had some difficulties over the last few years, with some developments not generating the expected returns and the company has at times struggled to pay its finance costs. As a result Moonstar Co’s credit rating has been lowered, affecting the terms it can obtain for bank finance. Although Moonstar Co is listed on its local stock exchange, 75% of the share capital is held by members of the family who founded the company. The family members who are shareholders do not wish to subscribe for a rights issue and are unwilling to dilute their control over the company by authorising a new issue of equity shares. Moonstar Co’s board is therefore considering other methods of financing the development, which the directors believe will generate higher returns than other recent investments, as the country where Moonstar Co is based appears to be emerging from recession.

Securitisation proposals

One of the non-executive directors of Moonstar Co has proposed that it should raise funds by means of a securitisation process, transferring the rights to the rental income from the commercial property development to a special purpose vehicle. Her proposals assume that the leases will generate an income of 11% per annum to Moonstar Co over a ten-year period. She proposes that Moonstar Co should use 90% of the value of the investment for a collateralised loan obligation which should be structured as follows:

– 60% of the collateral value to support a tranche of A-rated floating rate loan notes offering investors LIBOR plus 150 basis points

– 15% of the collateral value to support a tranche of B-rated fixed rate loan notes offering investors 12%

– 15% of the collateral value to support a tranche of C-rated fixed rate loan notes offering investors 13%

– 10% of the collateral value to support a tranche as subordinated certificates, with the return being the excess of receipts over payments from the securitisation process

The non-executive director believes that there will be sufficient demand for all tranches of the loan notes from investors. Investors will expect that the income stream from the development to be low risk, as they will expect the property market to improve with the recession coming to an end and enough potential lessees to be attracted by the new development.

The non-executive director predicts that there would be annual costs of $200,000 in administering the loan. She acknowledges that there would be interest rate risks associated with the proposal, and proposes a fixed for variable interest rate swap on the A-rated floating rate notes, exchanging LIBOR for 9·5%.

However the finance director believes that the prediction of the income from the development that the non-executive director has made is over-optimistic. He believes that it is most likely that the total value of the rental income will be 5% lower than the non-executive director has forecast. He believes that there is some risk that the returns could be so low as to jeopardise the income for the C-rated fixed rate loan note holders.

Islamic finance

Moonstar Co’s chief executive has wondered whether Sukuk finance would be a better way of funding the development than the securitisation.

Moonstar Co’s chairman has pointed out that a major bank in the country where Moonstar Co is located has begun to offer a range of Islamic financial products. The chairman has suggested that a Mudaraba contract would be the most appropriate method of providing the funds required for the investment.

Required:

(a) Calculate the amounts in $ which each of the tranches can expect to receive from the securitisation arrangement proposed by the non-executive director and discuss how the variability in rental income affects the returns from the securitisation. (11 marks)

(b) Discuss the benefits and risks for Moonstar Co associated with the securitisation arrangement that the non-executive director has proposed. (6 marks)

(c) (i) Discuss the suitability of Sukuk finance to fund the investment, including an assessment of its appeal to potential investors. (4 marks)

(ii) Discuss whether a Mudaraba contract would be an appropriate method of financing the investment and discuss why the bank may have concerns about providing finance by this method. (4 marks)

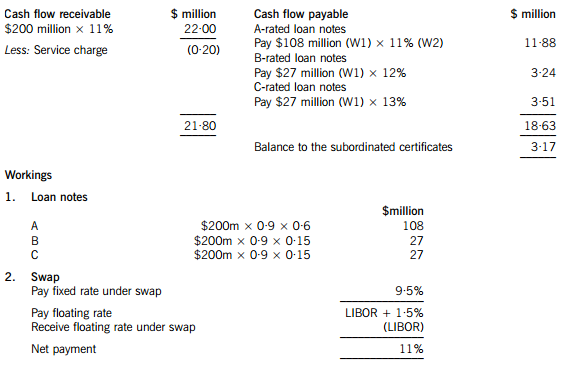

(a) An annual cash flow account compares the estimated cash flows receivable from the property against the liabilities within the securitisation process. The swap introduces leverage into the arrangement.

The holders of the certificates are expected to receive $3·17million on $18 million, giving them a return of 17·6%. If the cash flows are 5% lower than the non-executive director has predicted, annual revenue received will fall to $20·90 million, reducing the balance available for the subordinated certificates to $2·07 million, giving a return of 11·5% on the subordinated certificates, which is below the returns offered on the B and C-rated loan notes. The point at which the holders of the certificates will receive nothing and below which the holders of the C-rated loan notes will not receive their full income will be an annual income of $18·83 million (a return of 9·4%), which is 14·4% less than the income that the non-executive director has forecast.

(b) Benefits

The finance costs of the securitisation may be lower than the finance costs of ordinary loan capital. The cash flows from the commercial property development may be regarded as lower risk than Moonstar Co’s other revenue streams. This will impact upon the rates that Moonstar Co is able to offer borrowers.

The securitisation matches the assets of the future cash flows to the liabilities to loan note holders. The non-executive director is assuming a steady stream of lease income over the next 10 years, with the development probably being close to being fully occupied over that period.

The securitisation means that Moonstar Co is no longer concerned with the risk that the level of earnings from the properties will be insufficient to pay the finance costs. Risks have effectively been transferred to the loan note holders.

Risks

Not all of the tranches may appeal to investors. The risk-return relationship on the subordinated certificates does not look very appealing, with the return quite likely to be below what is received on the C-rated loan notes. Even the C-rated loan note holders may question the relationship between the risk and return if there is continued uncertainty in the property sector.

If Moonstar Co seeks funding from other sources for other developments, transferring out a lower risk income stream means that the residual risks associated with the rest of Moonstar Co’s portfolio will be higher. This may affect the availability and terms of other borrowing.

It appears that the size of the securitisation should be large enough for the costs to be bearable. However Moonstar Co may face unforeseen costs, possibly unexpected management or legal expenses.

(c) (i) Sukuk finance could be appropriate for the securitisation of the leasing portfolio. An asset-backed Sukuk would be the same kind of arrangement as the securitisation, where assets are transferred to a special purpose vehicle and the returns and repayments are directly financed by the income from the assets. The Sukuk holders would bear the risks and returns of the relationship.

The other type of Sukuk would be more like a sale and leaseback of the development. Here the Sukuk holders would be guaranteed a rental, so it would seem less appropriate for Moonstar Co if there is significant uncertainty about the returns from the development.

The main issue with the asset-backed Sukuk finance is whether it would be as appealing as certainly the A-tranche of the securitisation arrangement which the non-executive director has proposed. The safer income that the securitisation offers A-tranche investors may be more appealing to investors than a marginally better return from the Sukuk. There will also be costs involved in establishing and gaining approval for the Sukuk, although these costs may be less than for the securitisation arrangement described above.

(ii) A Mudaraba contract would involve the bank providing capital for Moonstar Co to invest in the development. Moonstar Co would manage the investment which the capital funded. Profits from the investment would be shared with the bank, but losses would be solely borne by the bank. A Mudaraba contract is essentially an equity partnership, so Moonstar Co might not face the threat to its credit rating which it would if it obtained ordinary loan finance for the development. A Mudaraba contract would also represent a diversification of sources of finance. It would not require the commitment to pay interest that loan finance would involve.

Moonstar Co would maintain control over the running of the project. A Mudaraba contract would offer a method of obtaining equity funding without the dilution of control which an issue of shares to external shareholders would bring. This is likely to make it appealing to Moonstar Co’s directors, given their desire to maintain a dominant influence over the business.

The bank would be concerned about the uncertainties regarding the rental income from the development. Although the lack of involvement by the bank might appeal to Moonstar Co's directors, the bank might not find it so attractive. The bank might be concerned about information asymmetry – that Moonstar Co’s management might be reluctant to supply the bank with the information it needs to judge how well its investment is performing.

6 Alasdair, aged 42, is single. He is considering investing in property, as he has heard that this represents a good

investment. In order to raise the funds to buy the property, he wants to extract cash from his personal company, Beezer

Limited, whose year end is 31 December.

Beezer Limited was formed on 1 May 1998 with £1,000 of capital issued as 1,000 £1 ordinary shares, and traded

until 1 January 2005 when Alasdair sold the trade and related assets. The company’s only asset is cash of

£120,000. Alasdair wants to extract this cash from the company with the minimum amount of tax payable. He is

considering either, paying himself a dividend of £120,000, on 31 March 2006, after which the company would have

no assets and be wound up or, leaving the cash in the company and then liquidating the company. Costs of liquidation

of £5,000 would then be incurred.

Since Beezer Limited ceased trading, Alasdair has been taken on as a partner at a marketing firm, Gallus & Co. He

estimates his profit share for the year of assessment 2005/06 will be £30,000. He has not made any capital disposals

in the current tax year.

Alasdair wishes to reinvest the cash extracted from Beezer Limited in property but is not sure whether he should invest

directly in residential or commercial property, or do so via some form. of collective investment. He is aware that Gallus

& Co are looking to rent a new warehouse which could be bought for £200,000. Alasdair thinks that he may be able

to buy the warehouse himself and lease it to his firm, but only if he can borrow the additional money to buy the

property.

Alasdair has a 25% shareholding in another company, Glaikit Limited, whose year end is 31 March. The remaining

shares in this company are held by his friend, Gill. Alasdair is considering borrowing £15,000 from Glaikit Limited

on 1 January 2006. He does not intend to pay any interest on the loan, which is likely to be written off some time

in 2007. Alasdair does not have any connection with Glaikit Limited other than his shareholding.

Required:

(a) Advise Alasdair whether or not a dividend payment will result in a higher after-tax cash sum than the

liquidation of Beezer Limited. Assume that either the dividend would be paid on 31 March 2006 or the

liquidation would take place on 31 March 2006. (9 marks)

Assume that Beezer Limited has always paid corporation tax at or above the small companies rate of 19%

and that the tax rates and allowances for 2004/05 apply throughout this part.

(ii) The recoverability of the deferred tax asset. (4 marks)

(ii) Principal audit procedures – recoverability of deferred tax asset

– Obtain a copy of Bluebell Co’s current tax computation and deferred tax calculations and agree figures to any

relevant tax correspondence and/or underlying accounting records.

– Develop an independent expectation of the estimate to corroborate the reasonableness of management’s estimate.

– Obtain forecasts of profitability and agree that there is sufficient forecast taxable profit available for the losses to be

offset against. Evaluate the assumptions used in the forecast against business understanding. In particular consider

assumptions regarding the growth rate of taxable profit in light of the underlying detrimental trend in profit before

tax.

– Assess the time period it will take to generate sufficient profits to utilise the tax losses. If it is going to take a number

of years to generate such profits, it may be that the recognition of the asset should be restricted.

– Using tax correspondence, verify that there is no restriction on the ability of Bluebell Co to carry the losses forward

and to use the losses against future taxable profits.

Tutorial note: in many tax jurisdictions losses can only be carried forward to be utilised against profits generated

from the same trade. Although in the scenario there is no evidence of such a change in trade, or indeed any kind

of restriction on the use of losses, it is still a valid audit procedure to verify that this is the case

5 Financial statements have seen an increasing move towards the use of fair values in accounting. Advocates of ‘fair

value accounting’ believe that fair value is the most relevant measure for financial reporting whilst others believe that

historical cost provides a more useful measure.

Issues have been raised over the reliability and measurement of fair values, and over the nature of the current level

of disclosure in financial statements in this area.

Required:

(a) Discuss the problems associated with the reliability and measurement of fair values and the nature of any

additional disclosures which may be required if fair value accounting is to be used exclusively in corporate

reporting. (13 marks)

(a) Reliability and Measurement

Fair value can be defined as the price that would be received to sell an asset or paid to transfer a liability. The fair value can

be thought of as an ‘exit price’. A fair value measurement assumes that the transaction to sell the asset or transfer the liability

occurs in the principal market for the asset or liability or, in the absence of a principal market, the most advantageous market

for the asset or liability which is the market in which the reporting entity would sell the asset or transfer the liability with the

price that maximises the amount that would be received or minimises the amount that would be paid. IAS39 ‘Financial

Instruments: Recognition and Measurement’ requires an entity to use the most advantageous active market in measuring the

fair value of a financial asset or liability when multiple markets exist whereas IAS41 ‘Agriculture’ requires an entity to use the

most relevant market. Thus there can be different approaches for estimating exit prices. Additionally valuation techniques and

current replacement cost could be used.

A hierarchy of fair value measurements would have to be developed in order to convey information about the nature of the

information used in creating the fair values. For example quoted prices (unadjusted) in active markets would provide better

quality information than quoted prices for similar assets and liabilities in active markets which would provide better quality

information than prices which reflect the reporting entity’s own thinking about the assumptions that market participants would

use in pricing the asset or liability. Enron made extensive use of what it called ‘mark-to-market’ accounting which was based

on valuation techniques and estimates. IFRSs currently do not have a single hierarchy that applies to all fair value measures.

Instead individual standards indicate preferences for certain inputs and measures of fair value over others, but this guidance

is not consistent among all IFRSs.

Some companies, in order to effectively manage their businesses, have already developed models for determining fair values.

Businesses manage their operations by managing risks. A risk management process often requires measurement of fair values

of contracts, financial instruments, and risk positions.

If markets were liquid and transparent for all assets and liabilities, fair value accounting clearly would give reliable information

which is useful in the decision making process. However, because many assets and liabilities do not have an active market,

the inputs and methods for estimating their fair value are more subjective and, therefore, the valuations are less reliable. Fair

value estimates can vary greatly, depending on the valuation inputs and methodology used. Where management uses

significant judgment in selecting market inputs when market prices are not available, reliability will continue to be an issue.

Management can use significant judgment in the valuation process. Management bias, whether intentional or unintentional,

may result in inappropriate fair value measurements and consequently misstatements of earnings and equity capital. Without

reliable fair value estimates, the potential for misstatements in financial statements prepared using fair value measurements

will be even greater.

Consideration must be given to revenue recognition issues in a fair value system. It must be ensured that unearned revenue

is not recognised early as it recently was by certain high-tech companies.

As the variety and complexity of financial instruments increases, so does the need for independent verification of fair value

estimates. However, verification of valuations that are not based on observable market prices is very challenging. Users of

financial statements will need to place greater emphasis on understanding how assets and liabilities are measured and how

reliable these valuations are when making decisions based on them.

Disclosure

Fair values reflect point estimates and do not result in transparent financial statements. Additional disclosures are necessary

to bring meaning to these fair value estimates. These disclosures might include key drivers affecting valuations, fair-valuerange

estimates, and confidence levels. Another important disclosure consideration relates to changes in fair value amounts.

For example, changes in fair values on securities can arise from movements in interest rates, foreign-currency rates, and credit

quality, as well as purchases and sales from the portfolio. For users to understand fair value estimates, they must be given

adequate disclosures about what factors caused the changes in fair value. It could be argued that the costs involved in

determining fair values may exceed the benefits derived therefrom. When considering how fair value information should be

presented in the financial statements, it is important to consider what type of financial information investors want. There are

indications that some investors desire both fair value information and historical cost information. One of the issues affecting

the credibility of fair value disclosures currently is that a number of companies include ‘health warnings’ with their disclosures

indicating that the information is not used by management. This language may contribute to users believing that the fair value

disclosures lack credibility.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-02-27

- 2020-08-05

- 2020-01-09

- 2020-01-10

- 2020-03-07

- 2020-01-02

- 2020-01-10

- 2020-01-10

- 2020-02-27

- 2021-06-03

- 2020-04-18

- 2020-03-27

- 2019-03-28

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-11

- 2020-01-10

- 2020-01-10

- 2021-06-03

- 2020-01-10

- 2020-03-27

- 2007-05-15

- 2020-01-09

- 2020-01-30

- 2020-01-10

- 2020-01-10

- 2019-07-20

- 2020-01-10

- 2020-04-15